Beef Market Outlook (Baptiste Buczinski)

Welcome to the Beef Market Outlook January 2026, your monthly update on global beef markets and price trends. This edition analyses December 2025 data, covering the latest shifts in beef production, cattle prices, and export dynamics across Europe, Brazil, China, and the United States. With clear, data-driven insights, we highlight the key factors influencing global supply and demand, trade flows, and overall market profitability.

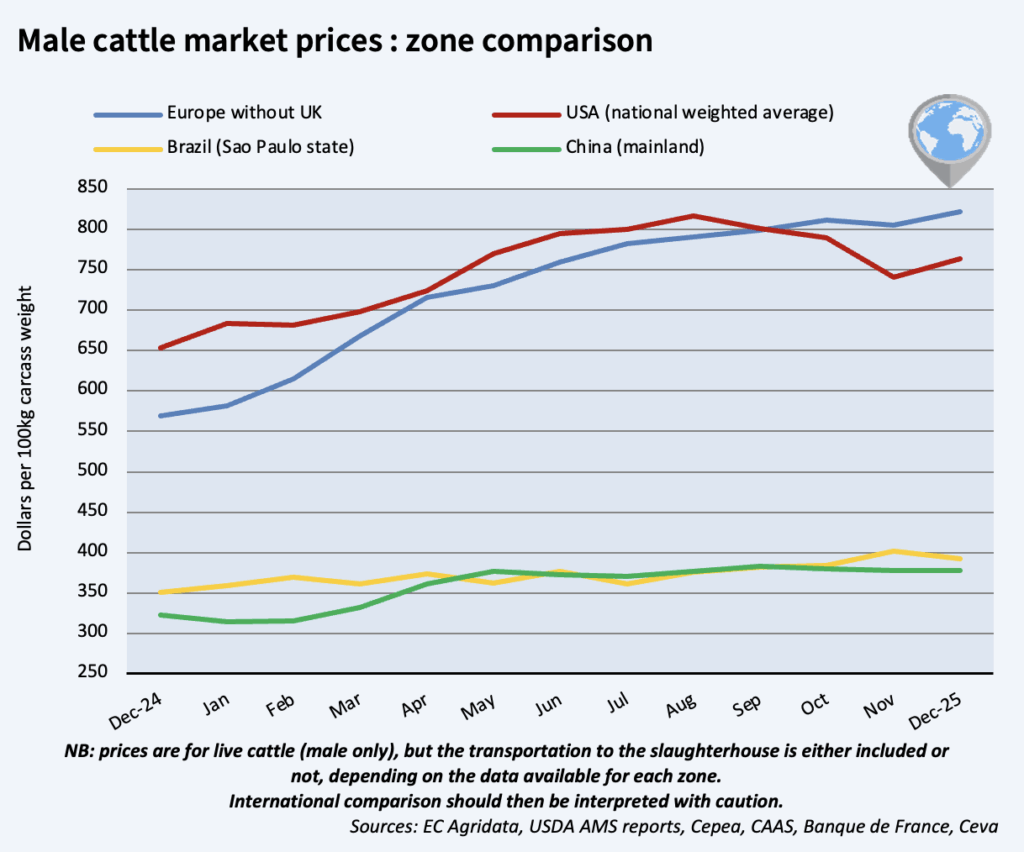

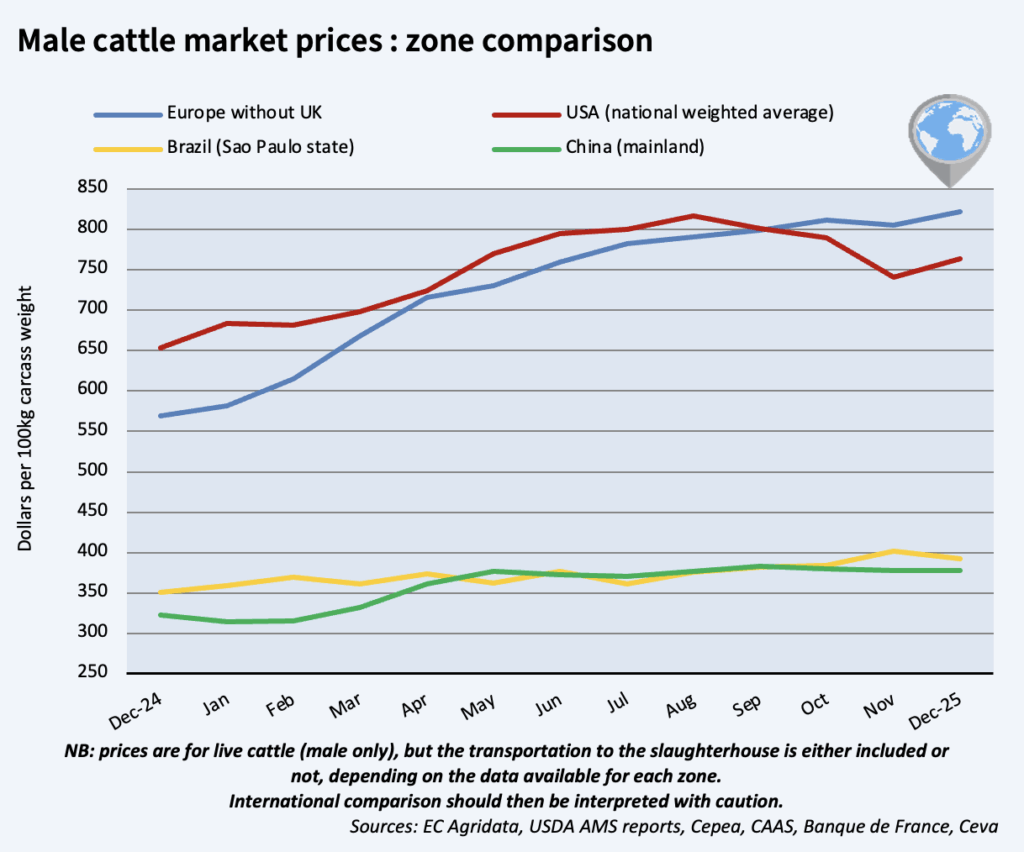

What were the trends in global beef prices in December 2025?

In December, European male prices continued increasing, while US prices had gone underneath, in autumn dip. Brazilian prices slightly decreased, while Chinese prices were stable, underneath the Brazilian price, because of large imports, which will be curbed in 2026.

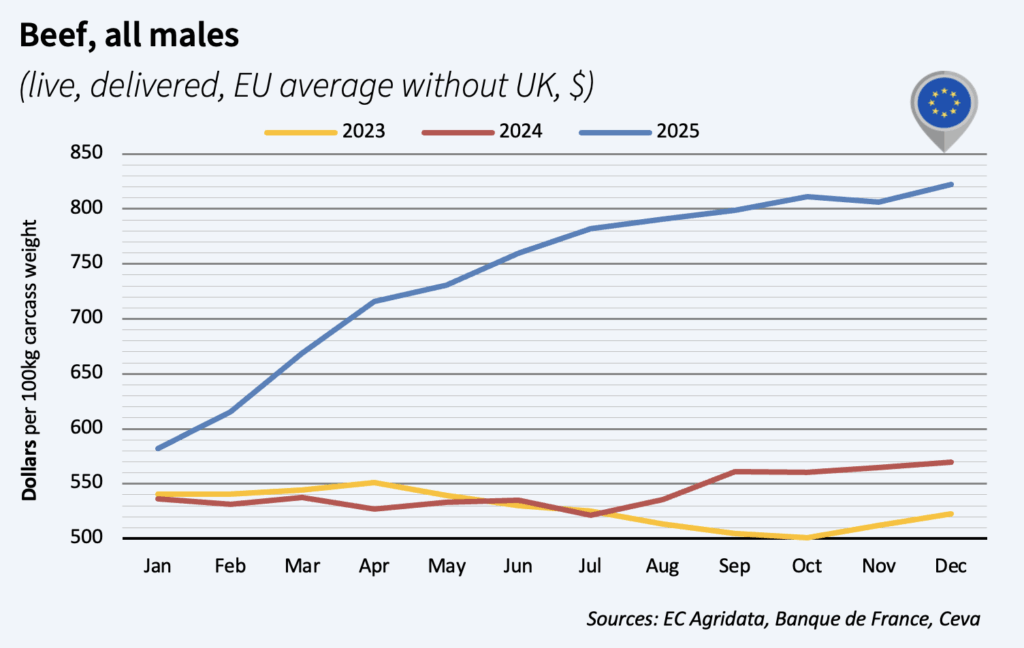

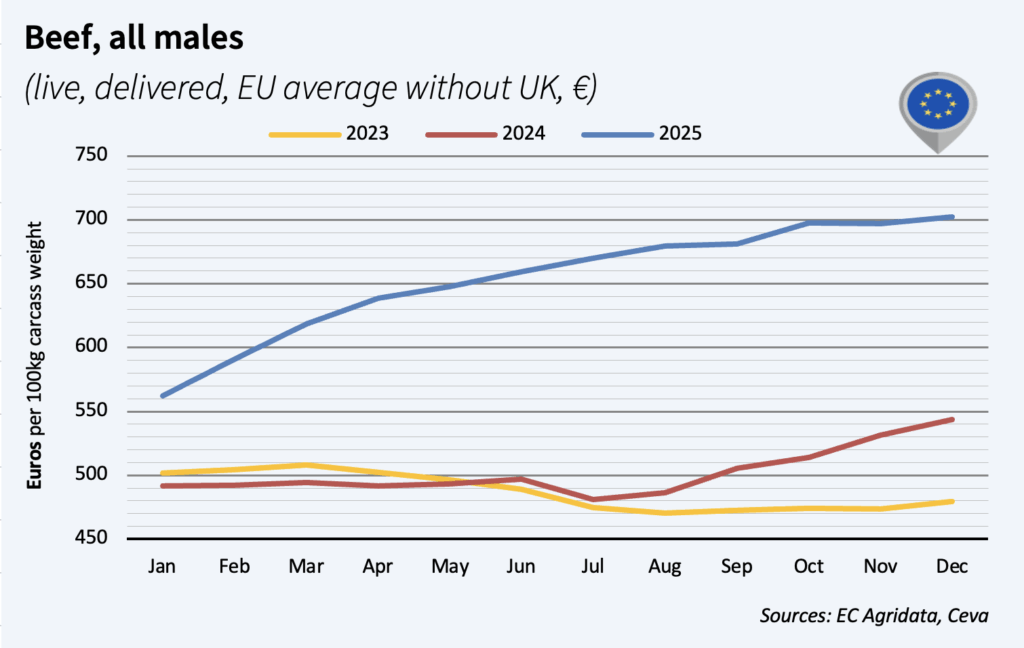

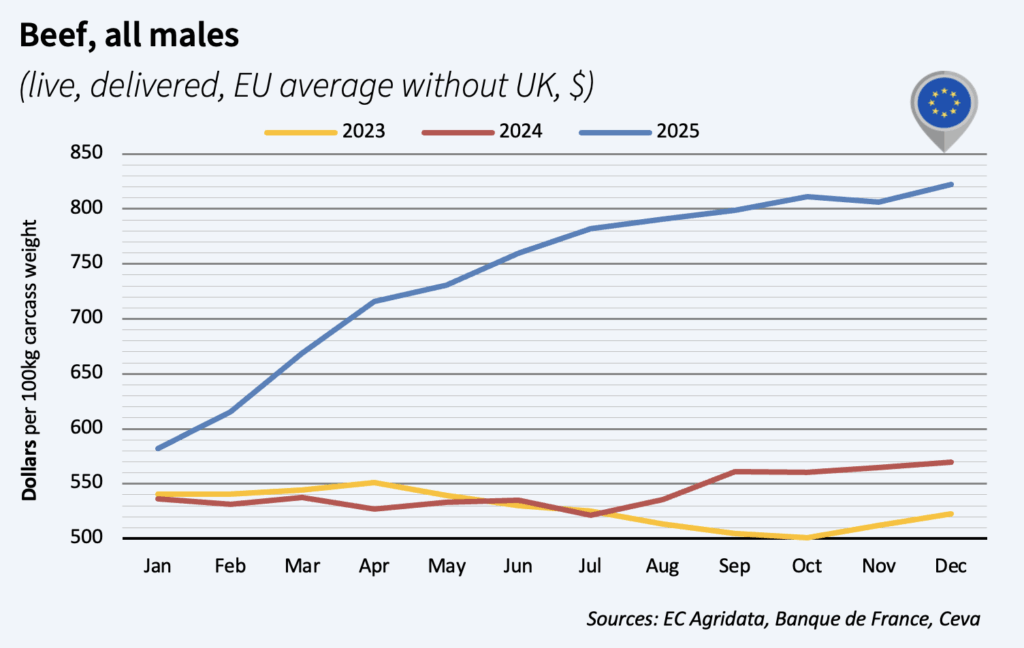

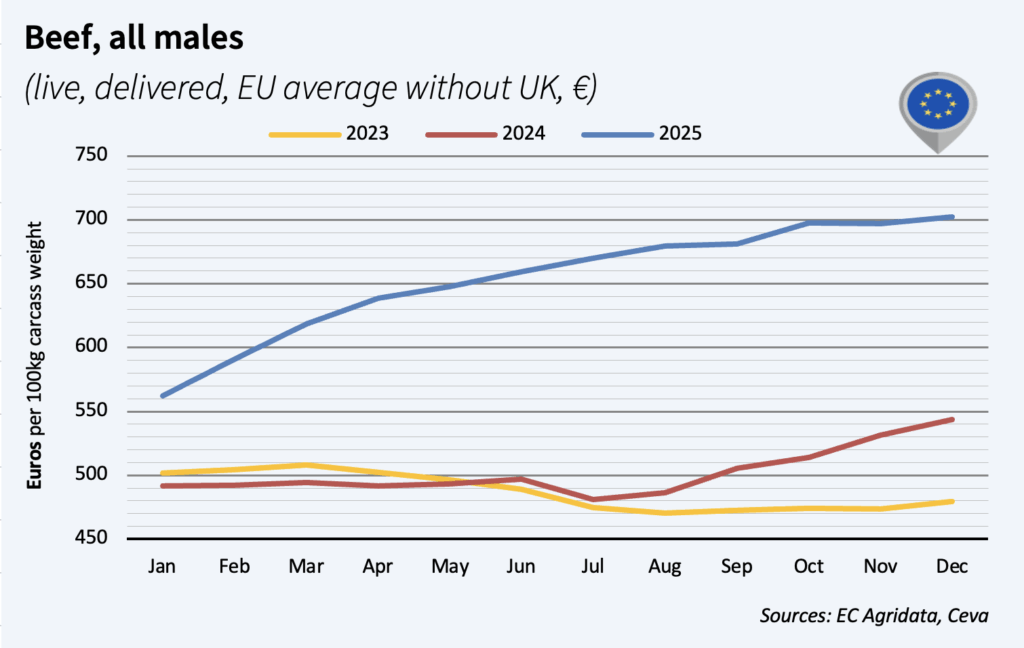

How did beef prices and production perform in Europe in December 2025?

In December, male cattle prices, already at record levels, continued increasing by 2% in a month and were 44% above 2024 high level. EU beef production contracted by 3% in the first 10 months of 2025, making meatpackers scramble for cattle, adding every week a few $ to the male prices. This trend could continue in 2026 as cow herds are low. However, consumer’s willingness or not to buy, may be a difficulty.

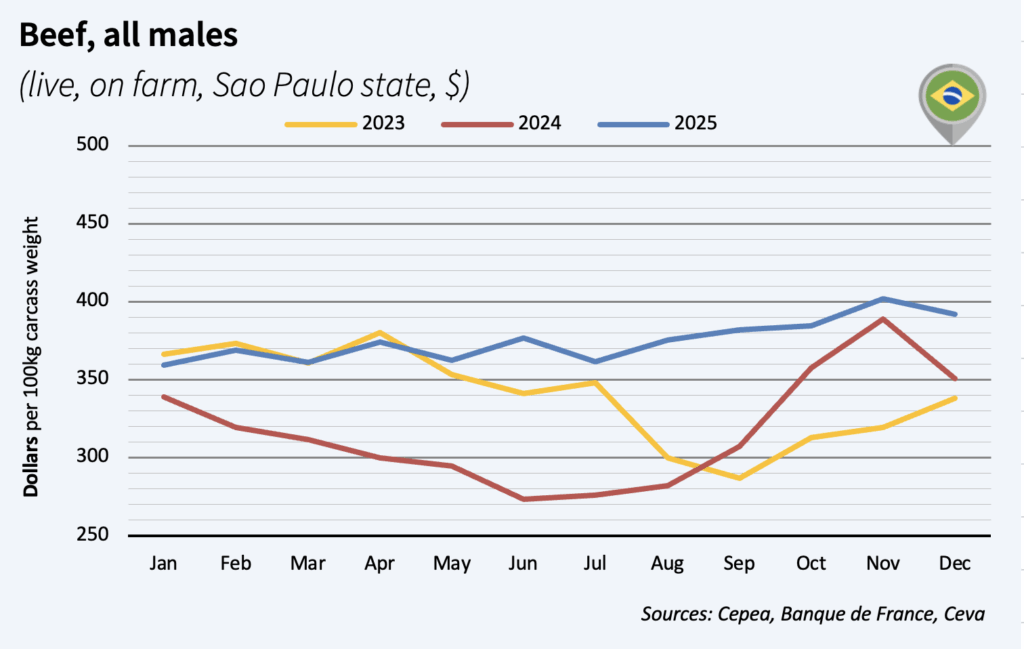

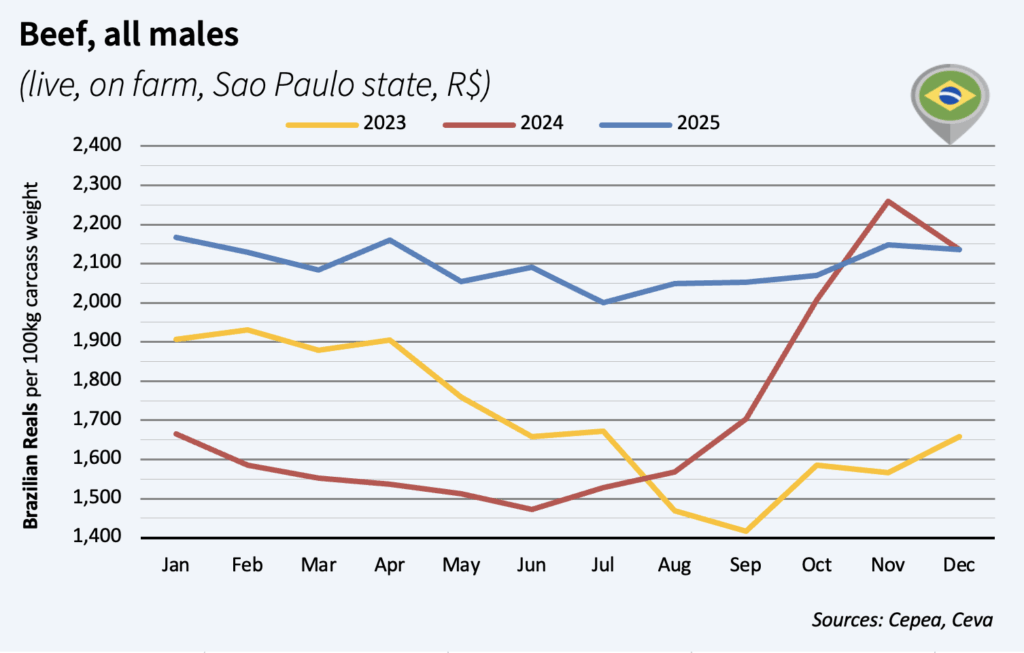

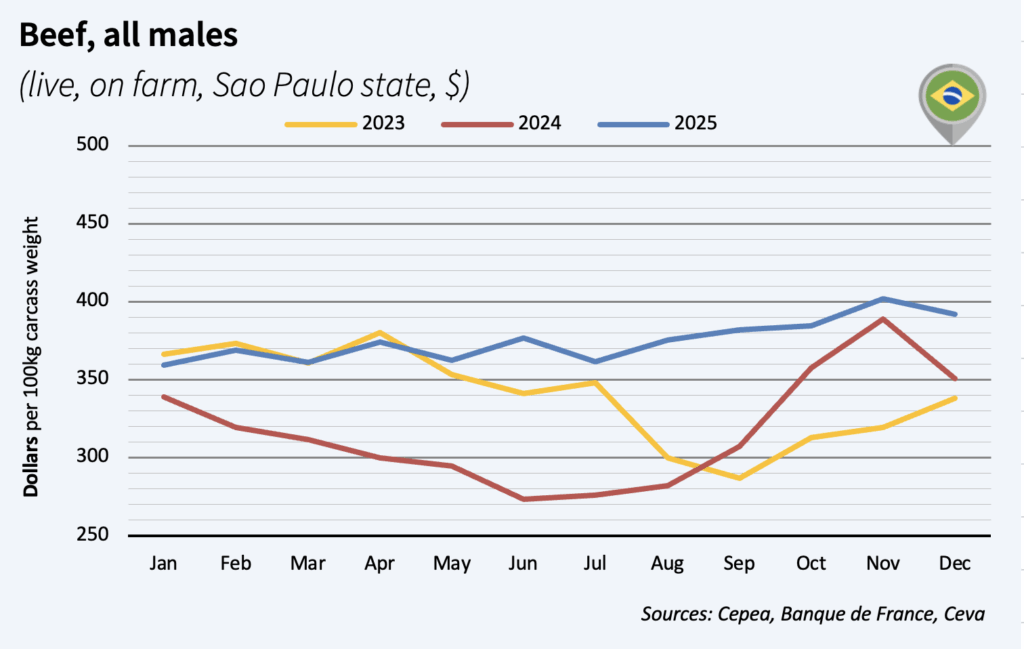

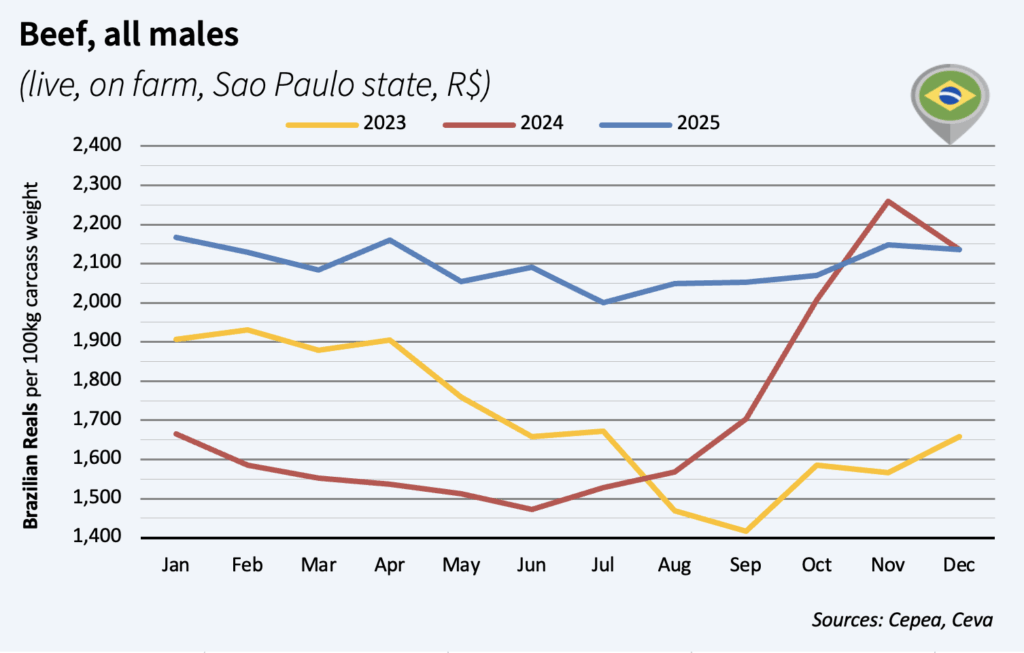

How is the beef market evolving in Brazil this month?

In December, Brazilian beef prices decreased by 3% in a month but are above 2024 level (+12%). Beef meat production has increased by 4% in 2025, according to latest estimates. The country’s total beef exports during 2025 culminated at a historic 4.145 million tons cwe, 21% above 2024, already huge. Exports to China (& Hong Kong) were of 2.2 million tons (+24%) and will be curbed in 2026 as China put a 55% tariff on all major exporting countries to its territory, above a maximum quantity exported from each country (safeguard measures). The limit for Brazil is 1.1 million tons. The country will probably send more beef to Japan, Korea, the Philippines or Indonesia, and the US.

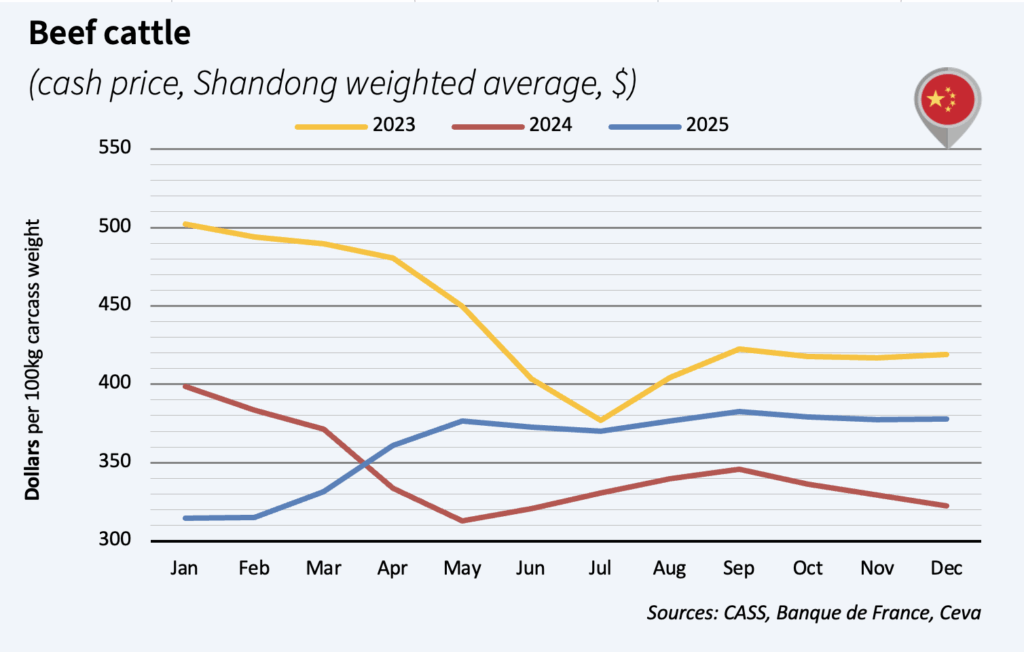

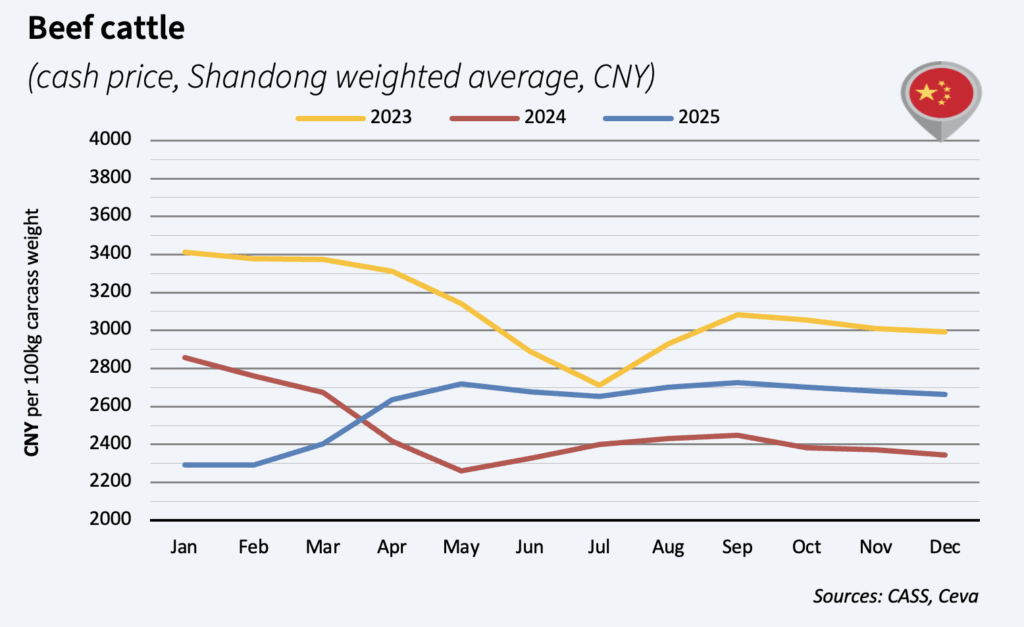

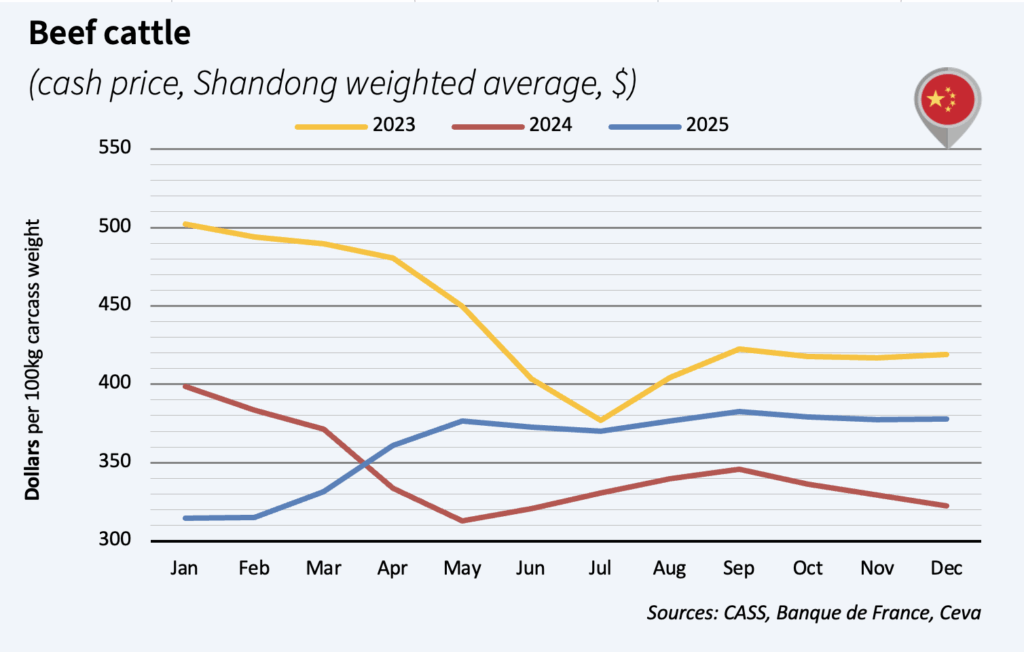

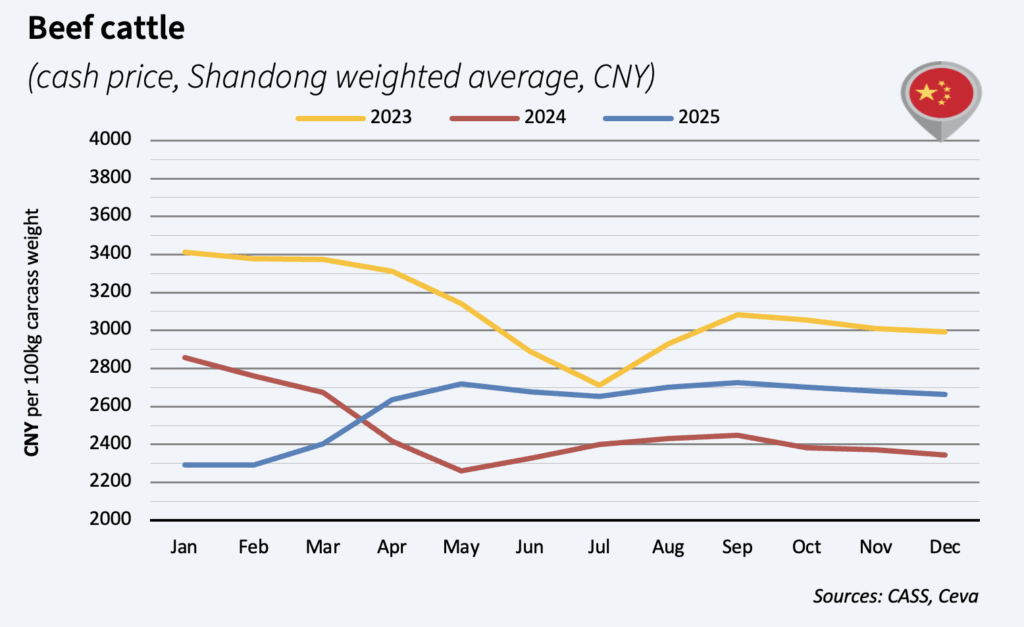

What is happening with beef prices and imports in China?

In December, beef prices stayed stable at a low level and just underneath brazilian prices, as meat imports continued. Nevertheless, prices were 17% above 2024 low level. China’s main meat furbishers say they sent a record 3.68 million tons cwe of beef to China in the first 11 months of 2025 (+6% year-over-year). China released its safeguard measures on beef imports, with a 55% tariff on extra volumes above a total world quota of 2.7 million tons of beef imported yearly, with individual quotas per origin. This should curb imports and help the local cattle industry.

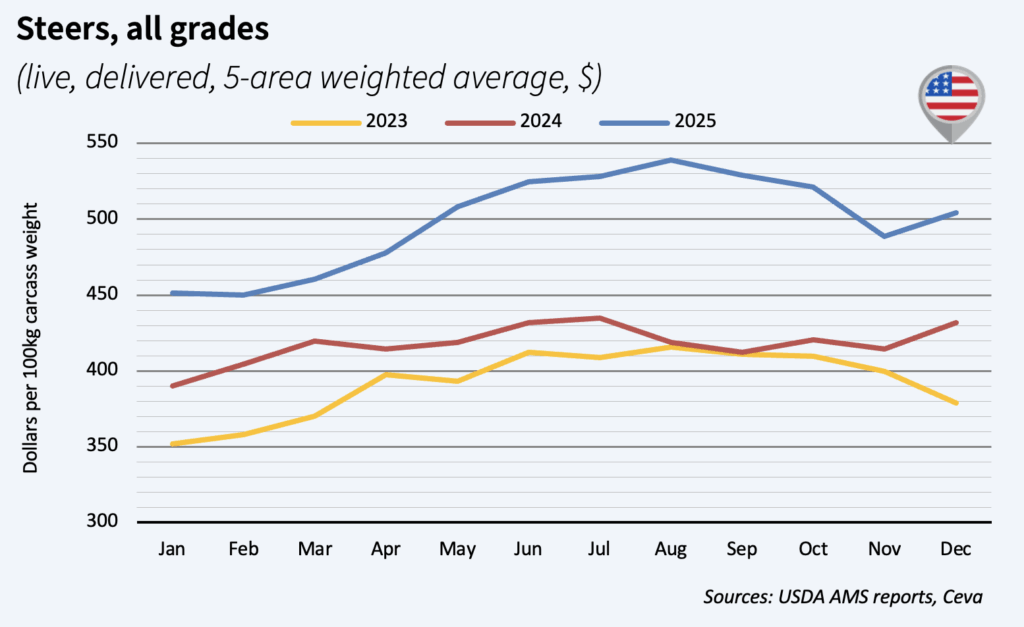

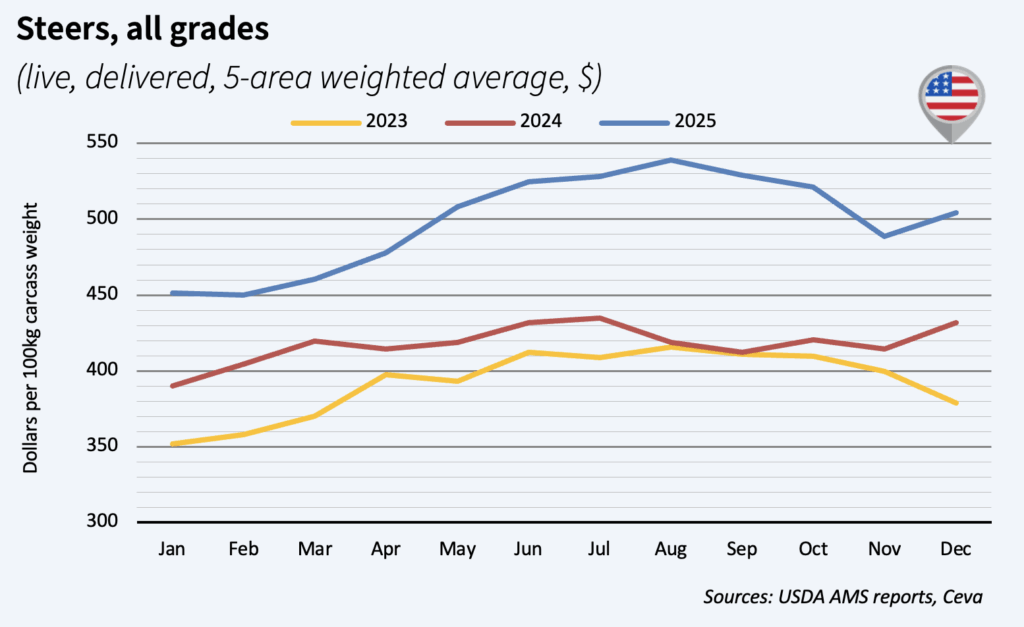

What factors are affecting beef prices in the United States?

After falling in November, prices started recovering in December, increasing by 3% in a month, and 17% above 2024 level. By January the 11th, prices had recovered 60% of the autumn drop (USDA). Preliminary slaughtering data says beef meat production decreased by approximately 3% in 2025, as the US cattle herd is historically low. Consumer’s demand is still very strong for beef, but some households shift from high level cuts to more minced meat, because of the retail price increase (+16% in Dec. y-o-y).

Source:

Make sure to check out our News and Events section for access to all the monthly beef and milk market outlooks.