Beef Market Outlook (Baptiste Buczinski)

Welcome to the new Beef Market Outlook. Explore the latest beef cattle trends across Europe, Brazil, China, and the USA. Supported by comprehensive data analysis, our insights provide a clear perspective on the key factors influencing the global beef industry.

SEE and share this valuable content.

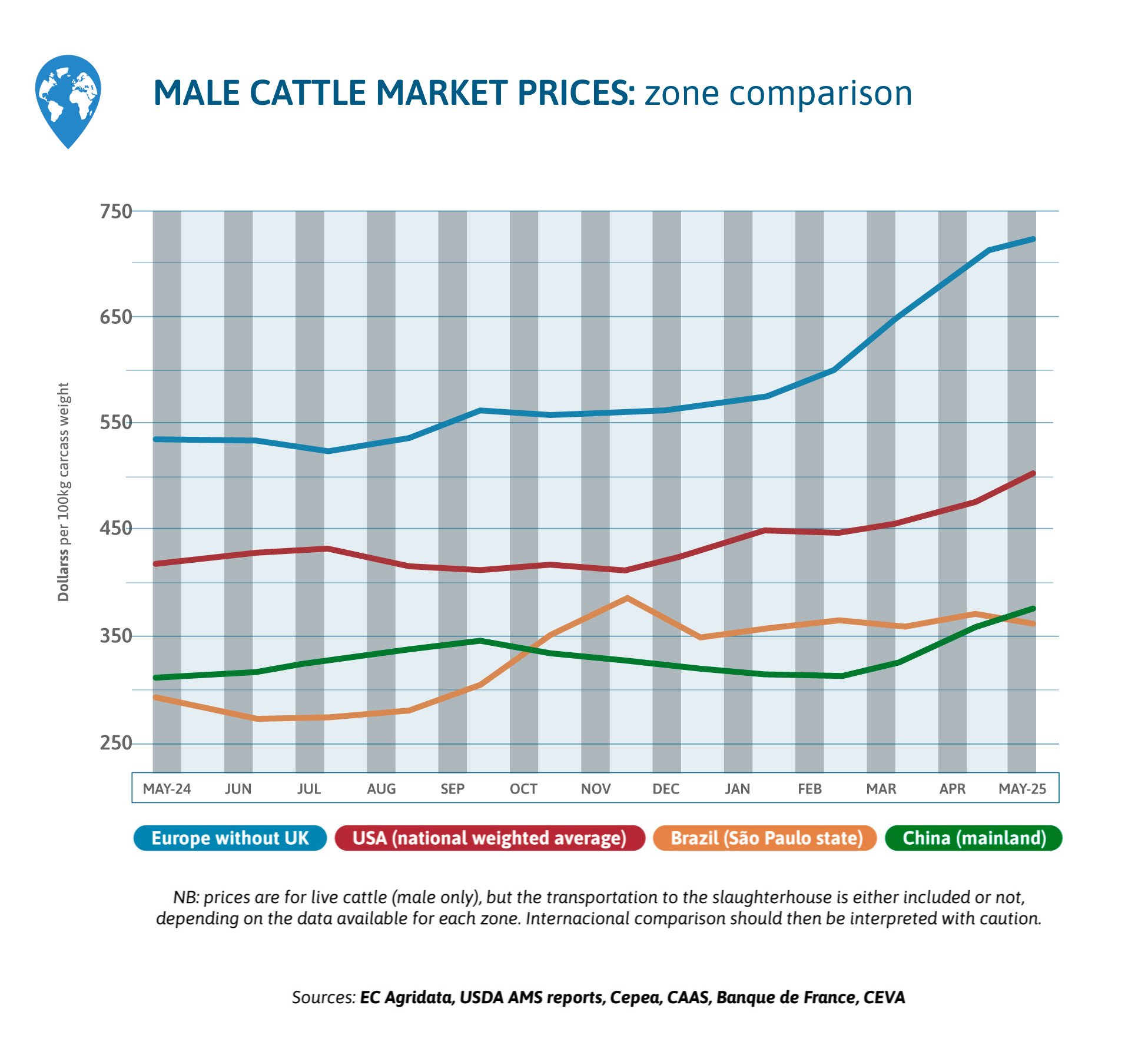

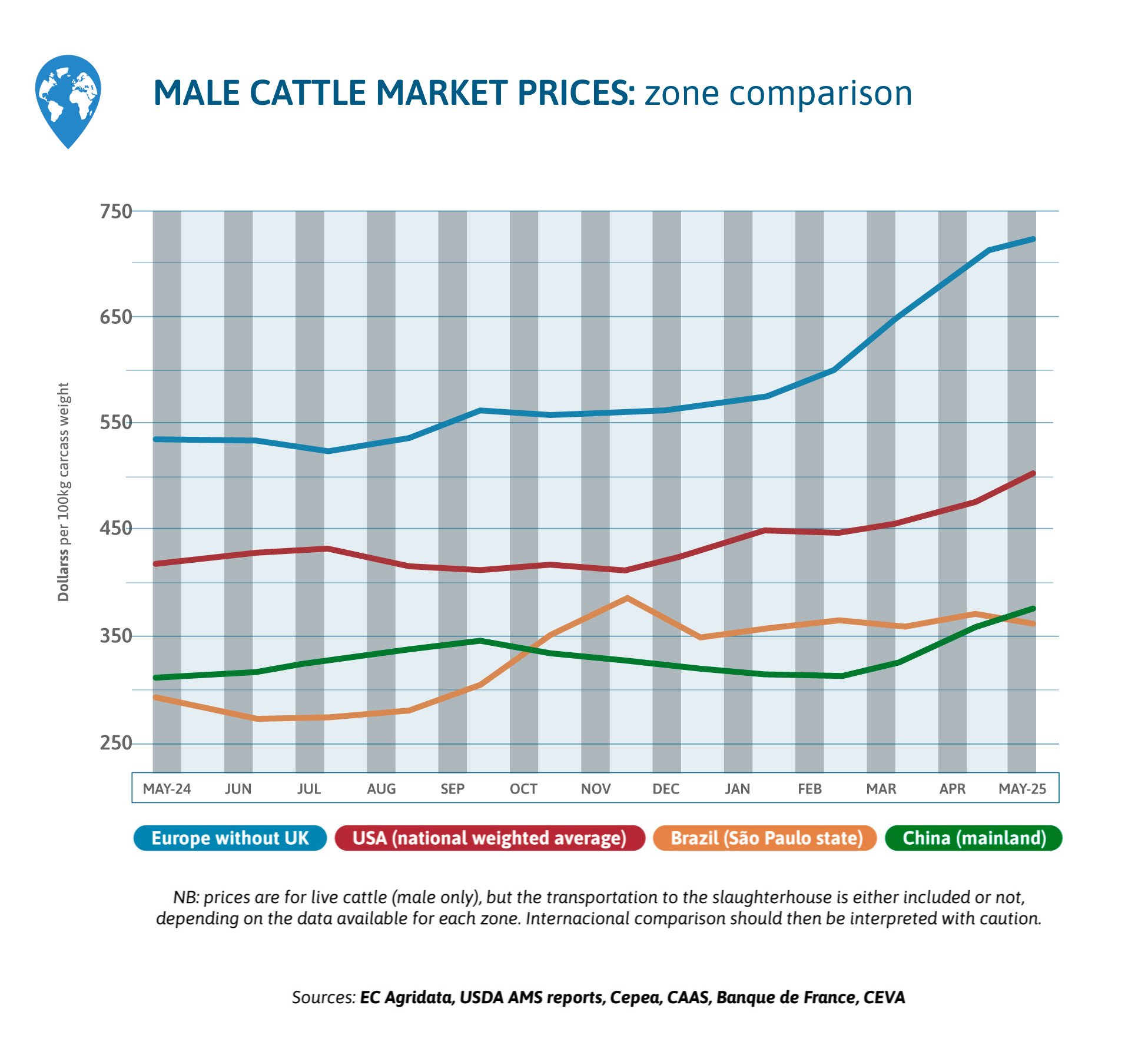

GLOBAL BEEF MARKET TREND

In May, cattle prices increased again, the local market somewhat recovering, with less beef imports. Brazilian prices are oscillating, and Brazilian beef exports are still increasing after record levels in 2024. US prices are high and still going up as cattle is scarce and demand is strong, just as in Europe.

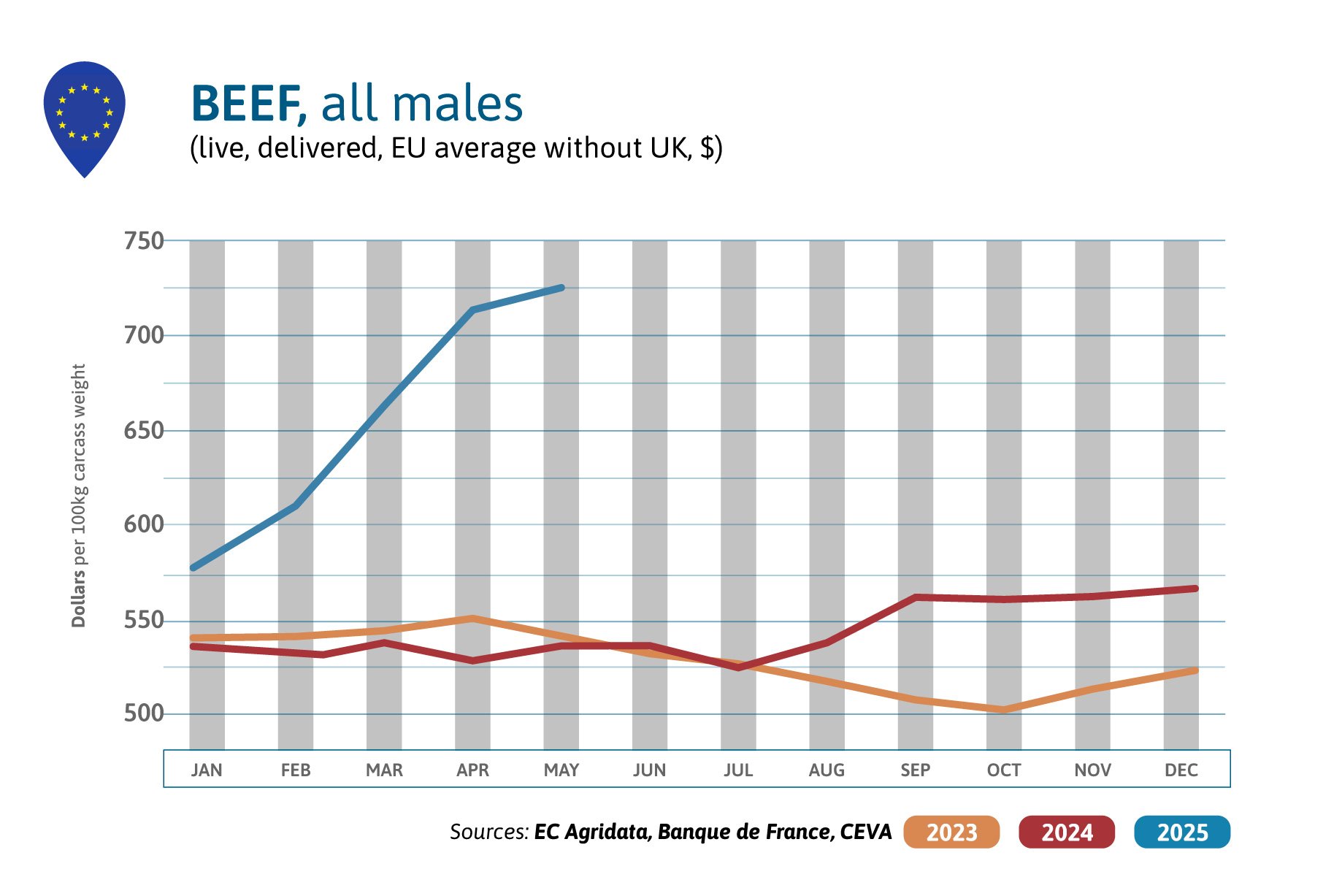

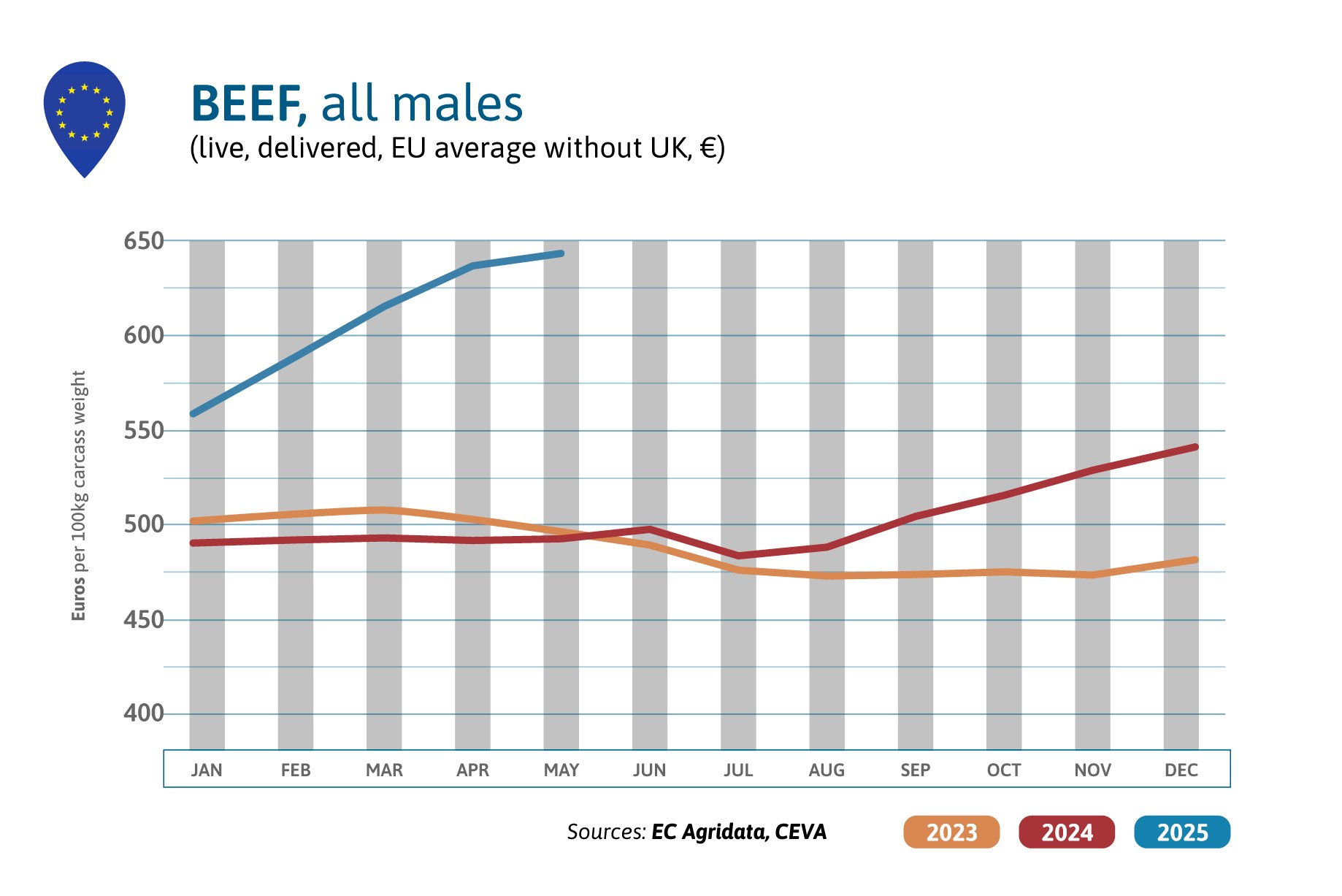

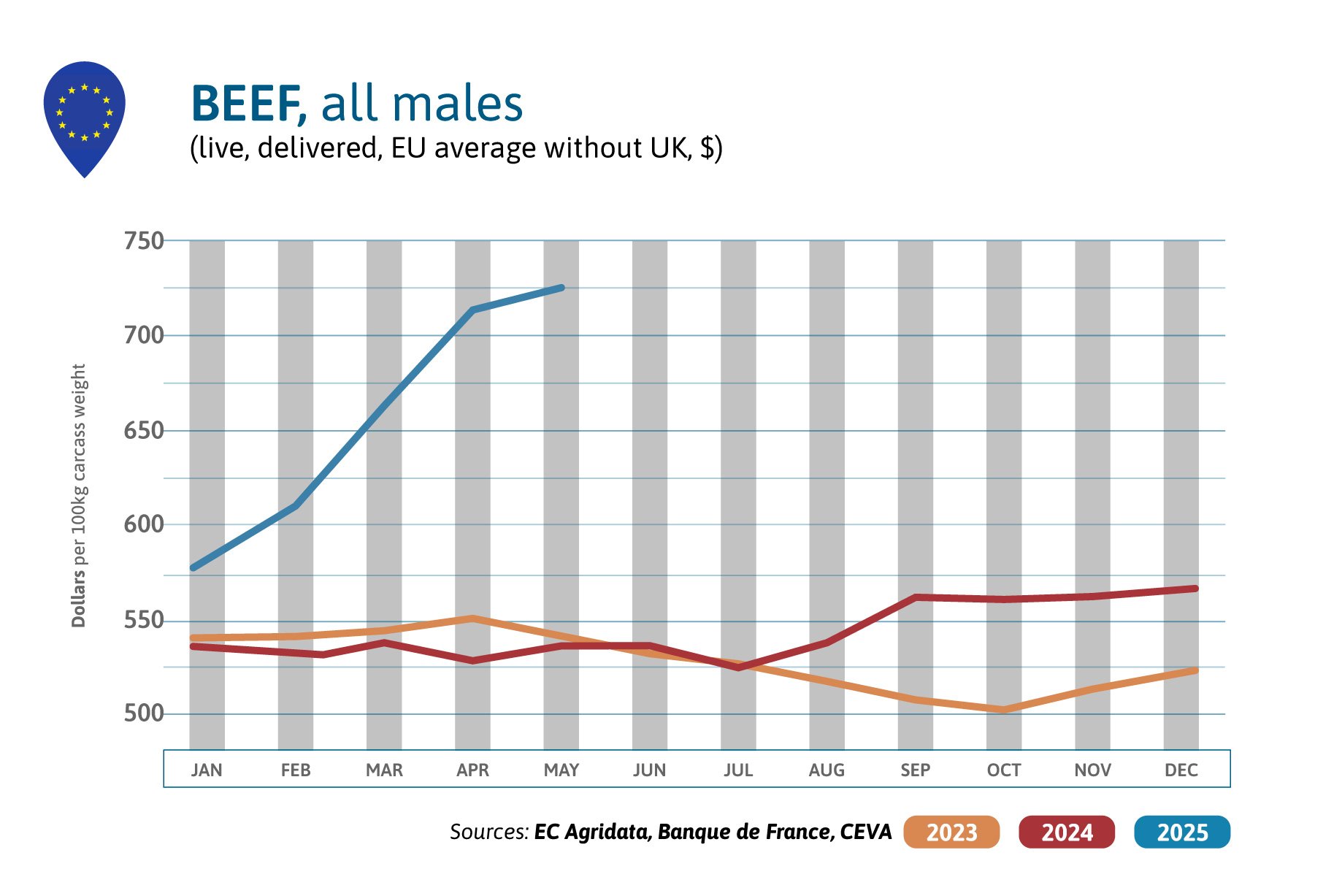

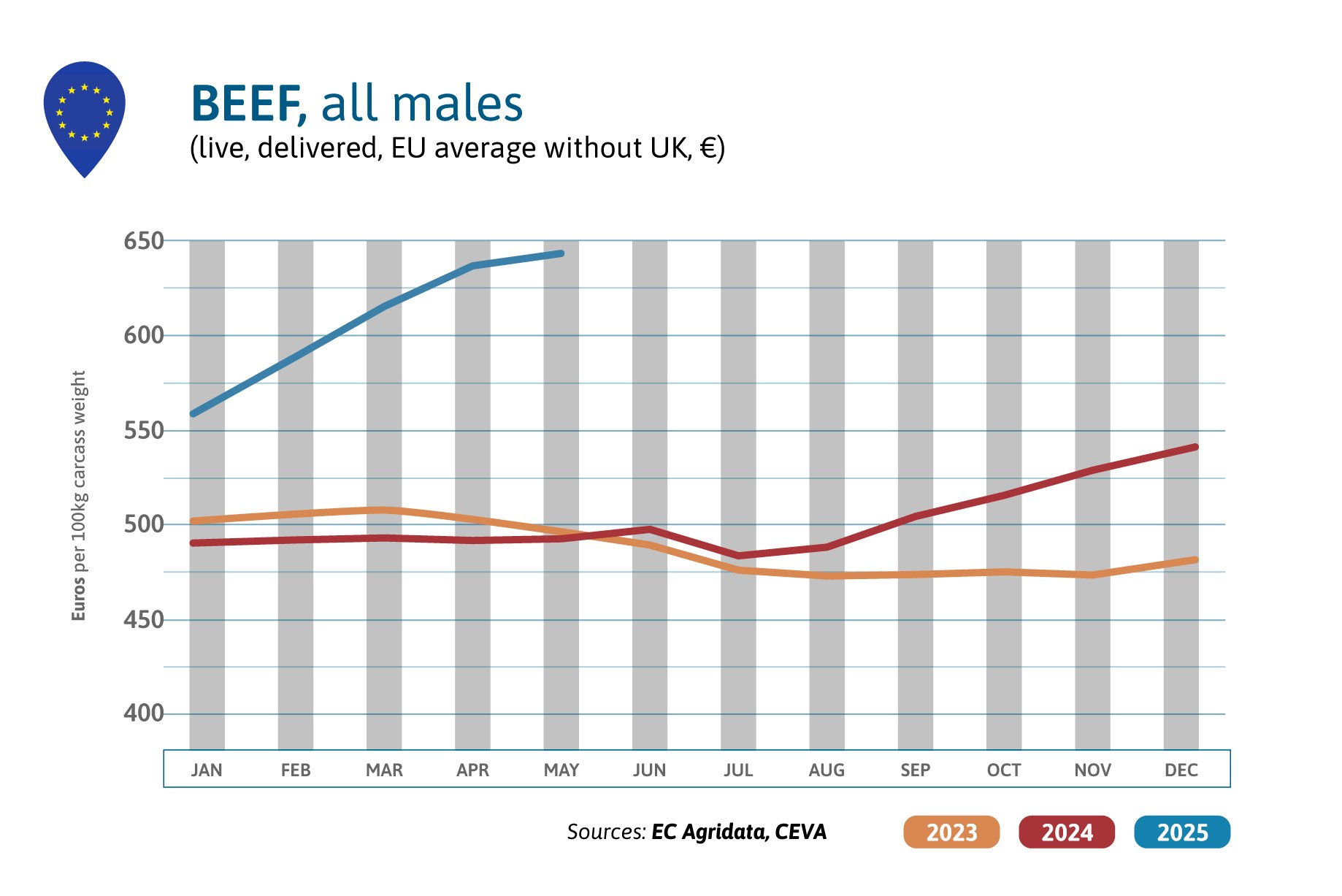

BEEF PRICES IN EUROPE

In May 2025, prices for male beef increased more slowly this month than the previous month: +2% compared to previous month in US$ but are still 35% above the 2024 high level! Male prices are increasing while they usually recline as summer approaches and demand slackens a bit. But male prices are still increasing because Europe has less cattle to slaughter than what is needed for consumption: in the first 4 months of 2025, the EU imports have therefore increased by 7% (+7 000 tons cwe), while exports have decreased by 7% (-11 000 tons cwe).

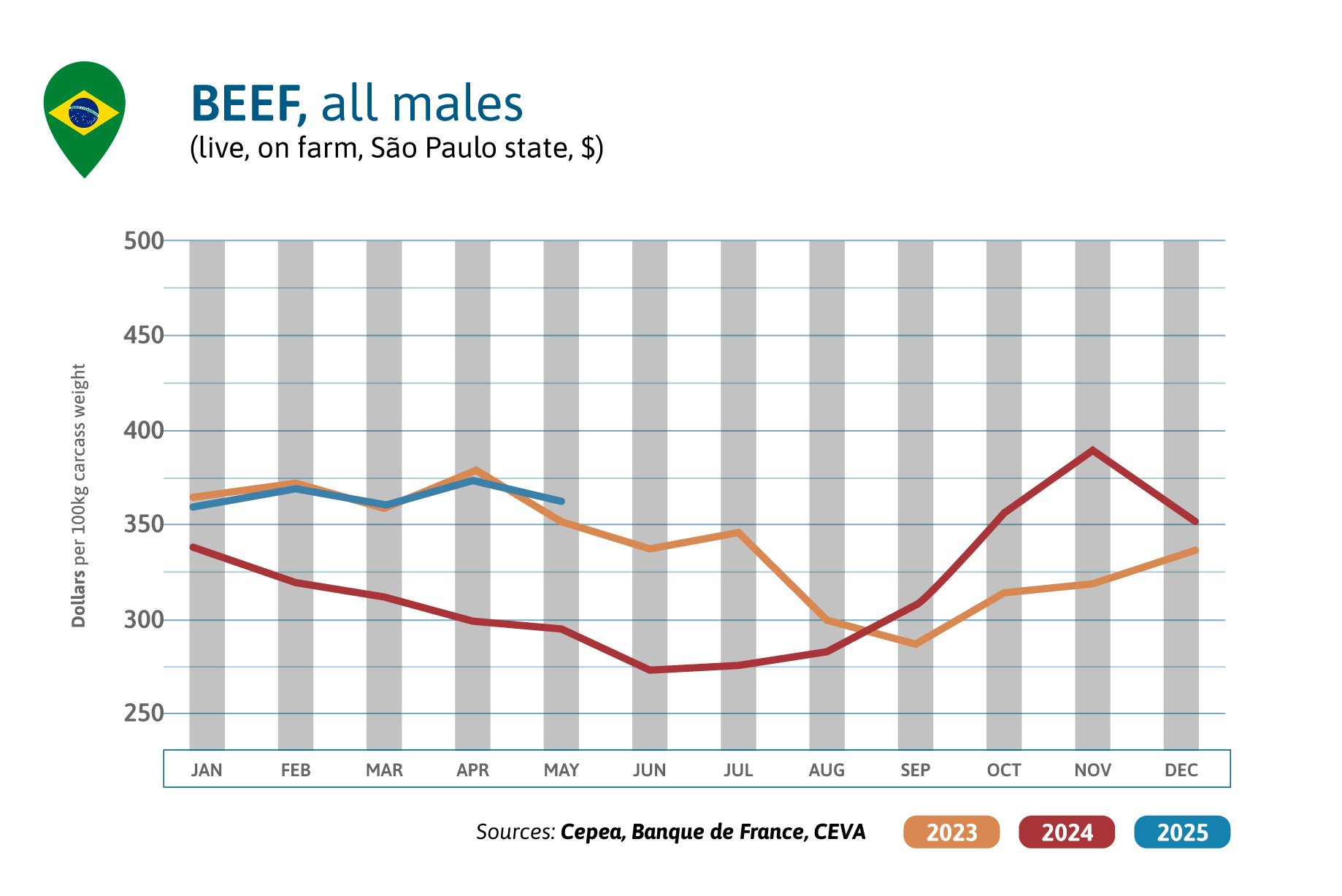

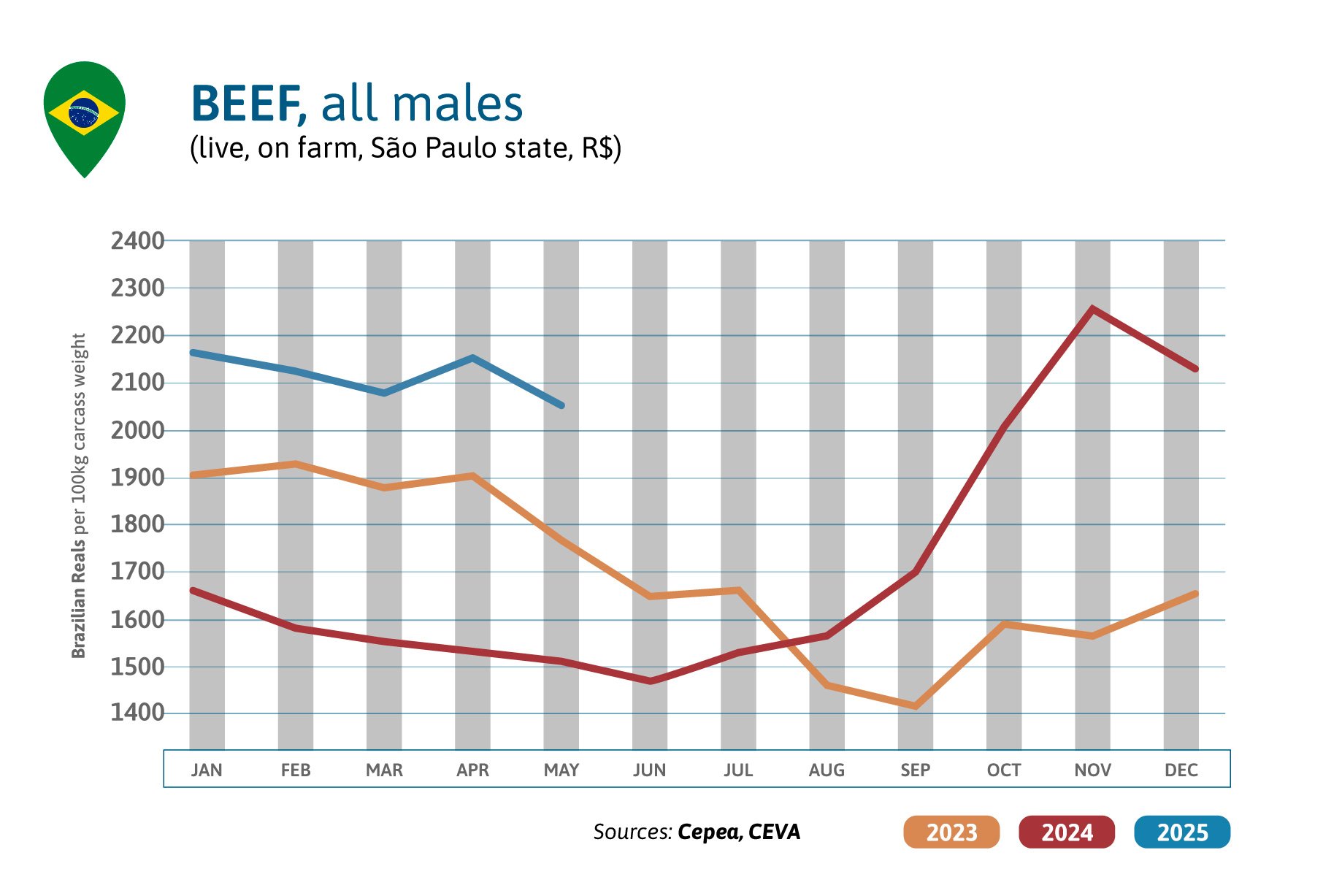

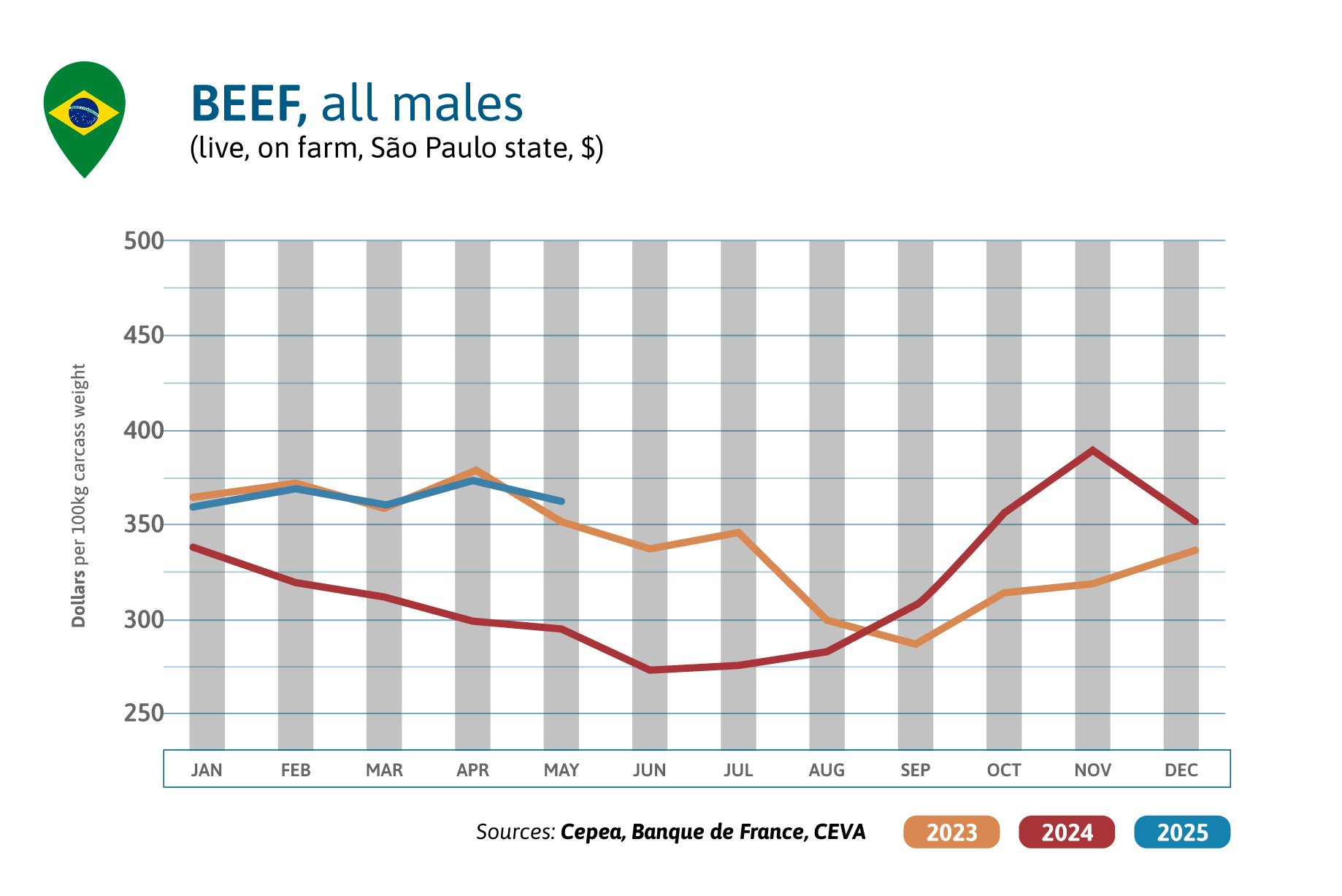

BRAZIL BEEF MARKET SITUATION

Brazilian beef prices are oscillating this year around 365 US$/100 kg cwe, -3% in May compared to a month ago, and 23% above the 2024 level. In Réals, beef price has slightly decreased by 5% since the beginning of the year. The World lacks beef, particularly the USA, so global beef exports of Brazil increased by 10% in volume in the first 5 months of 2025, compared to 2024, and by +10% in price (according to CEPEA), as scarcity made beef more expensive on the world market.

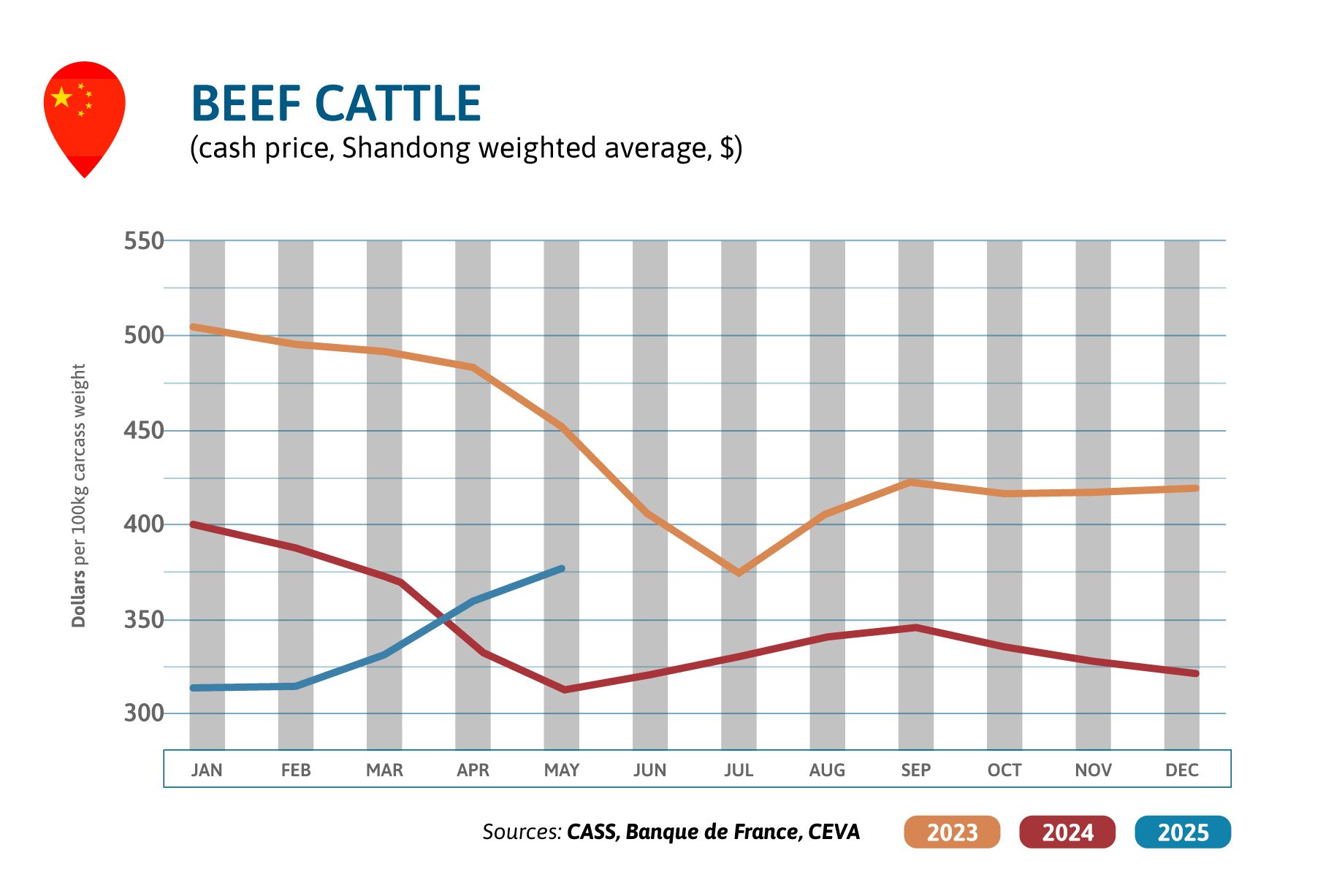

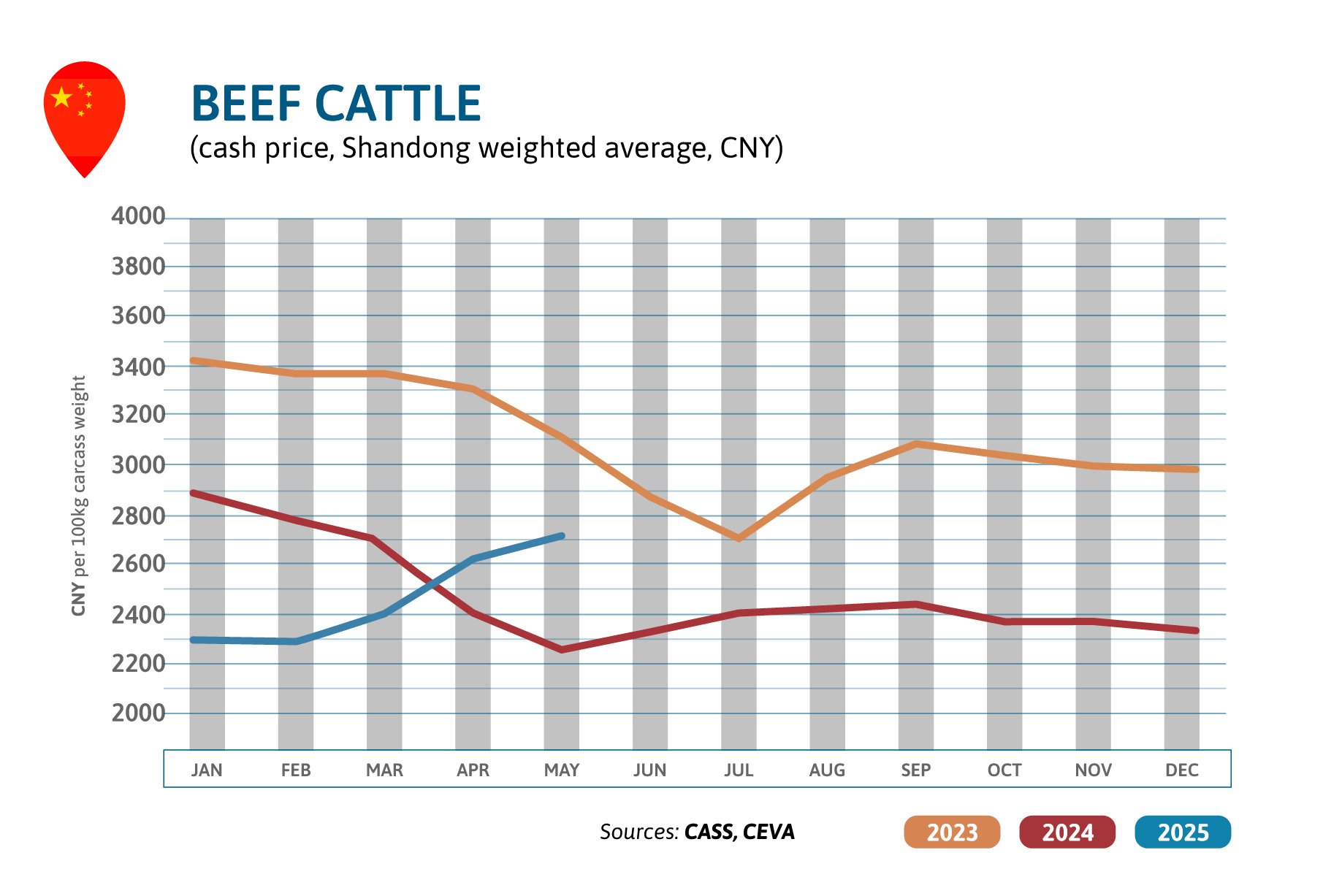

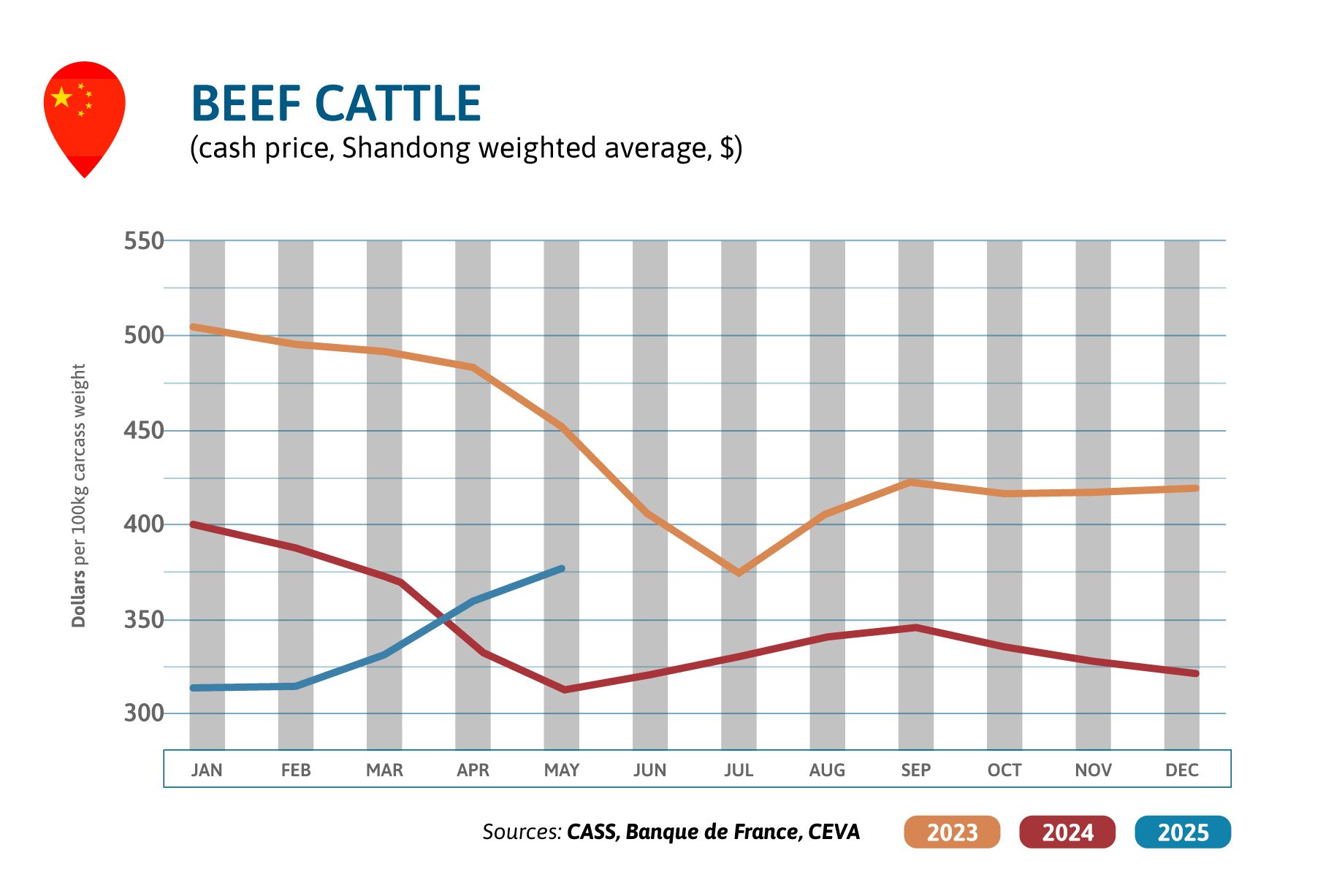

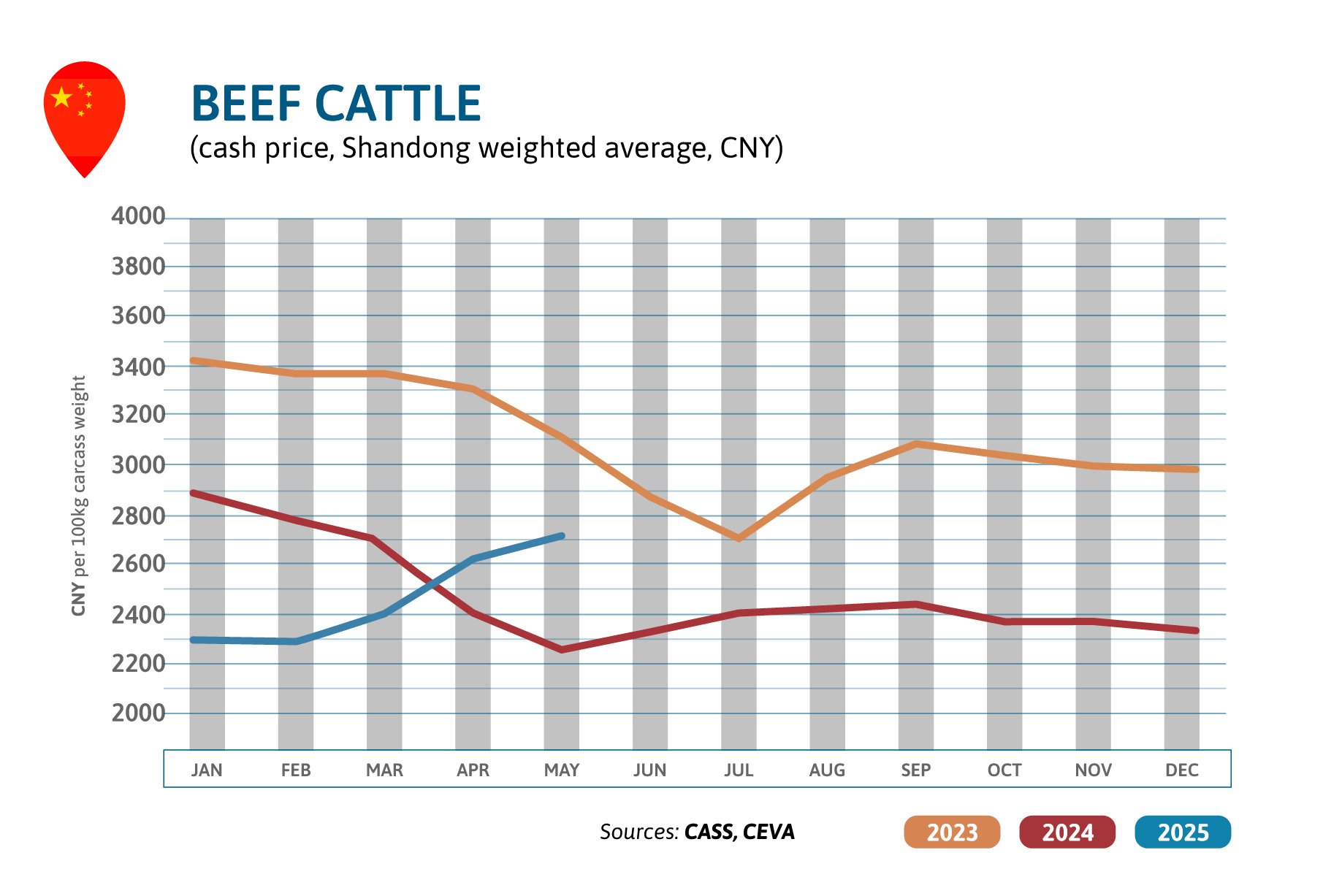

BEEF PRICES IN CHINA

Chinese finished cattle prices are steadily increasing since March 2025, after a terrible 2024 year. In May, the prices increased by 4% in a month and are now 20% above the 2024 level and are approaching 2023 prices. The recovering beef prices are linked to shrinking beef imports. In the first 4 months of 2025, China and Hong Kong together imported 1,01 million tons cwe of beef meat, -8% compared to 2024. The Chinese Ministry of Agriculture indicated that the total beef cattle numbers decreased by 3.5% y.o.y. at the end of March 2025, lowest level since mid-2021, which shows China has ended a production increase cycle, live cattle prices having been the lowest for a decade during 2024.

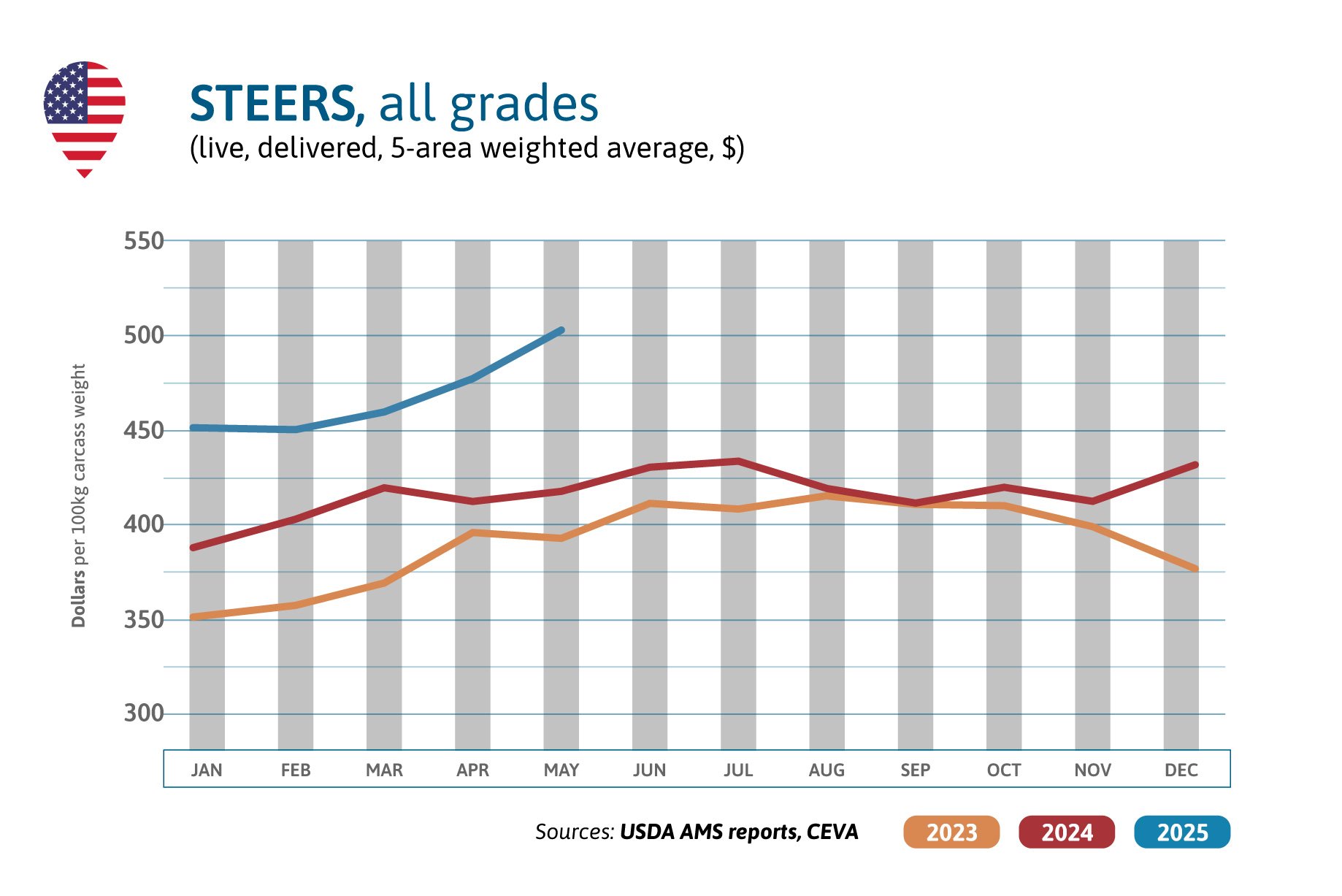

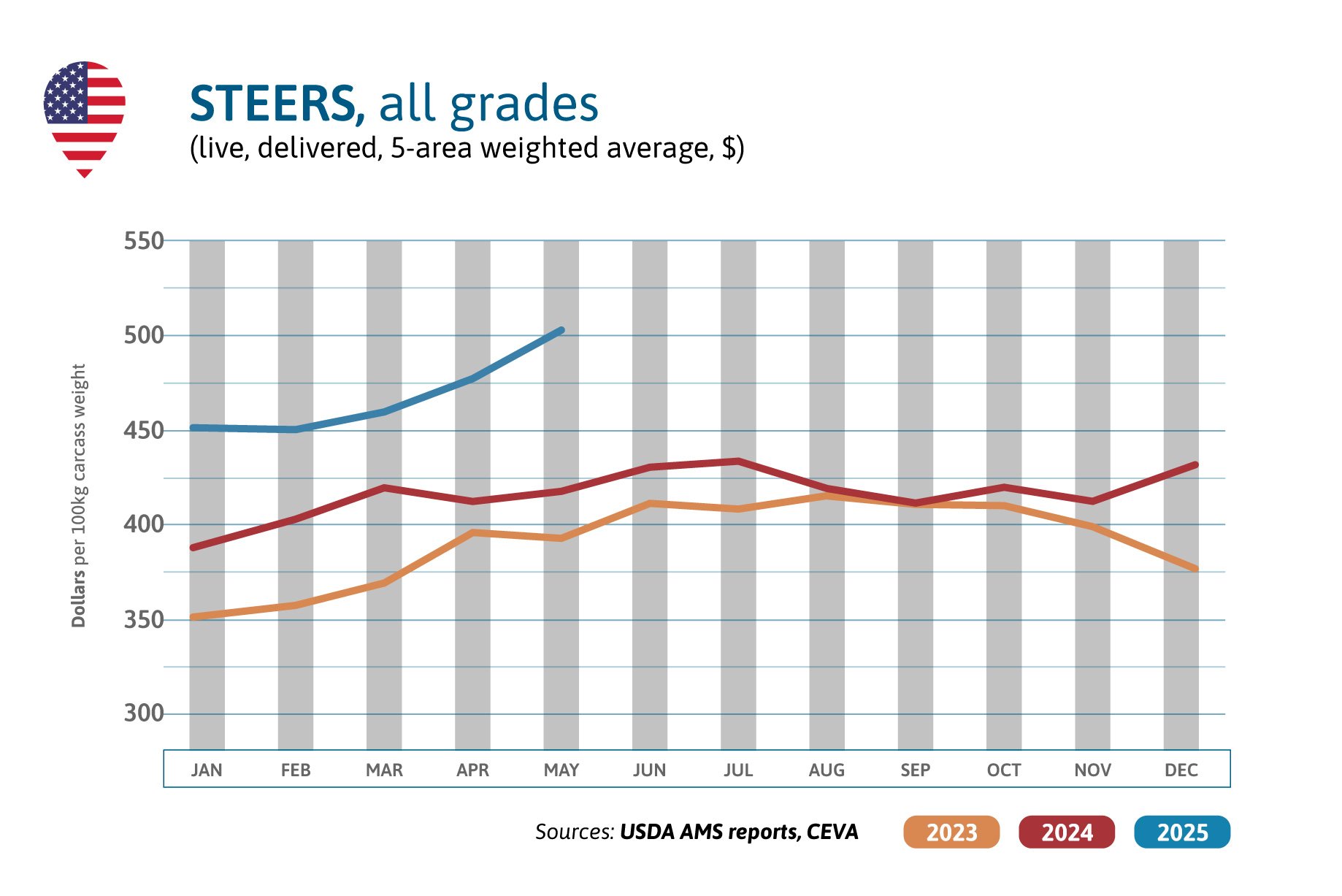

USA’S CATTLE MARKET

In May, steer prices increased by 5% in a month and were 20% above last year’s high level. Meatpackers have decreased the rhythm of slaughter between April and May 2025, a trend never seen since 1970, as processing usually increases as the summer grilling time approaches. Therefore, boxed meat prices increased. Mid-May USA activated a new ban on Mexican live cattle, and mid-June broad spread plan to strictly control NWS was given out by the government, with close cooperation with Mexico. Beef exports of April reclined by 4%, especially towards China, because many meatpackers are still ineligible to export to the country for administrative reasons. Cumulative beef imports until April 2025 were 28% above last year’s level.

Source:

Make sure to check out our News and Events section for access to all the monthly beef and milk market outlooks.