The Milk Market (Baptiste Buczinski)

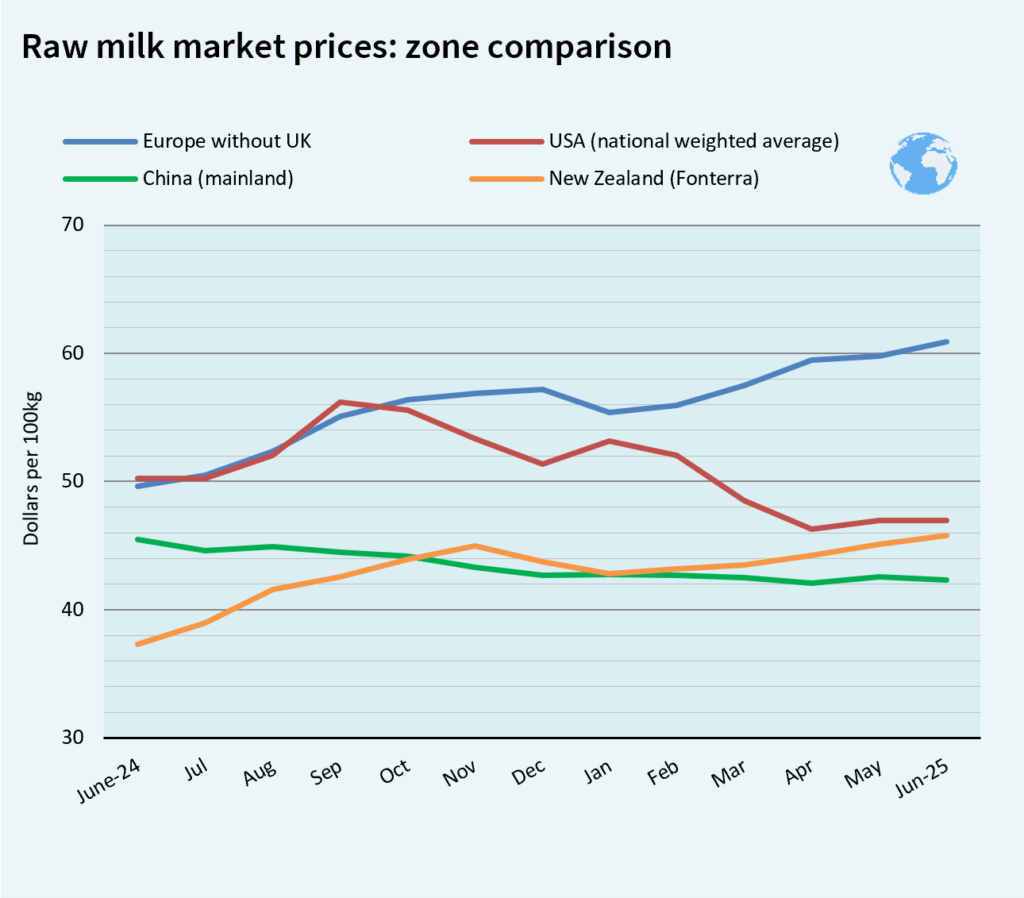

GLOBAL MILK MARKET PRICES

Global milk collection is gaining strong momentum. After three years of relative stagnation, production across the five major dairy-exporting regions has returned to growth in recent months, rising 1.7% year-on-year in June 2024, with similar gains in April and May. In June, U.S. milk output expanded at its fastest pace since 2020, while New Zealand posted its strongest year-on-year growth since 2017. By contrast, milk deliveries in the EU-27 remained flat.

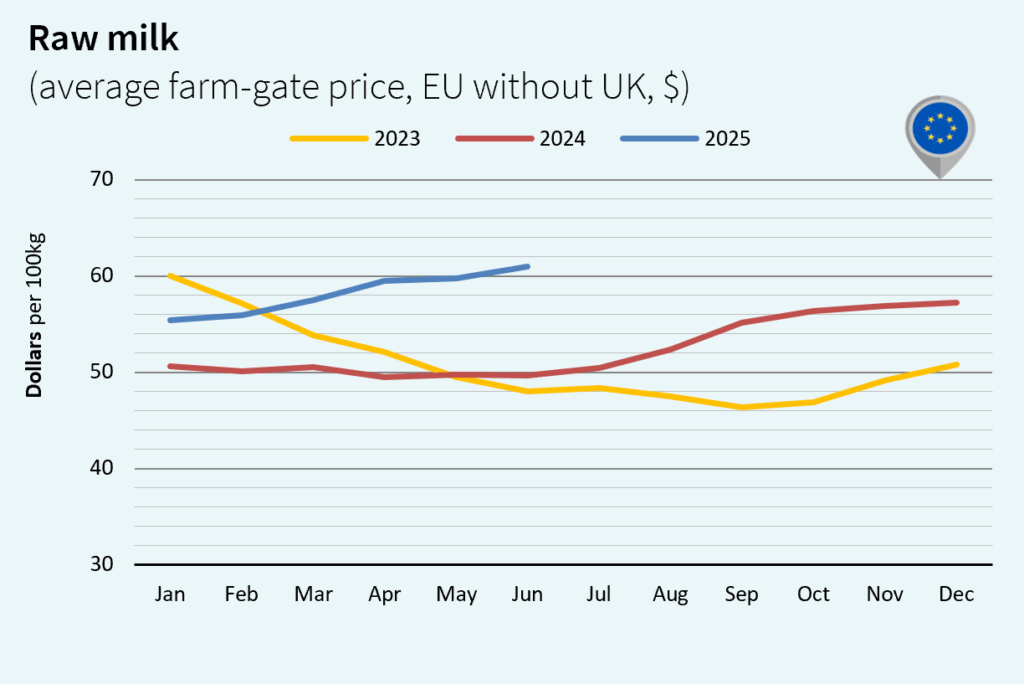

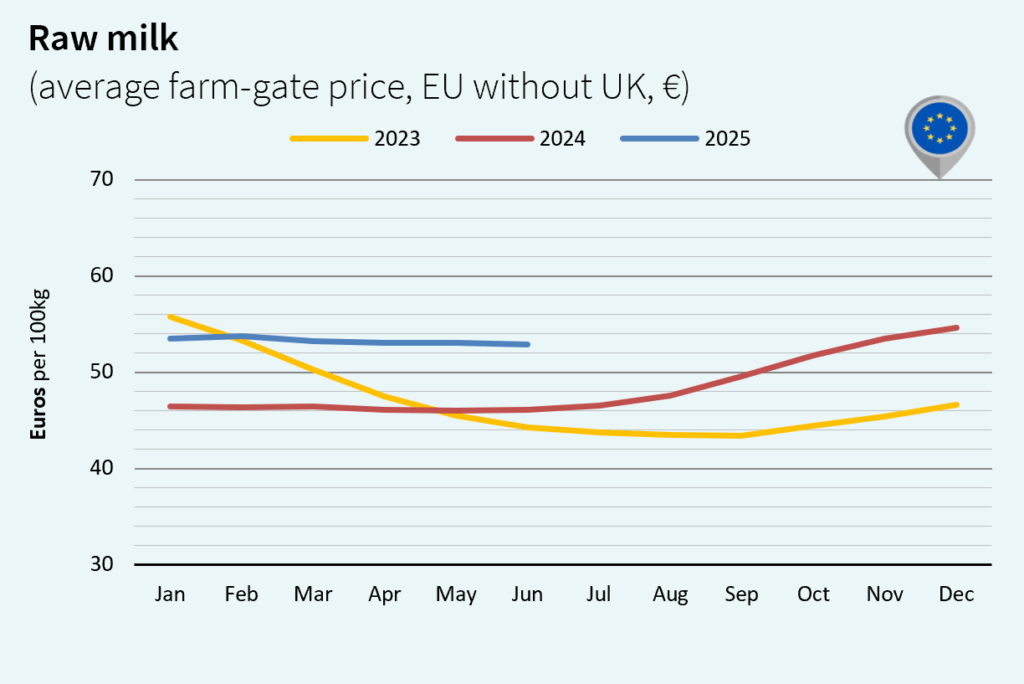

EUROPE´S MILK MARKET PRICES

In June, once again? EU-27 milk collection stagnated year-on-year. Growth in Poland (+1% vs. 2024) and Ireland (+15%) barely offset the declines seen in Germany (-2%), Belgium (-6%) and the Netherlands (-0.5%). In the first half of 2025, EU exports fell by -1% in milk equivalent, despite a slight increase in cheese exports (+1% vs. 2024). Exports of butter (-2%), butteroil (-14%) and WMP (-23%) were down. In June, EU raw milk prices edged down in euros but increased in U.S. dollars, at US$60.92/100 kg (+2% vs. May 2025 and +23% vs. June 2024).

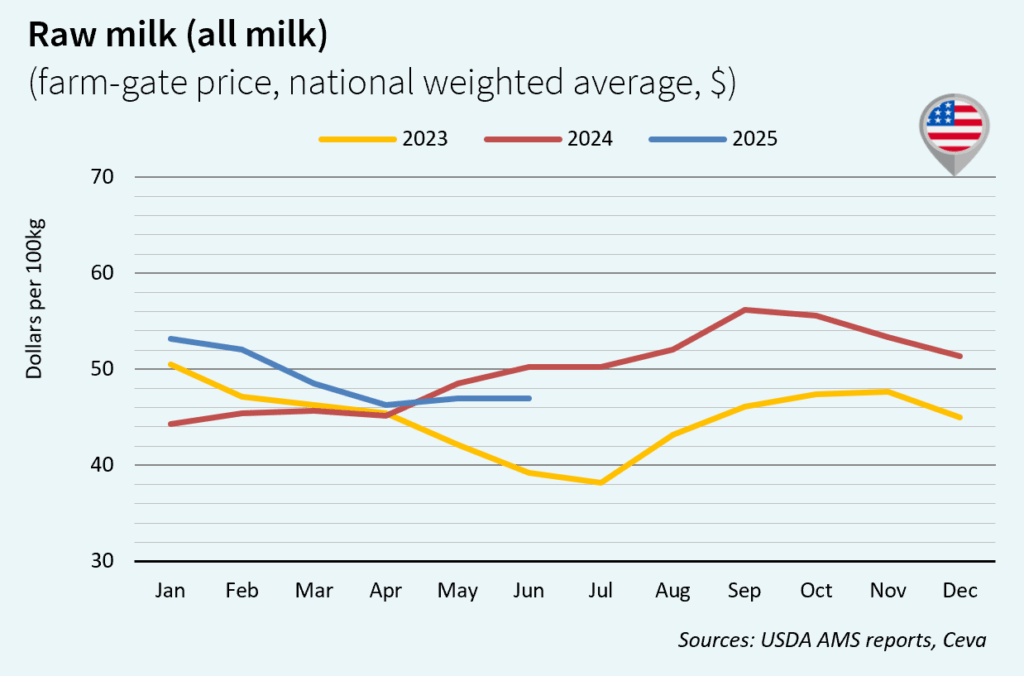

DAIRY MARKET TRENDS IN THE USA

In June, U.S. milk collection grew at its fastest pace since 2020 (+3.2% year-on-year). With a weak dollar against the euro — its lowest level in three years — U.S. dairy exports hit an all-time high in milk-equivalent terms. This increase was driven by cheese, with monthly volumes reaching a record 57,000 tonnes (+34% year-on-year). Despite this performance, the US raw milk price remained stable in June, at US$46.96/100 kg (= vs. May 2025 but -7% vs. June 2024).

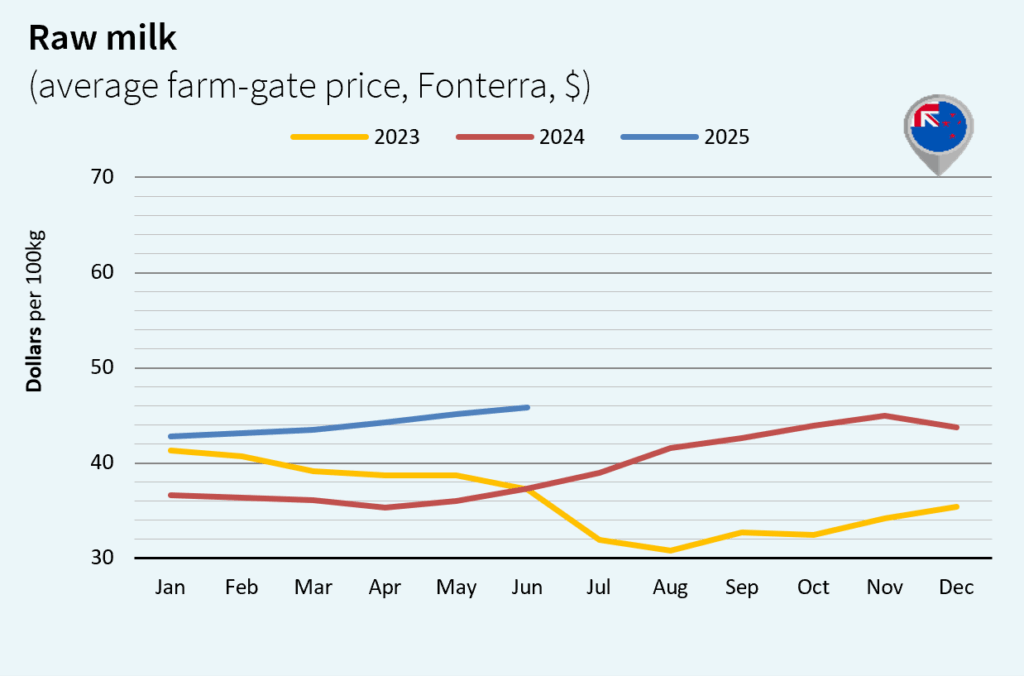

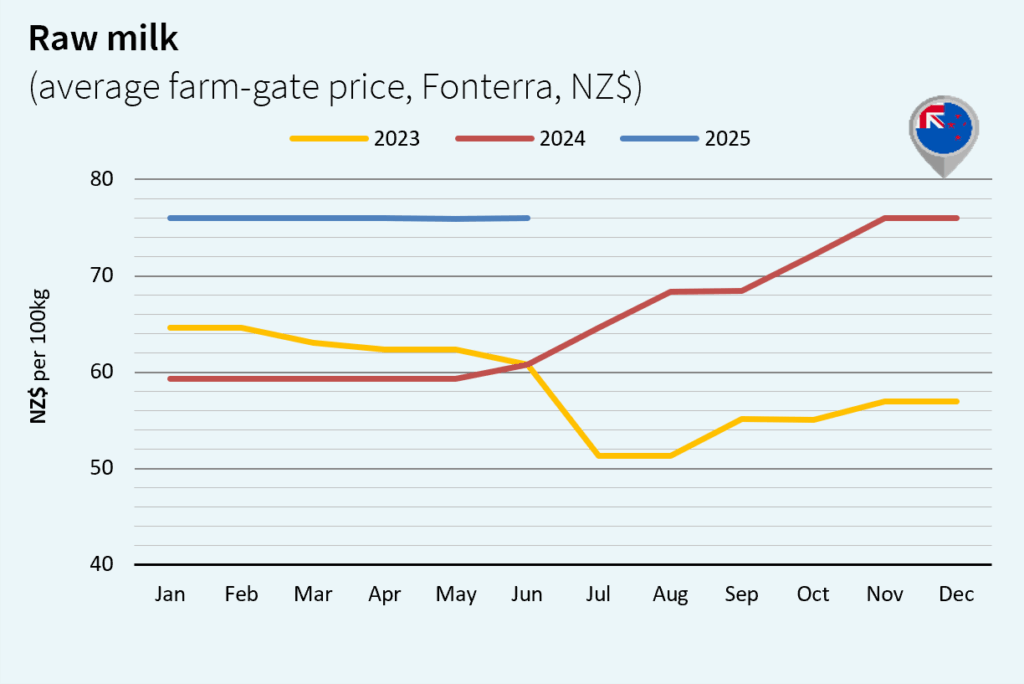

MILK TRENDS IN NEW ZEALAND

At its annual trough, New Zealand’s milk production in June posted its strongest year-on-year growth since 2017 (+14%). Butter prices nevertheless eased in Oceania, in contrast to skim milk powder prices. In the first six months of 2025, New Zealand’s cheese exports reached an all-time high (+25% vs. 2024), as they did in the United States (+1%) and the EU (+1%). At the production trough, the NZ raw milk price remained firm in NZ$ and in US$, at US$45.79/100 kg (+2% vs. May 2025 and +23% vs. June 2024).

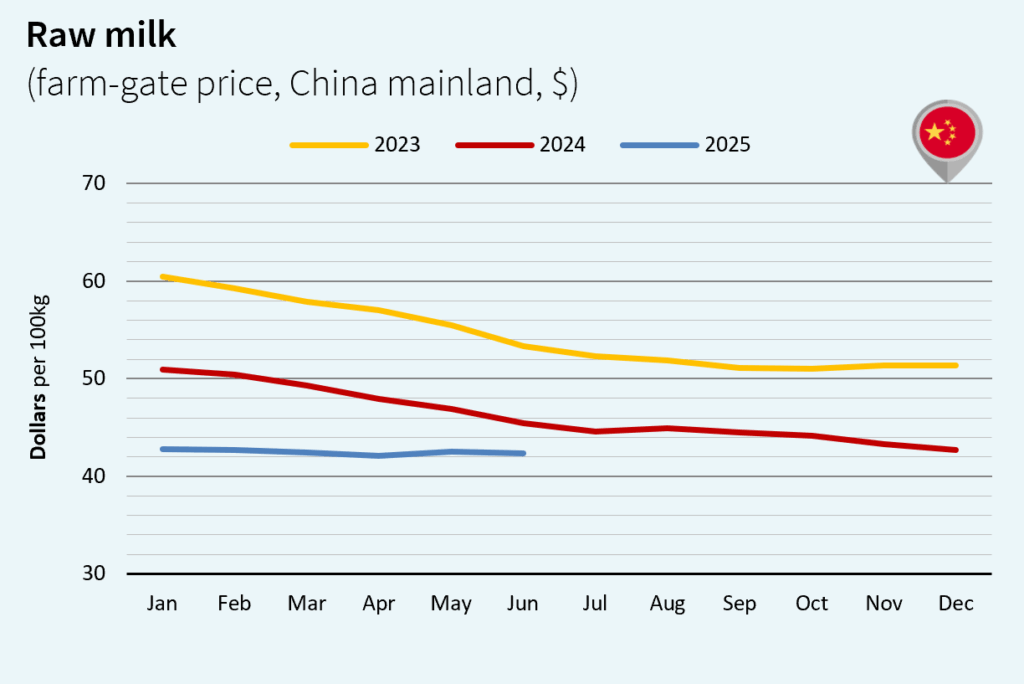

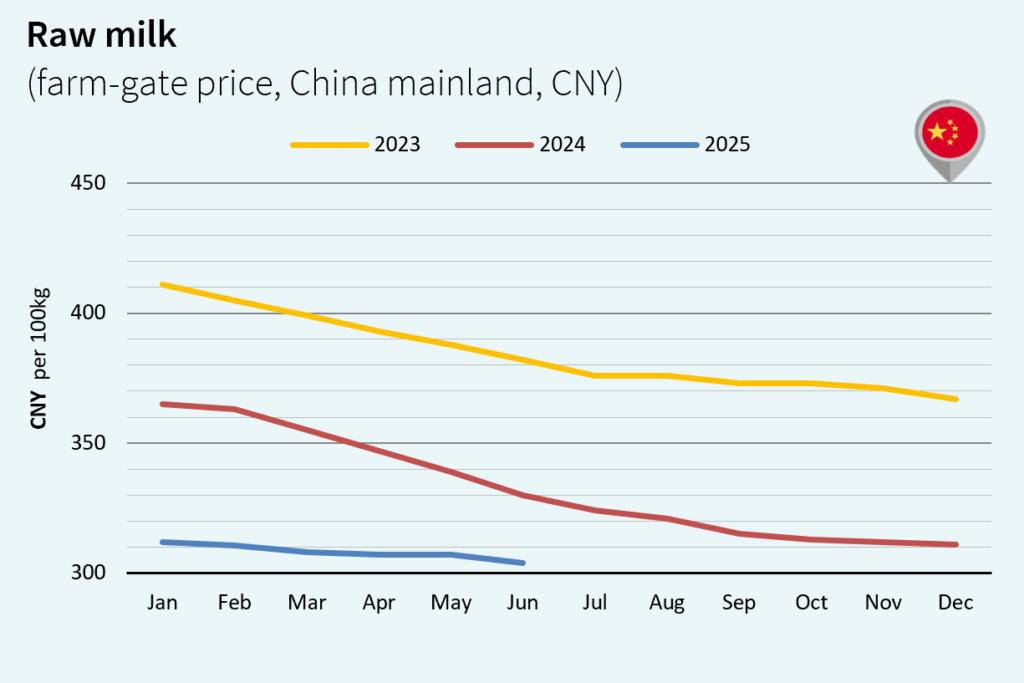

CHINA’s MILK MARKET

While early in the year there were signs of a modest recovery in Chinese dairy purchases across all products, activity in May, June, and July was once again subdued, particularly for powders. Uncertainty in the Chinese dairy market remains high as milk production in China is expected to decline by 2.6% year-on-year in 2025 according to Rabobank. Meanwhile, Chinese raw milk was under pressure in June, at US$42.33/100 kg (-0.5% vs. May 2025 but -7% vs. June 2024).

Source: