Beef Market Outlook (Baptiste Buczinski)

Welcome to the updated Beef Market Outlook. Discover the latest trends in beef cattle across Europe, Brazil, China, and the USA. Backed by in-depth data analysis, our insights offer a clear view of the key factors shaping the global beef industry.

SEE and share this valuable content.

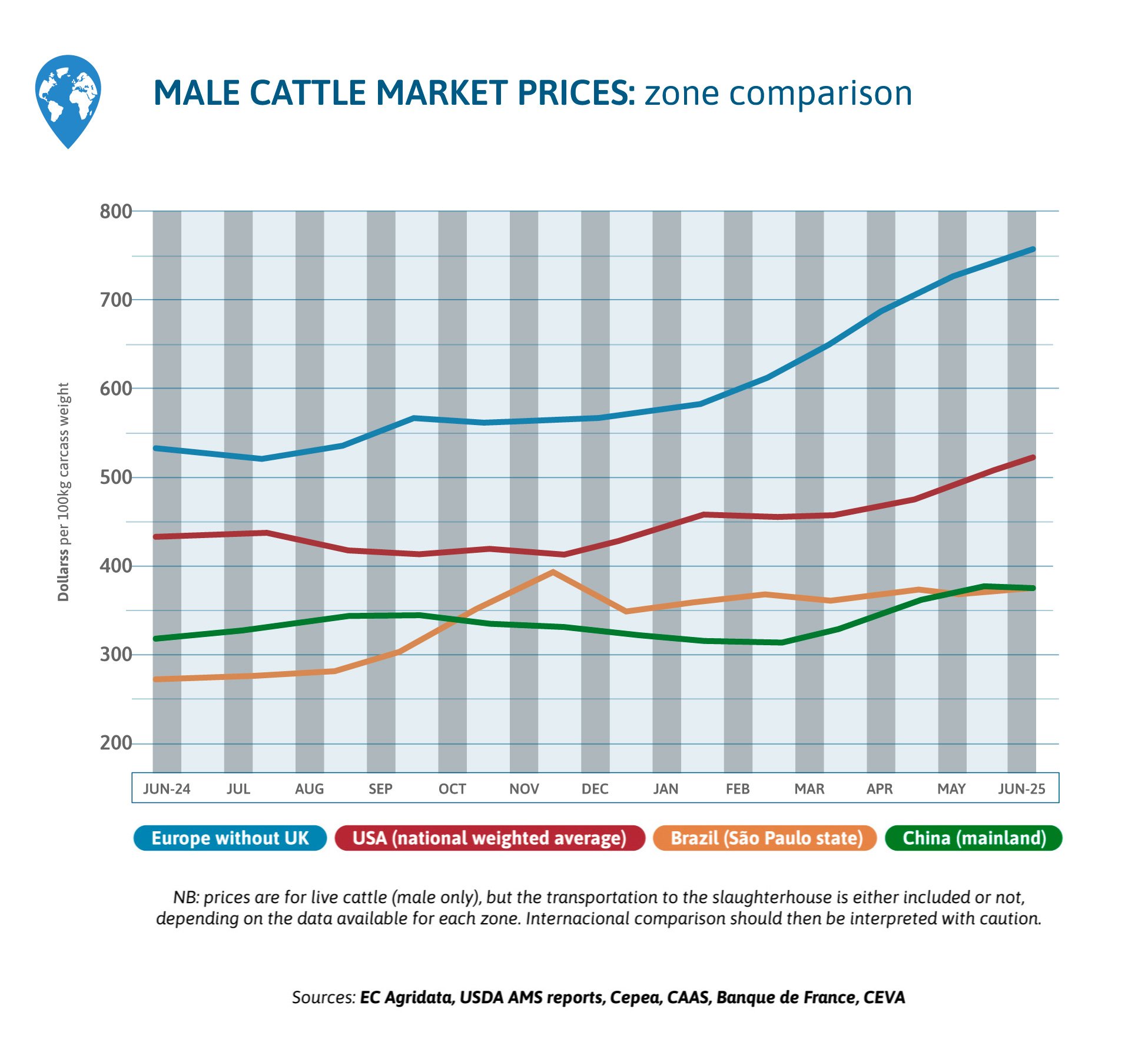

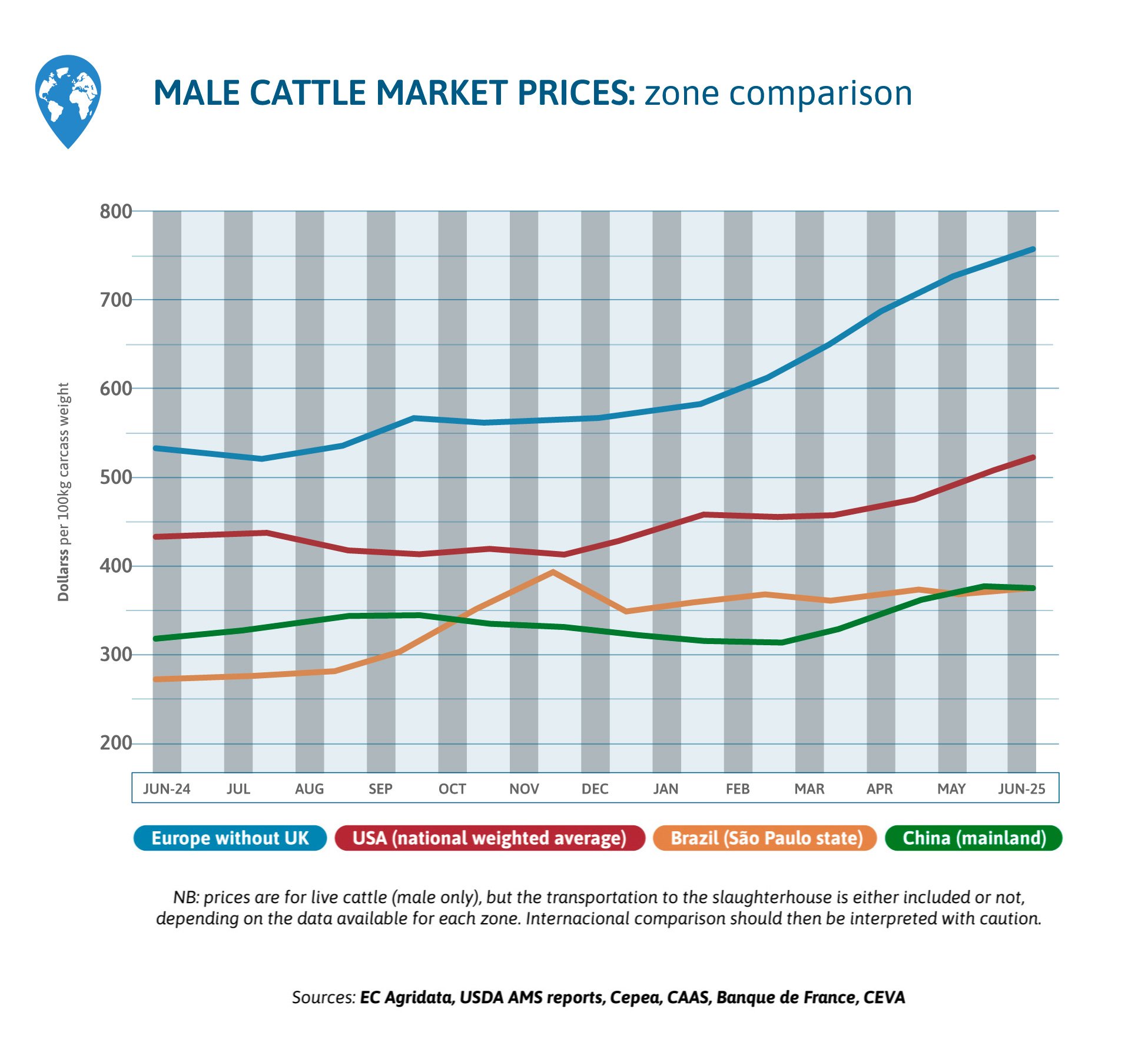

GLOBAL BEEF MARKET

In June, Chinese cattle prices stagnated as had increased in May. Brazilian prices are oscillating and slowly increasing in $US, as world demand is strong for beef. US prices are still going up as cattle is scarce and demand is good, just as in Europe.

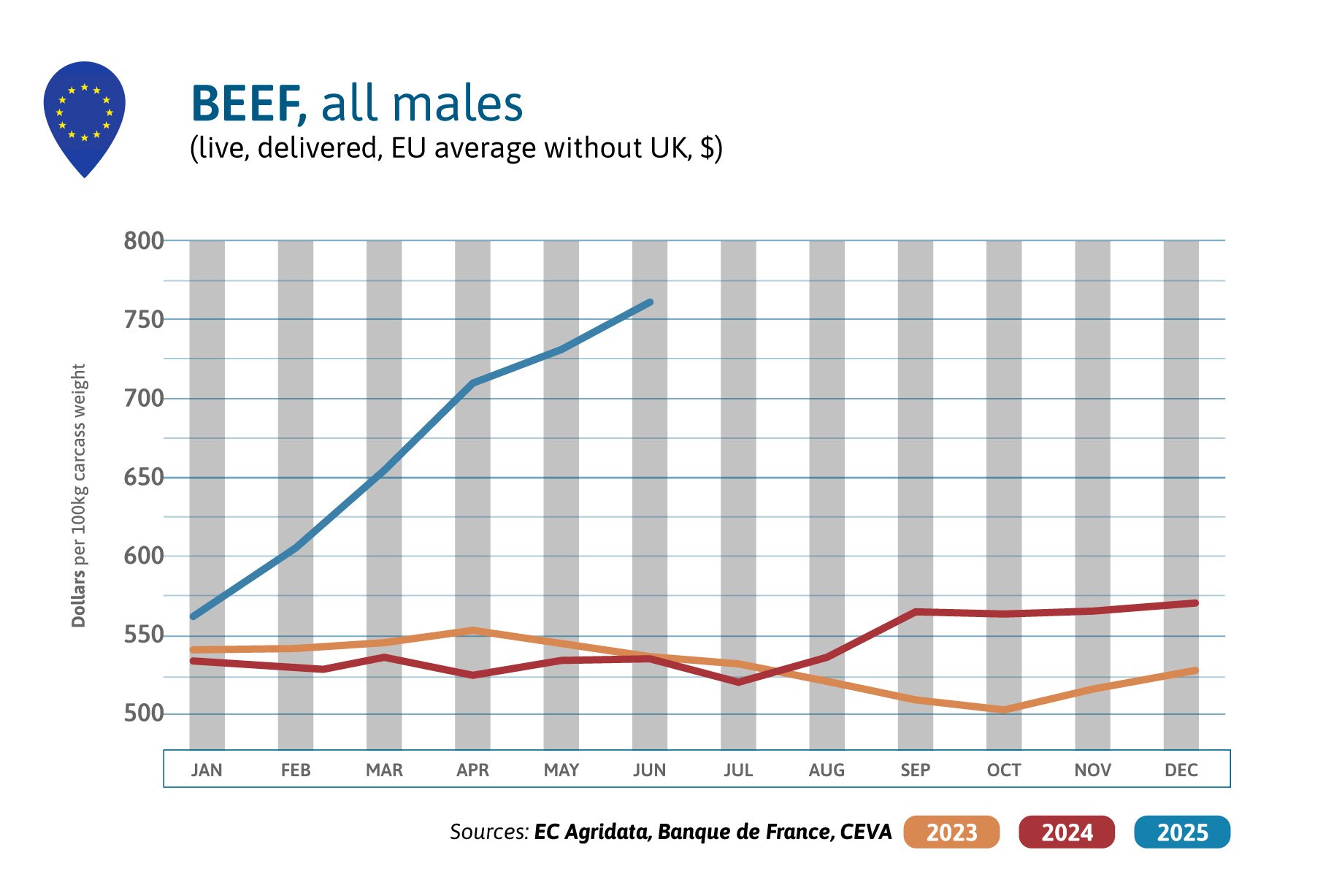

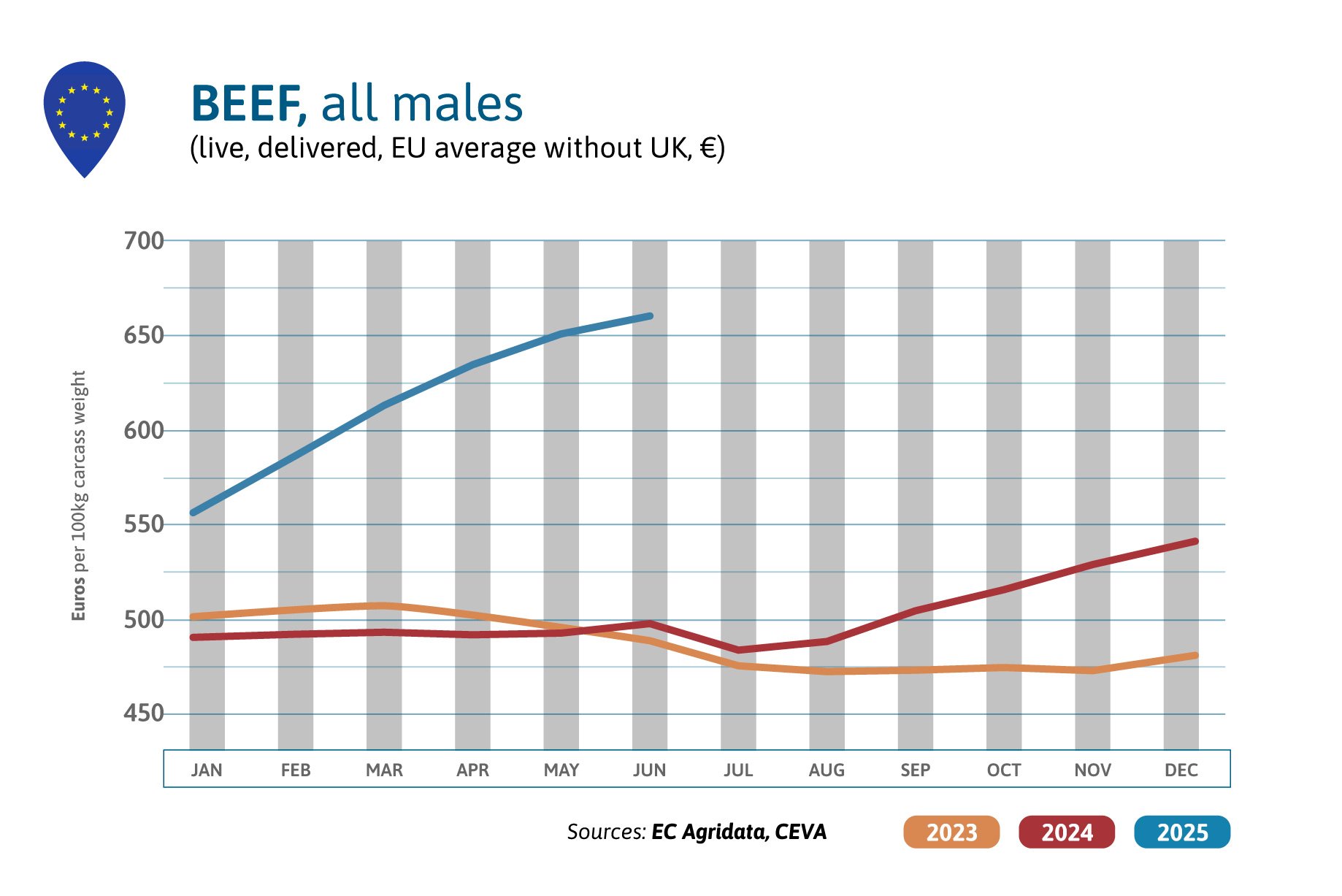

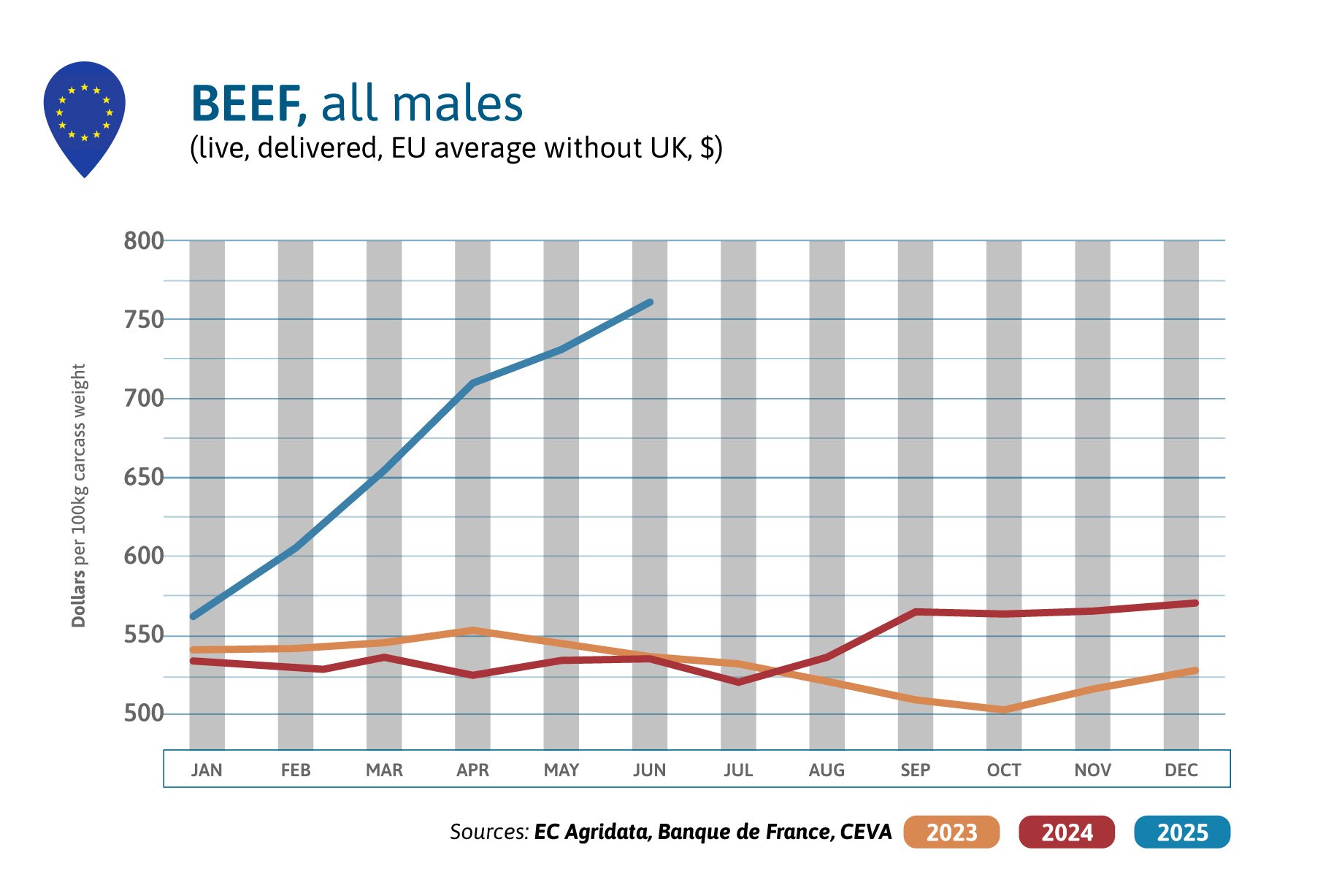

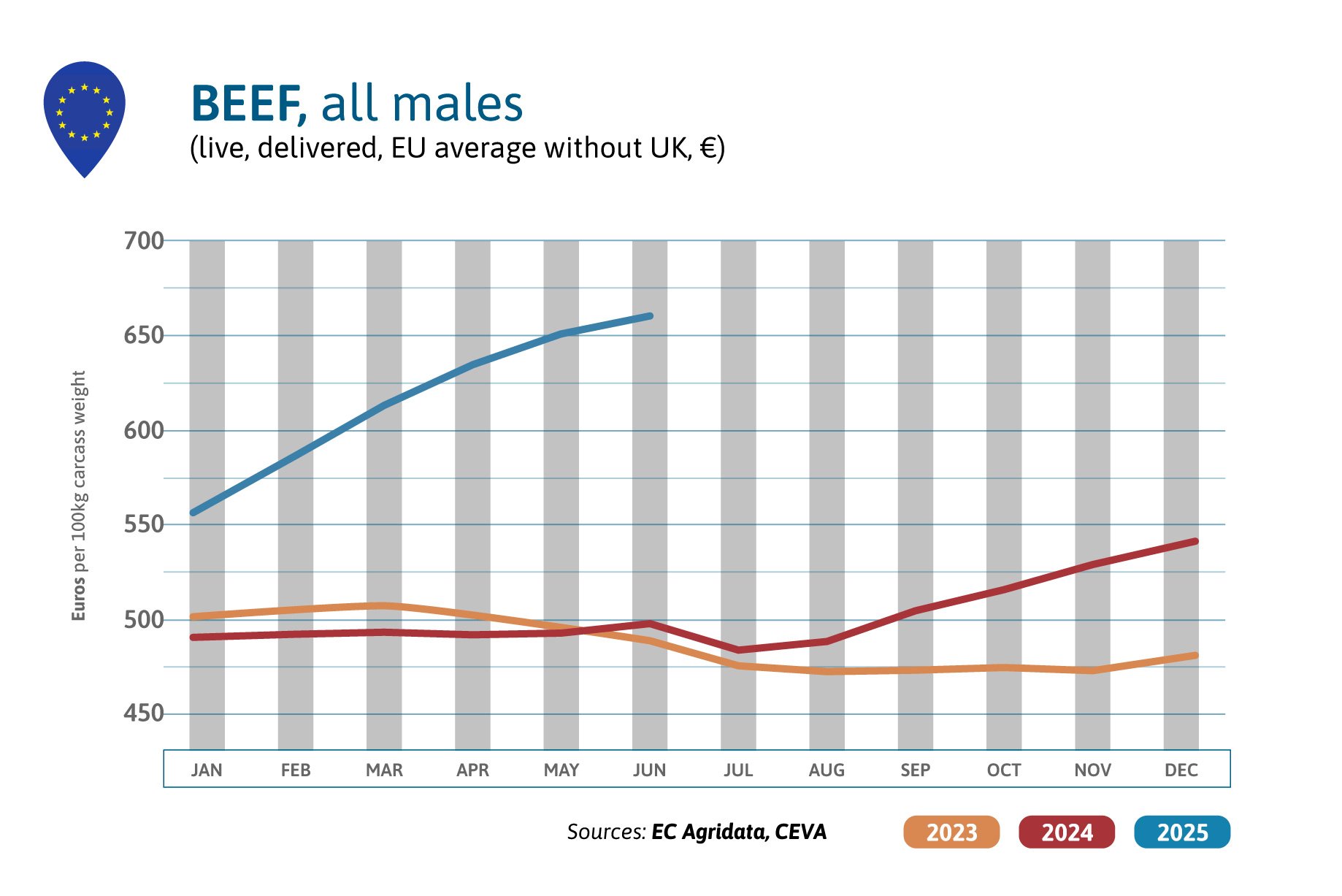

EUROPE

In June 2025, prices for male beef increased quickly in US$ (+4% compared to previous month) and are now 42% above the 2024 high level. Male prices usually decline at this time, as demand slackens a bit, due to the heat but the EU has less cattle than what is needed for its consumption and the Maghreb’s demand is increasing.

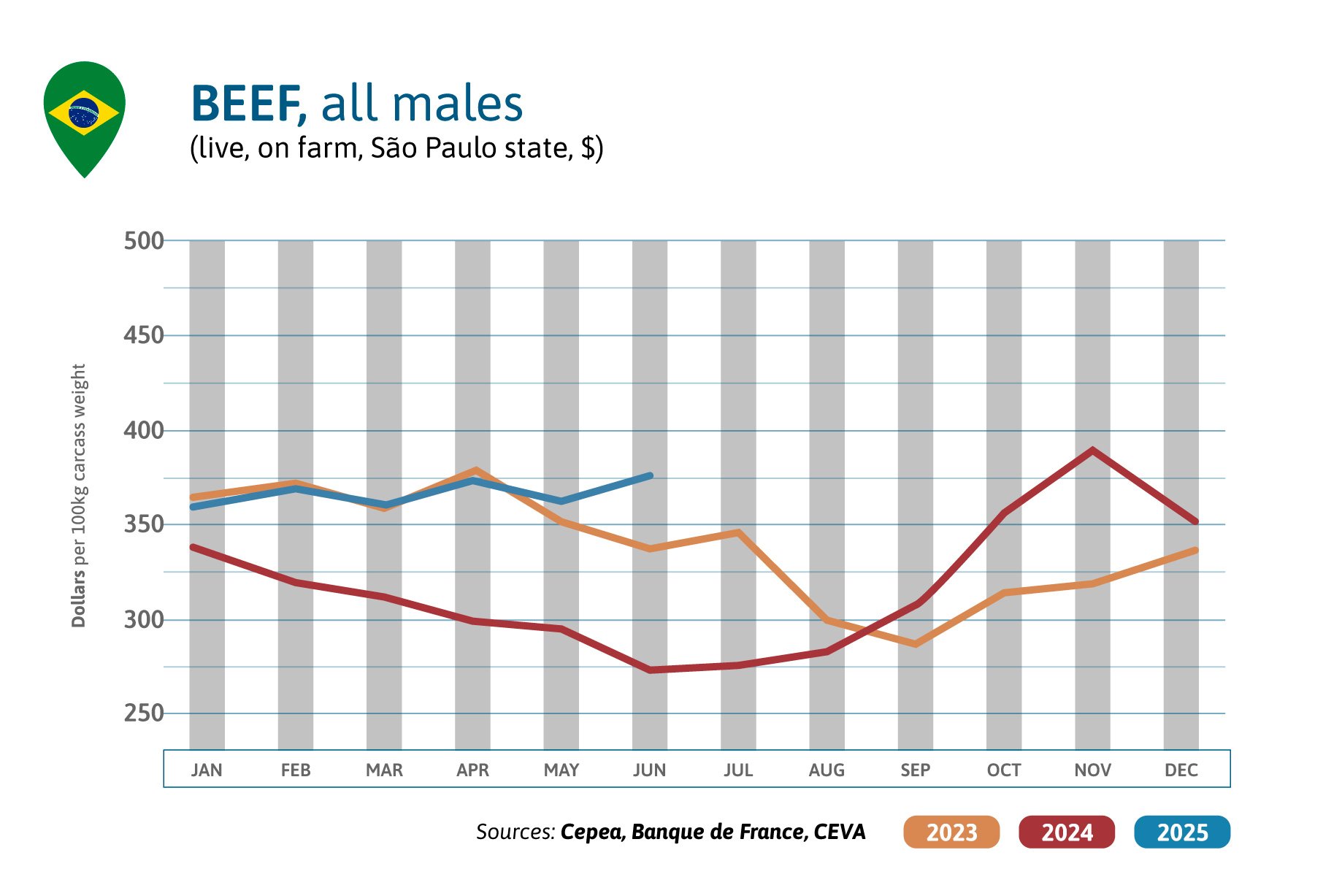

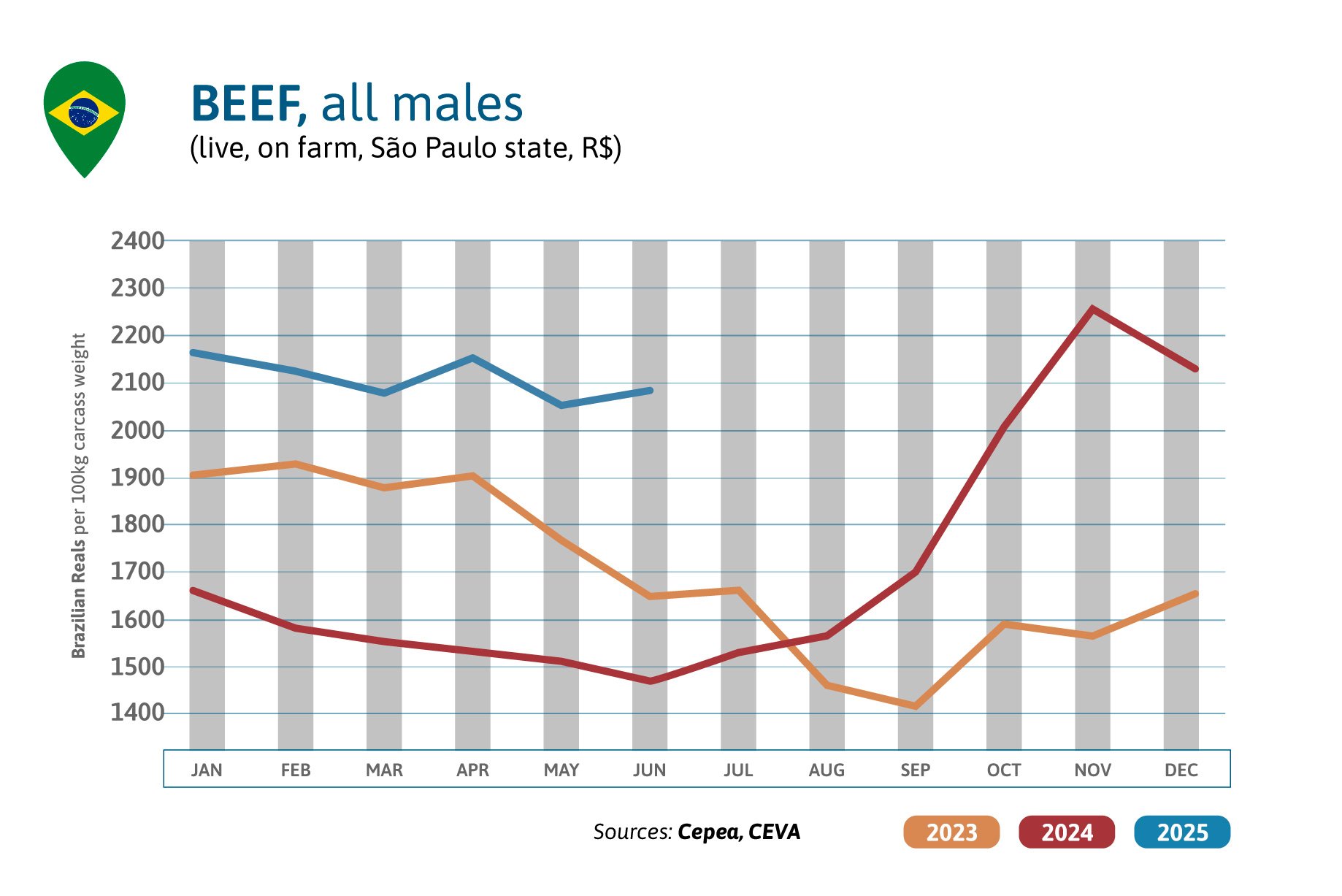

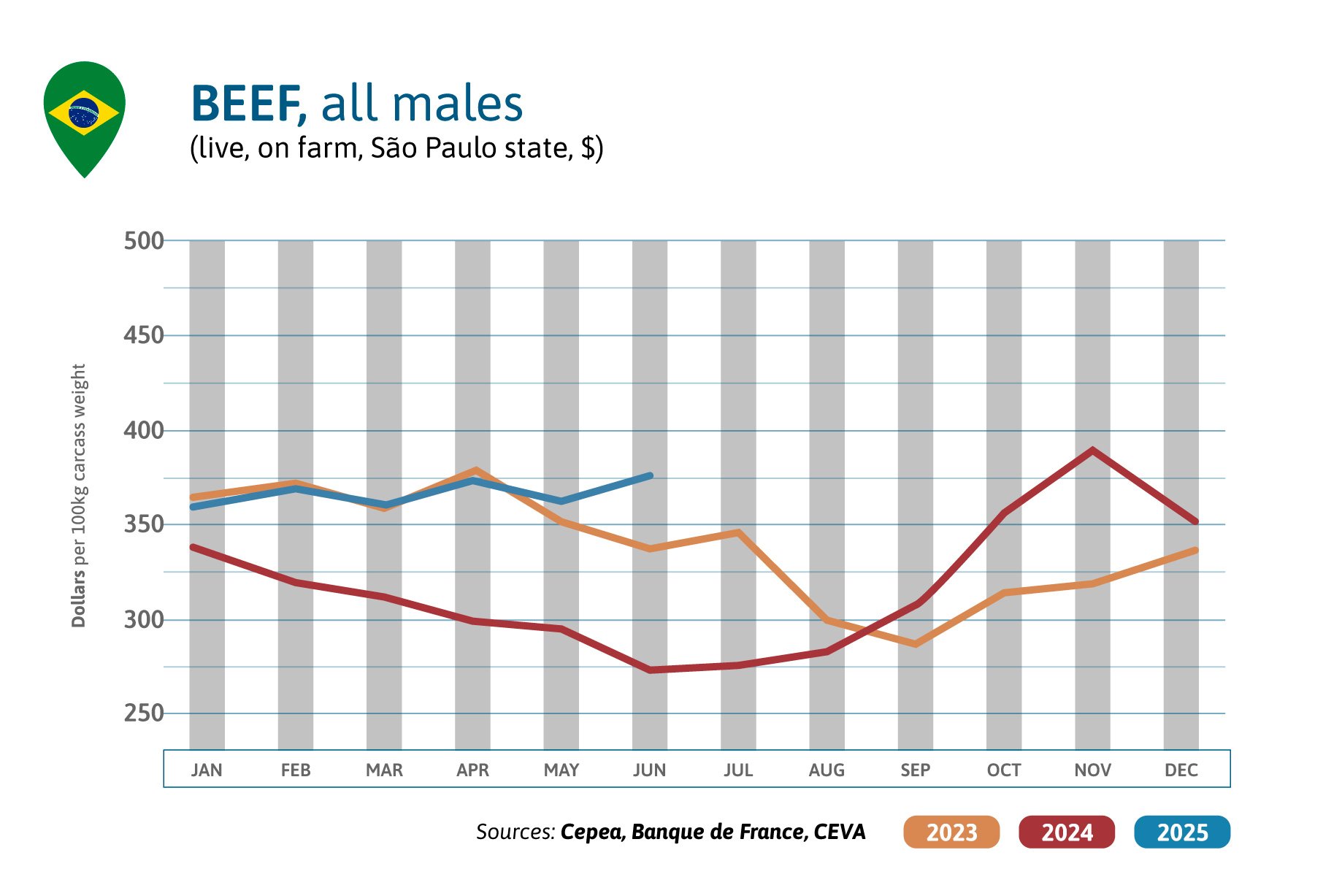

BRAZIL

Brazilian beef prices are oscillating this year but slowly increasing, by 4% in June compared to a month ago in $US, and +38% compared to 2024. In Réais, beef price are in slight seasonal decrease since January, winter conditions reducing a bit the grass growth and bringing more cattle to slaughterhouses. The World is hungry for beef and Brazilian beef exports have therefore by 12% in volume in the first half of 2025, compared to 2024, and by 13% in price in $US, according to CEPEA, as the global demand makes prices rise on the export market.

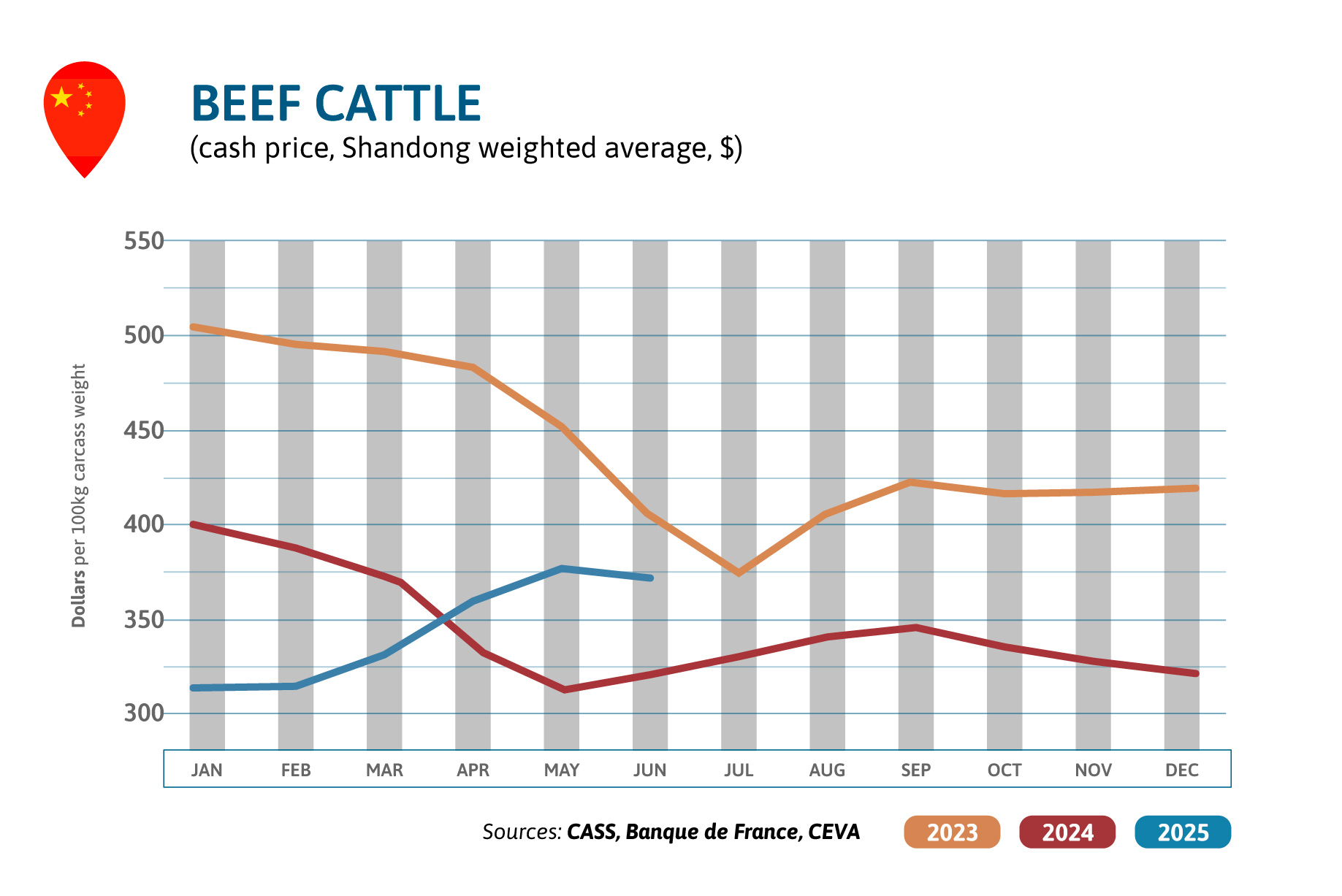

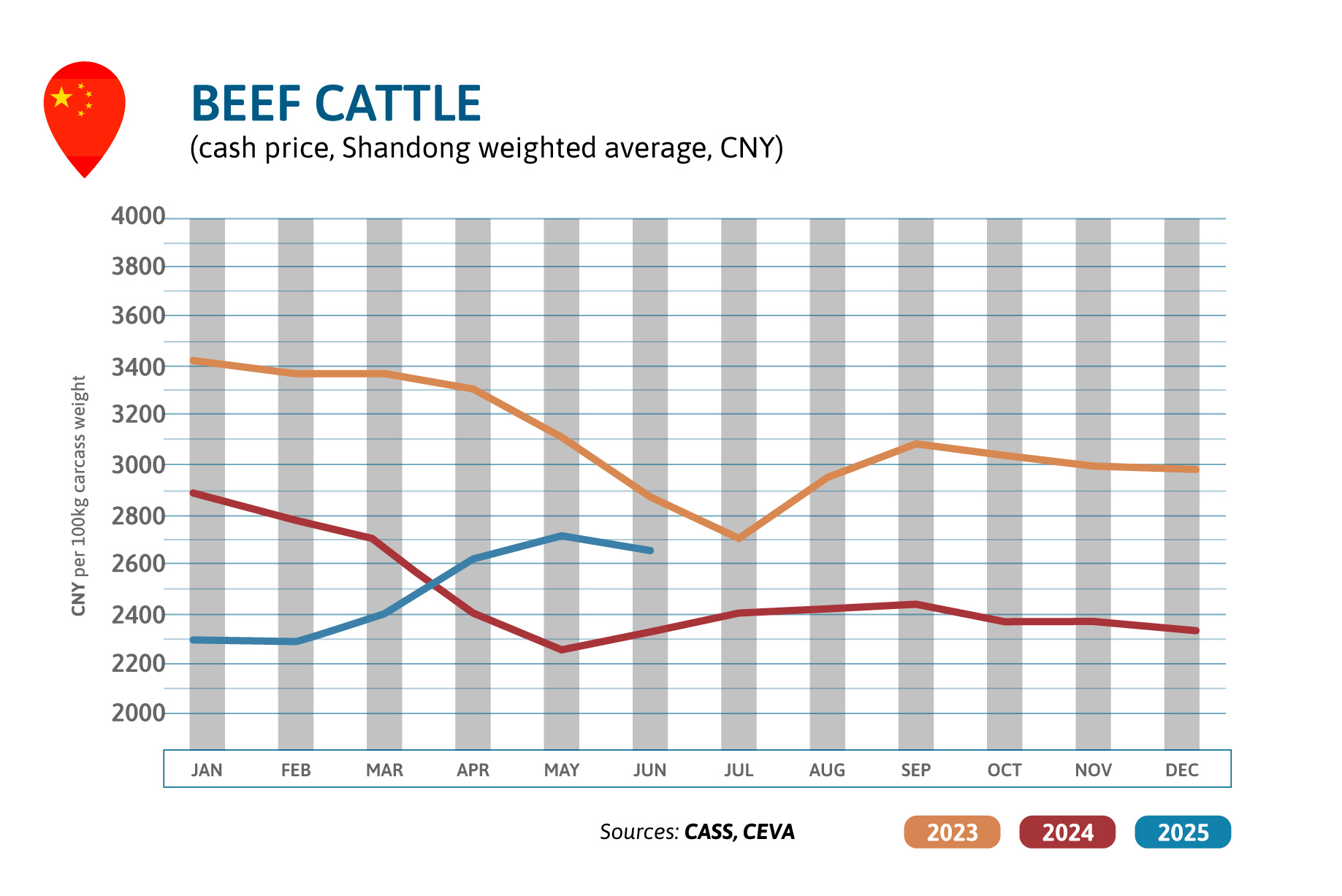

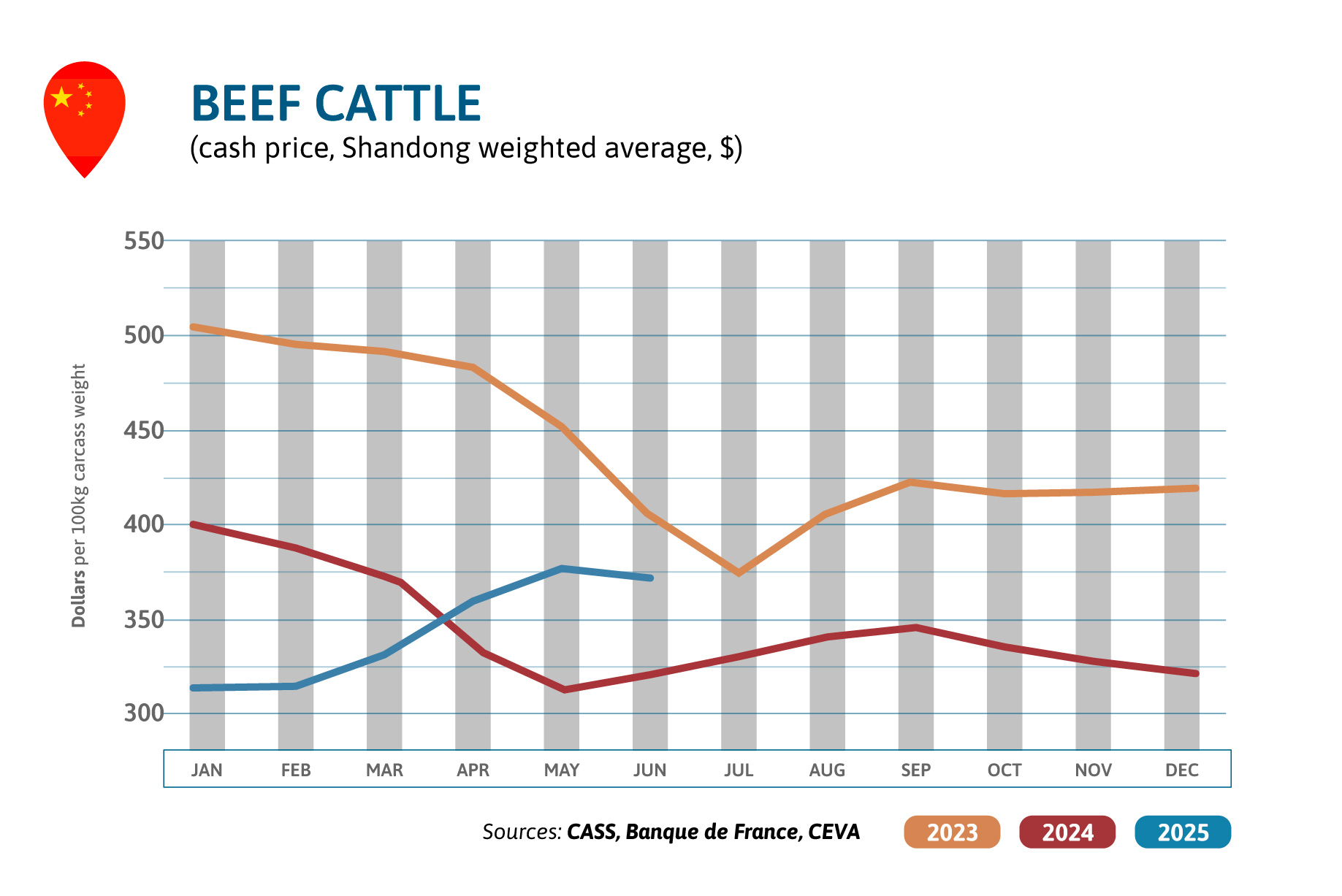

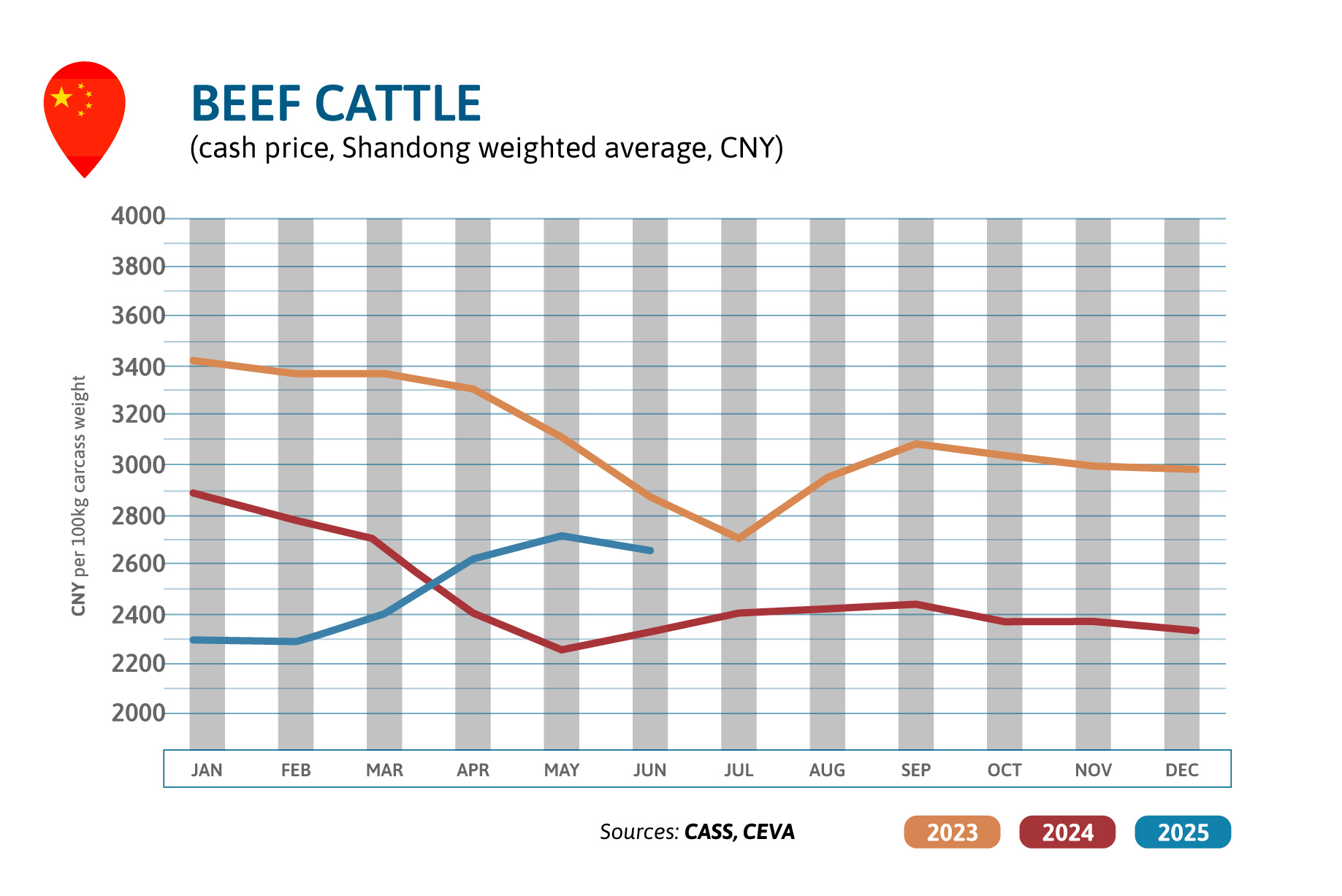

CHINA

Chinese finished cattle prices didn’t increase this month, between May and June (-1% in $US). The prices are better than a year ago (+16%) but are far from 2022 levels (-27%), before the drop in prices that began at the end of 2022. The price increase on the local market has halted, as May’s beef imports increased again (+2% year over year). The total imports through the first 5 months of 2025 decreased by 6% y.o.y. Market experts say that the Chinese food service sector’s situation is improving, which could trigger a new increase in beef imports.

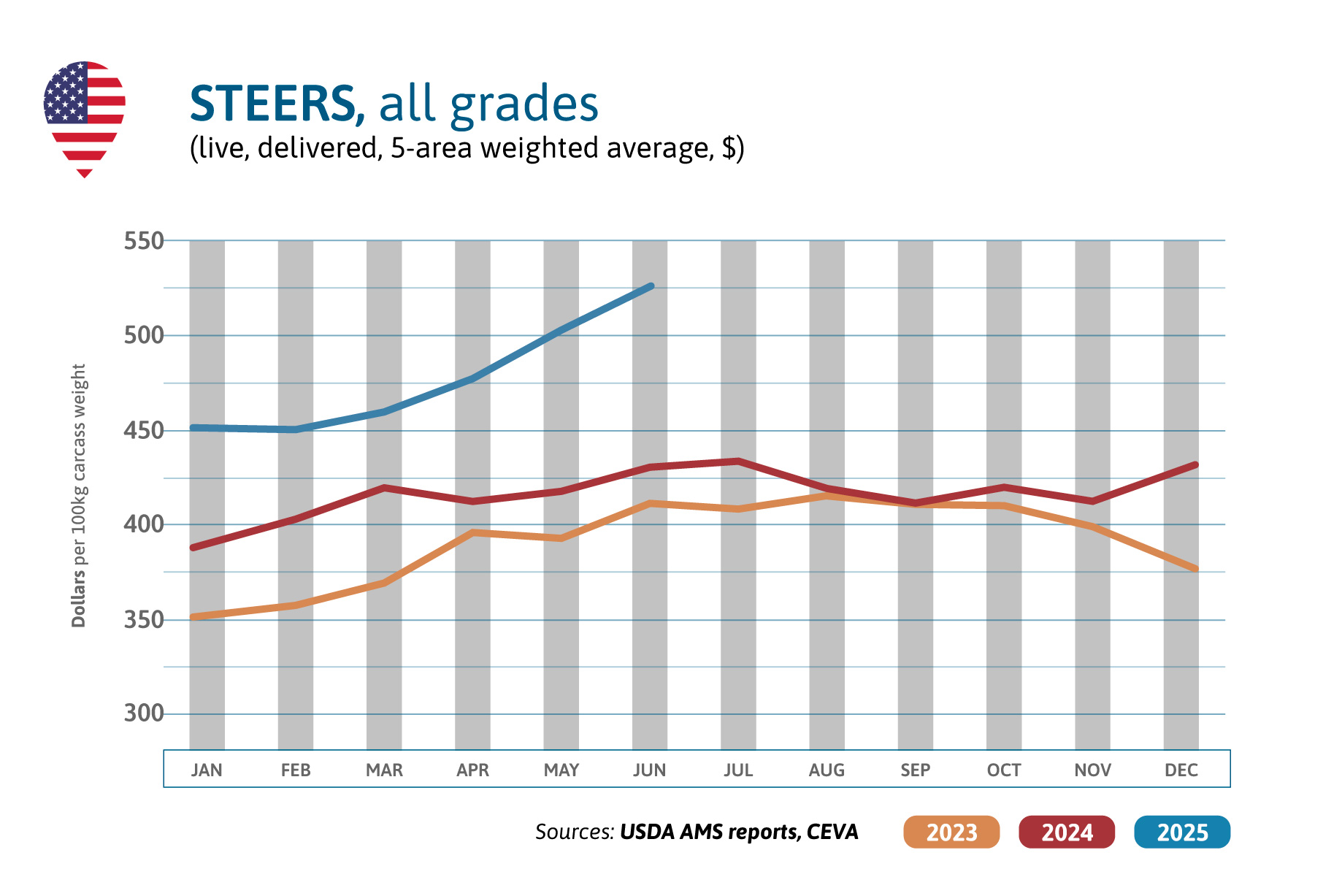

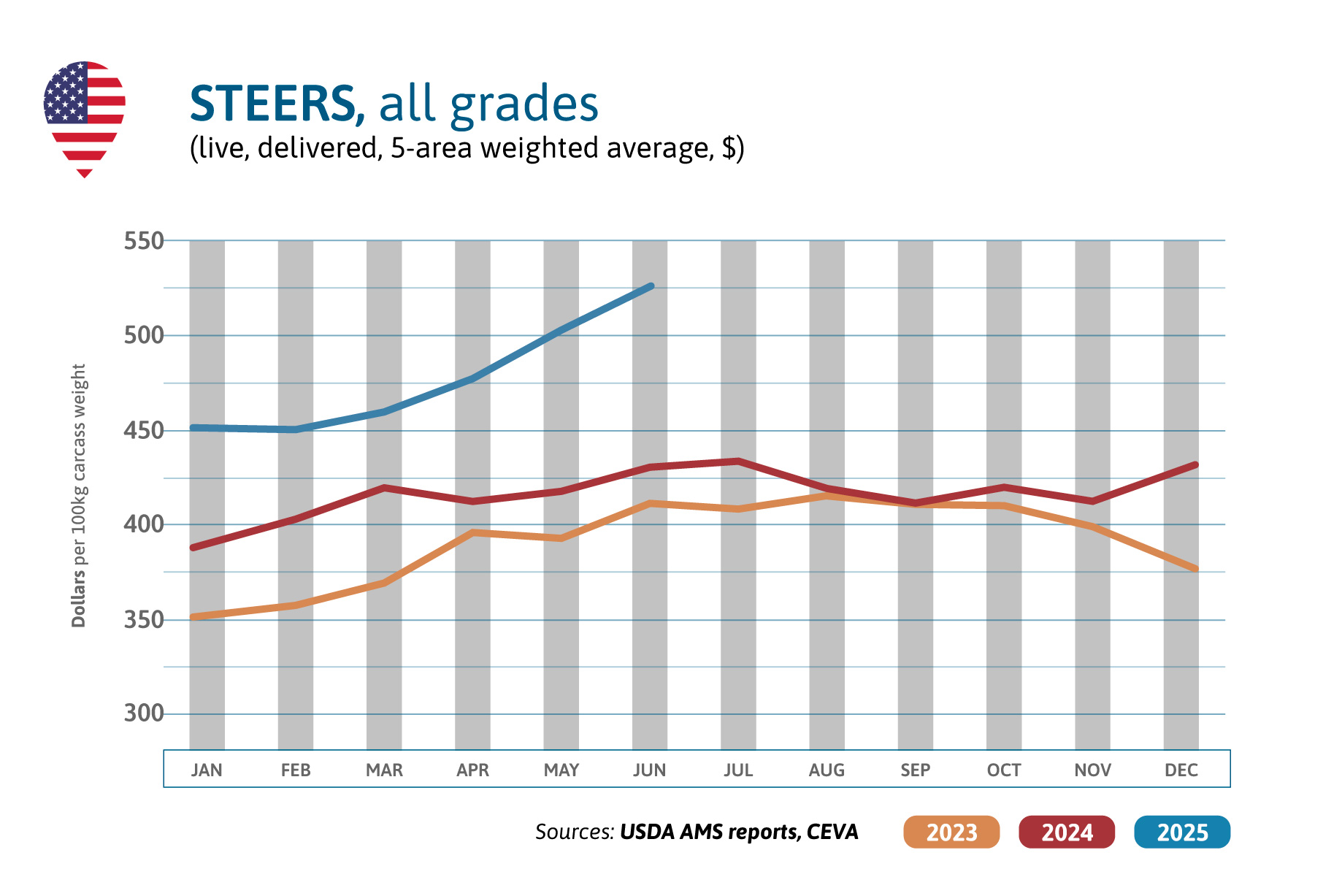

USA

In June, steer prices continued their increase over last year’s high levels: +2% compared to last month and +42% year over year. In June a broad-spread plan to control NWS was announced, in cooperation with Mexico. The boarder was opened on July the 7th but closed 2 days later as a case of NWS was detected north of the sterile fly dispersal area. USDA assumes the import of Mexican cattle may be suspended for several months. Cumulative beef imports until April 2025 were 28% above last year’s level, and May imports were up by 60% compared to one year before.

Source:

Make sure to check out our News and Events section for access to all the monthly beef and milk market outlooks.