Beef Market Outlook (Baptiste Buczinski)

Welcome to the Beef Market Outlook – December 2025, your monthly update on global beef markets and price trends. In this edition, we analyse the latest shifts in beef production, cattle prices, and export dynamics across Europe, Brazil, China, and the United States. With clear, data-driven insights, we highlight the key factors influencing global supply and demand, trade flows, and overall market profitability.

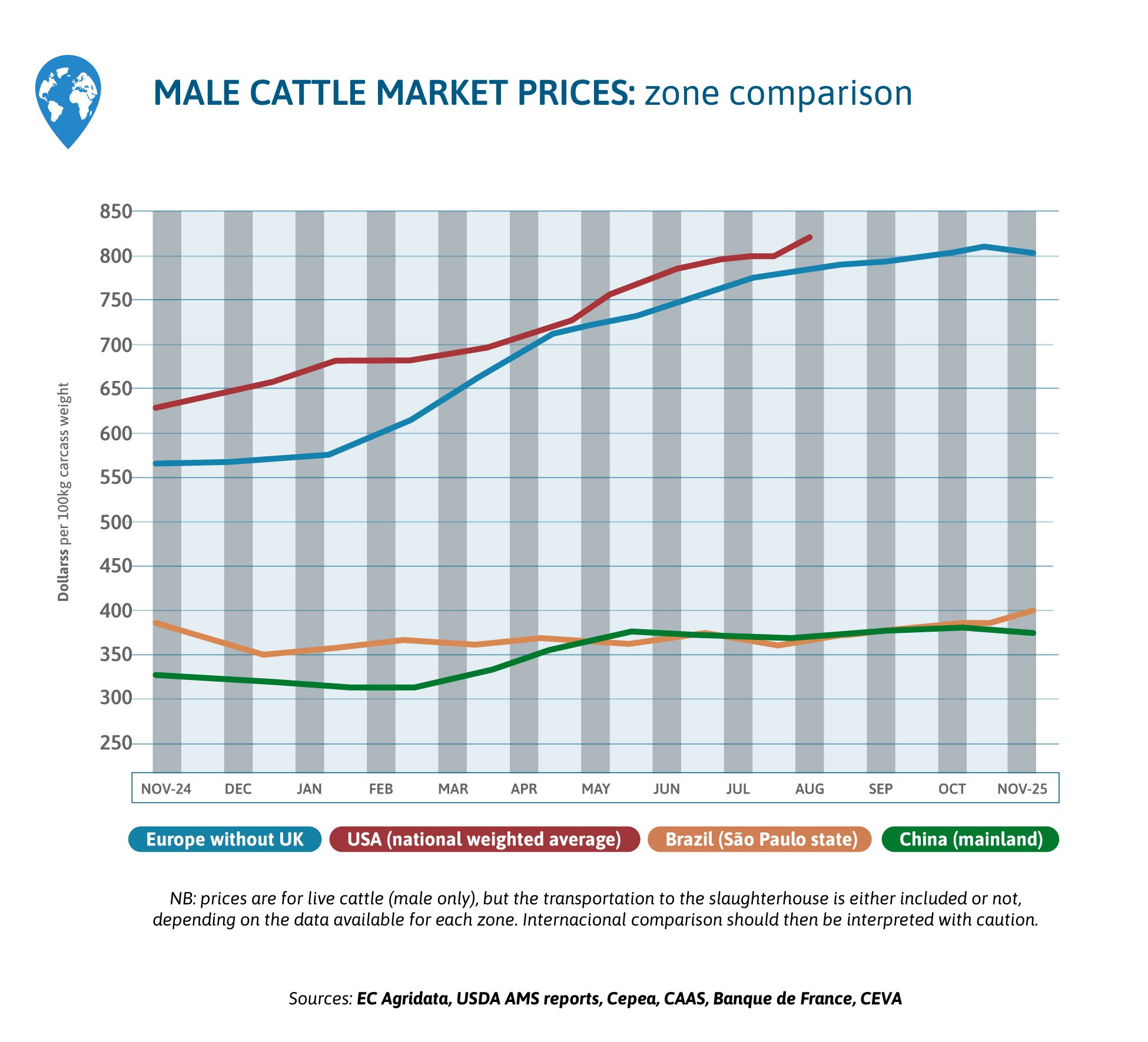

What were the trends in global beef prices in November 2025?

In November, Brazilian male prices were increasing, Chinese prices being at a slightly lower level. European prices stabilized at a record high.

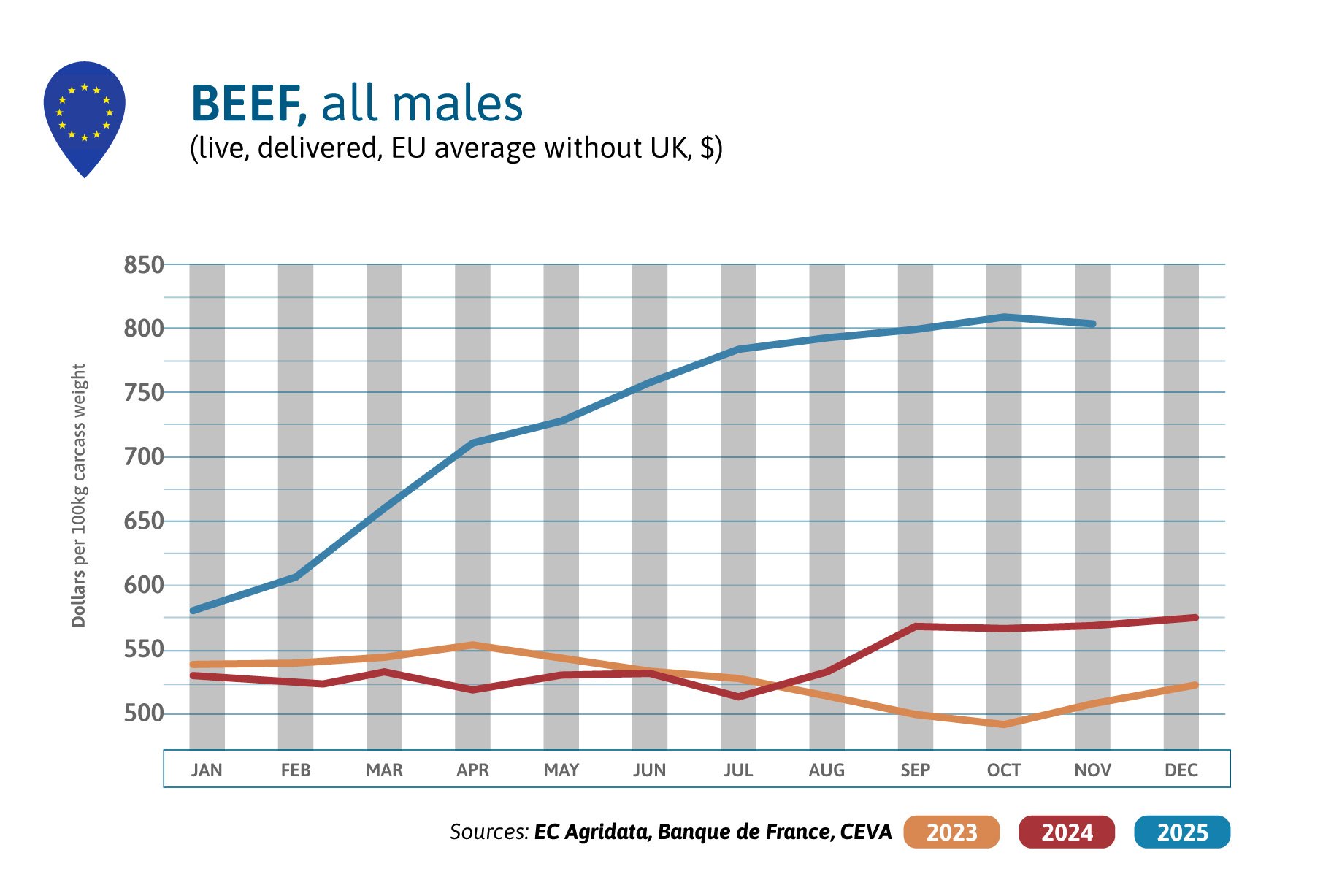

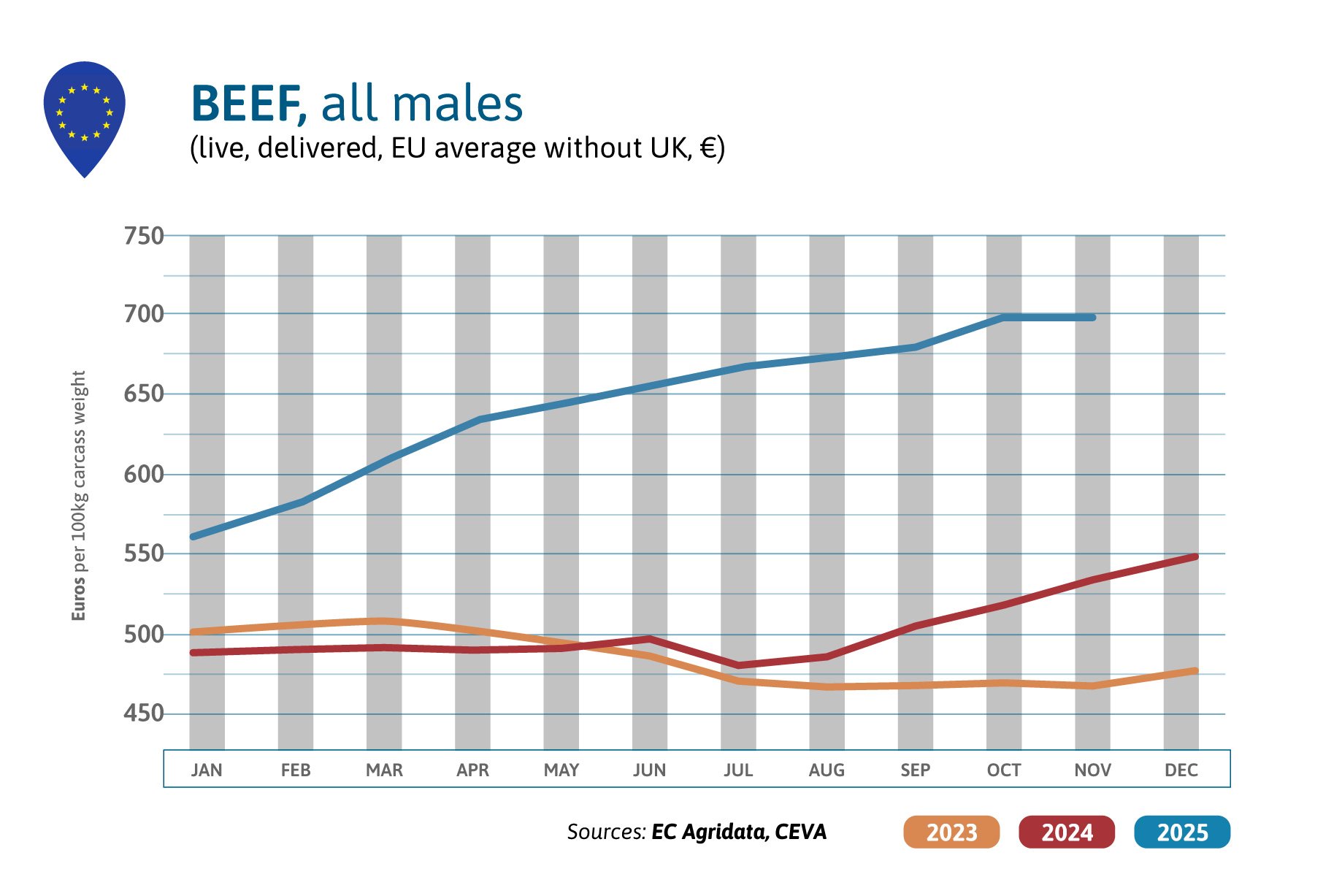

How did beef prices and production perform in Europe in November 2025?

In November, male cattle prices were very slightly decreasing in $US (-1% compared to Oct.) but were stable in €, at a never-recorded maximum level of 806 $/100 kg cwe. Meat consumption increases in autumn and winter in Italy and Germany, who eat young bull meat, putting some tension on the meat market, thus setting prices 43% above 2024 level. EU beef production contracted by 3% in the first 9 months of 2025.

What factors are affecting beef prices in the United States?

US beef prices are not available since September, due to shutdown consequences, not completely overcome yet. However, we know that the beef prices reached record highs in October and November because of the low supplies and extra taxes on Brazilian beef. The largest meatpacker, Tyson Foods, announced it will close facilities to reduce its national slaughter capacity by 8% as the US has the lowest number of cattle on its pastures since the 1950s. Trump is trying to lower prices, talking about opening the borders to Mexican cattle and South American beef but he is not succeeding. Prices will remain high in 2026.

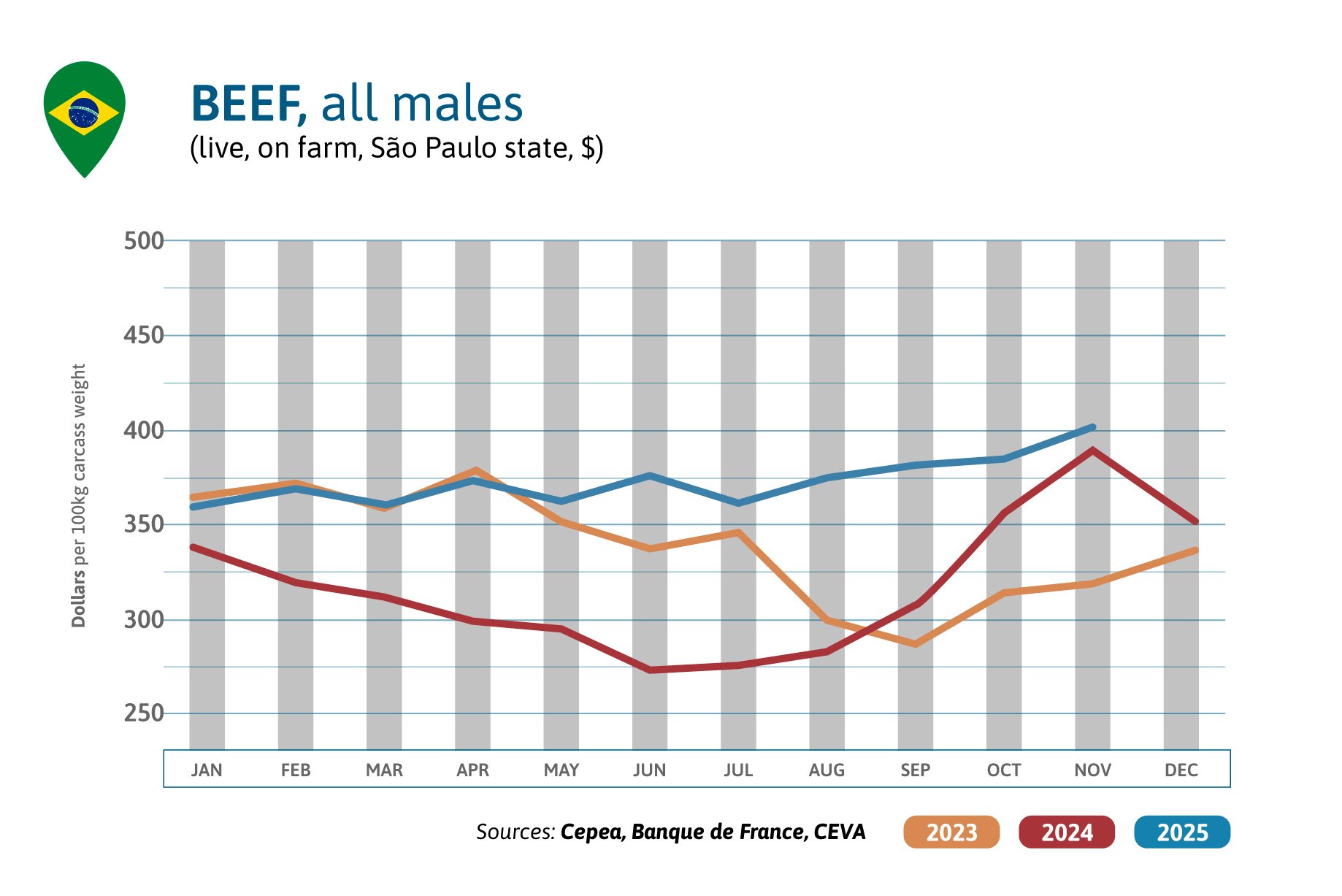

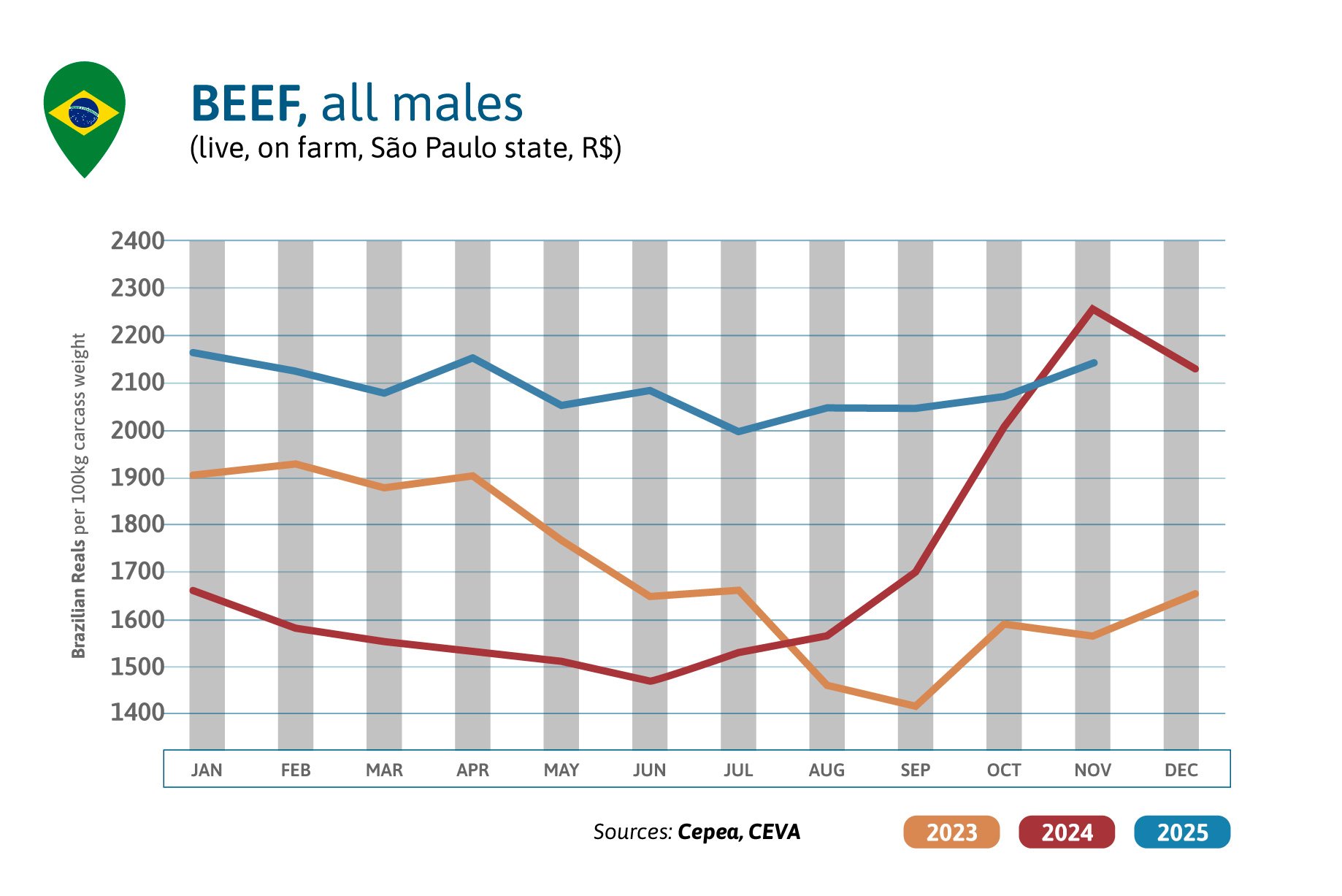

How is the beef market evolving in Brazil this month?

Brazilian beef prices have increased by 5% in US$ in a month but are only slightly above last year’s level (+3%) as deliveries of fed cattle to slaughterhouses are regular, the market seeming only slightly under tension. Brazil’s beef exports from January to November are 18% above 2024, at 3.74 million tons cwe, and 21% above towards China & Hong Kong (2.0 million tons). On Nov. 21st, the US have decided to stop the 50% tariff on Brazilian beef. This has probably already eased Brazilian exports to the US, helping improve beef availability there.

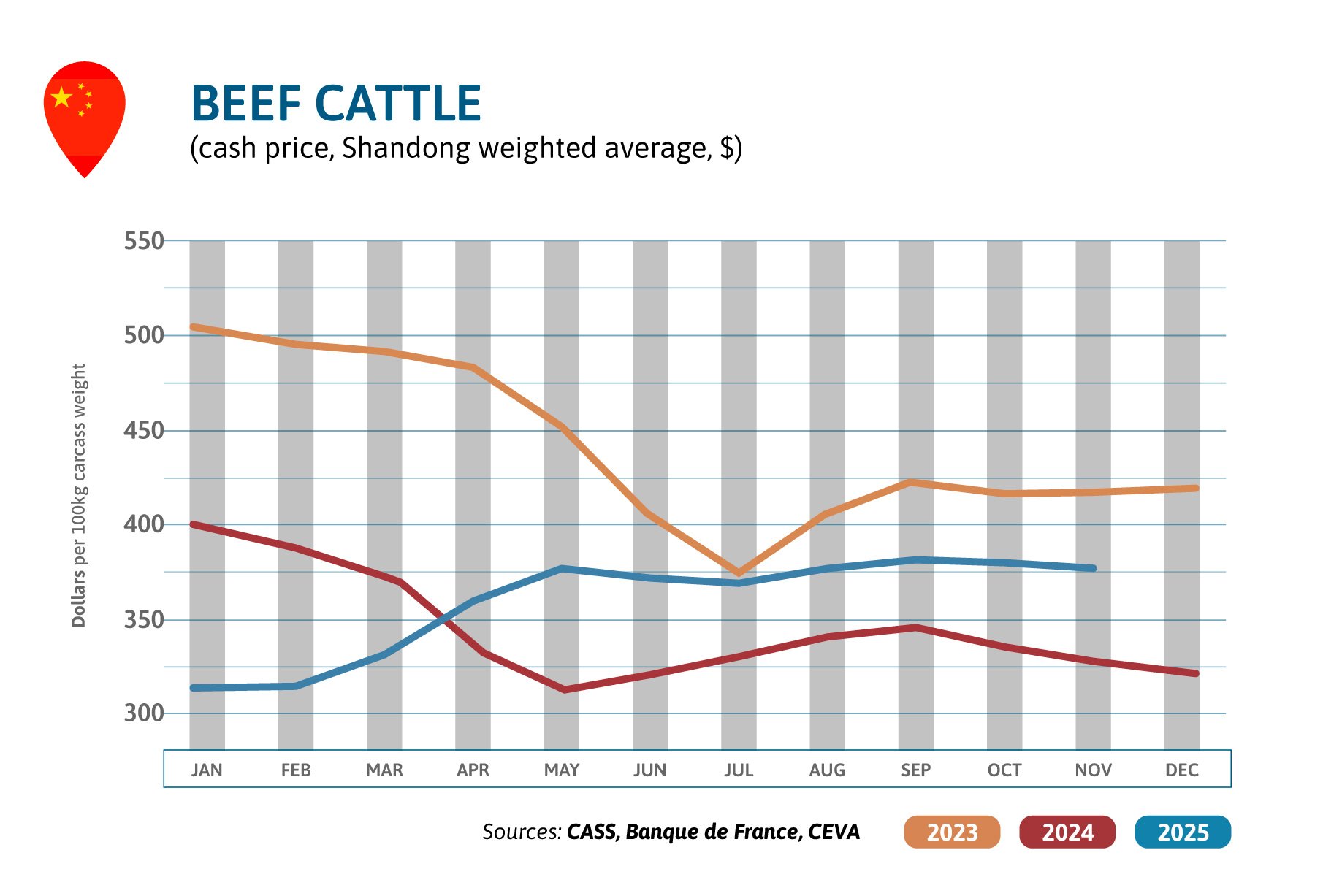

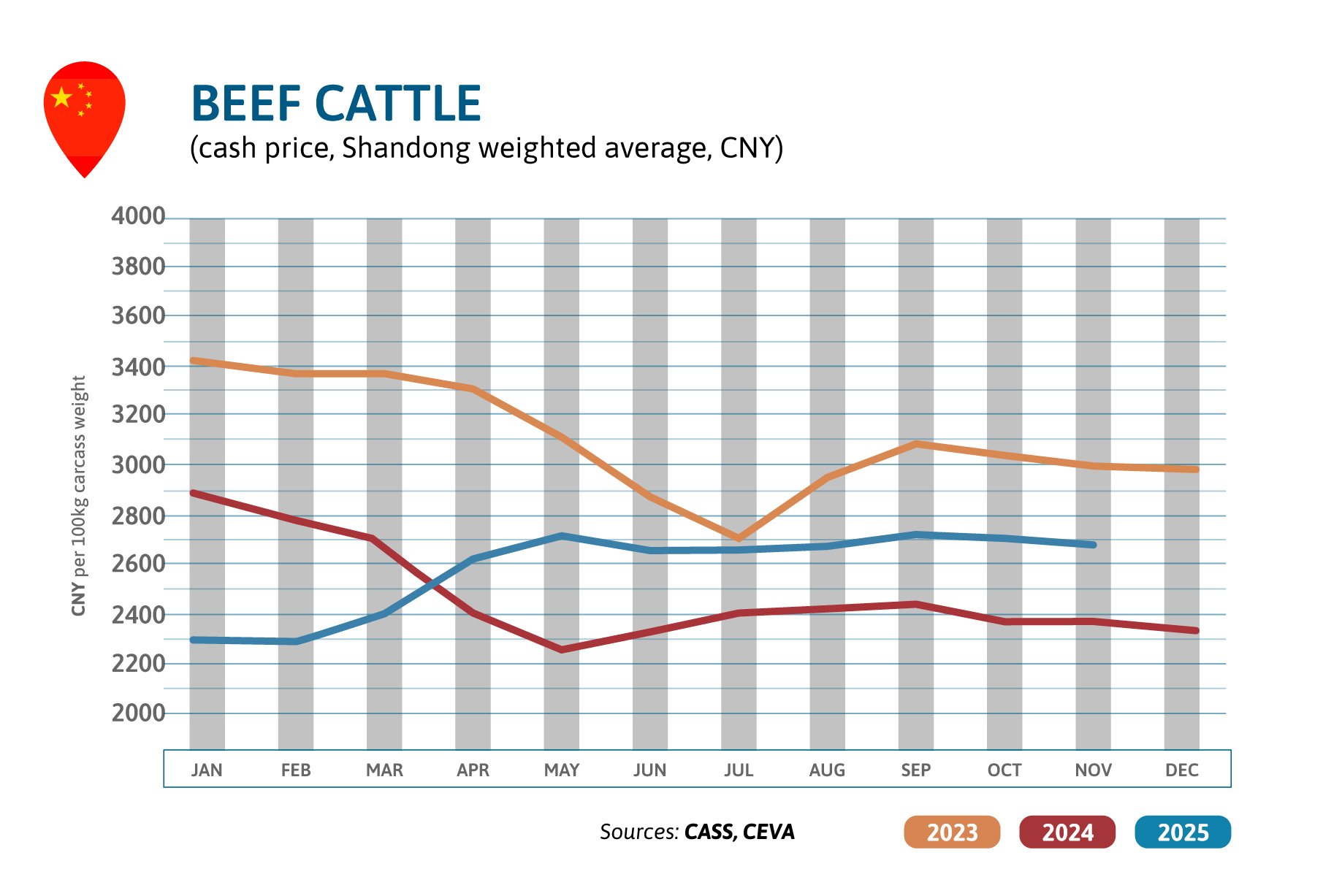

What is happening with beef prices and imports in China?

In November, beef prices reclined of 1% in a month in China, just as in the previous month and were only 15% above the historic low level of 2024. China’s beef imports had slowed until May, but increase since, putting pressure on local beef prices. China has added two months to the enquiry period on potentially excessive beef exports to its country, until the end of January 2026. The complexity of the study and probably the important consequences of restrictions on beef imports explain this delay. November leeks in the press mentioned a total 2 million tons import quota and the end of the unlimited tariff-free NZ exports.

Source: