The Milk Market (Baptiste Buczinski)

Our new Milk Market Outlook is out! Global dairy markets remain mixed: prices hold firm in Europe and Oceania, while the US and China continue to soften. Discover how production trends, animal disease outbreaks, and shifting demand are shaping the latest dynamics in milk deliveries and raw milk prices worldwide.

Don’t forget to SEE and share today!

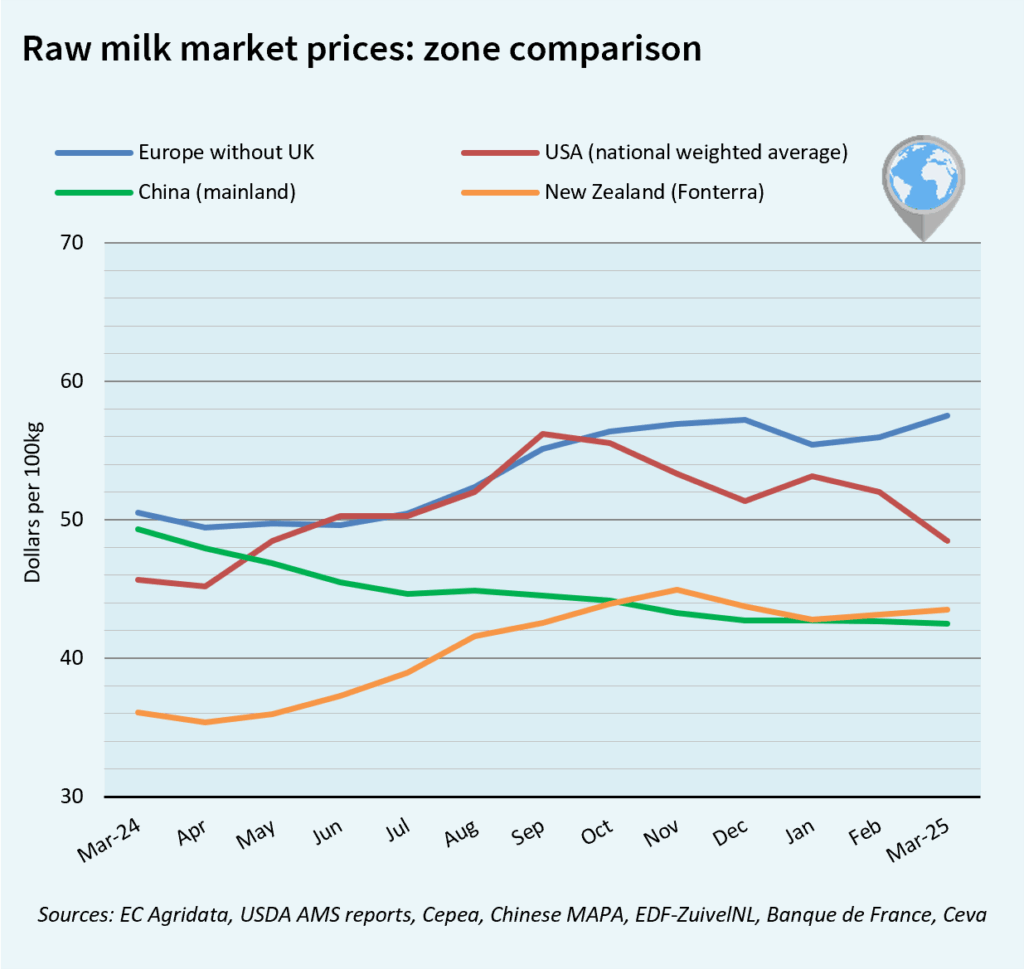

GLOBAL MILK MARKET PRICES

Supply in the United States remains high and prices are under pressure. The weakening of the US dollar is boosting the competitiveness of US butter exports, which are at their peak. The skimmed milk powder market is generally trending downward. Trends in milk producer prices continue to differ.

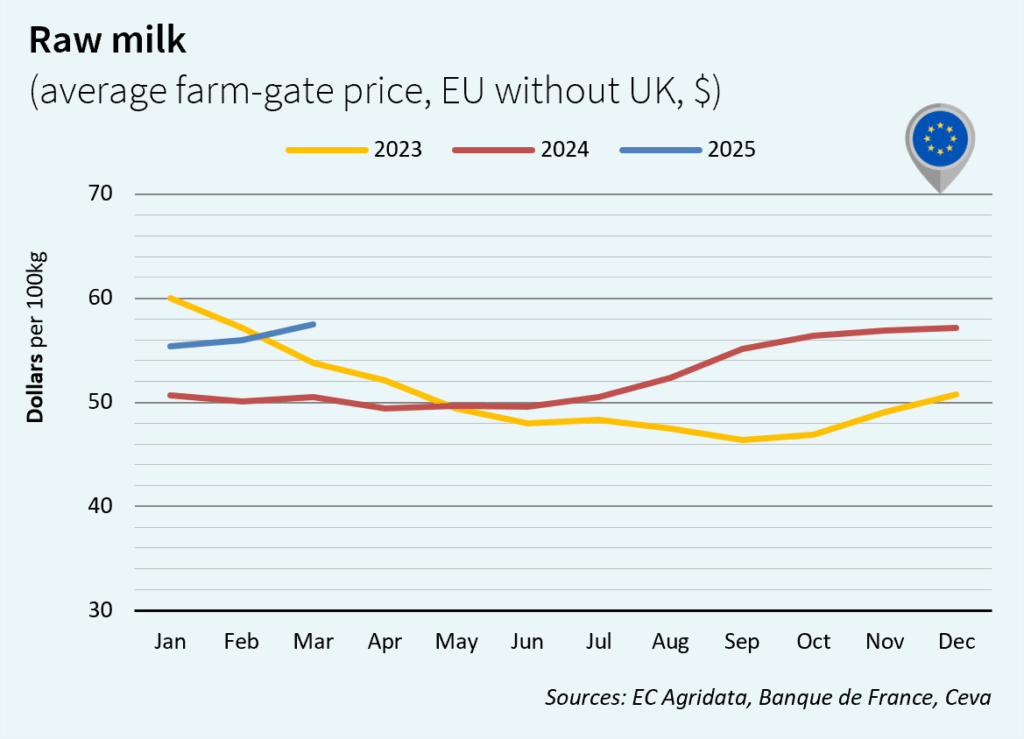

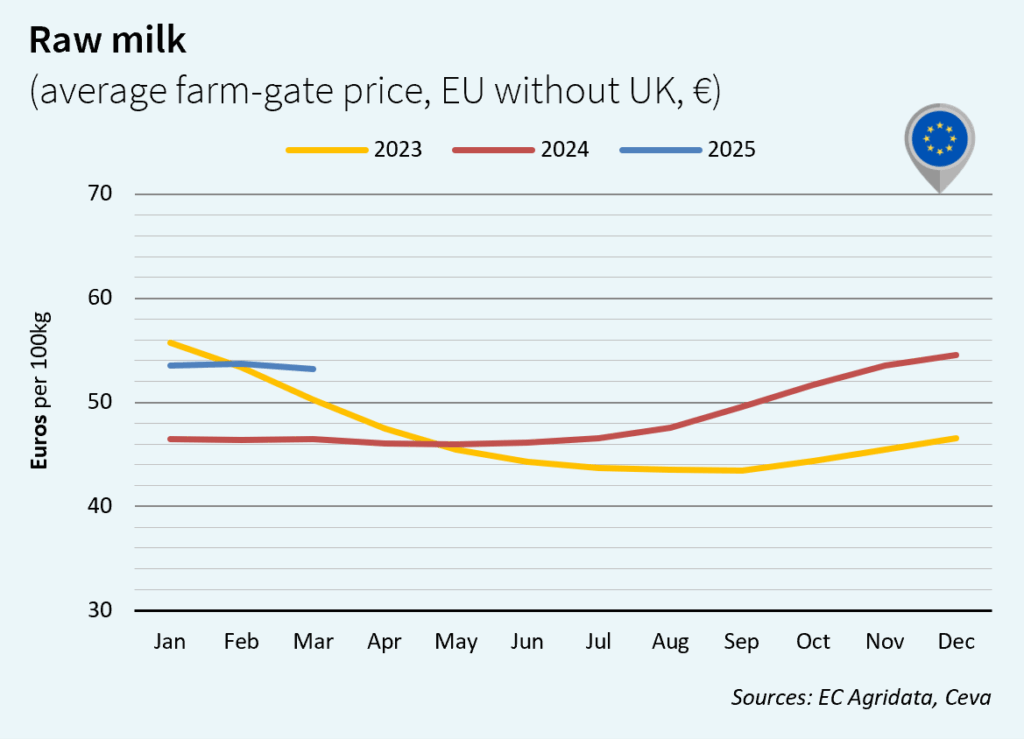

EUROPE´S MILK MARKET PRICES

Milk deliveries are still affected by the bluetongue disease outbreak. In March 2025, European milk deliveries had rebounded but remained down for the third consecutive month, reaching 12.8 Mt (-0.2% vs 2024). Over the three-month period, it was also lower at 35.4 Mt (-1.1% vs 2024). French, German, and Dutch collections were all down. With limited availability, milk prices were still strong in euros. Price have increased in US dollars, whose value declined following the tariff hike imposed by Trump. Milk prices reached US$57.53/100 kg (+3% vs. February 2025 and +14% vs. March 2024).

DAIRY MARKET TRENDS IN THE USA

In the United States, milk production was up year-on-year in March 2025 (+0.9% vs 2024). But supply continues to exceed demand, putting pressure on both dairy ingredient prices and the price paid to farmers. In March 2025, the raw milk price had sharply declined to US$48.50/100 kg (-7% compated to February 2025 but +6% vs. March 2024). With greater availability and a more competitive price, U.S. exports of butter rebounded at the start of 2025, reaching 24,000 tonnes in the first quarter of 2025 (3 times higher than in 2024).

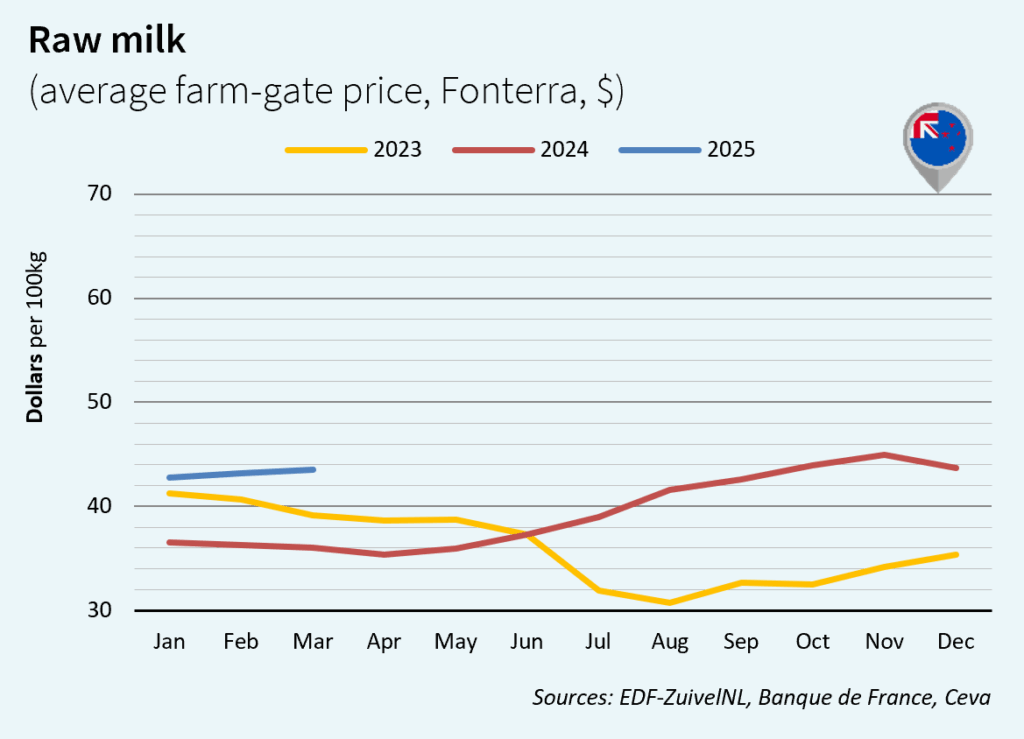

MILK TRENDS IN NEW ZEALAND

In New Zealand, milk deliveries and export demand for New Zealand dairy products remained strong. Production continued its rebound in March 2025, which had started in July 2024, but at a more moderate pace with a drought episode in the north of the country: New Zealand produced 1.76 million tons of milk in March (+0.6% or + 17 000 tons compared to 2024) and NZ raw milk prices remained strong, at US$43.51/100 kg (+1% vs. February 2025 and +21% vs. March 2024).

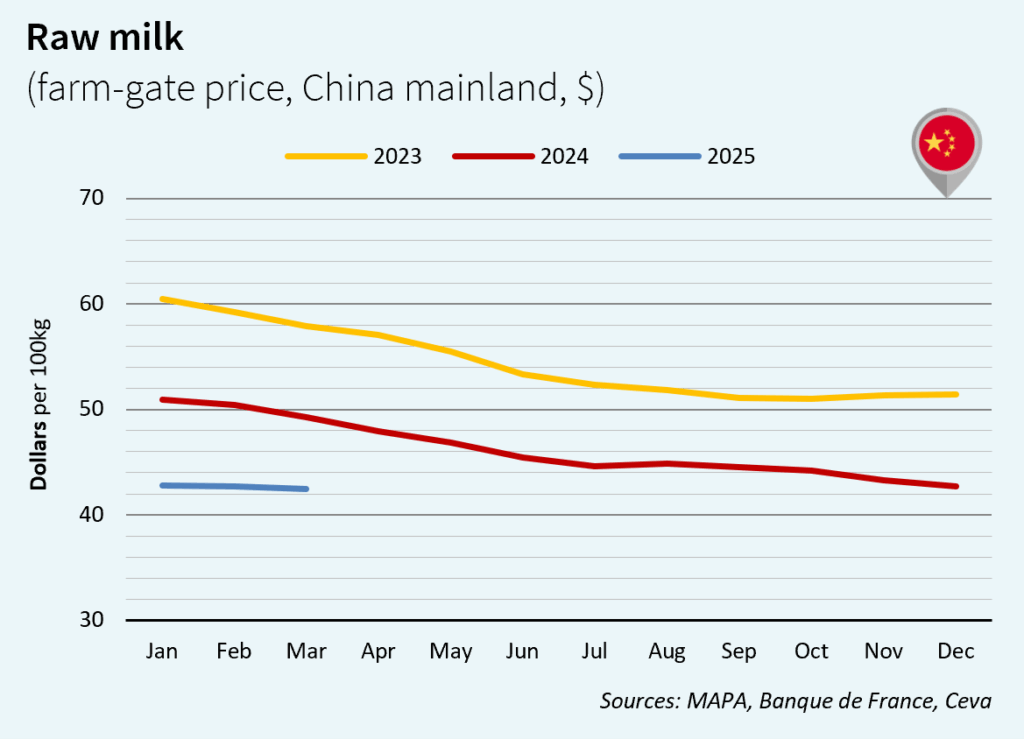

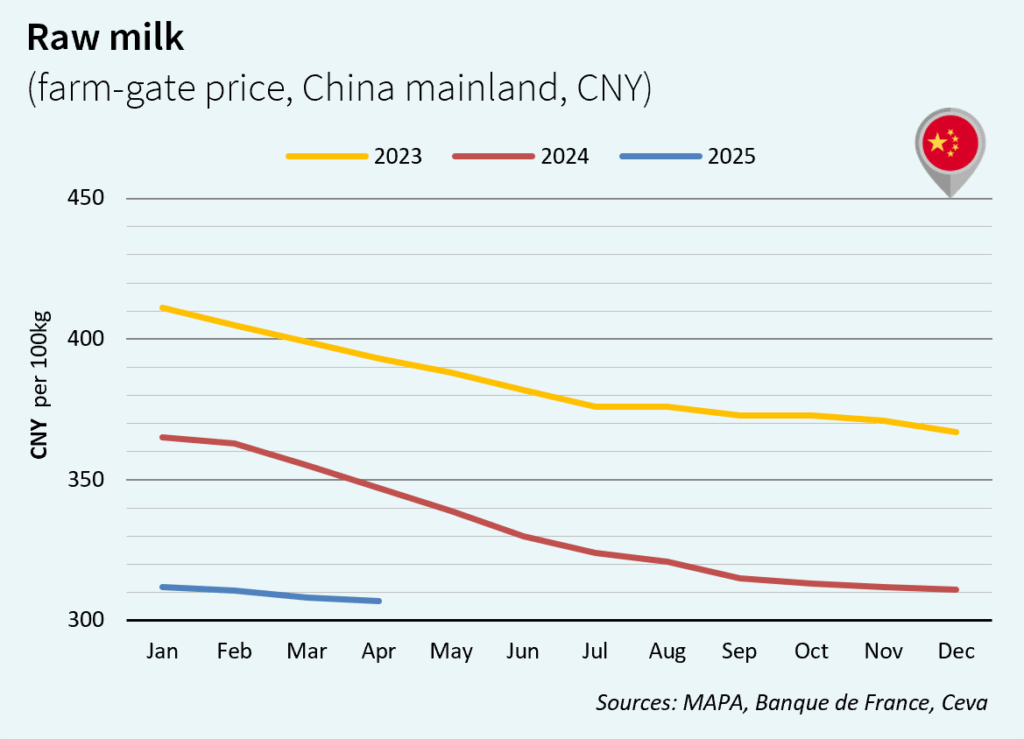

CHINA’s MILK MARKET

The situation remains similar in China, where the dairy market remained depressed due to an economic crisis and a weaker demand. Until now, the effects of the trade war with the United States are still limited. But in March 2025, Chinese raw milk prices had slightly declined, at US$42.48/100 kg (-0,5% compared to February 2025 and -14% YOY).

Source: