Beef Market Outlook (Baptiste Buczinski)

Welcome to the updated Beef Market Outlook. Explore the current developments in beef cattle across Europe, Brazil, China, and the United States. Supported by comprehensive data analysis, our insights provide a clear perspective on the main drivers influencing the global beef sector.

SEE and share this valuable content.

GLOBAL BEEF MARKET

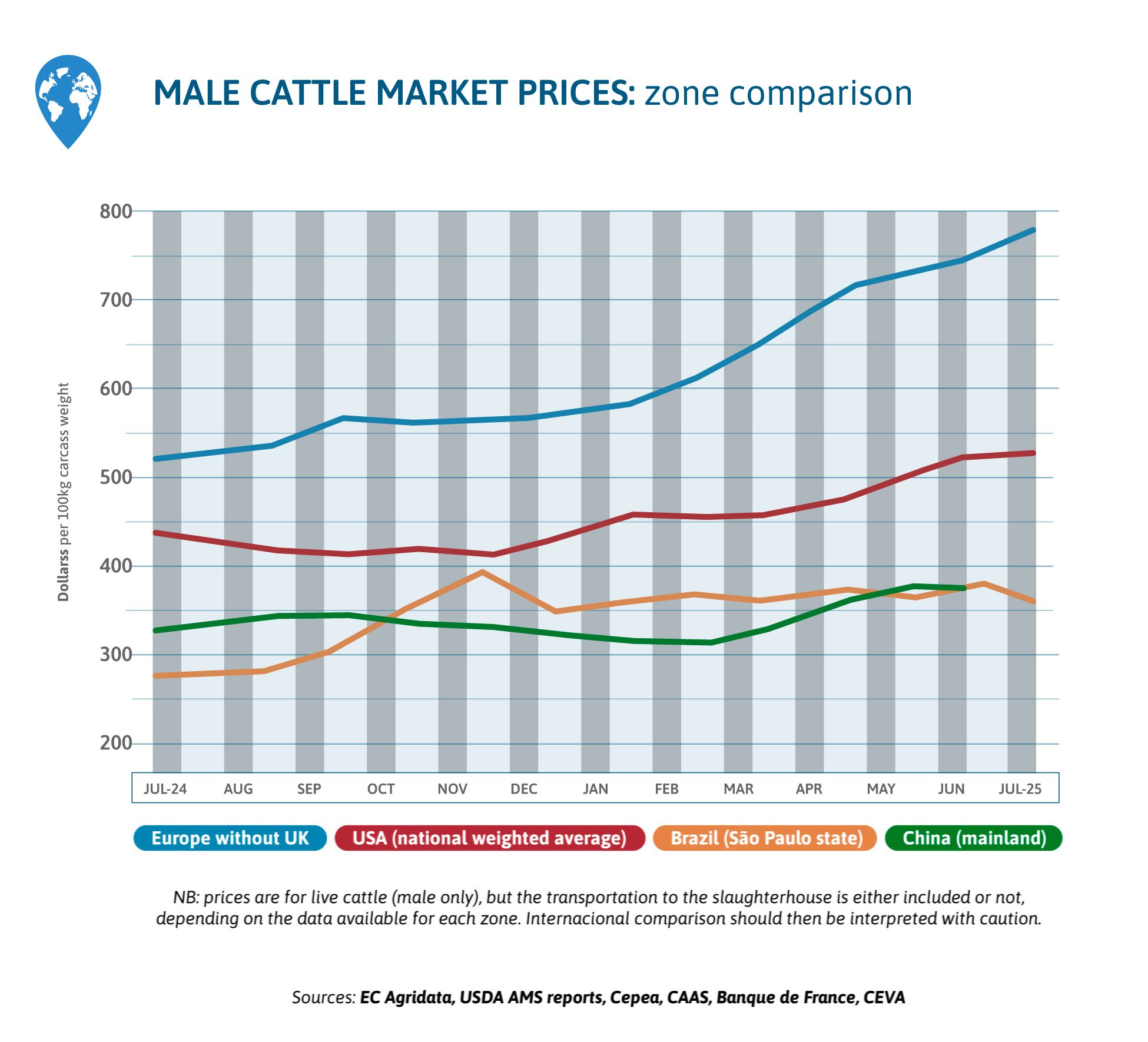

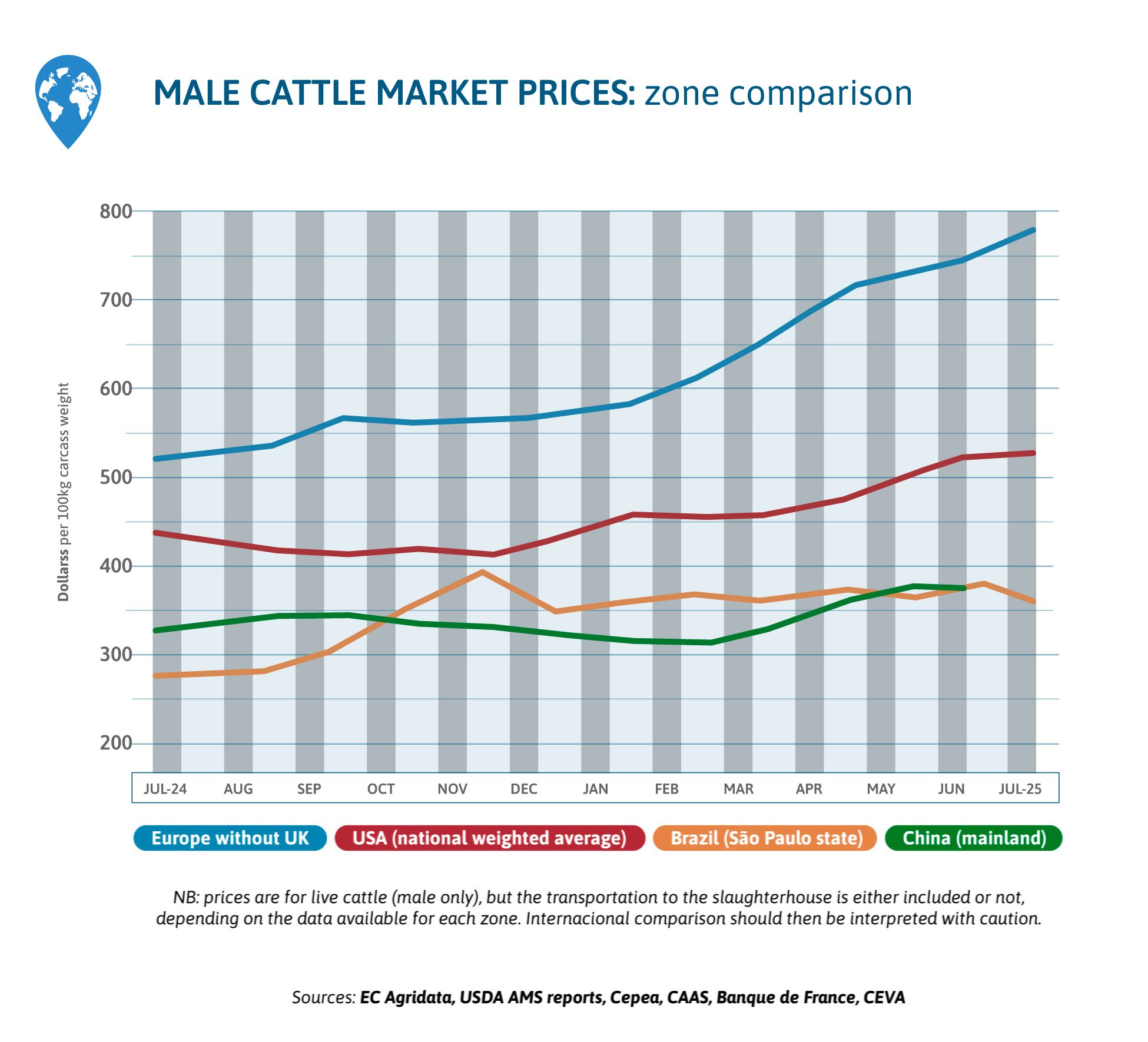

In July, Brazilian prices were globally stable at a high level, as the World seeks for beef. US prices are still increasing, the cattle supply being tight and demand good, just as in Europe. China’s June imports of beef increased by 24% year over year (y-o-y).

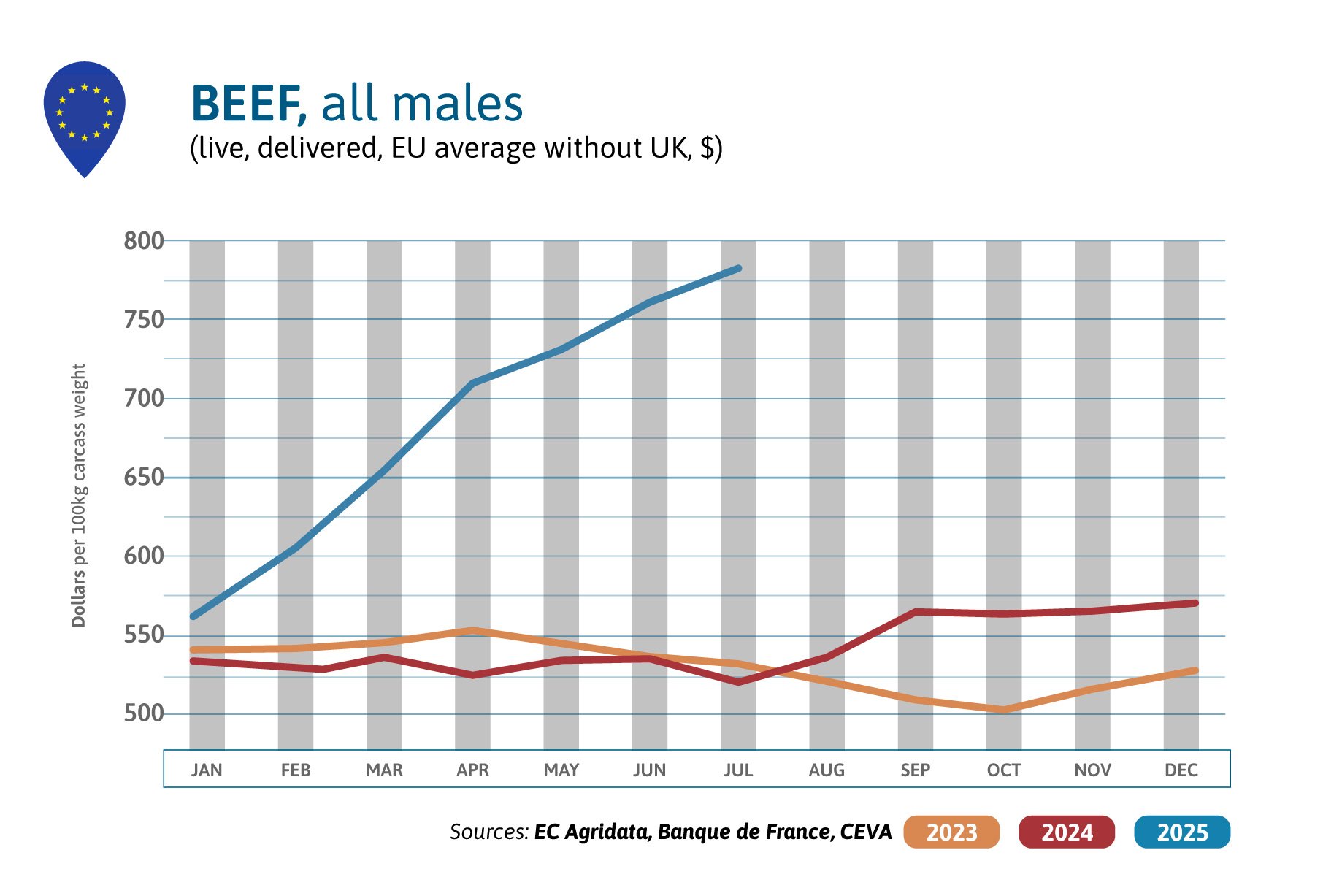

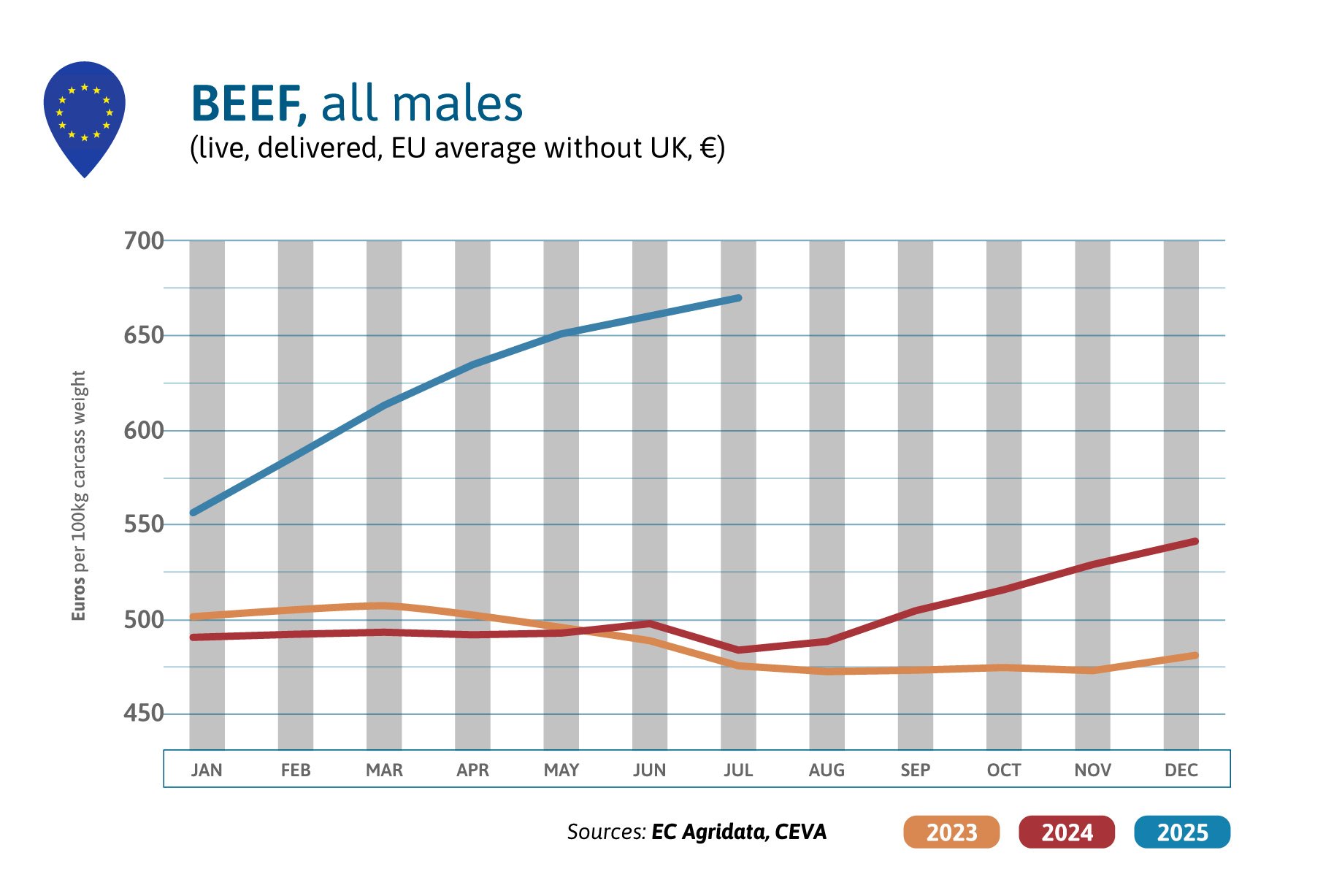

EUROPE

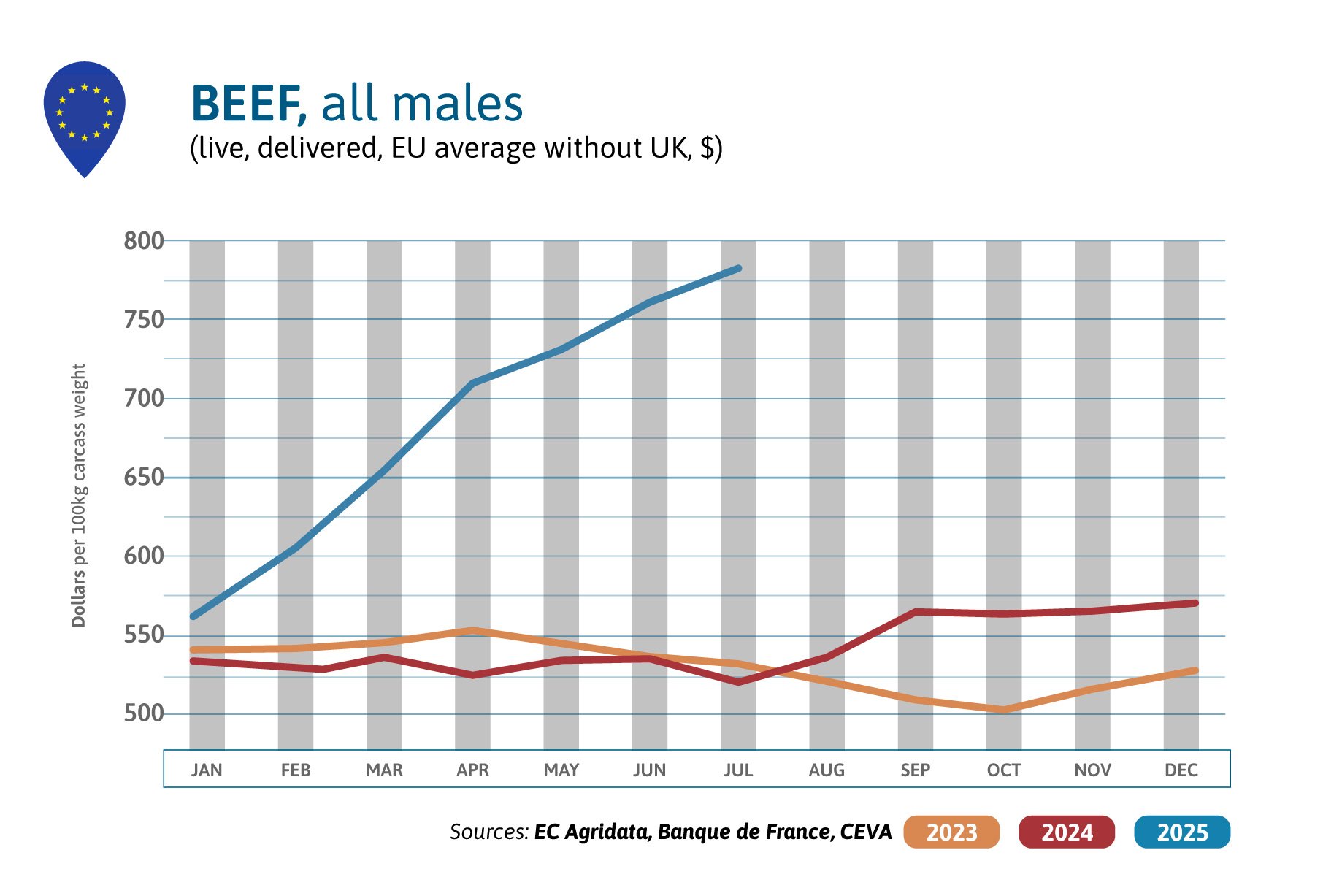

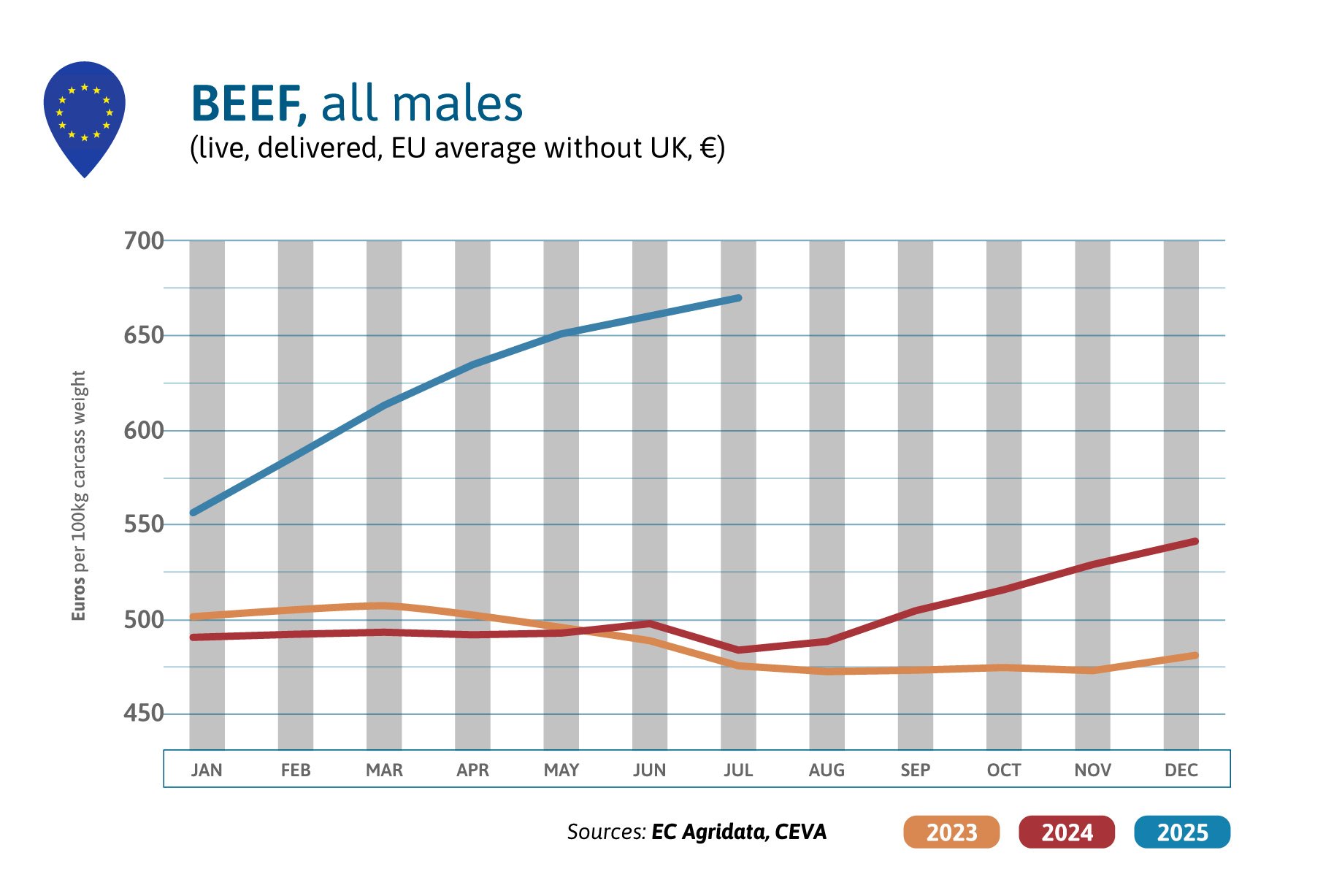

In July 2025, prices for male beef continued increasing in US$ (+3% compared to previous month, +2% in €) and are now 50% above the 2024 high level ($US). Cattle shortage is global and permanent in the EU. The volumes slaughtered are under the consumption’s level, which stimulates local prices.

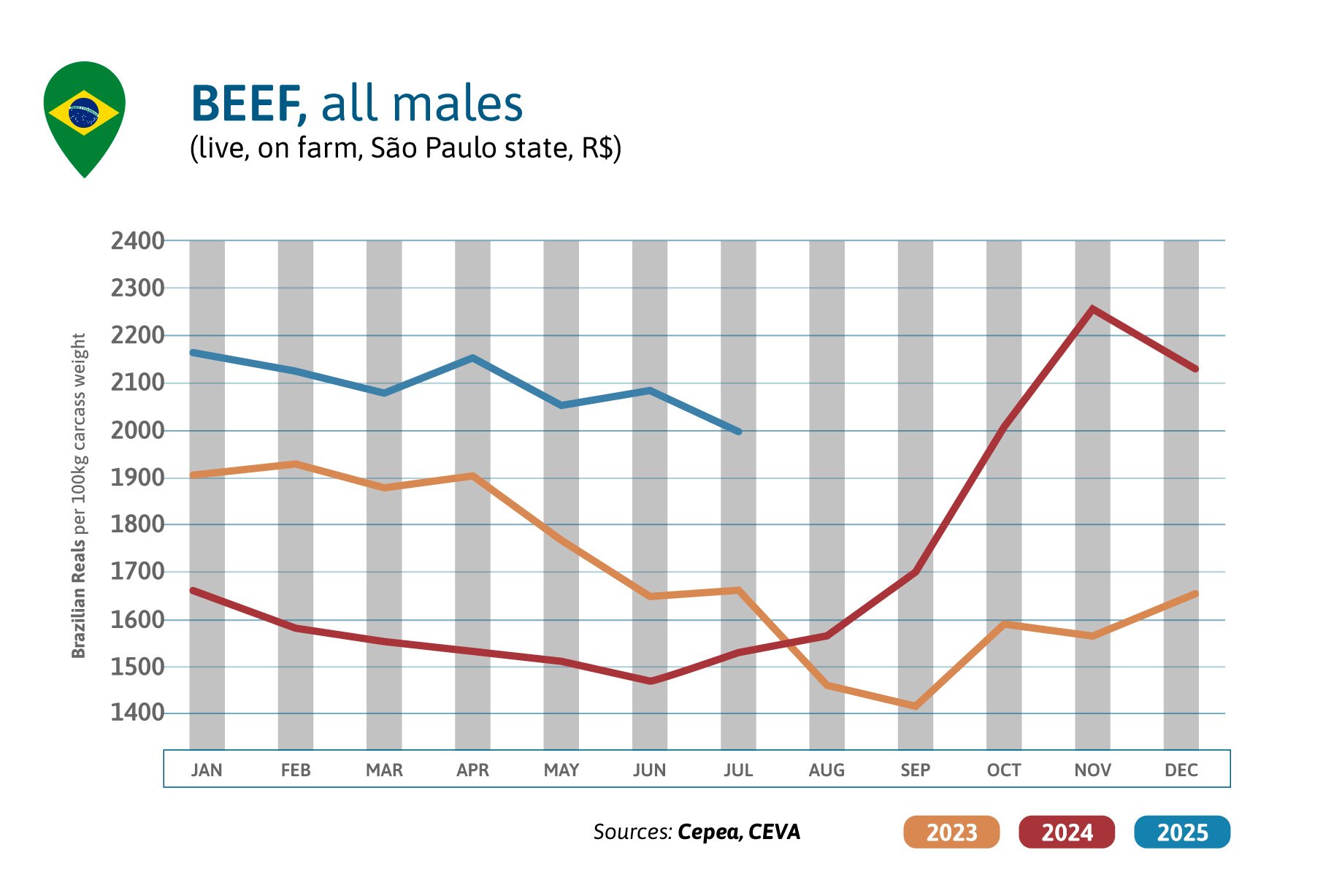

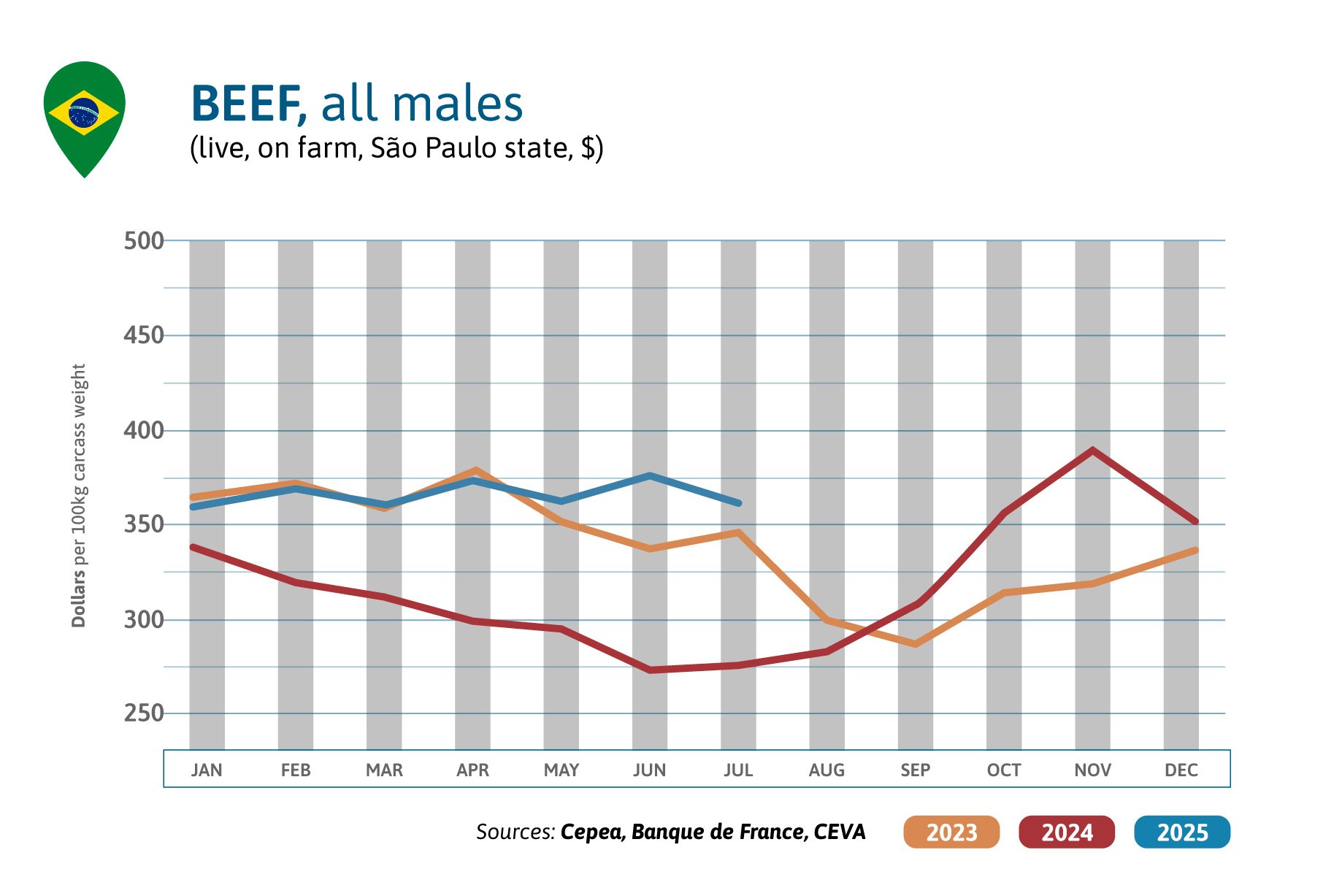

BRAZIL

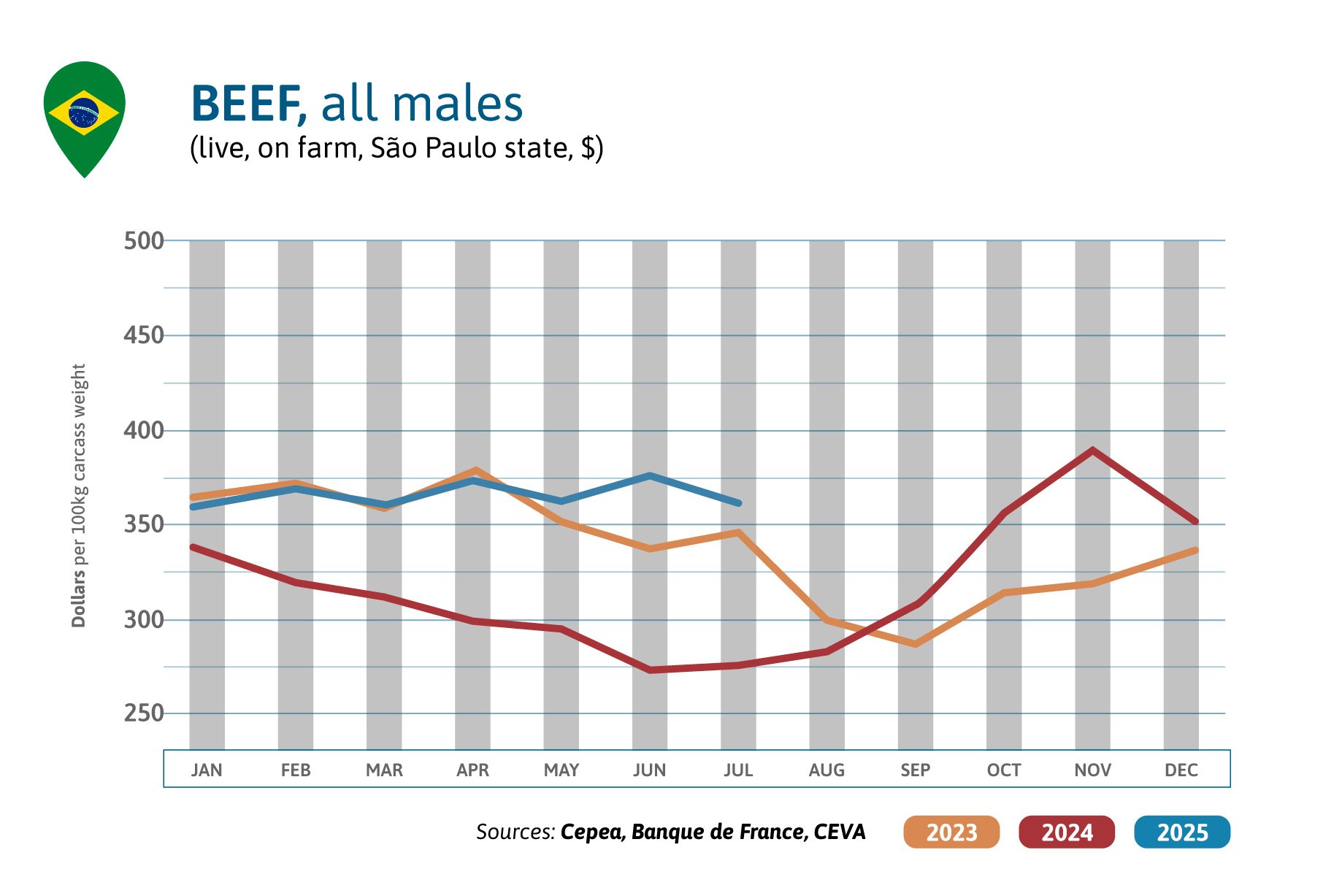

Brazilian beef prices are oscillating this year (-4% in a month) but remain globally stable in US$. Prices are high compared to last year: + 31%. The World is seeking for beef and Brazilian beef exports have soared by 14% in volume above the 2024 record level, in the first 7 months of 2025. The US have put a 50% tariff rate on Brazilian beef since July the 31st. Brazil is the US’s 1st beef furbisher (25% of the volumes, volumes x2 during Semester 1, from lack of beef in the US).

CHINA

China’s June beef imports jumped by 24% y-o-y, probably putting pressure on July local beef prices. Because of this, the total Chinese beef imports during Semester 1 of 2025 decreased only by 1% y.o.y, Brazilian imports still increasing (+11%). China has postponed to the end of November the publishing of its conclusions on beef imports and potential safeguard measures, because of the “complexity” of the case But has put 10% more tariff on US beef as part of retaliation tariffs against Trump’s tariff increases since March.

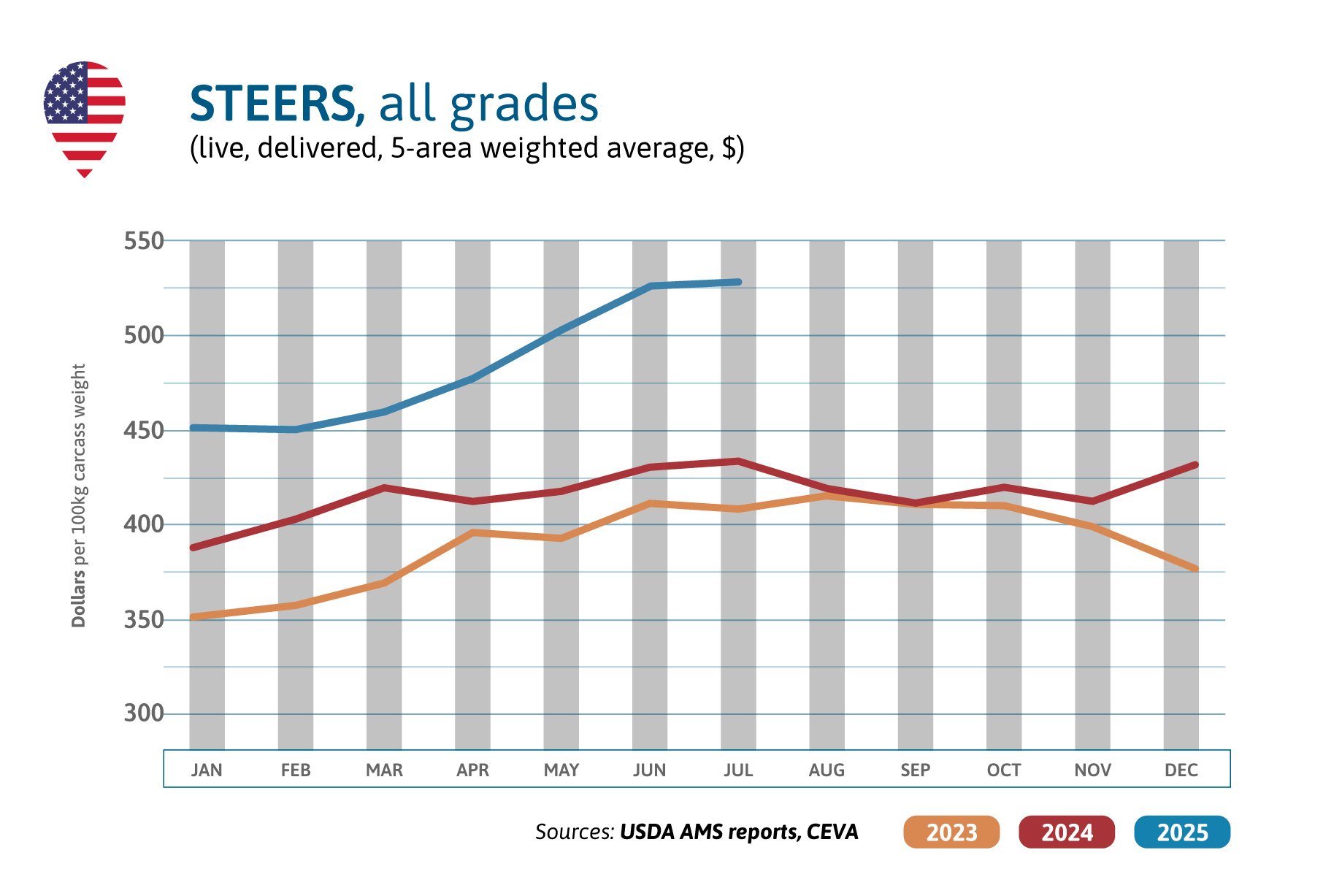

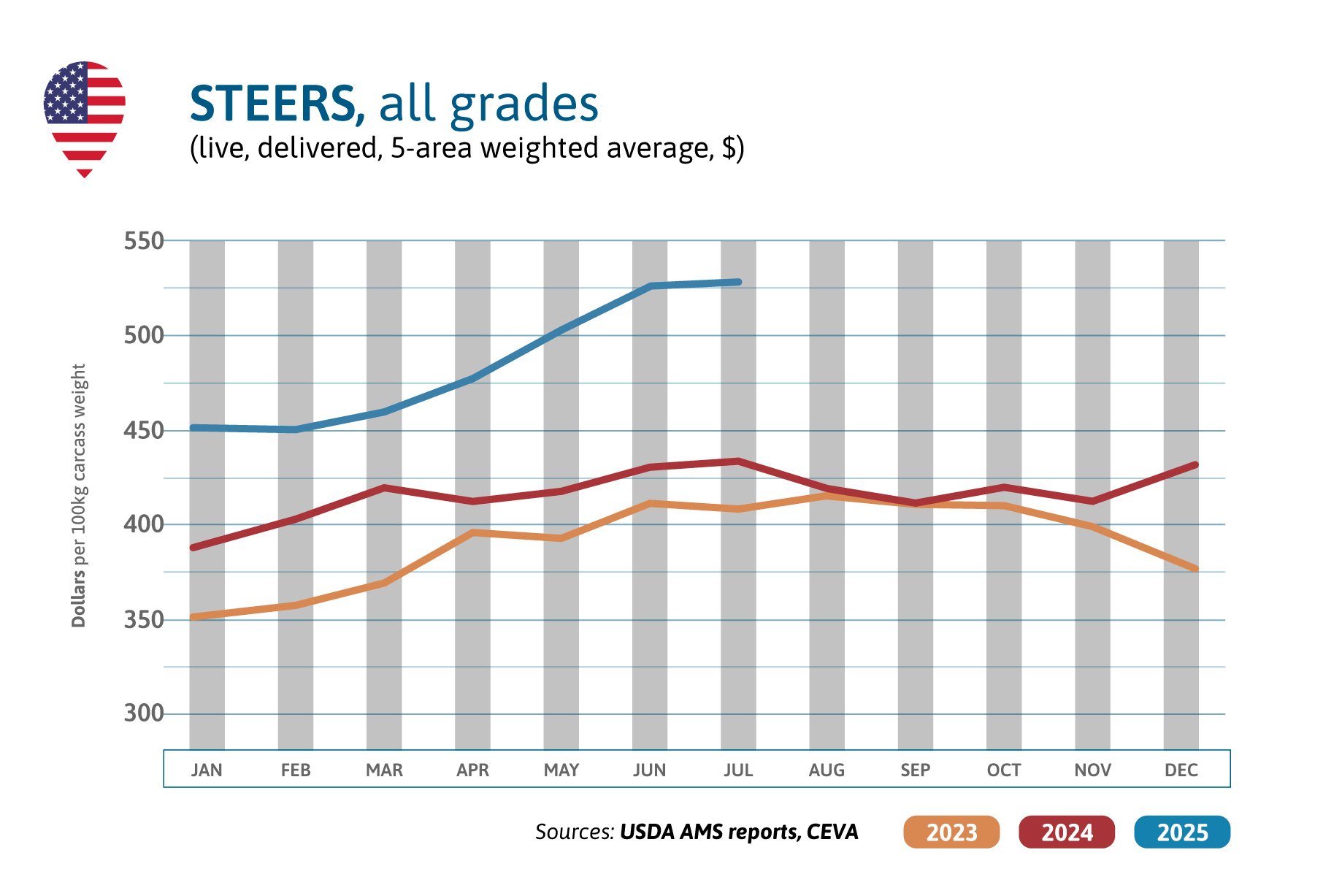

USA

In July, steer prices were at a historical high level (+1% in a month and +22% year over year) as the rhythm of slaughtering is slower than expected every month this year. Beef production will likely reduce in 2025-26, as cow numbers have been decreasing the last 5 years. The US-Mexican border was only briefly re-opened, since a case of NWS was detected north of the sterile fly dispersal area and the USDA believes the suspension of Mexican cattle imports may remain for several months. Cumulative beef meat imports during the first semester of 2025 were 33% above last year’s level (+28% in June) while beef exports were down 8%, supplies being tight.

Source:

Make sure to check out our News and Events section for access to all the monthly beef and milk market outlooks.