Beef Market Outlook (Baptiste Buczinski)

Welcome to the Beef Market Outlook – November 2025, your monthly update on global beef markets and price trends. In this edition, we analyse the latest shifts in beef production, cattle prices, and export dynamics across Europe, Brazil, China, and the United States. With clear, data-driven insights, we highlight the key factors influencing global supply and demand, trade flows, and overall market profitability.

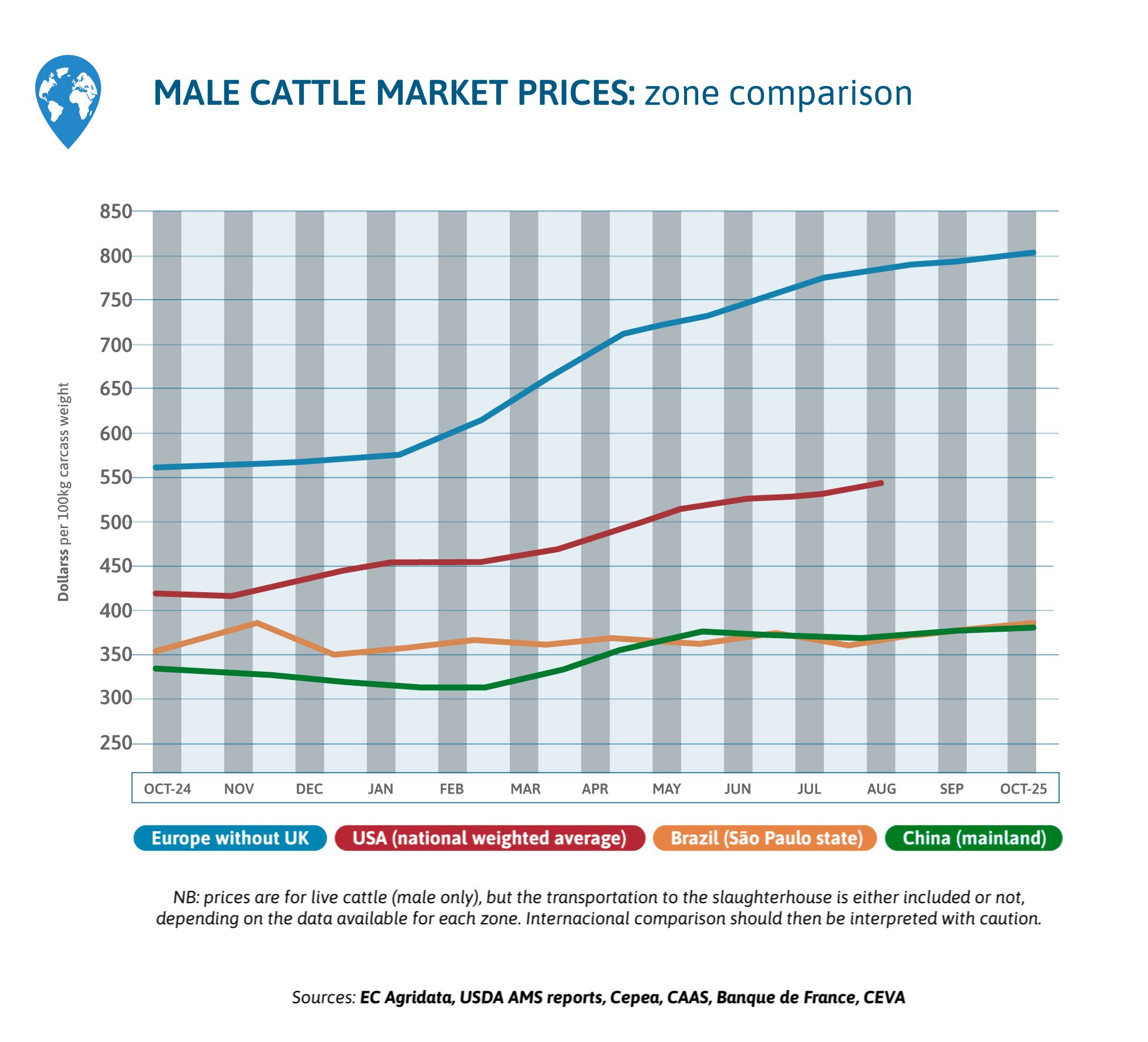

Why are global beef prices moving differently across regions?

In October, European prices continued to rise as production remained limited, while Brazilian prices moved up gradually with strong export demand. In China, prices softened slightly under growing import pressure, and US data for the month was still pending due to delayed statistical updates.

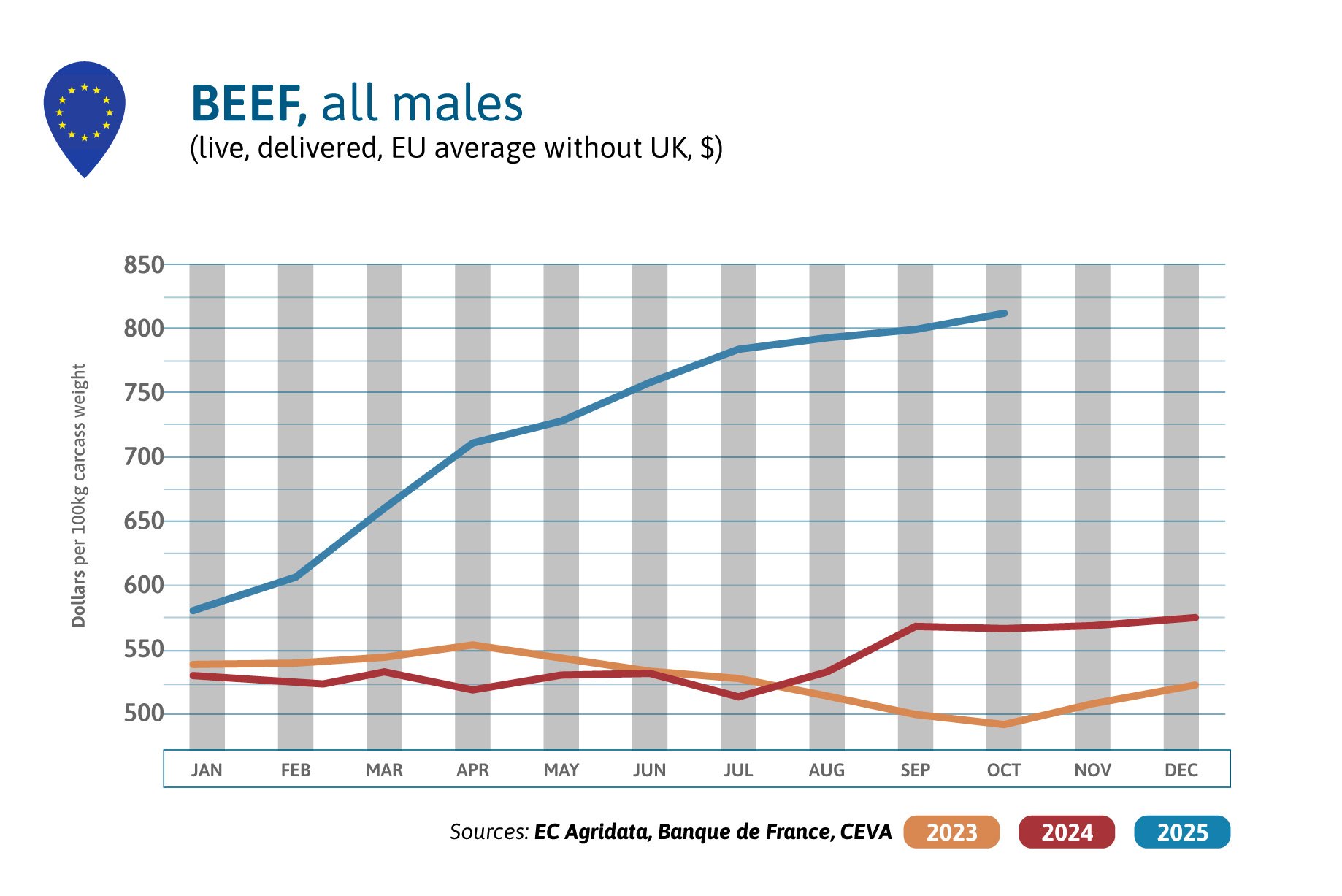

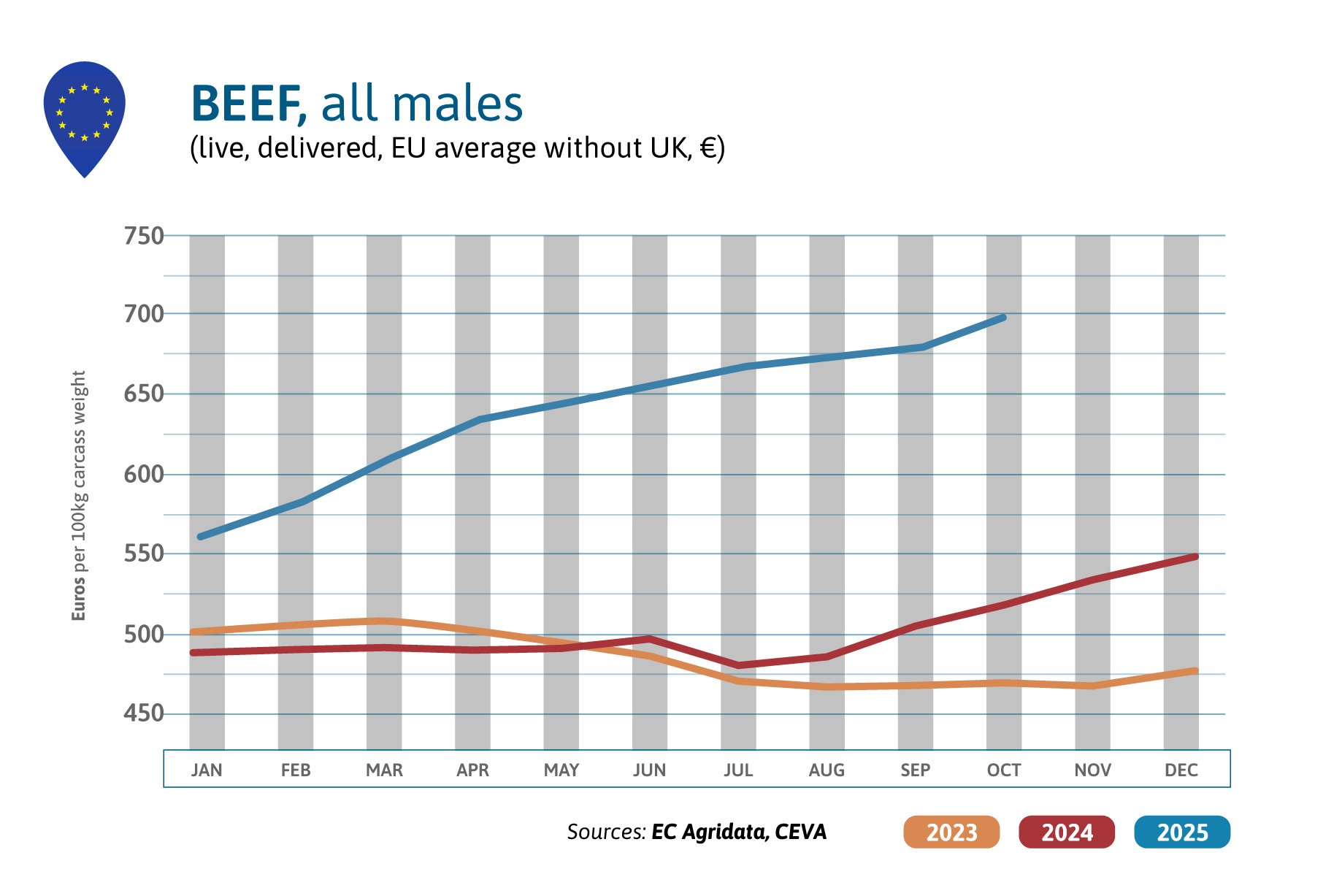

Why are European beef prices increasing in October 2025?

In October, male cattle prices are seasonally increasing (+2% compared to Sept., in $US) as beef consumption increases at this time in Italy and Germany and were 45% above 2024 high levels. EU beef production contracted by 3% in the first 8 months of 2025, making beef meat imports increase.

Why are October US beef prices still unavailable?

October US beef prices were not yet available on November the 20th, due to progressive update in the US of the statistical situation after end of shutdown.

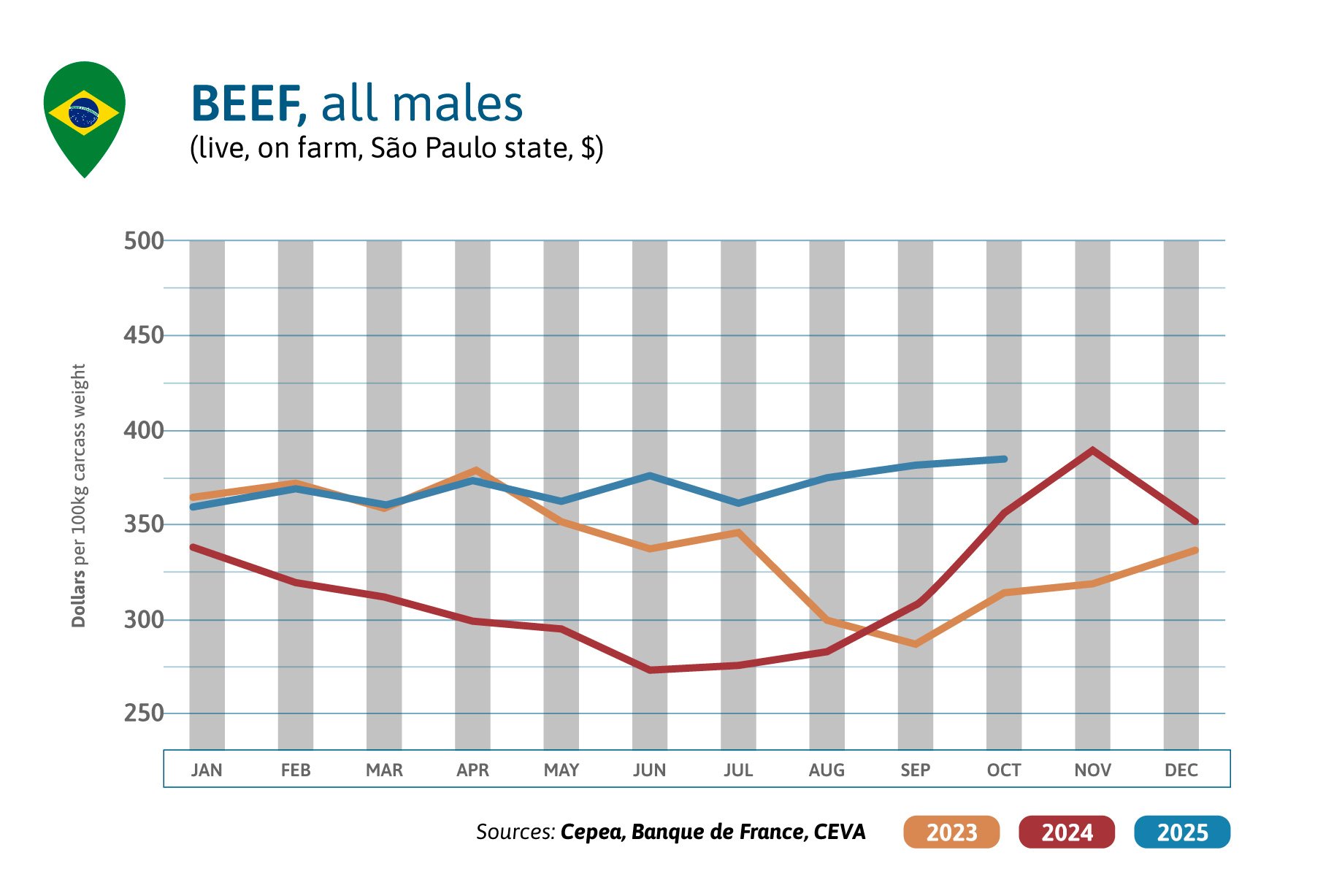

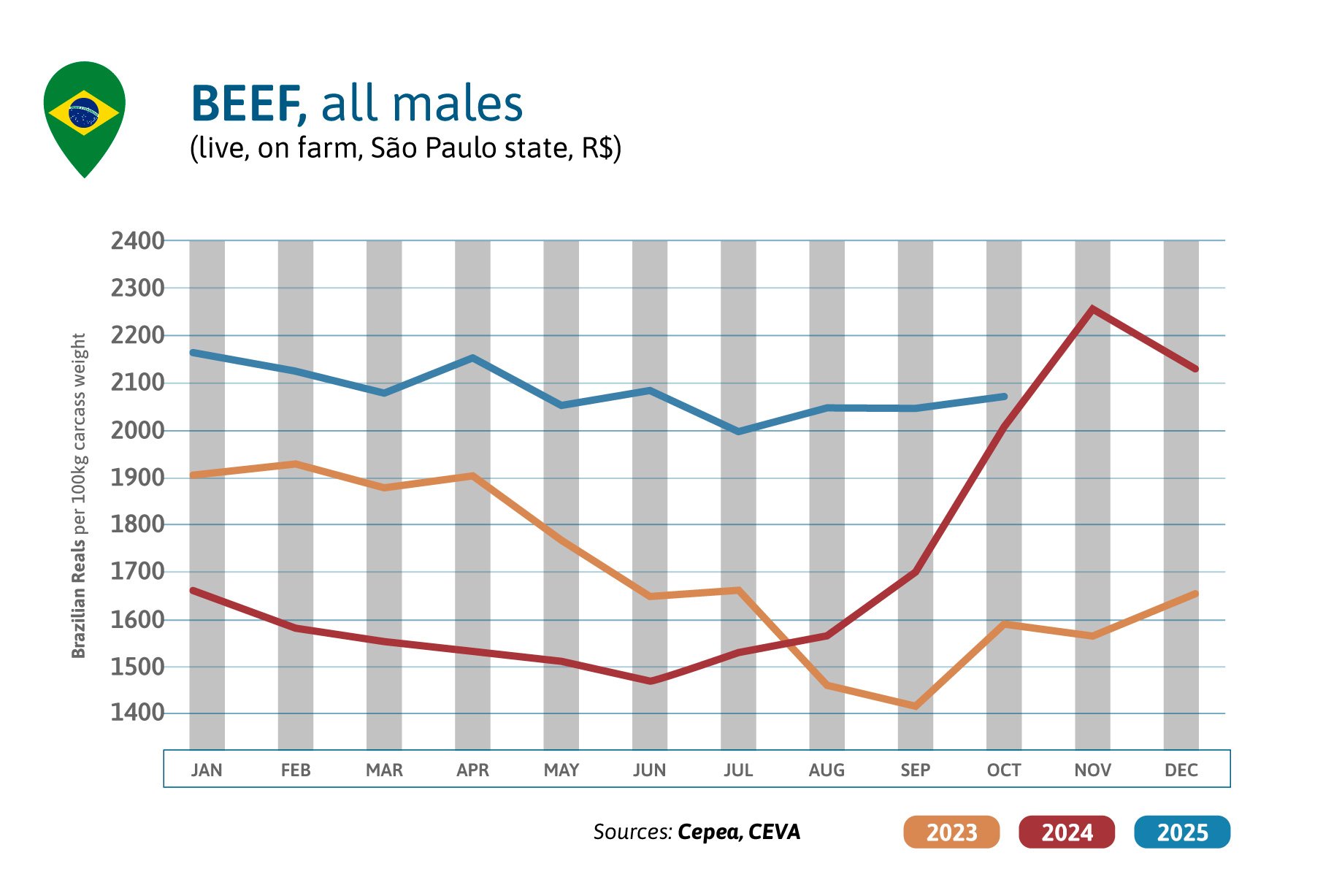

How are Brazil’s beef exports boosting market prices in 2025?

Brazilian beef prices are slowly increasing in US$ since beginning of 2025 (+1% in a month, +7% compared to 2024) but in Réais the prices increase only since August, as slaughter rhythm was 2.4% higher during Semester 1 of 2025, year-over-year (y-o-y), already compared to record 2024. Brazil’s beef exports are 16% above 2024 in the first 10 months of 2025, at 3.31 million tons cwe. On Nov. 21st, the US have decided to stop the 50% tariff on Brazilian beef that was active since August. The tax had divided by 2 the Brazilian beef imports in the US (Aug.-Sept.) increasing the lack of meat on the US market and sending US consumer prices up. Brazil’s 10-month beef exports to China/Hong Kong were 21% above 2024 level: 1.76 million tons cwe.

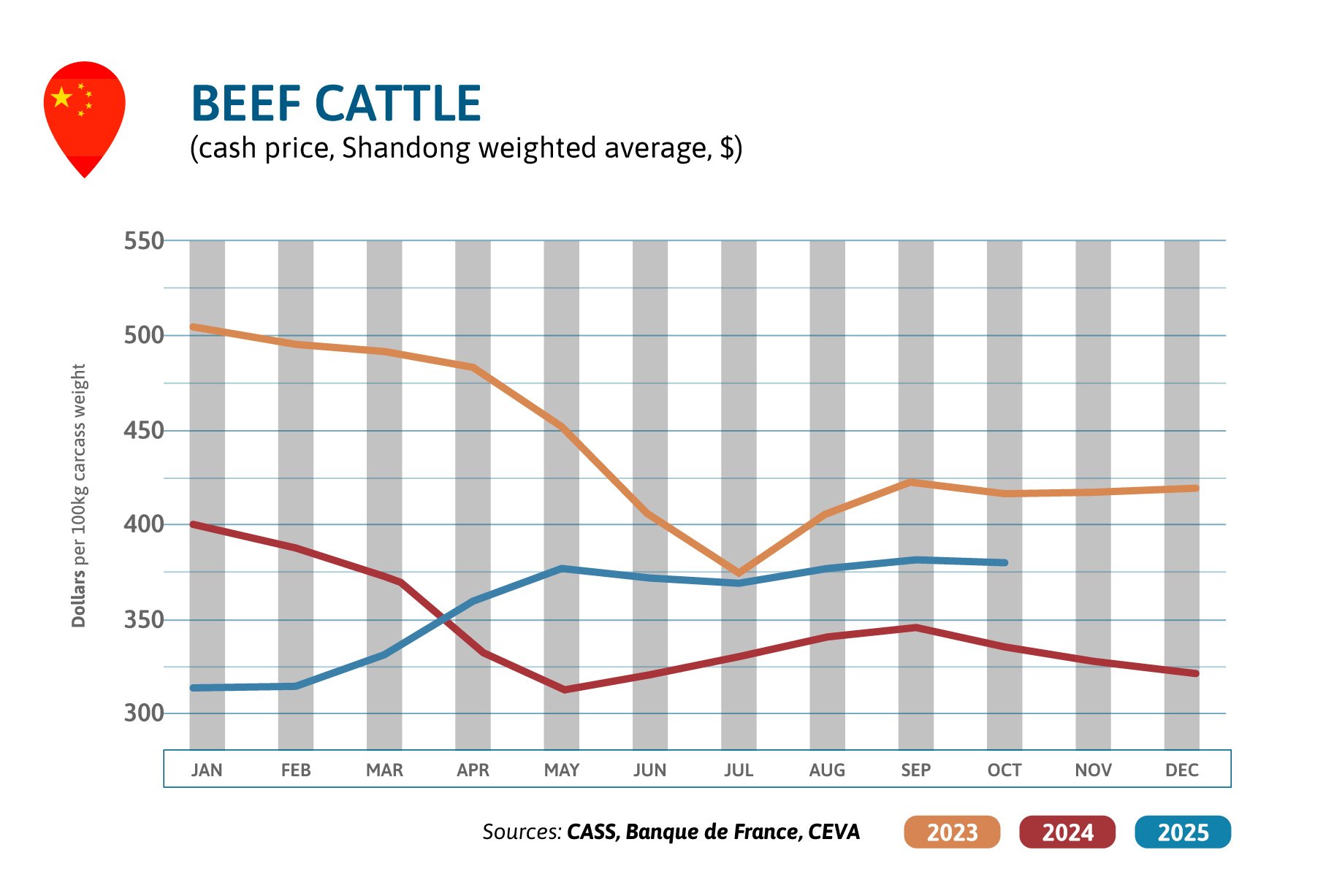

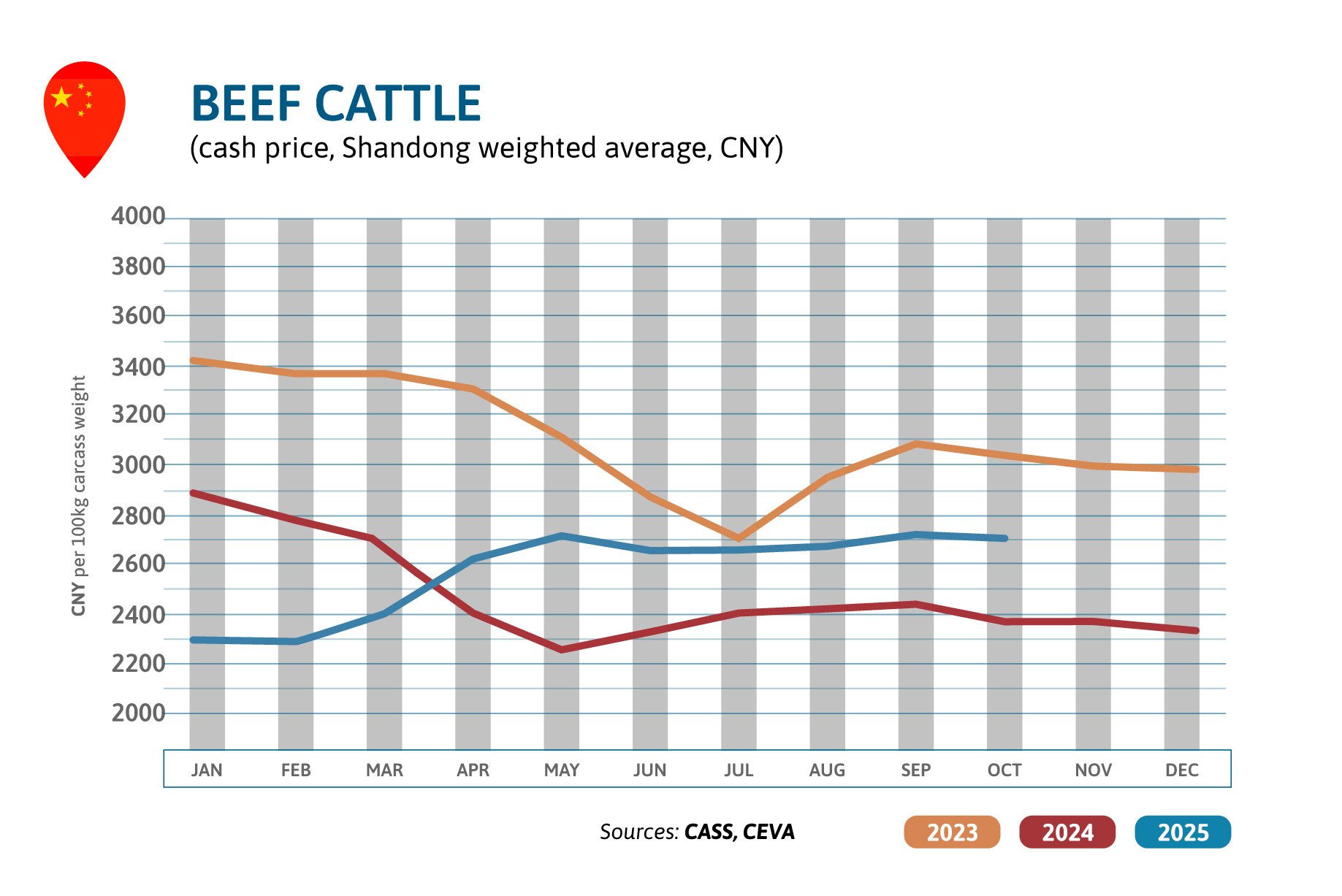

Why are beef prices falling again in China?

In October, beef prices reclined in China (-1% in a month), were 13% above the historic low level of 2024 but far from pre-crisis levels (-22% / 2022). China’s beef imports had slowed until May, but increase since, putting pressure on local beef prices. In September, import volumes jumped by 16% y-o-y. Brazilian exports to China/Hong Kong are up: 247,000 tons in October according to Brazilian customs, +19% /2024, as imports from Australia: 553,000 million tons cwe in 9 months, +50% y-o-y. China should deliver its report on potentially excessive beef exports to its country at the end of November. Leeks mention a total 2 million tons import quota and the end of the unlimited tariff-free NZ exports.

Source: