Beef Market Outlook (Baptiste Buczinski)

Welcome to this month’s Beef Market Outlook. In this edition, we bring you the latest updates on beef cattle markets from Europe, Brazil, China, and the USA. Our analysis is built on thorough data, offering you a clear view of the trends that matter most.

SEE and share this valuable content.

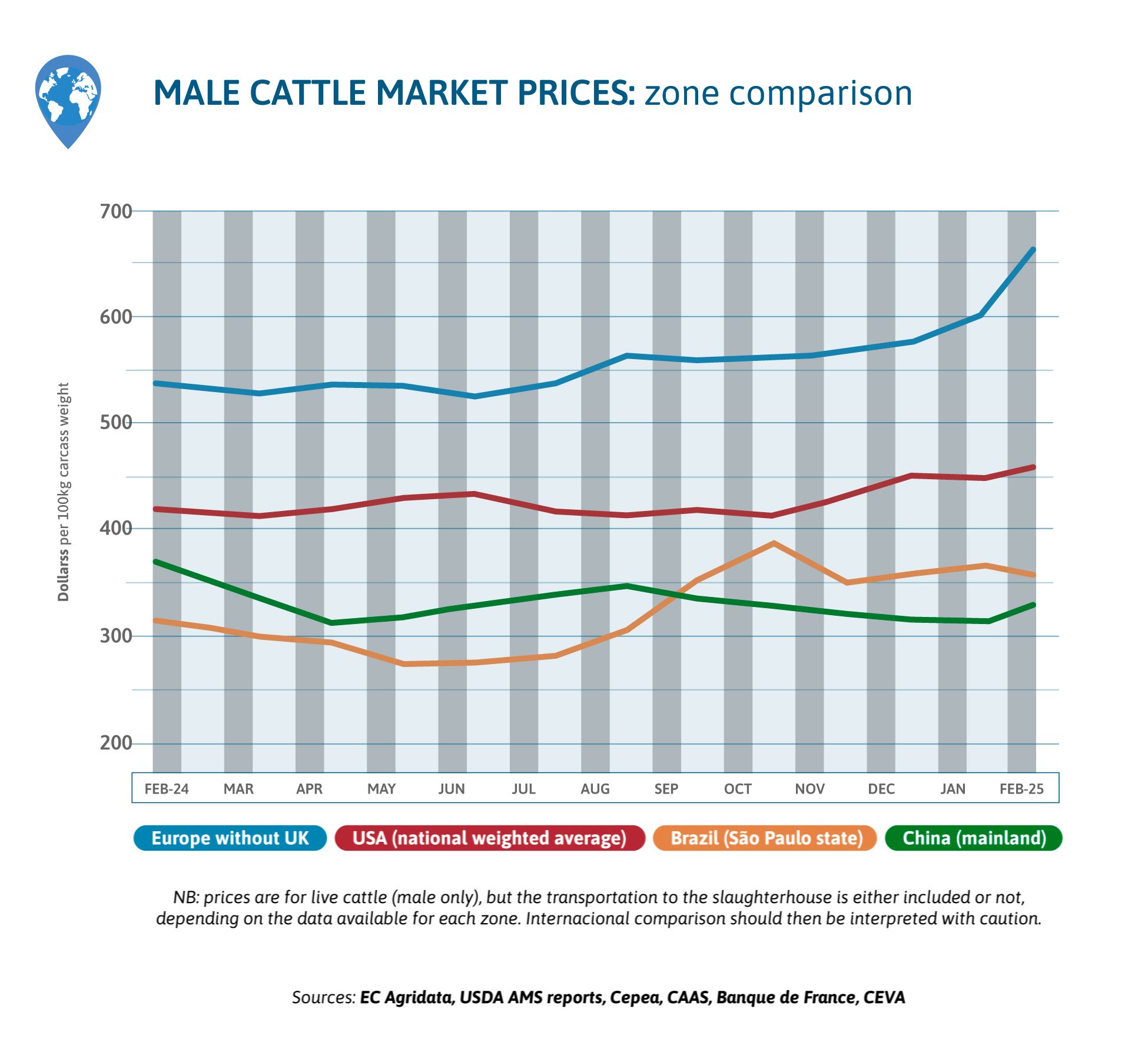

GLOBAL BEEF MARKET TREND

In March, cattle prices increased by 5% in China but stayed globally low. Brazilian prices are oscillating but World demand for Brazilian beef is very strong, as it is produced at more competitive price than other areas. US prices are high and slowly increasing as cattle is scarce, while in Europe male prices soared for the same reason and because demand was important for Ramadan in March on the South and East coasts of the Mediterranean Sea.

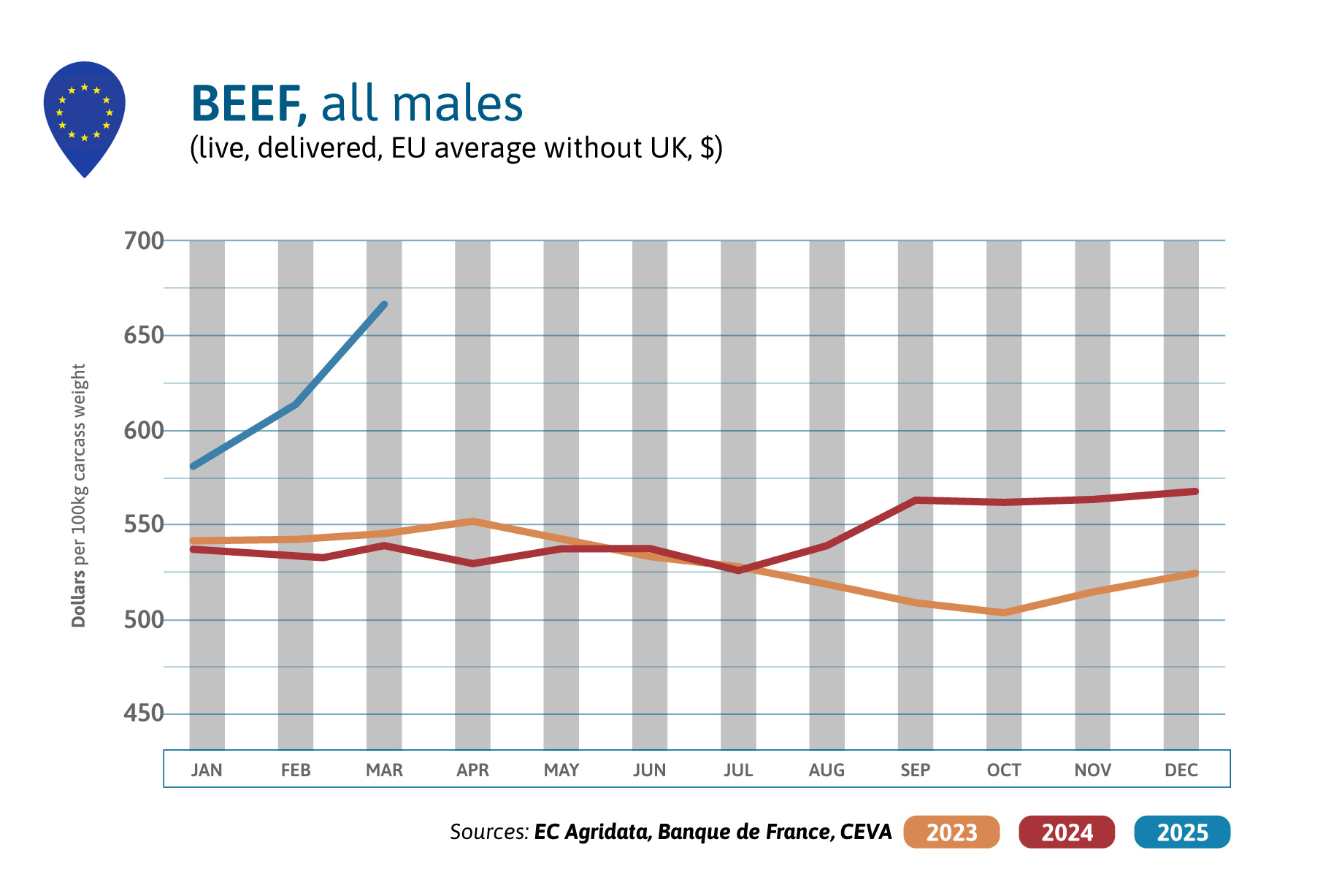

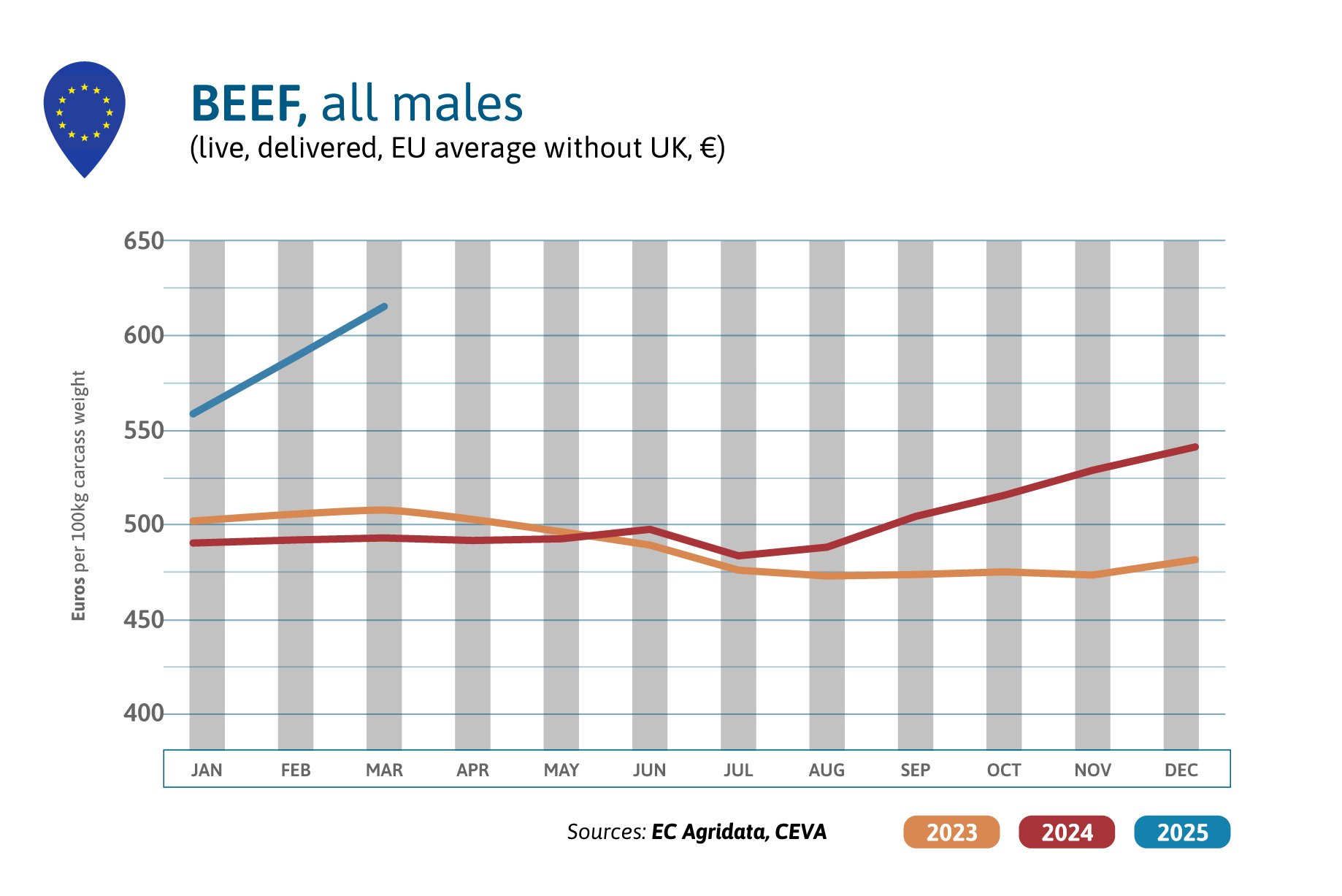

BEEF PRICES IN EUROPE

European prices for male beef soared by 9% compared to the previous month in US$ and are now 24% above the 2024 highest level! This increase is linked to Europe’s lack of cattle for slaughter. The number of cows decreased by 3% in 2024, a historic drop which reduces the slaughter numbers.

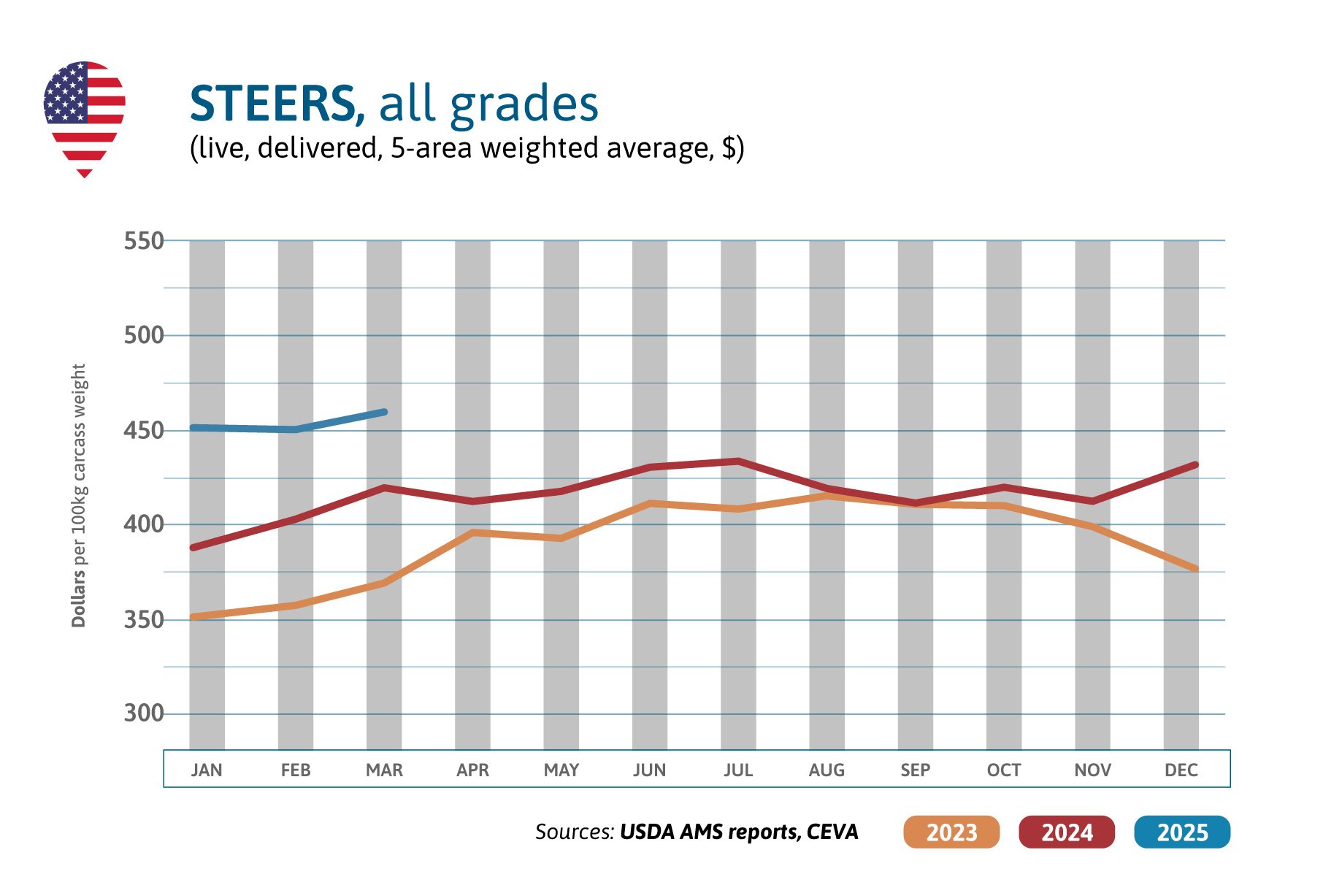

USA’S CATTLE MARKET

In March, steer prices increased by 2% MoM and were 10% above last year’s level. Ready-to-slaughter cattle is scarcer than last year, which pushed the prices up. Cattle imports from Mexico have been increasing since February and the new import protocol now in force, but are not yet back to normal (these imports were paused during December and January). As a result, the number of cattle to slaughter may be lower this year, but carcass weights are still increasing.

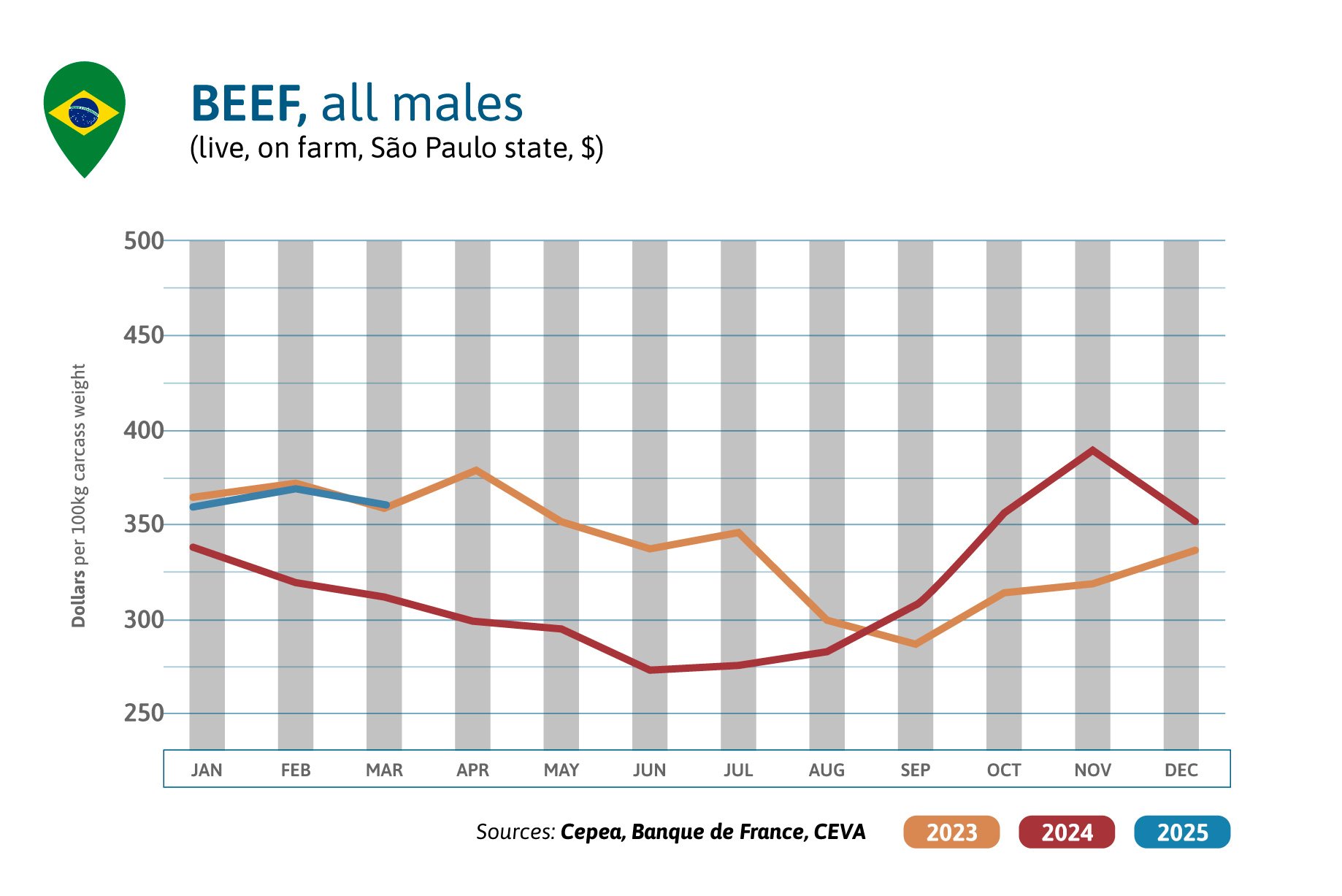

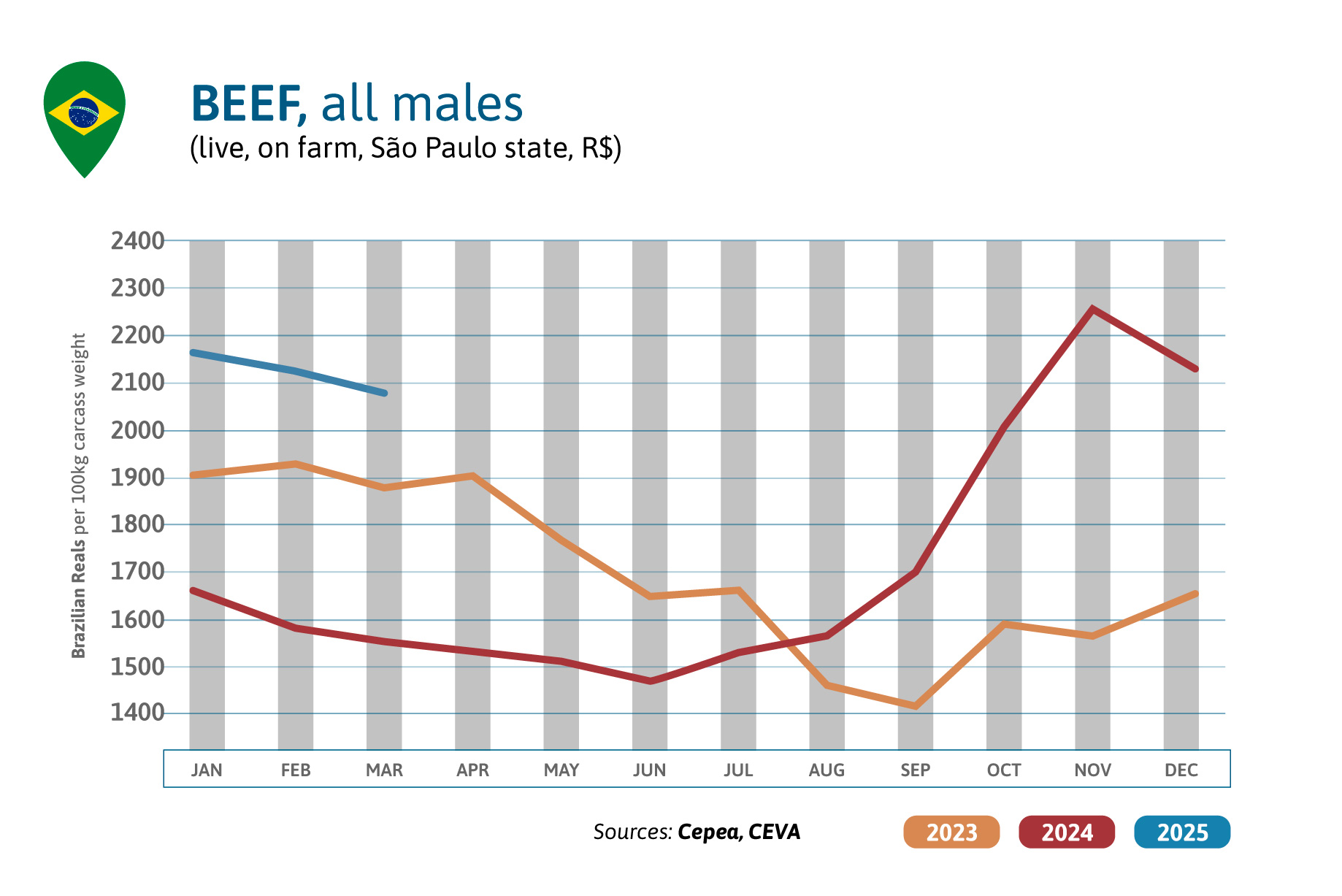

BRAZIL BEEF MARKET SITUATION

Brazilian beef prices have been oscillating since the beginning of the year: -2% in March compared to the previous month, but +3% in February. They are well above March 2024’s prices: +16% in US$ and +34% in Reals, the local currency having lost 19% of its value YoY. According to local reports, prices rose again slightly at the end of March. In the first three weeks of March, Brazilian exports were again soaring: +51% compared to the same period last year (Secex).

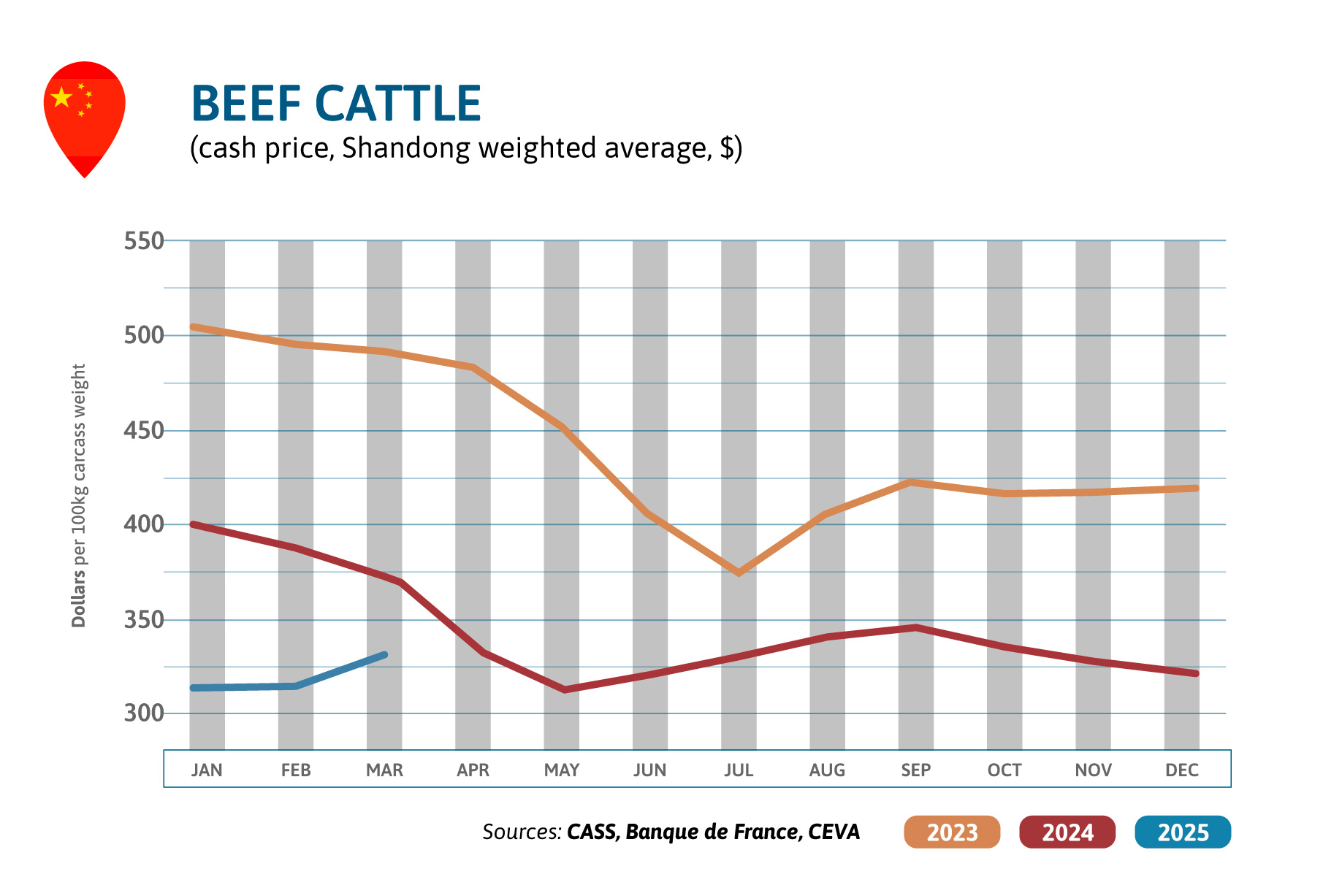

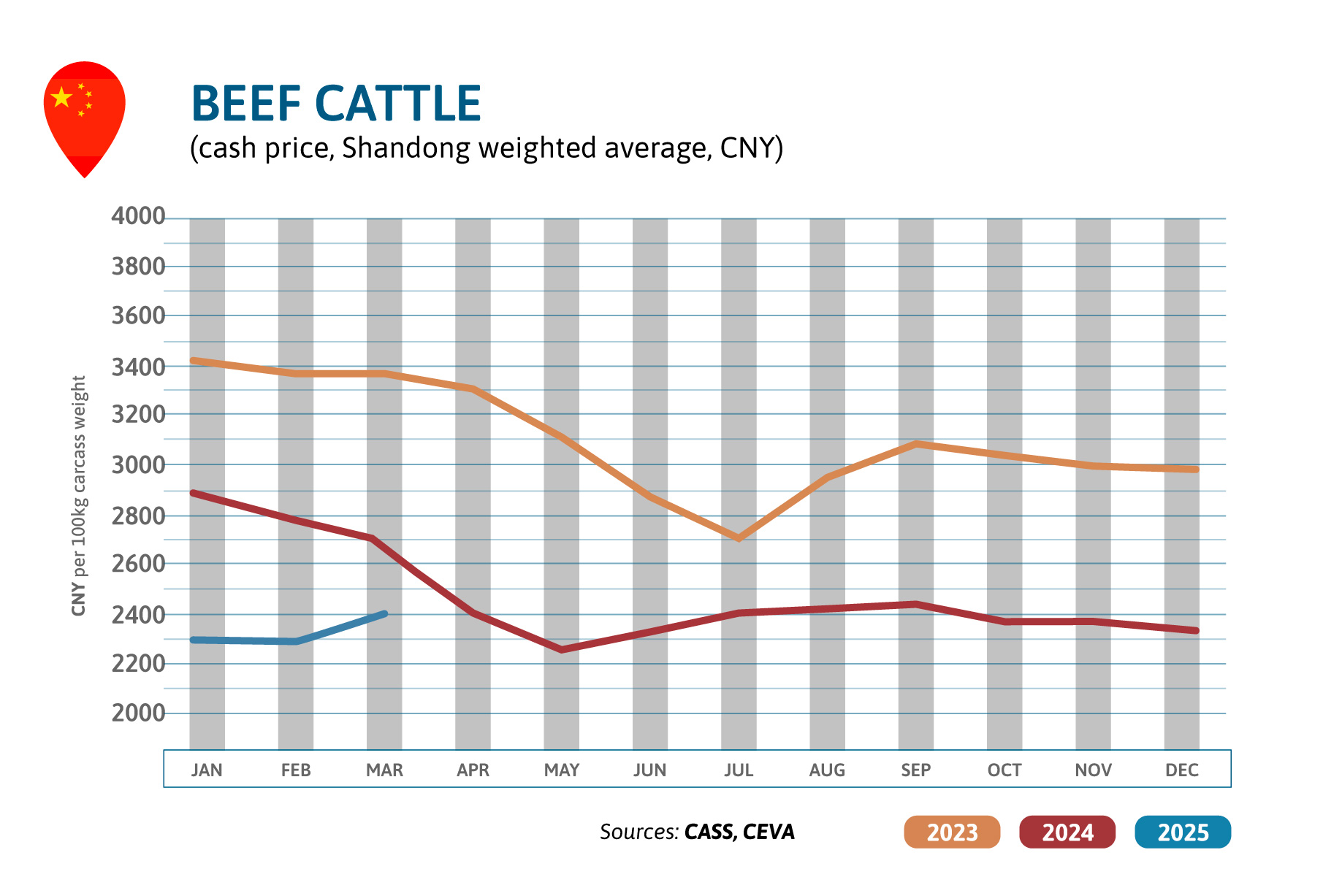

BEEF PRICES IN CHINA

In March, Chinese cattle prices increased by 5% MoM, but remained globally low (-31% compared to 2 years ago). In a report published in November 2024, the China Animal Husbandry Association announced that around 65% of cattle farms in China were losing money, after the historic decrease in cattle prices of 2024. FuCheng, n°1 in China for cattle raising said its activity’s profit dropped to only 2% in 2024, compared to 48% in 2023. Prospects for 2025 remain bleak. Companies try to improve profitability by optimising feed formulation and breeding, developing a more integrated system (investing in their own slaughterhouses and processing plants) or expanding sale channels to find new customers.

Source: