Beef Market Outlook (Caroline Monniot)

Welcome to this month’s Beef Market Outlook. In this edition, we bring you the latest updates on beef cattle markets from Europe, Brazil, China, and the USA. Our analysis is built on thorough data, offering you a clear view of the trends that matter most.

SEE and share this valuable content.

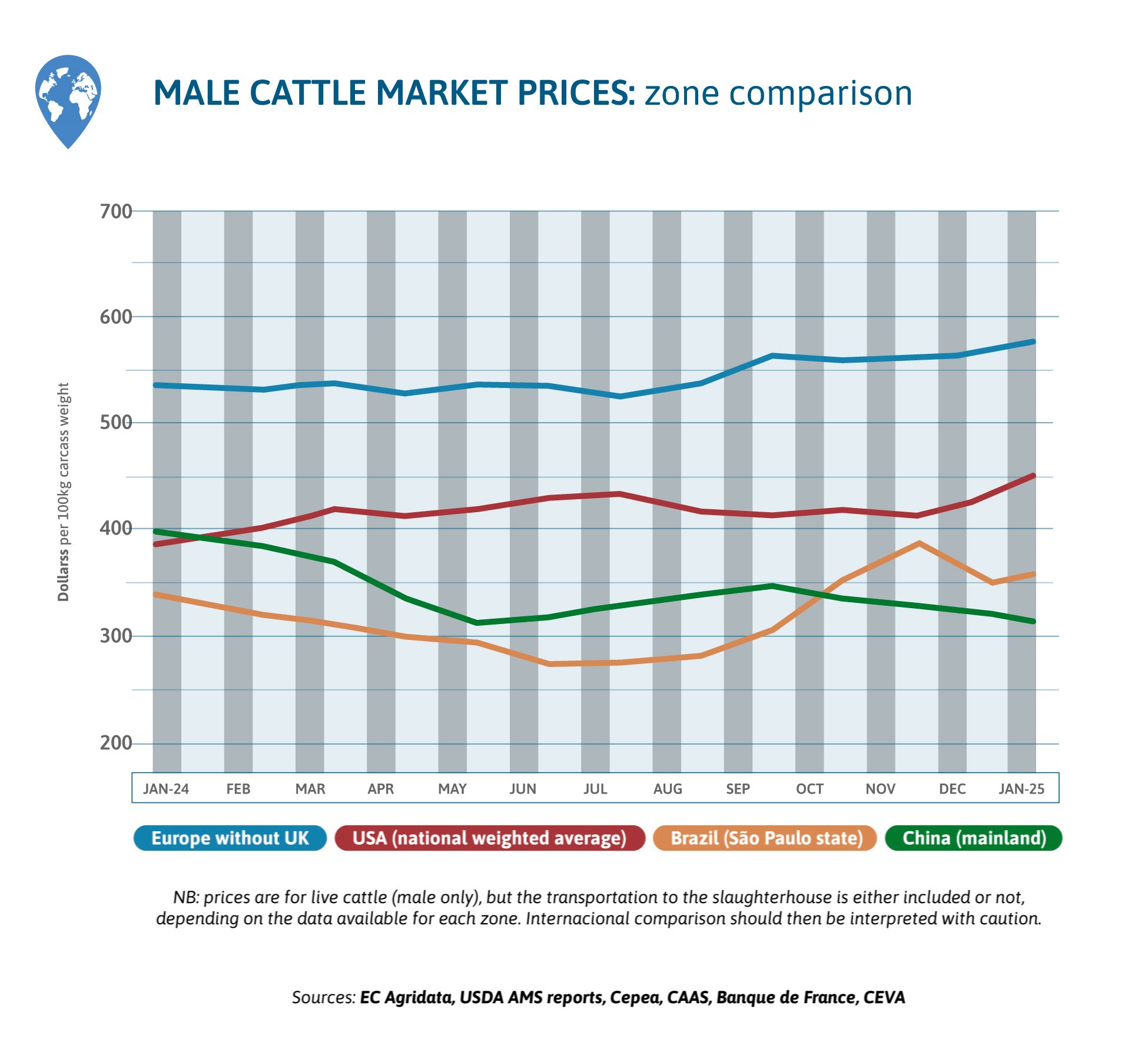

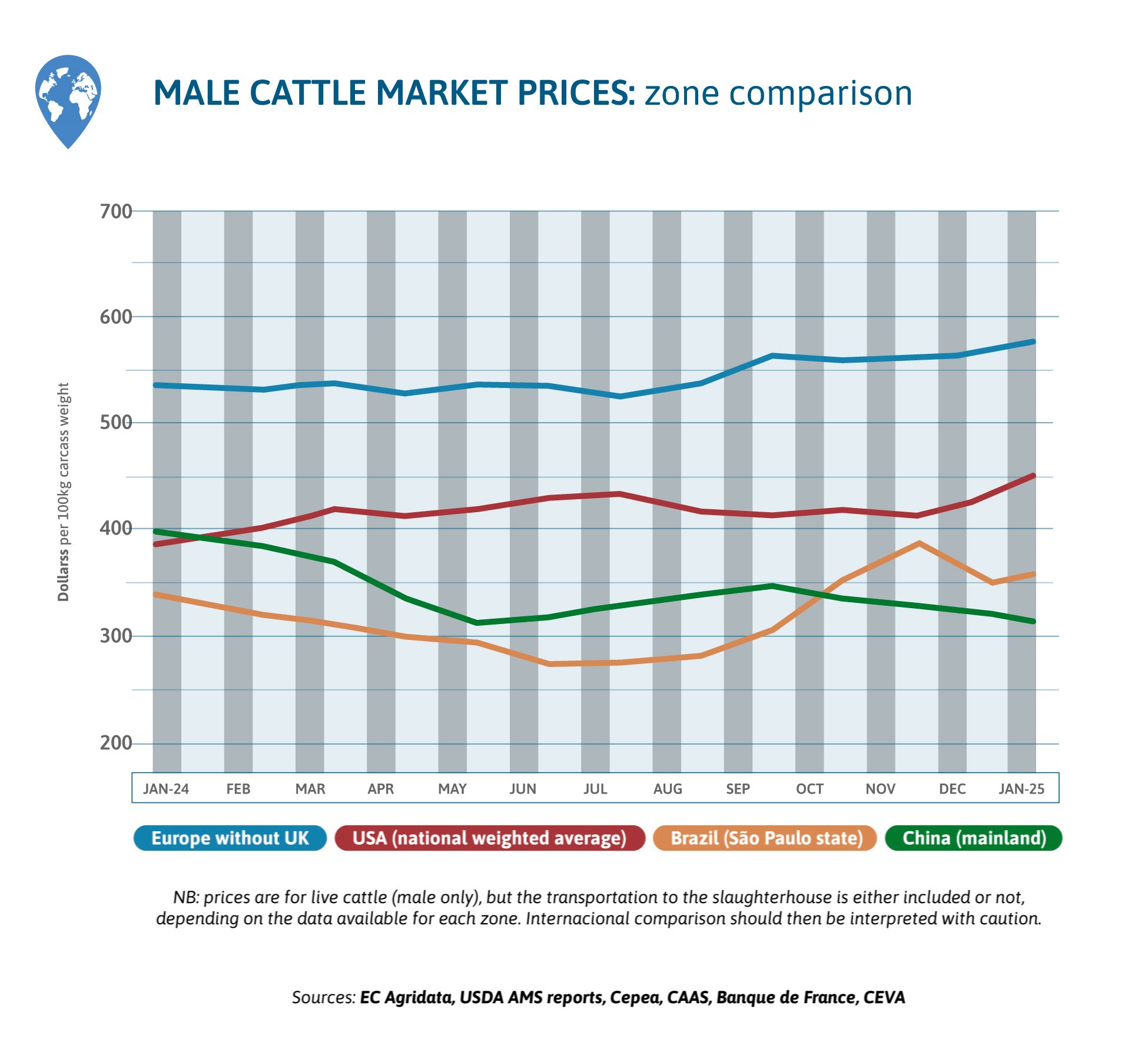

GLOBAL BEEF MARKET TREND

In January, cattle prices declined again in China and were underneath the Brazilian beef price for the fourth month. Brazilian prices increased, World demand for beef being important. US prices continued increasing, with good domestic demand and less cattle available. In Europe, prices increased too: supply is scarce.

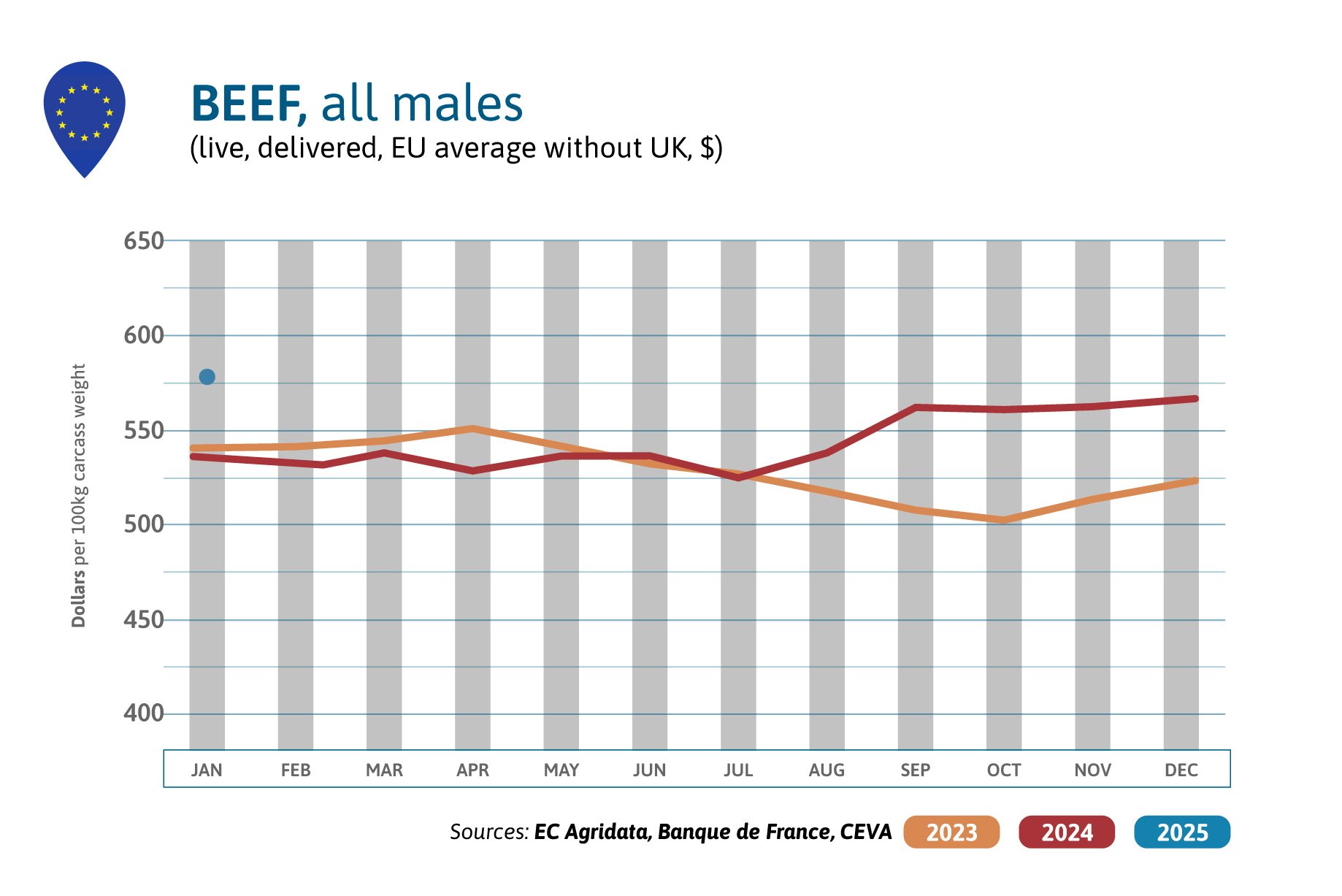

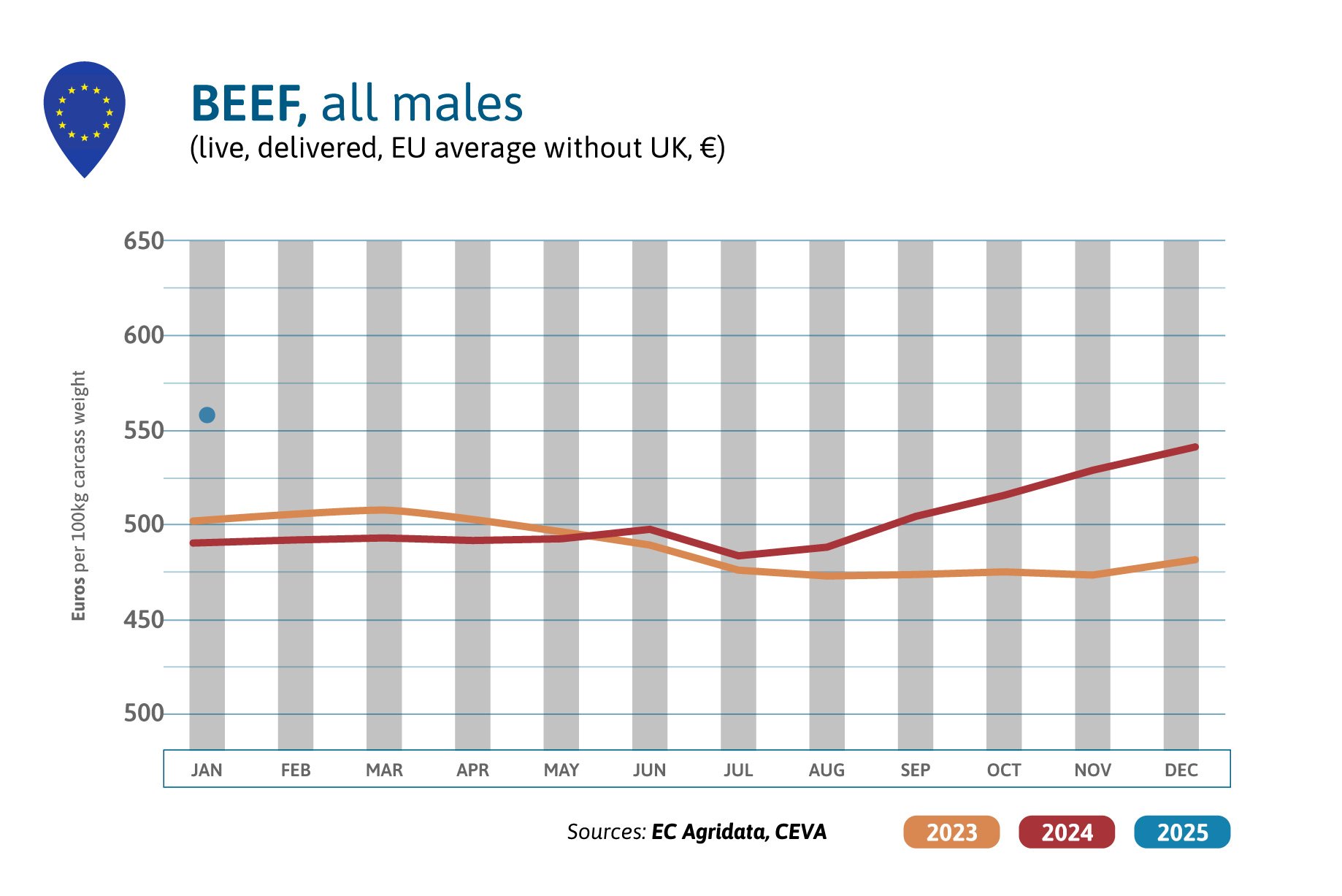

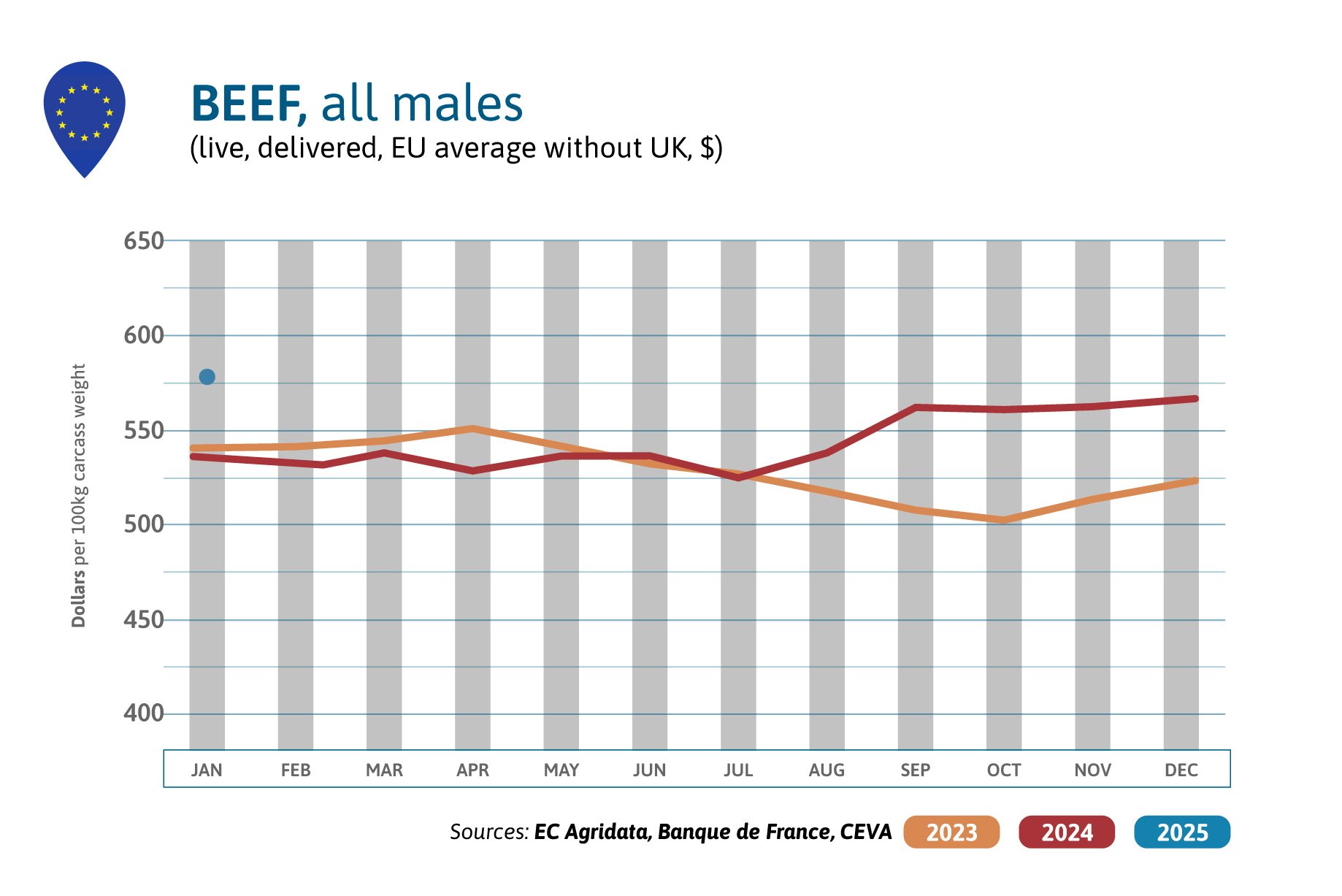

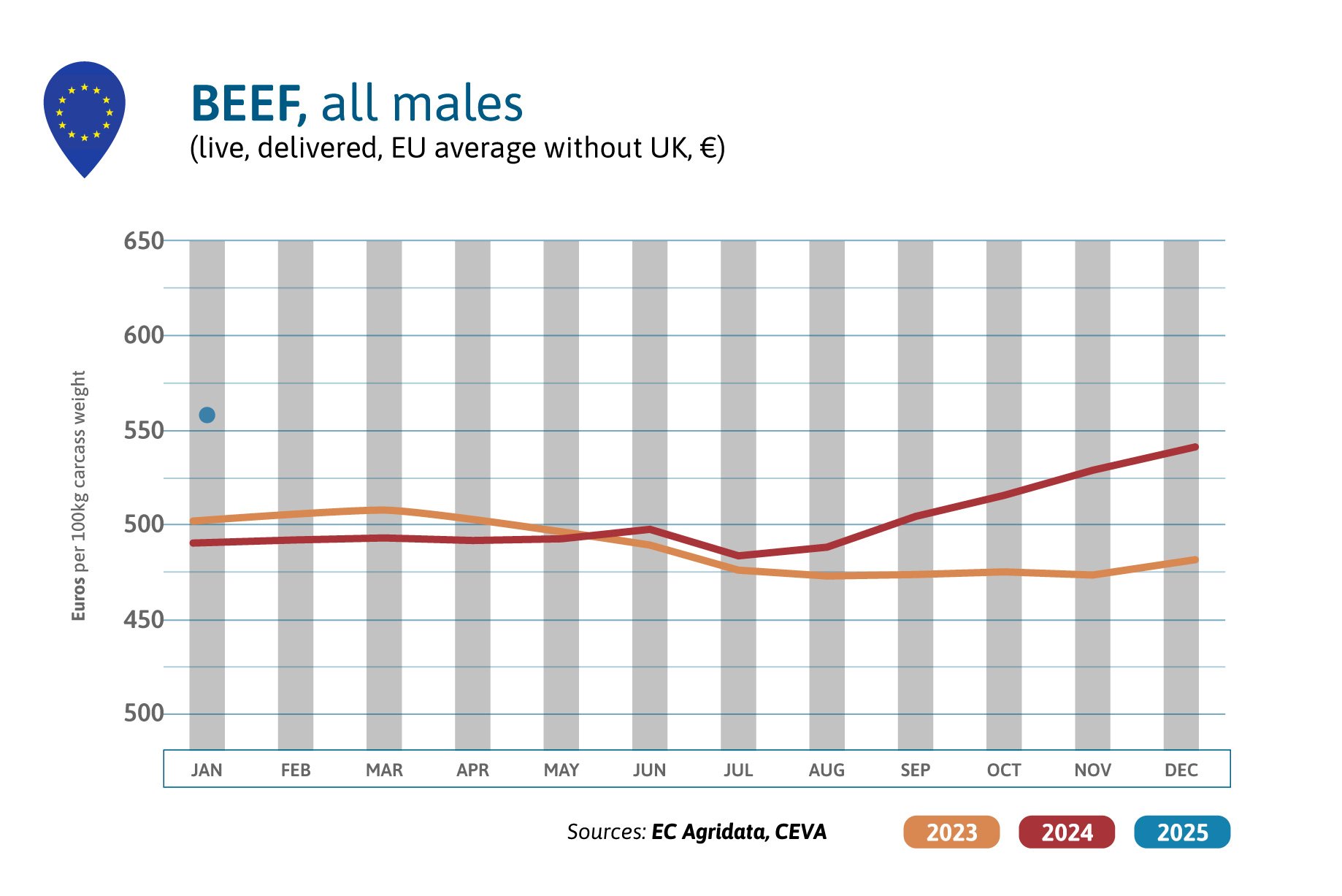

BEEF PRICES IN EUROPE

In January 2025, prices for male beef increased by 2% compared to the previous month in US$ (more quickly in €: +3%). Prices are well above the beginning of 2024’s level: +8% in US$ and +13% in € (€ falling back compared to the US$). Male prices have been increasing since summer, as there are not quite enough finished males on the market. In 2024, German consumption recovered, and Turkish and Algerian demand were strong for beef, sending the EU male prices up.

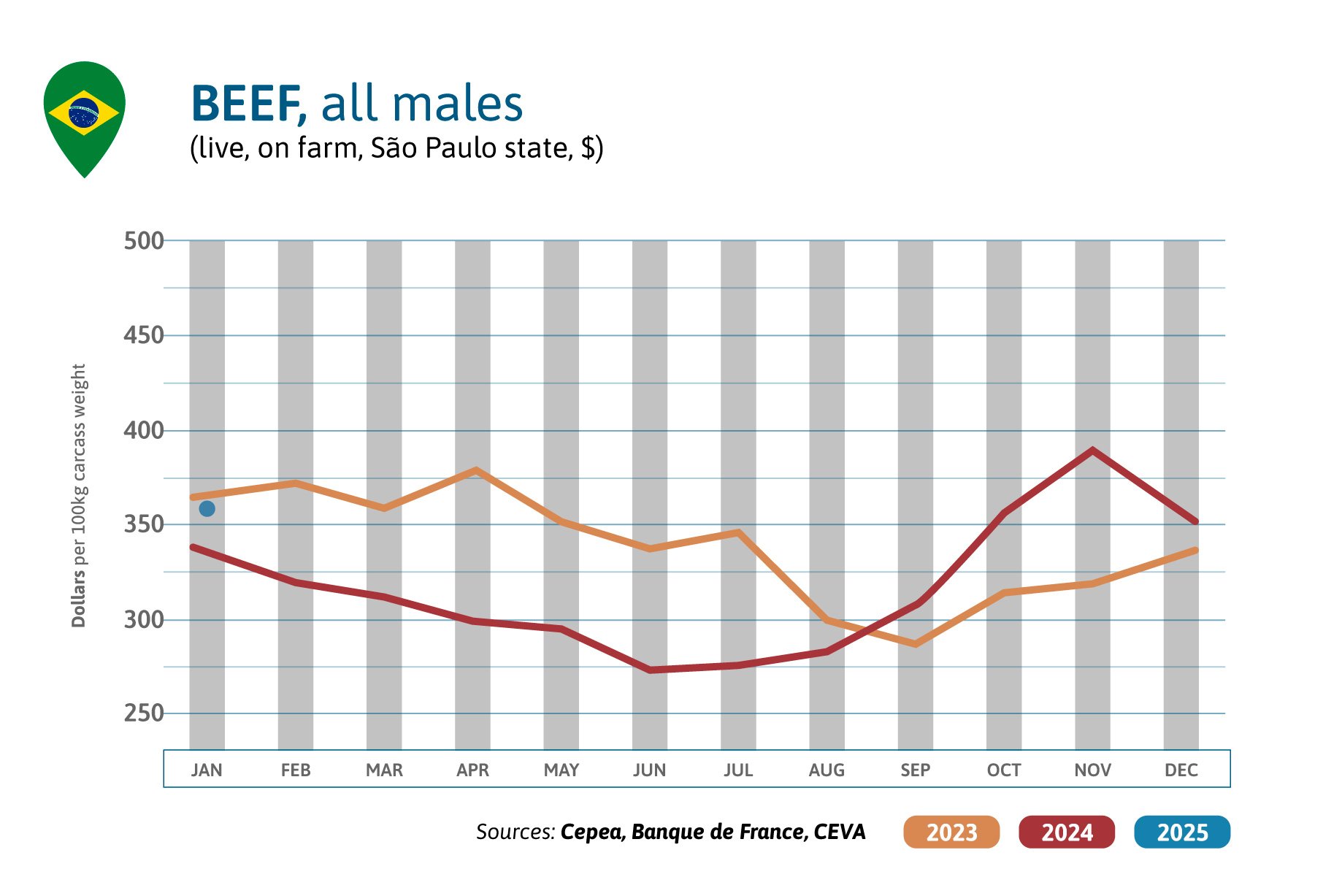

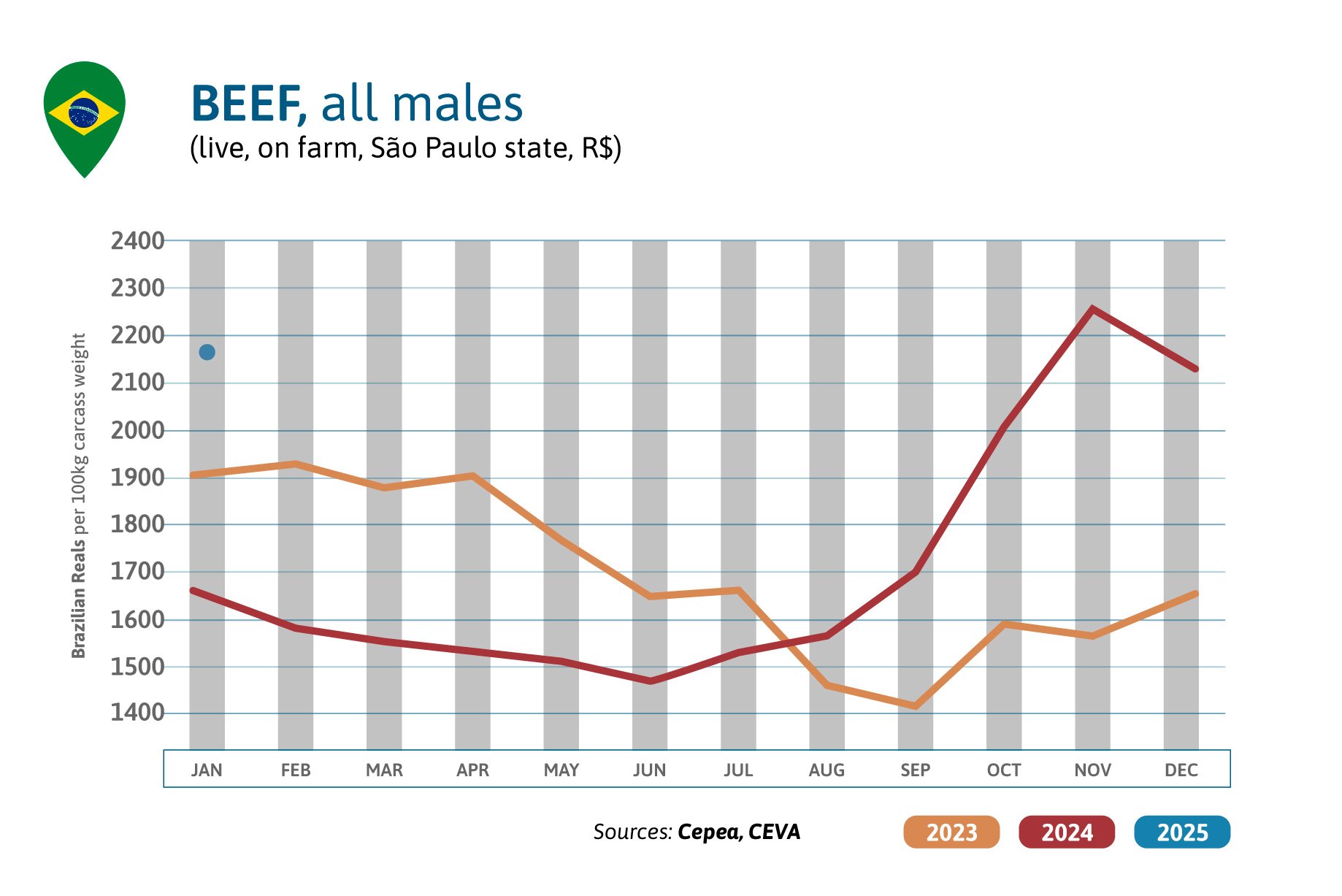

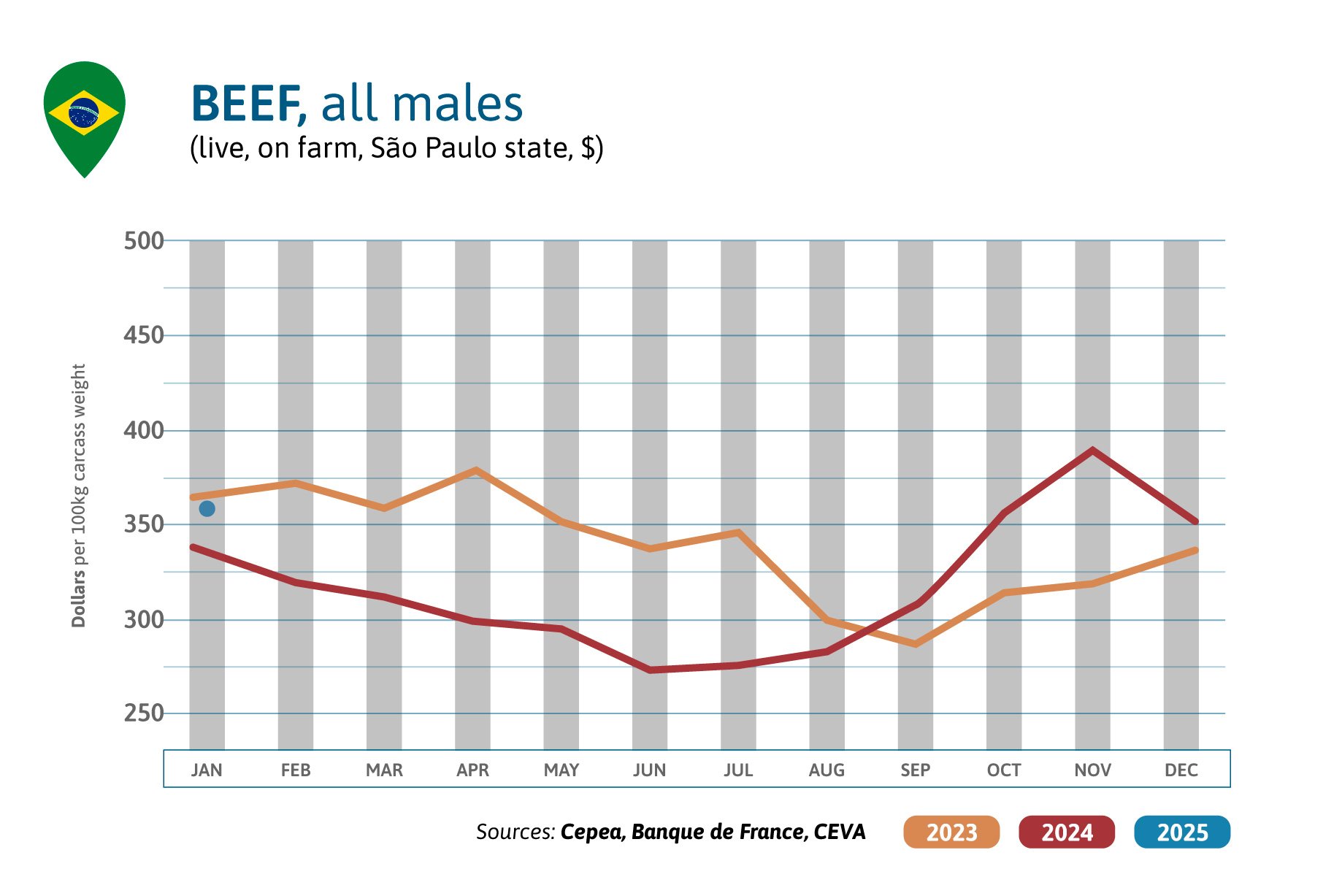

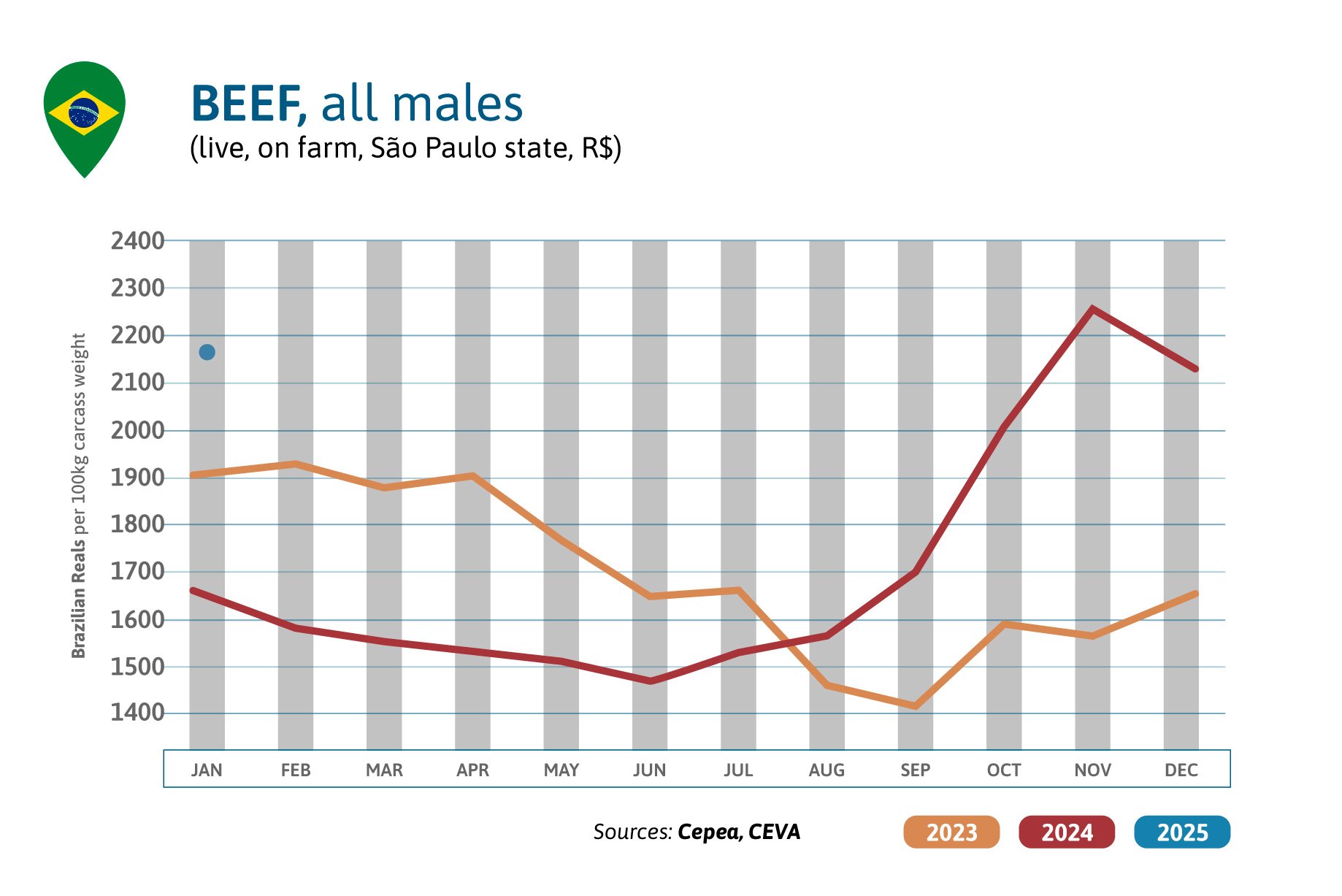

BRAZIL BEEF MARKET SITUATION

In January, male beef prices increased by 3% in US$ compared to previous month, after drawing back by 10% in December. Looking back a year, prices are much above 2024 level: +6% in US$ and +30% in Reals, the local currency having lost 19% of its value compared to US$ in a year. In 2024, Brazil established a historic World record for beef exports: 3,4 million of tons cwe (+26% /2023 record) including 1,3 million tons cwe to China (+11% /2023, 39% of Brazil’s exports). The exports of the first 3 weeks of January are following the same trend (Secex).

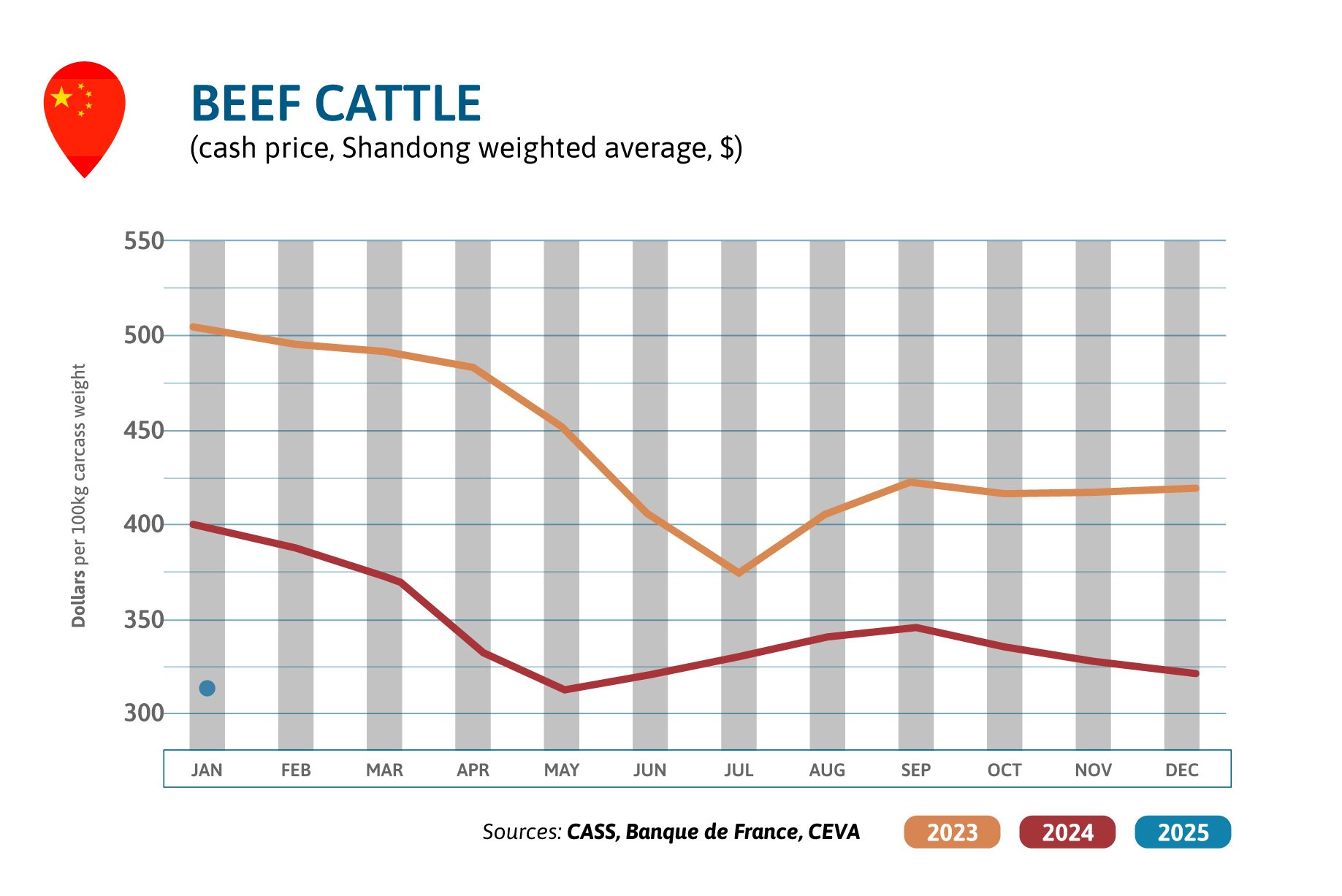

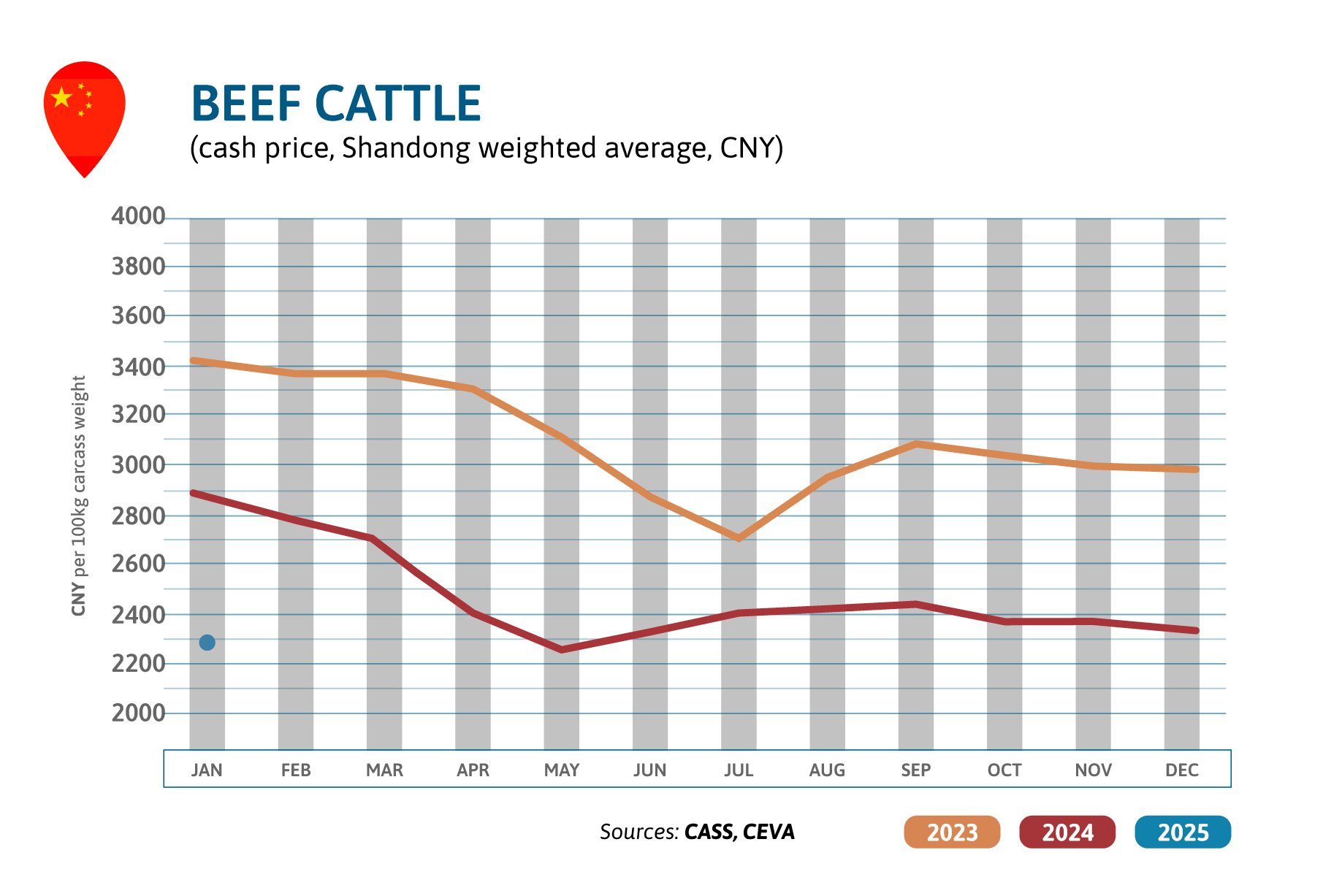

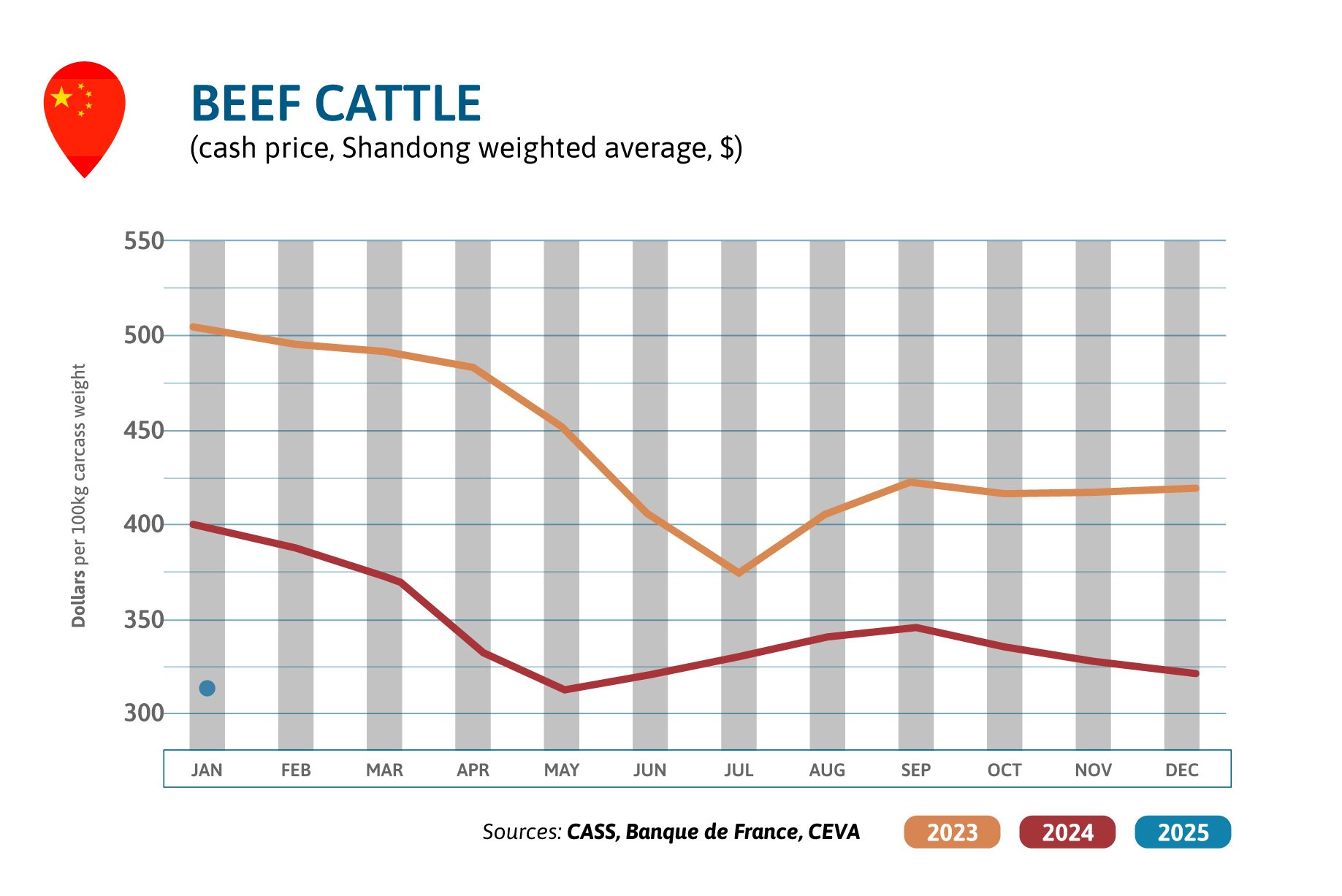

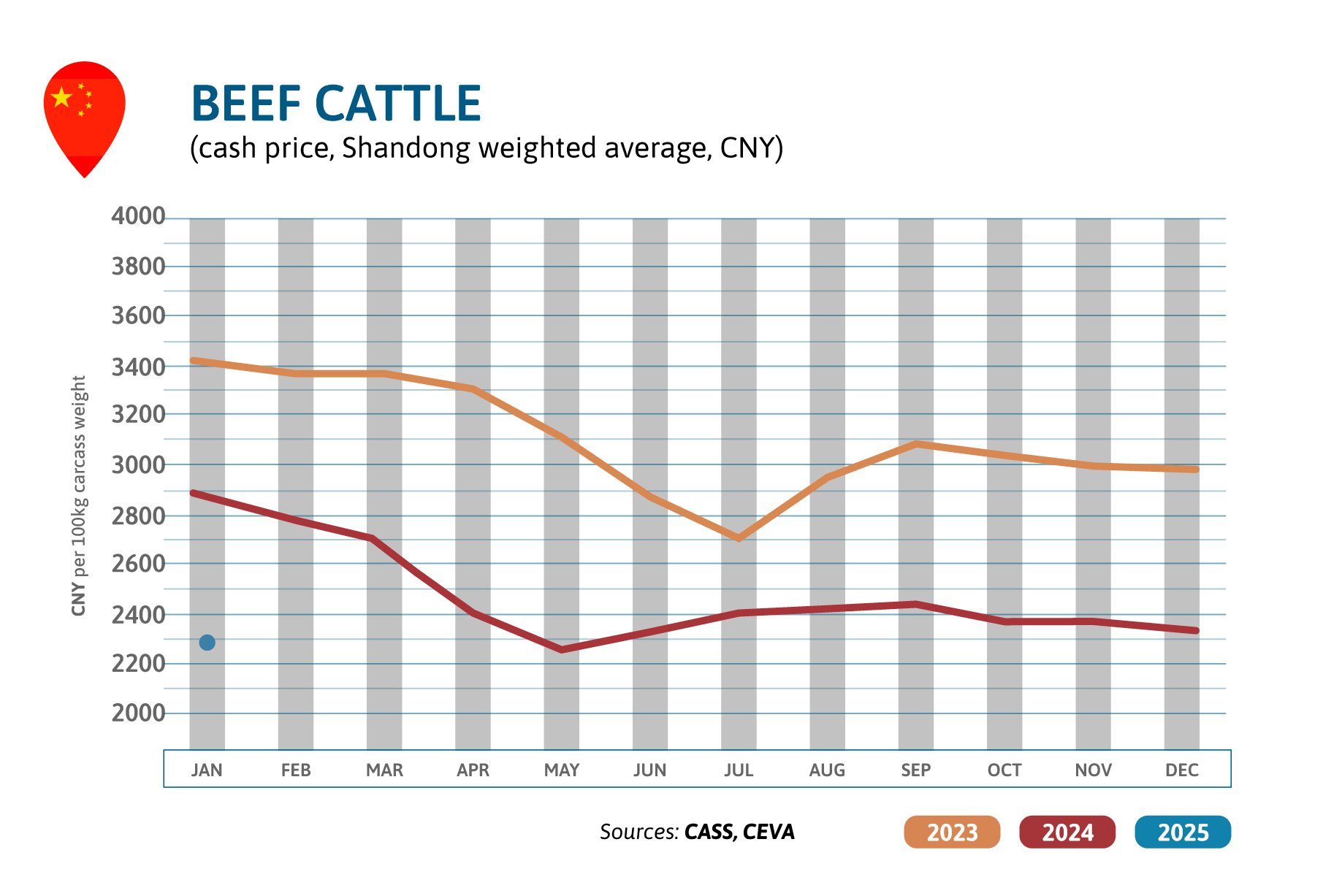

BEEF PRICES IN CHINA

In January, Chinese cattle prices fell back again by 2% in US$, compared to December, just as every month since October. Cattle prices are well under the last two years’ level (-21% /2024 and -37% /2023). Demand has not recovered from 2024 economic difficulties and the past years’ imports weigh on local prices, leading smaller breeders to exit. 2024 beef exports to China/Hong-Kong are not far 2023 level (3,5 million tons cwe; -2%). On December 27, China launched a safeguard investigation on imported beef. Exporters, importers, breeders can answer. It will determine if the increase in meat export to China has damaged the local businesses and farms, maybe leading to restriction on meat imports.

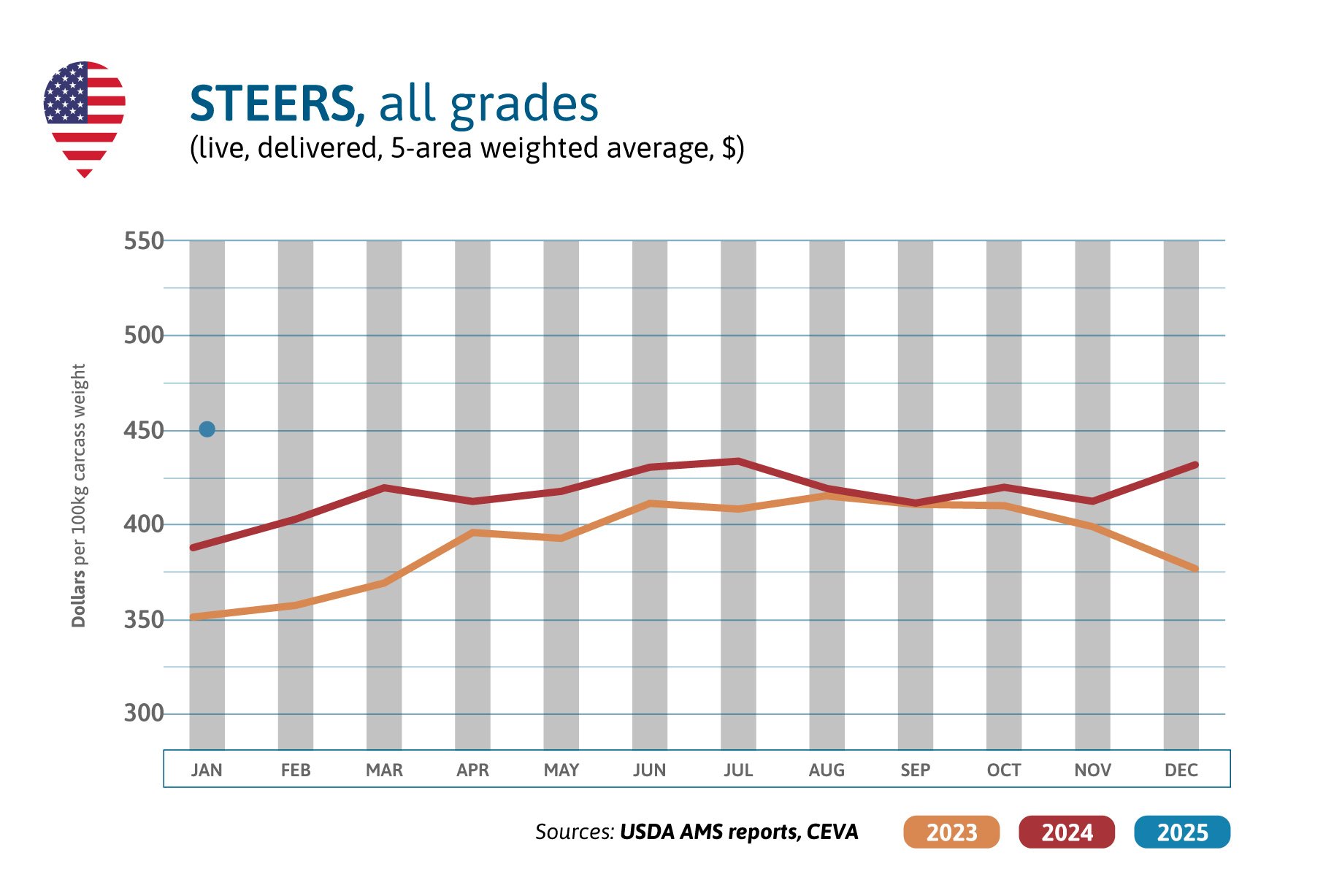

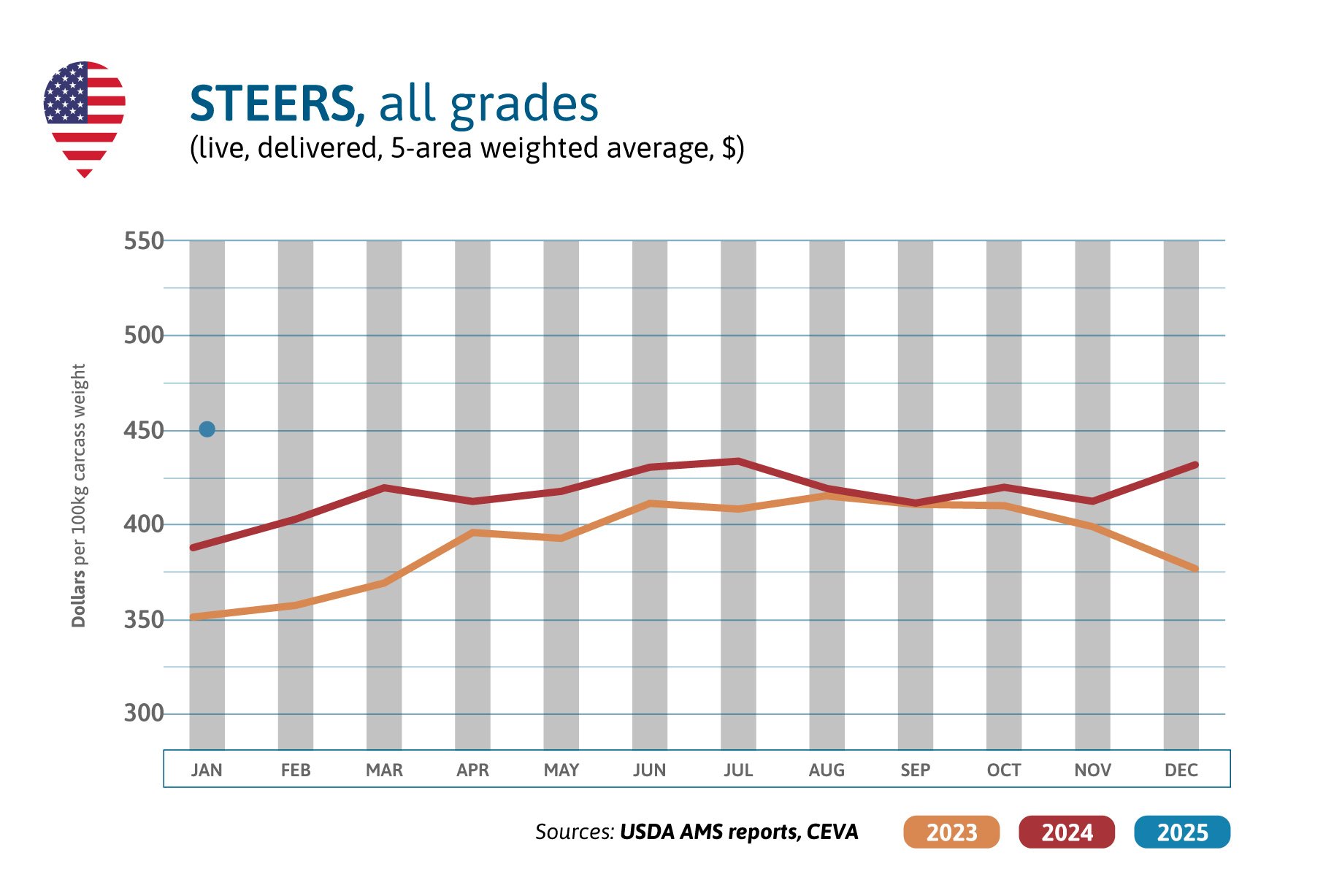

USA’S CATTLE MARKET

In January, steer prices increased by 5% compared to previous month and were again clearly above last year’s level: +16%. The seasonal decline in beef prices hasn’t occurred this winter, since cattle is scarce after 6 years of decrease in cow numbers. On February the 1st, cattle imports from Mexico have resumed, with a new sanitary protocol to limit the risk of New World Screwworm (NWS) spreading to the US.

Source:

Make sure to check out our News and Events section for access to all the monthly beef and milk market outlooks.