What is the Milk Market Outlook for November 2025?

Why is milk production increasing globally?

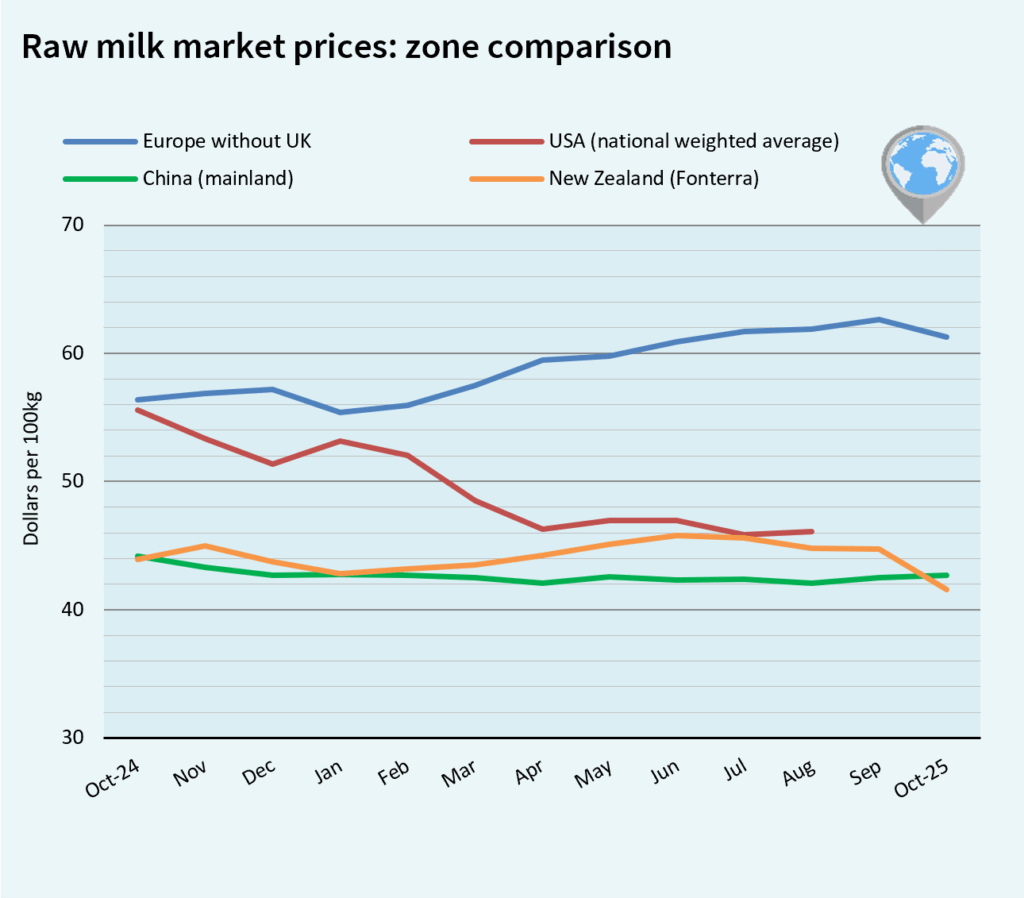

Global milk production continues to trend upward, driven mainly by the EU and the US, which are the primary contributors to growth. The EU and the US are driving this growth, supplying both domestic and international markets. As production increases, global prices for dairy ingredients and cheeses are trending downward, and raw milk prices are under pressure. This trend is consistent across most exporting regions, reflecting a shift in the balance between supply and demand in global dairy markets.

How is milk production and pricing evolving in the EU?

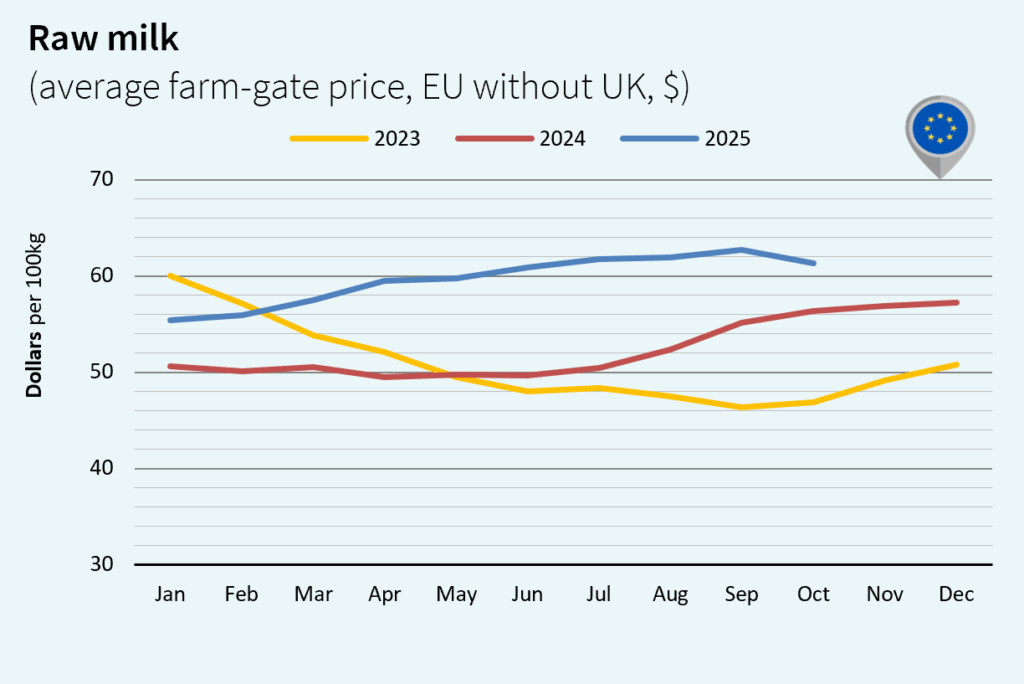

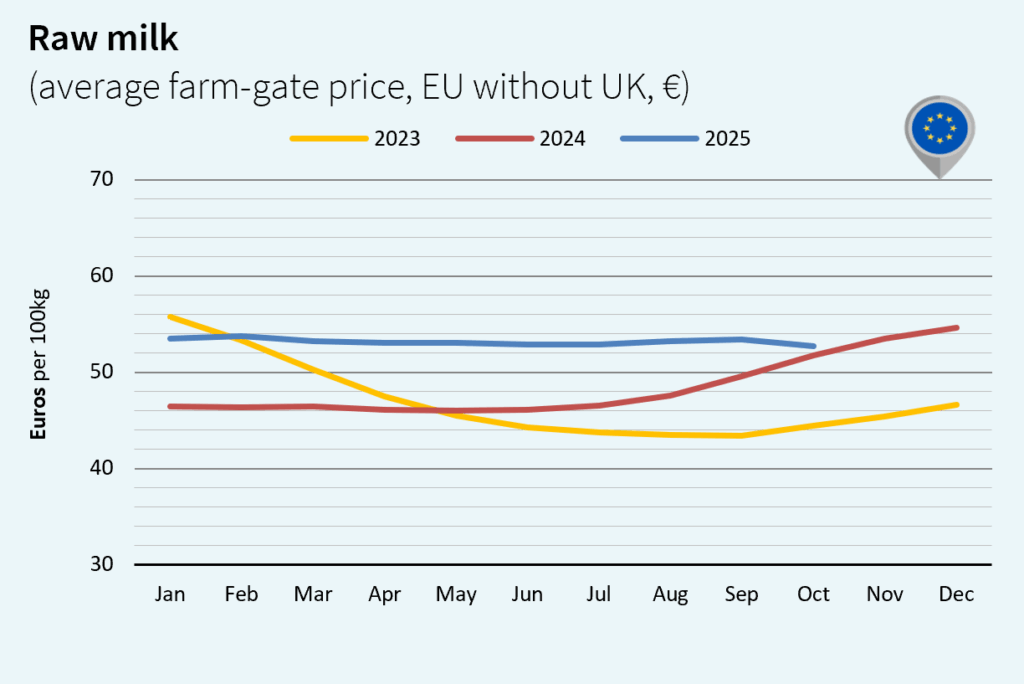

After a mixed start to the year, milk collection within the EU-27 continued to increase each month since summer. In October 2025, over 12.11 million tons of milk were collected, representing a 5.1% increase compared to October 2024 and setting a record for that month. This strong supply, particularly affecting Irish companies focused on dairy commodities and exports, is creating downward pressure on prices. Milk prices are also falling across the rest of Europe, with the average raw milk price reaching US$61.27/100 kg, down 2.2% versus September 2025 but up 8.7% versus October 2024, illustrating both seasonal and annual production effects.

What are the trends in US milk production and prices?

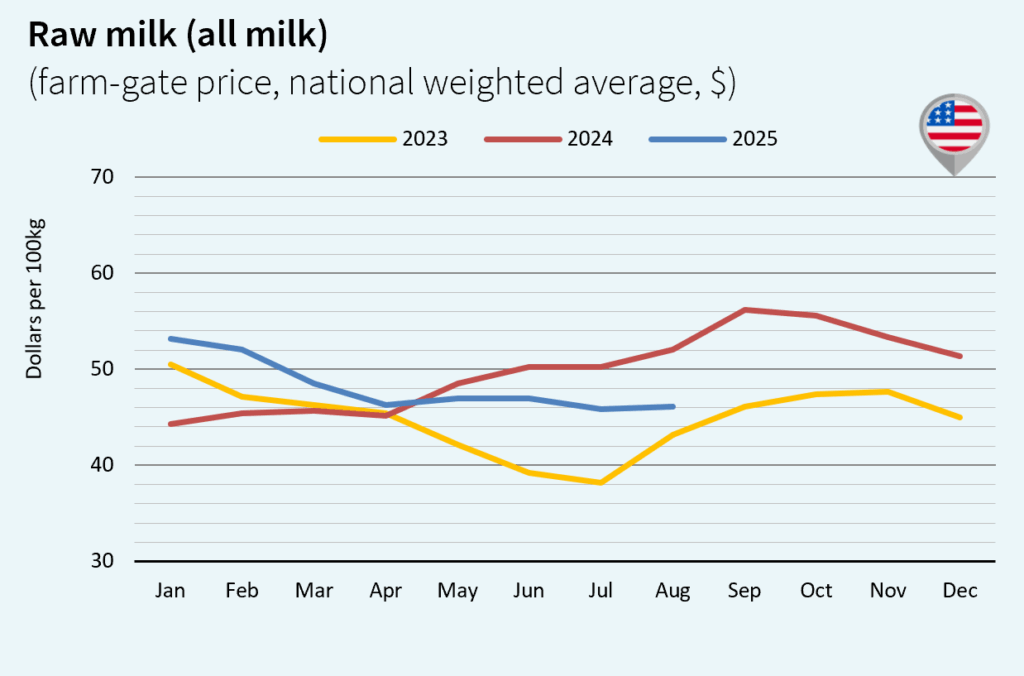

In the United States, despite declining commodity prices, farm margins remained relatively strong for much of the year, supported by a drop in feed costs, keeping production particularly dynamic.

In October 2025, US milk production exceeded 8.83 million tons (+3.7% vs. 2024), a record high for the month.

However, these large availabilities are weighing on prices. Due to a long government shutdown, the release of some data is still blocked. The latest raw milk price data date back to August and do not reflect the likely decline in prices.

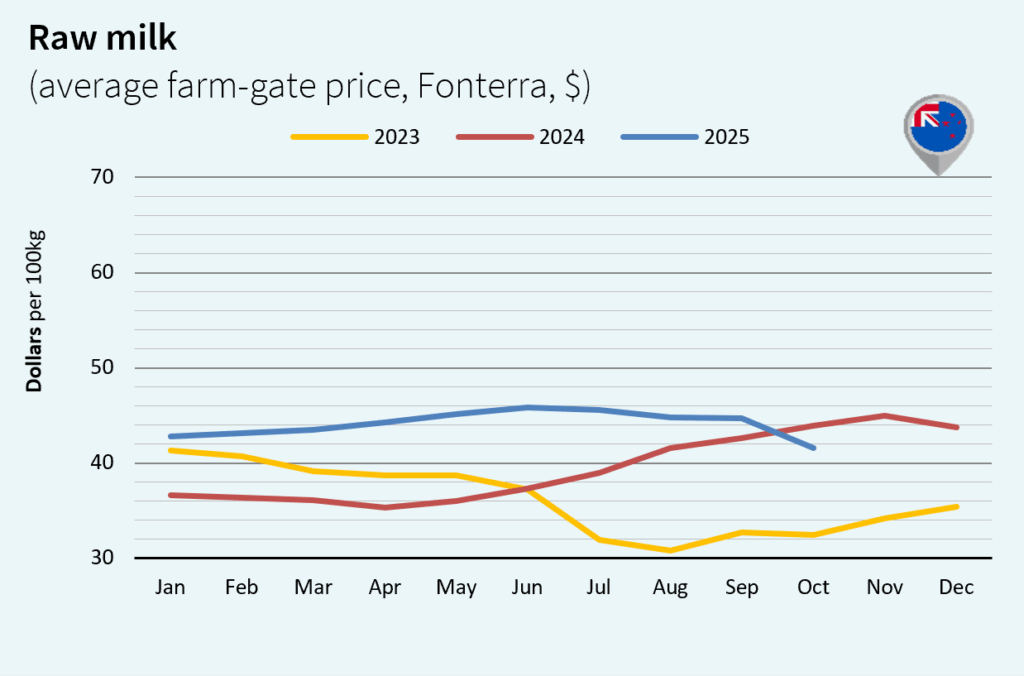

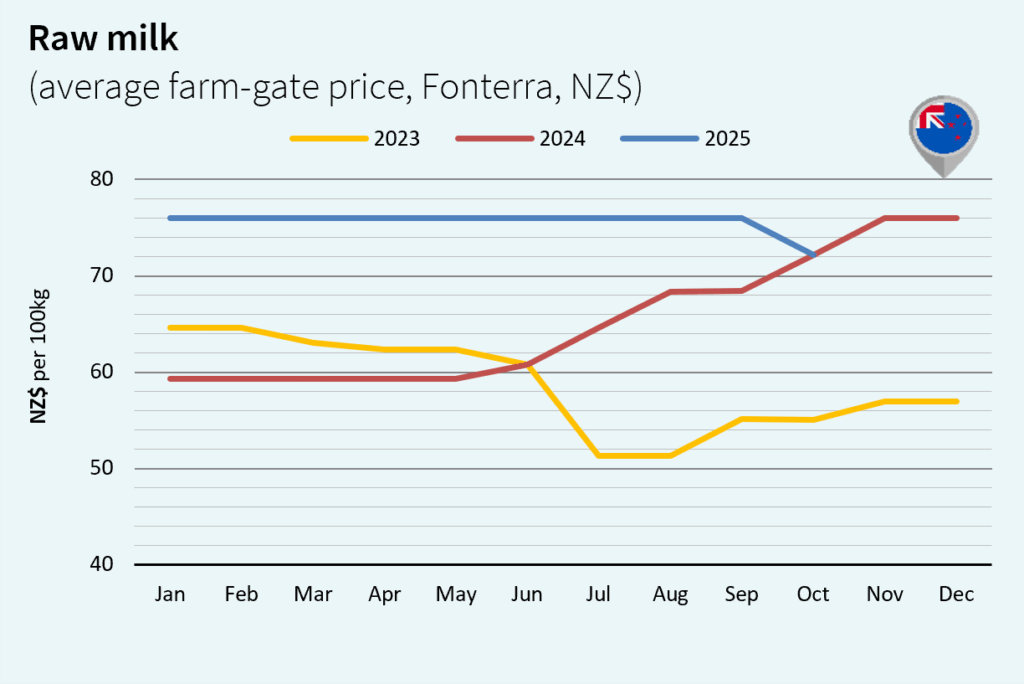

How are New Zealand’s milk production and prices performing?

The production peak of the 2025/2026 season was, as expected, relatively high. In October 2025, production totaled 3.13 million tons (+1.7% vs. 2024), the highest level since the 2021/2022 season. NZ dairy ingredient prices are now affected by the downturn in global markets. In October, raw milk in New Zealand was US$41.58/100 kg (-7.0% vs. September 2025 and -5.4% vs. October 2024). The cooperative Fonterra, which accounts for more than 80% of the country’s production, revised its prices downward after the record level paid during the 2024/2025 dairy season.

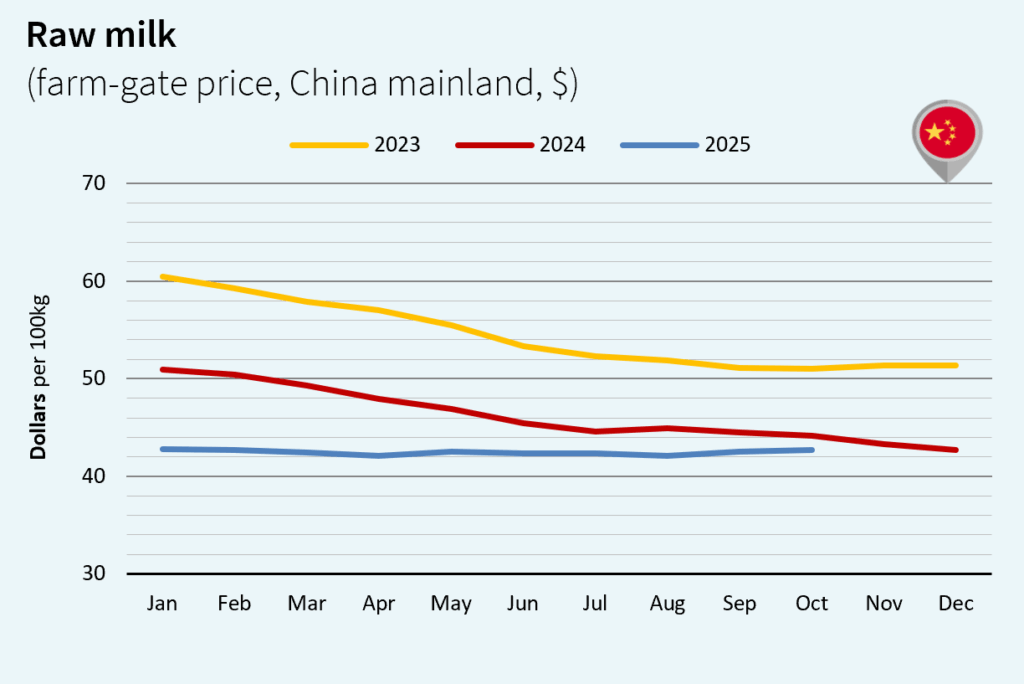

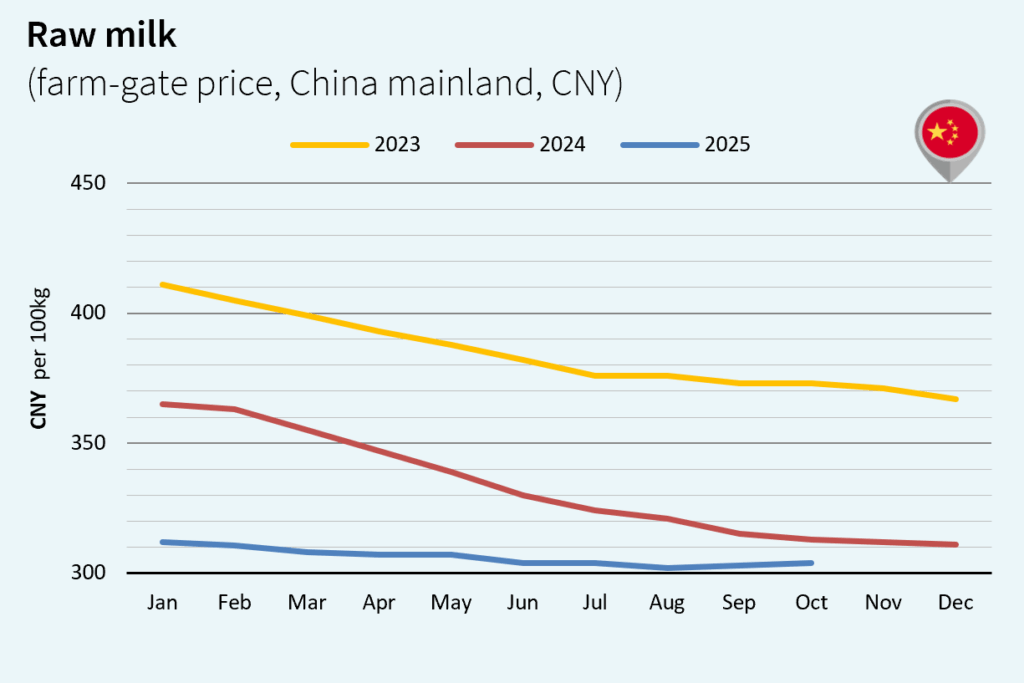

What is the situation of milk production and prices in China?

China remains mired in the dairy crisis that has been ongoing for many months, with low margins on dairy farms and weak household consumption. Nevertheless, China has become an exporter of Whole Milk Powder (WMP). Between October 2024 and October 2025, the country exported more than 53,500 tons (+226% year-on-year), with Nigeria, Bangladesh, and Venezuela as the top three customers. The situation for raw milk prices is improving very slightly. In October, Chinese raw milk reached US$42.69/100 kg (+0.4% vs. September 2025 but -3.3% vs. October 2024).

Source: