Beef Market Outlook (Baptiste Buczinski)

Welcome back to our monthly Beef Market Outlook. In this edition, we bring you the latest updates on beef cattle markets from Europe, Brazil, China, and the USA. Our analysis is built on thorough data, offering you a clear view of the trends that matter most.

SEE and share this valuable content.

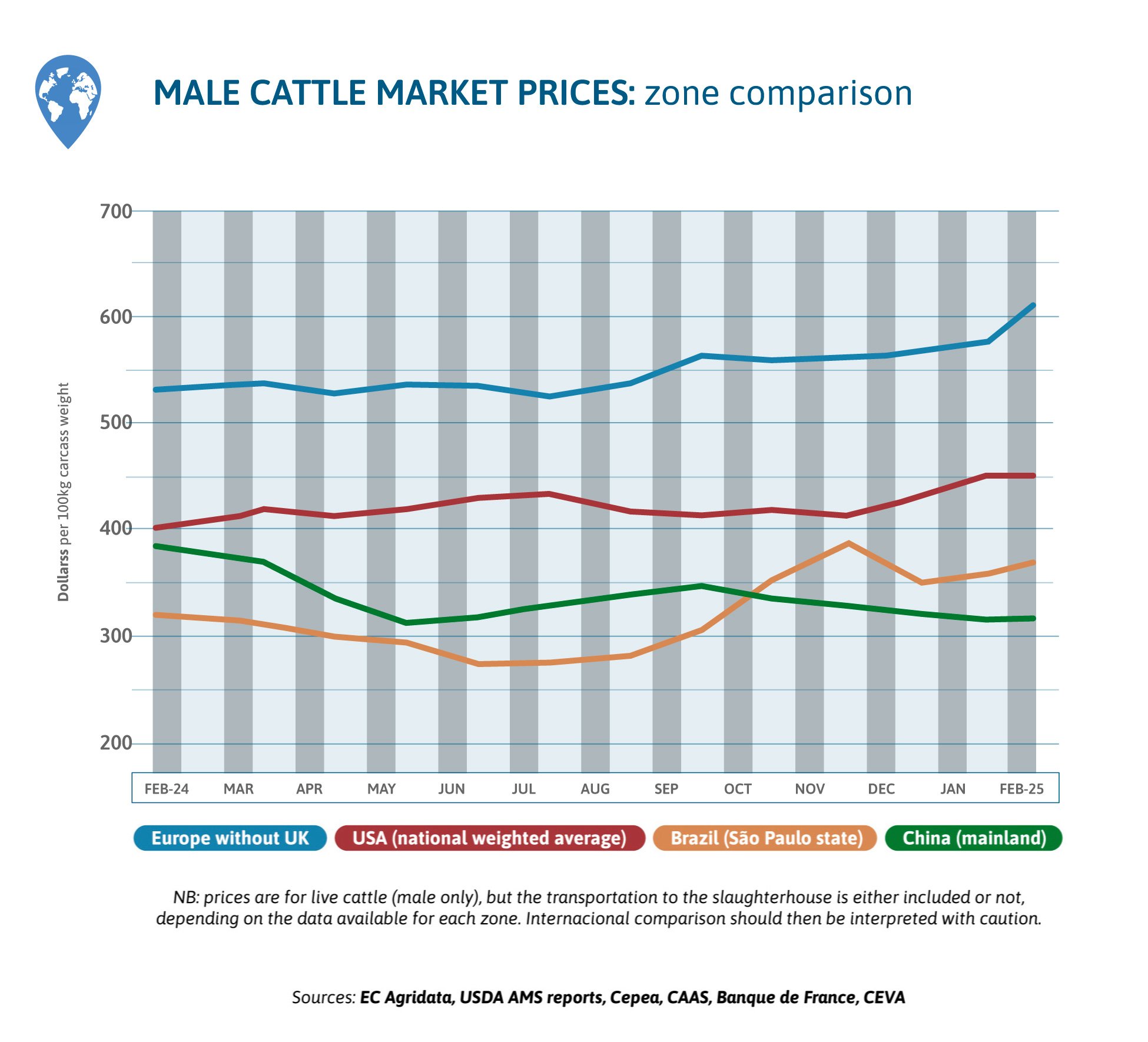

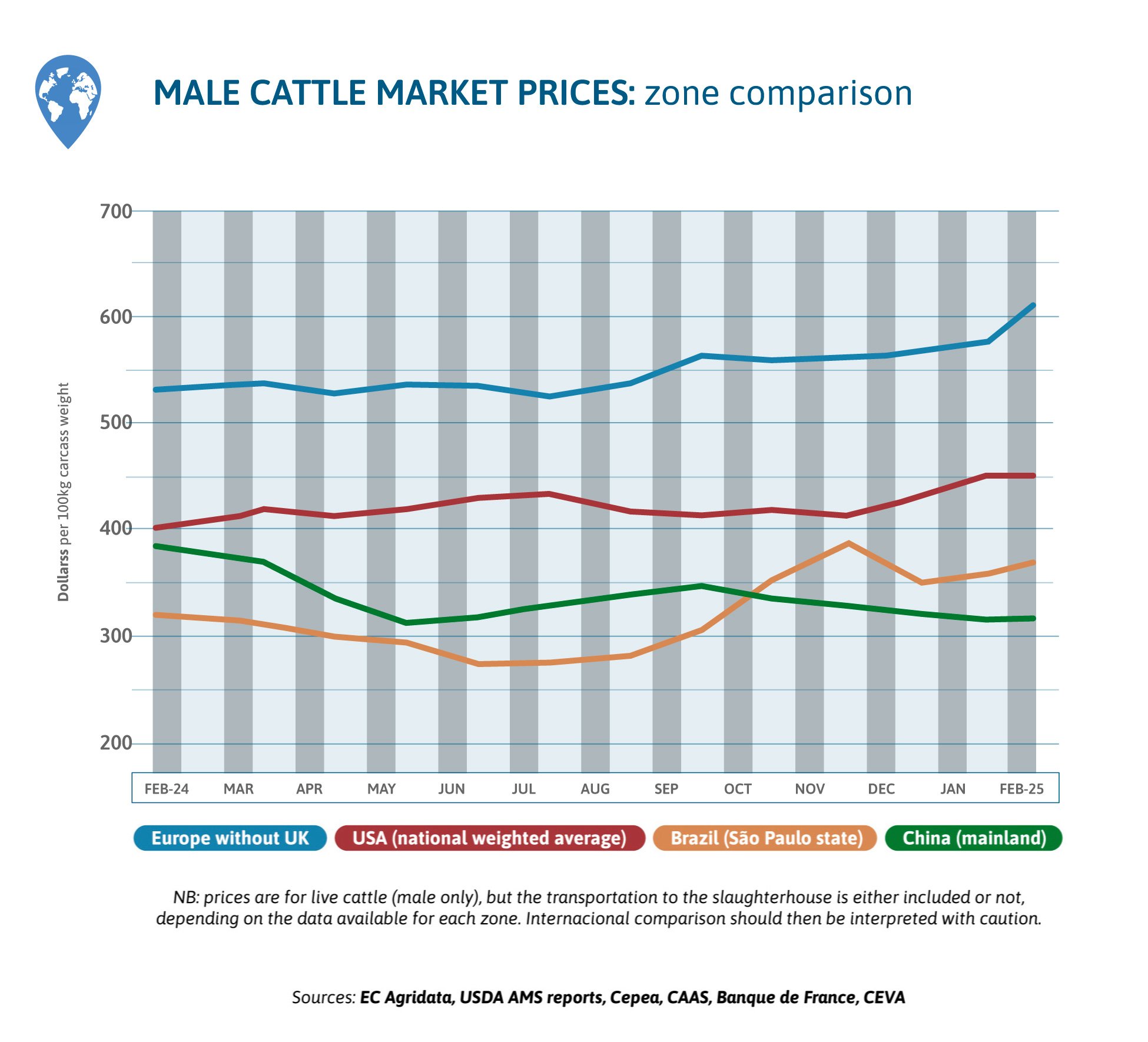

GLOBAL BEEF MARKET TREND

In February, cattle market prices were flat and low in China. Brazilian prices increased as World demand for beef at competitive price increases. US prices remained at high level. In Europe young bull prices have peaked as Ramadan starts on the Mediterranean South and East shore.

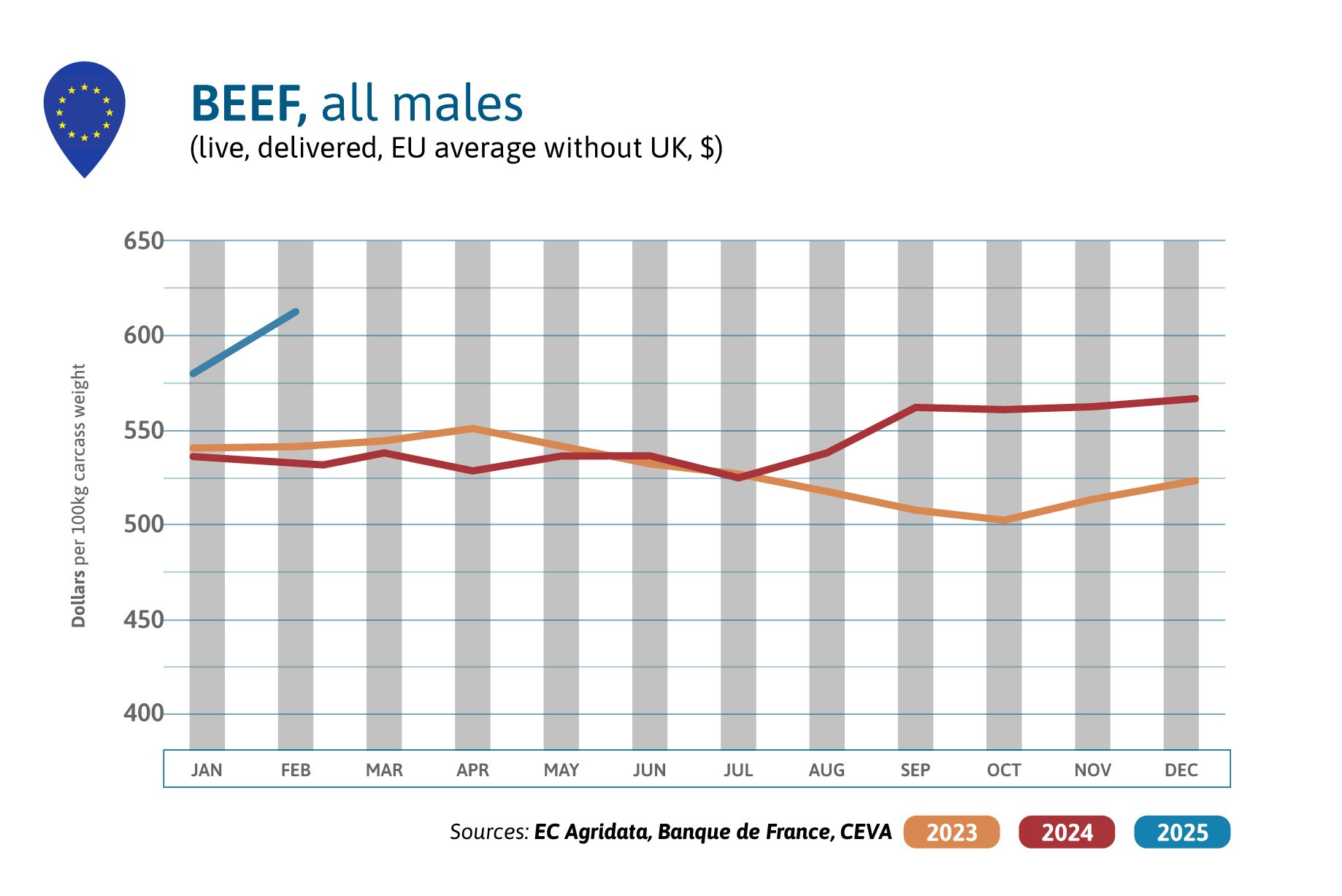

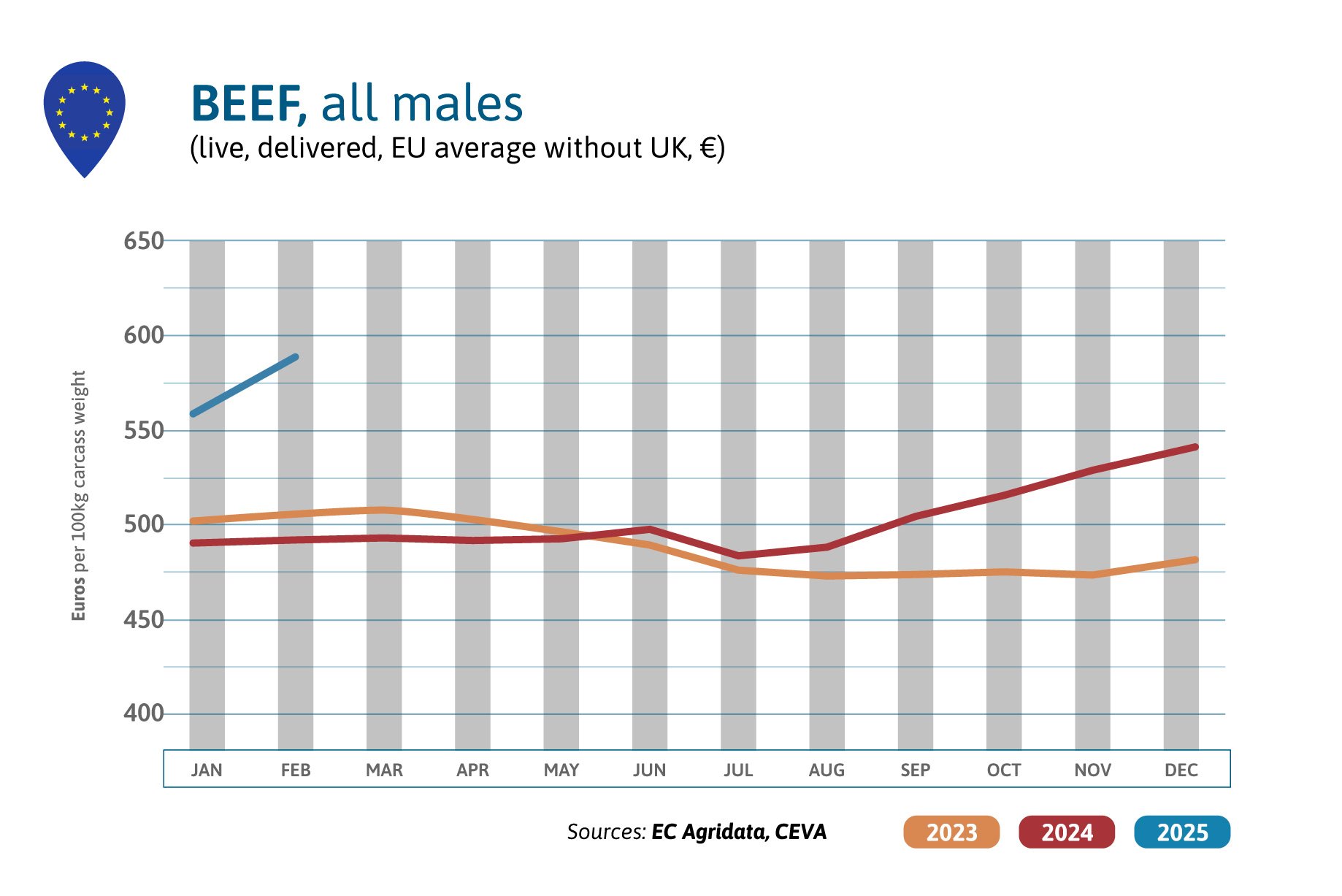

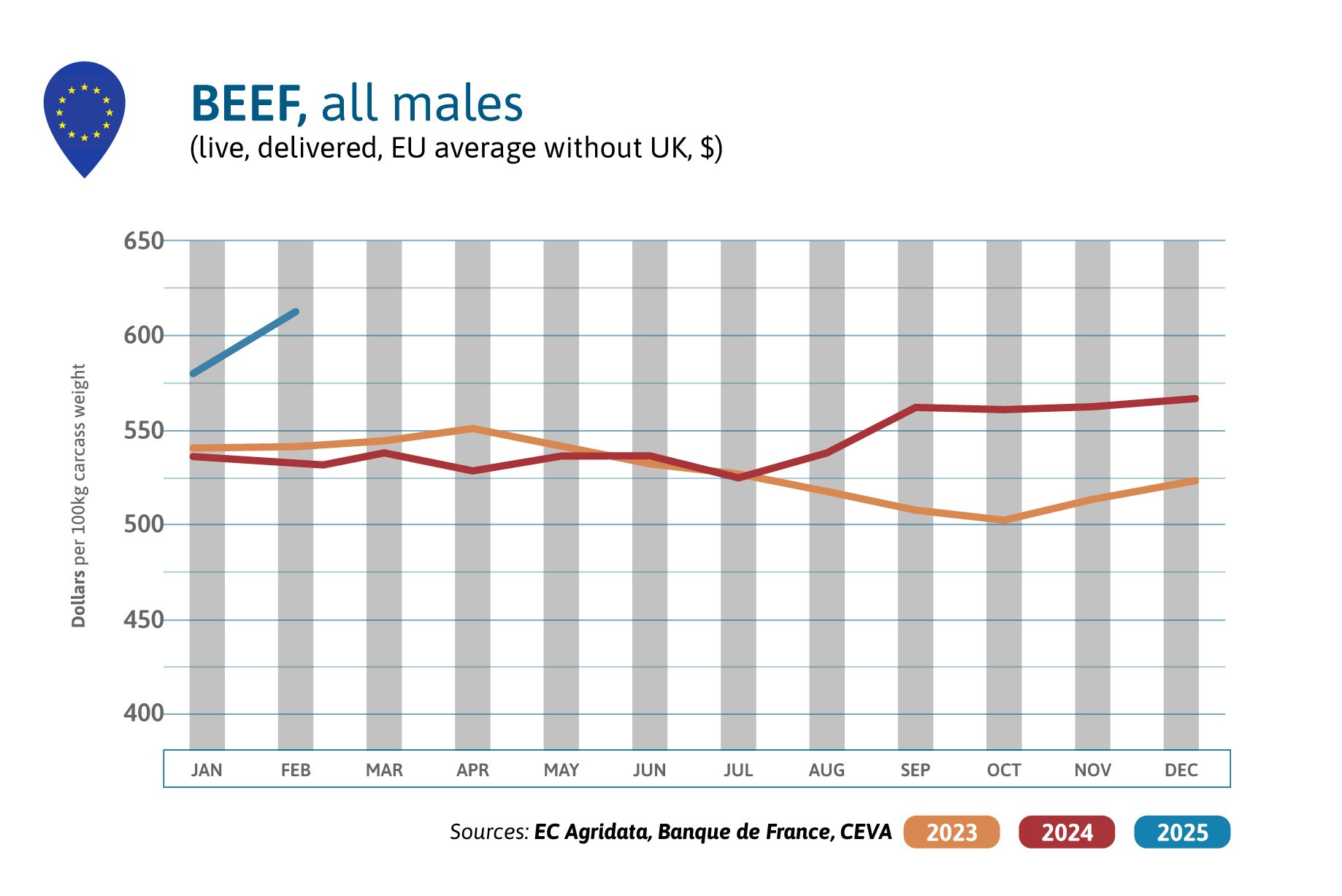

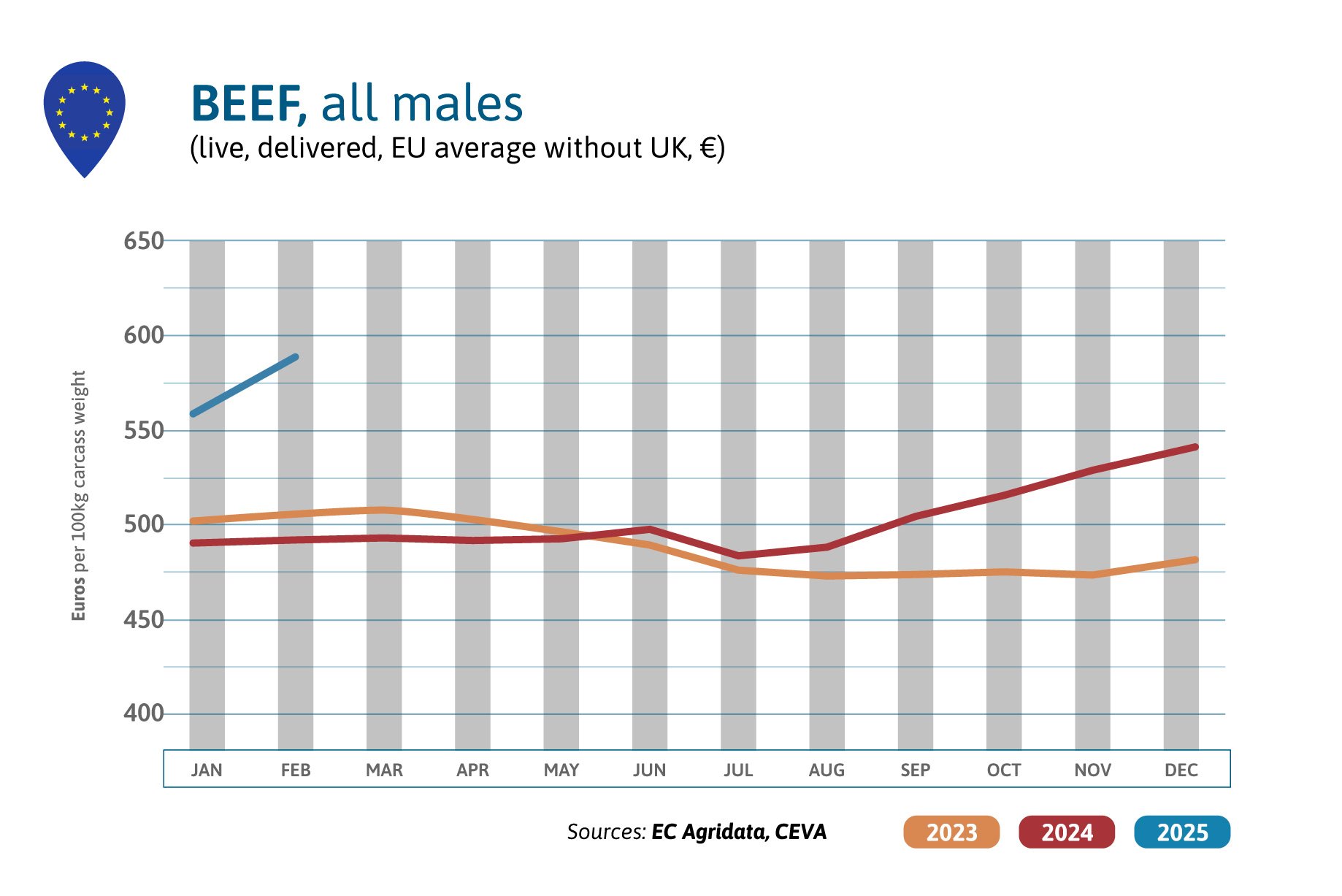

BEEF PRICES IN EUROPE

In February 2025, prices for male beef jumped by 6% compared to the previous month in US$ and are 15% above the 2024 level. Male prices were soaring, as Europe is more and more faced with a lack of cattle to slaughter. The beginning of the Ramadan period in the South-Mediterranean countries increased the demand for European young bulls also put some extra pressure on the market.

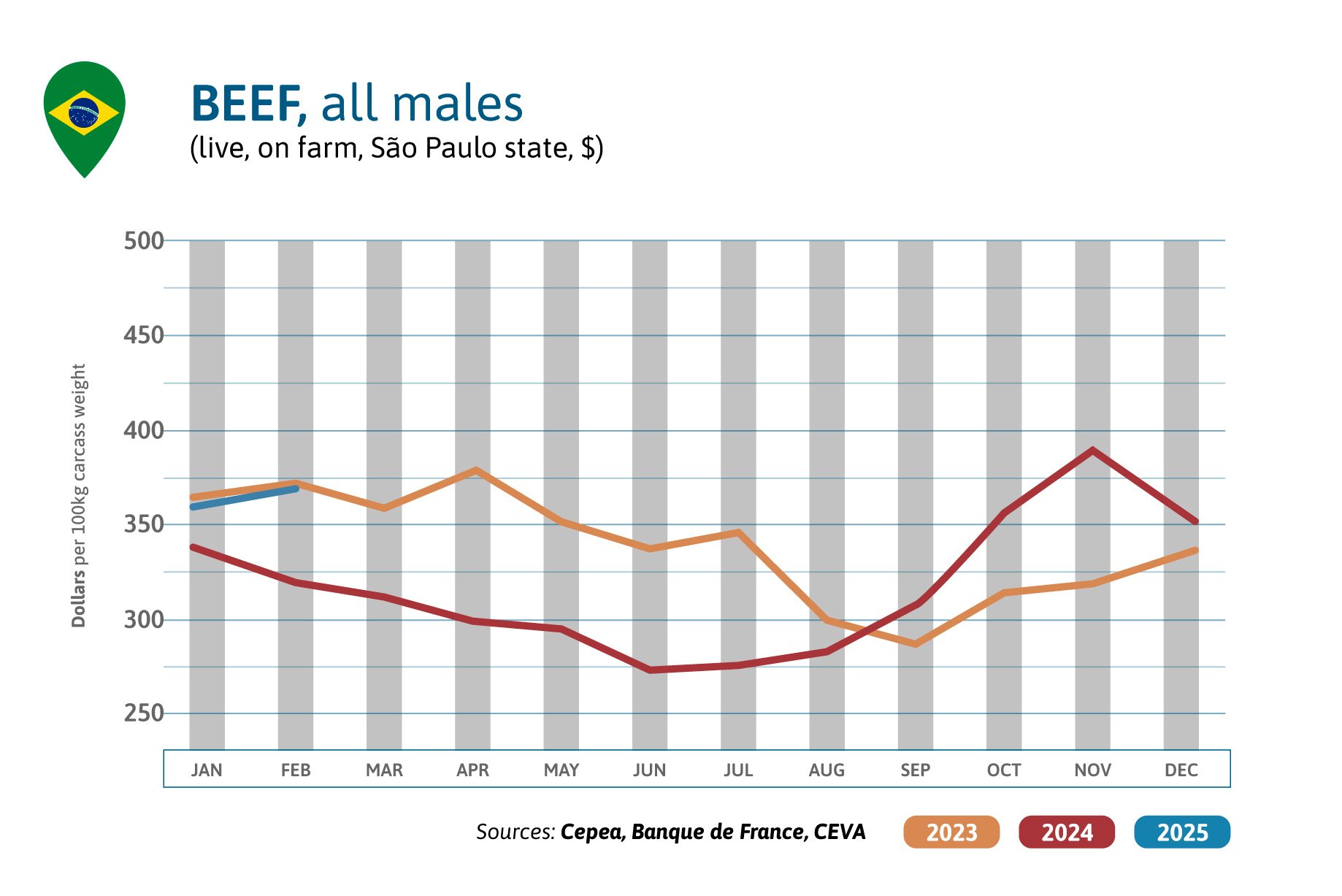

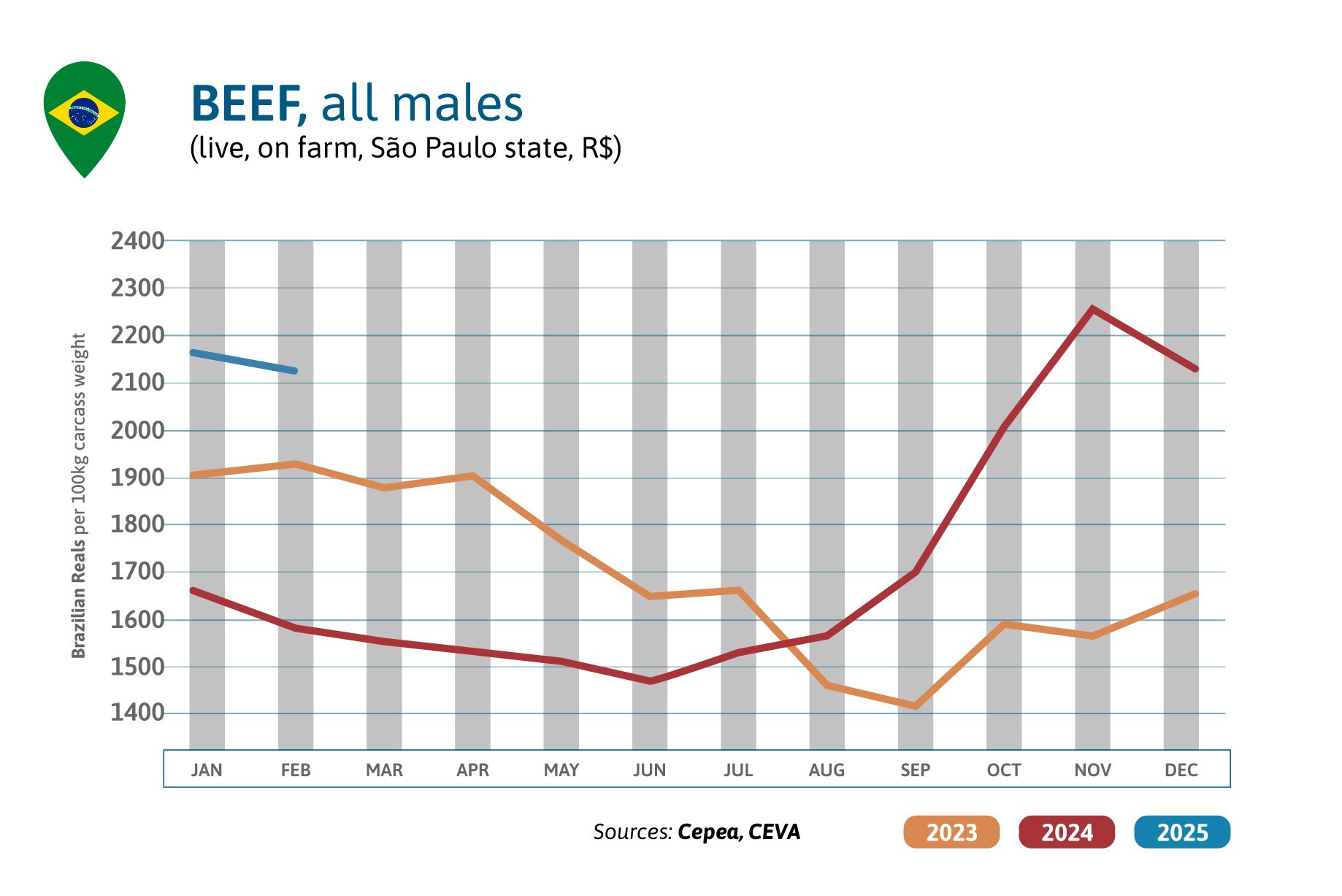

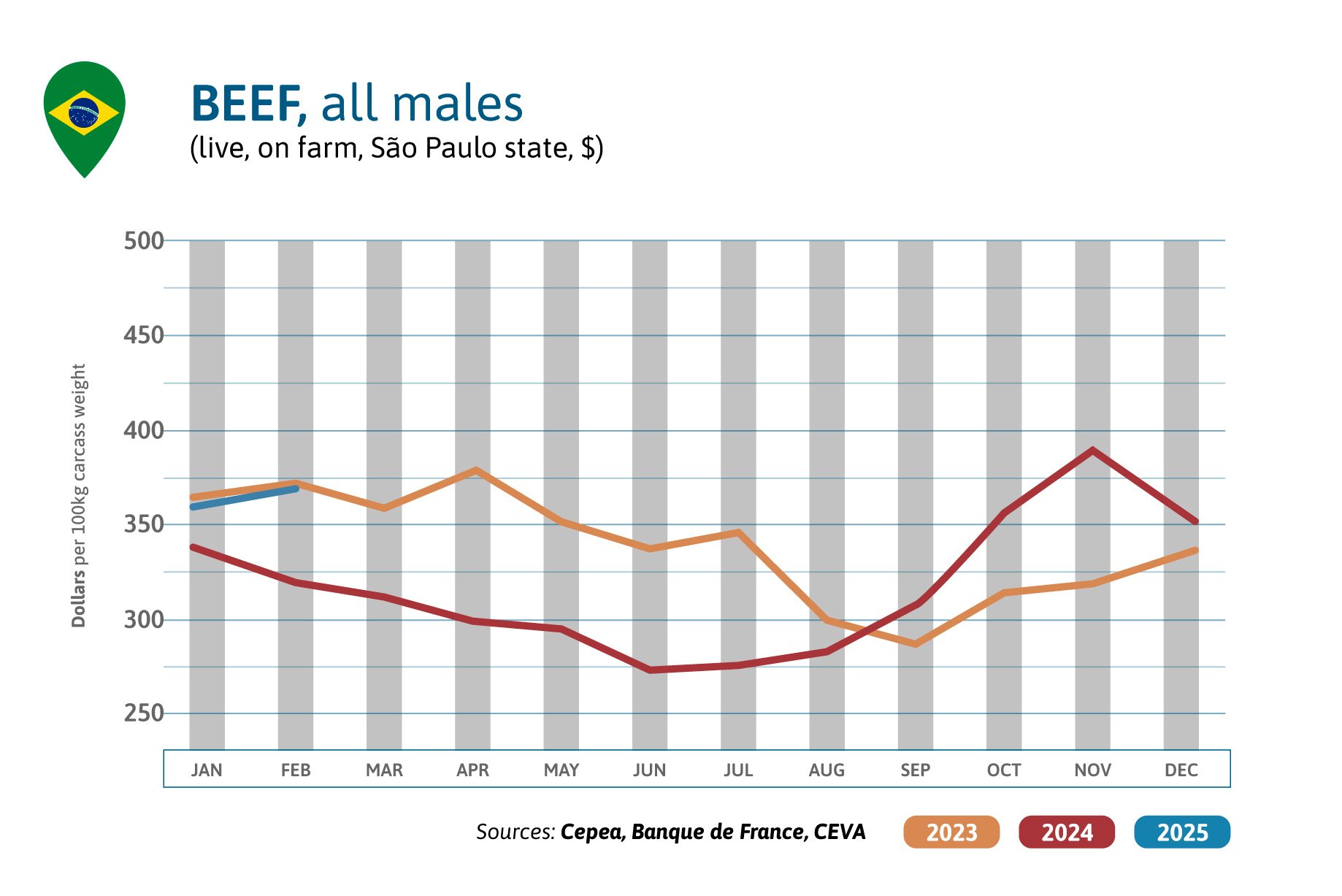

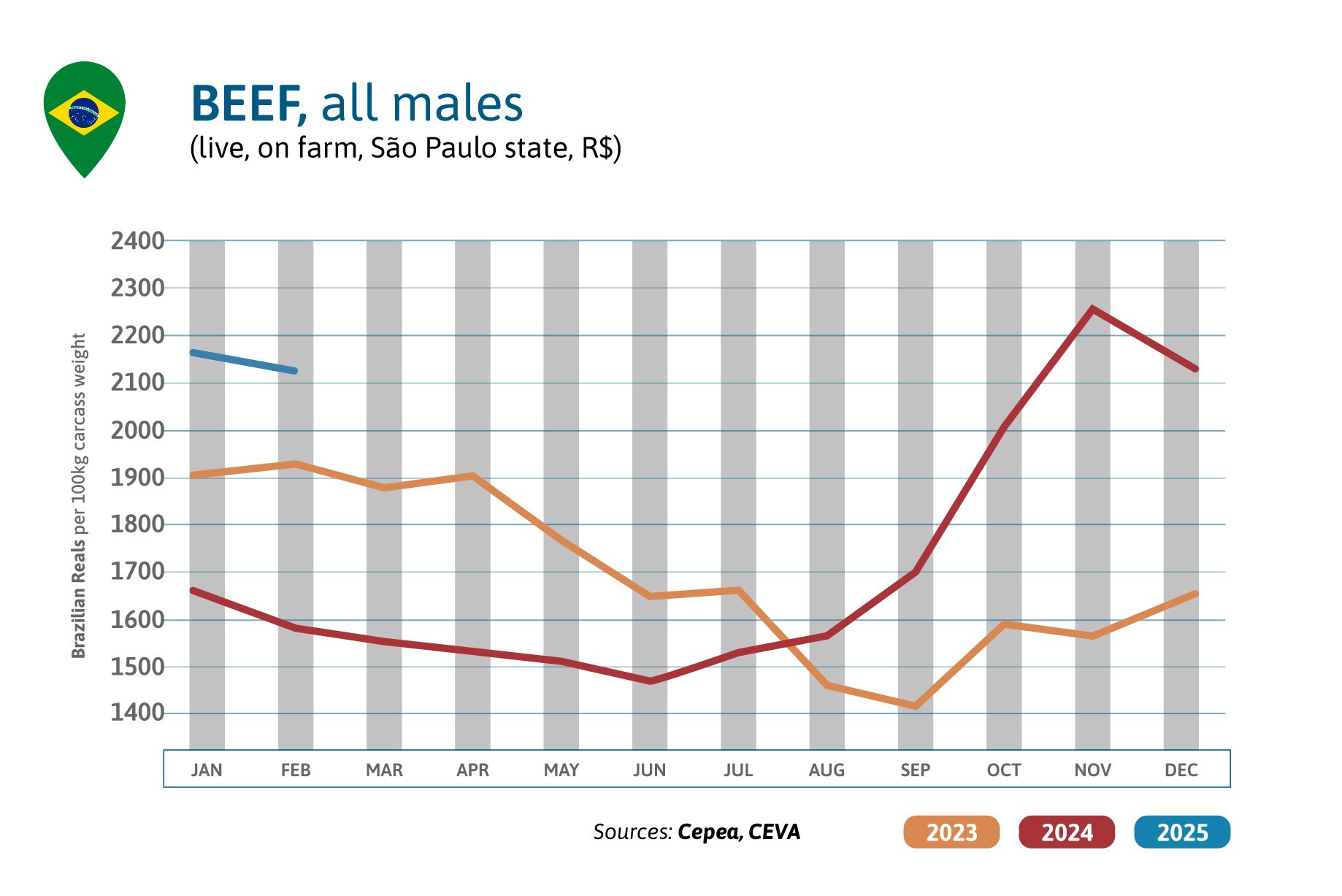

BRAZIL BEEF MARKET SITUATION

In February, male beef prices increased in the cattle market by 3% in US$ compared to previous month, just as in January. Prices are much above the 2024 level: +15% in US$ and +34% in Reals, the local currency having lost 19% of its value last year. In the first two months of 2025, Brazilian beef exports increased by 4%, even after hitting record figures in 2024 (Secex). However, exports to Chinese reclined a little (-4%): the country tries to decrease imports to stop local beef prices from falling. Exports to the USA soared by 33% compared to Jan.-Feb. 2024, after having already increased by 25% a year earlier.

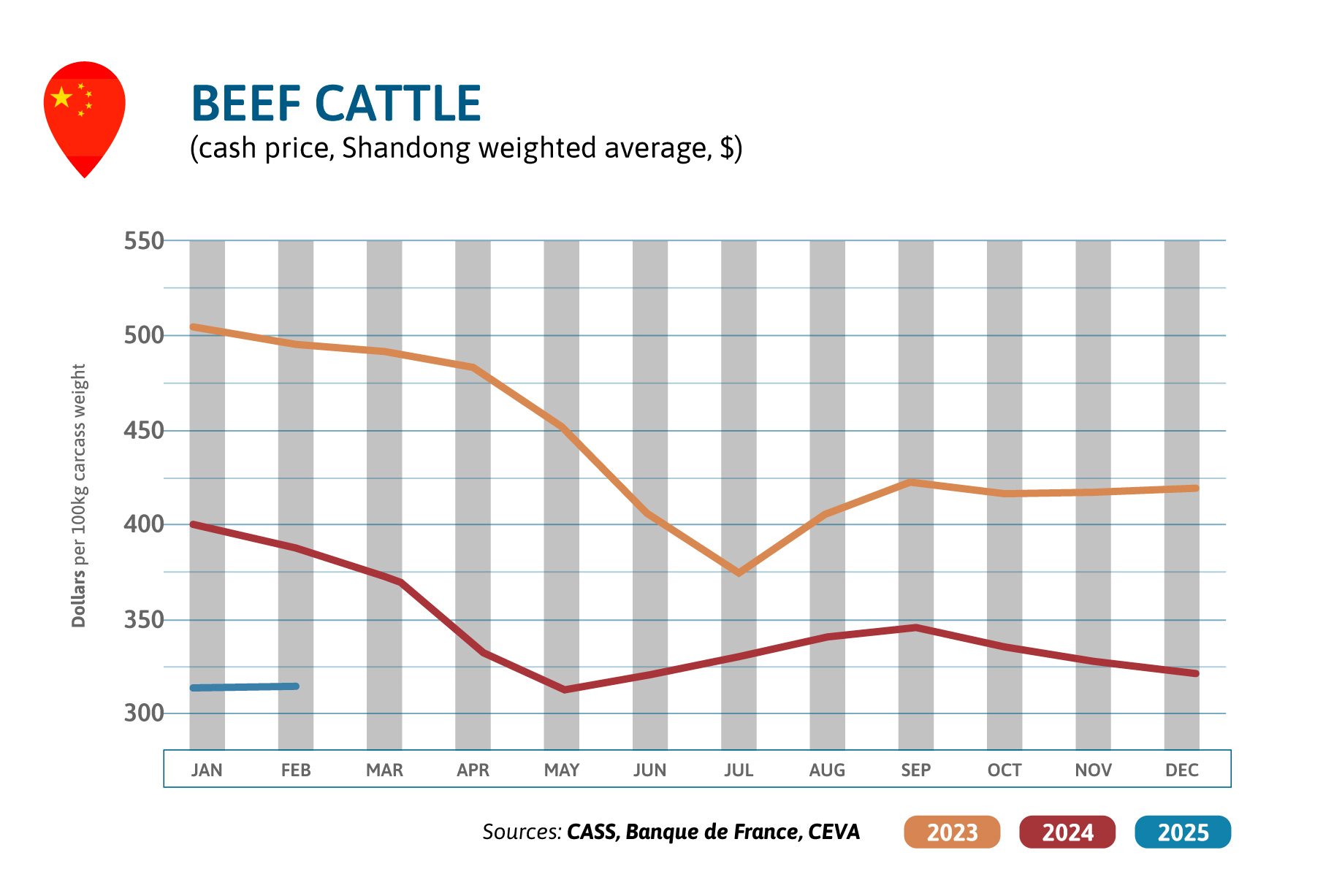

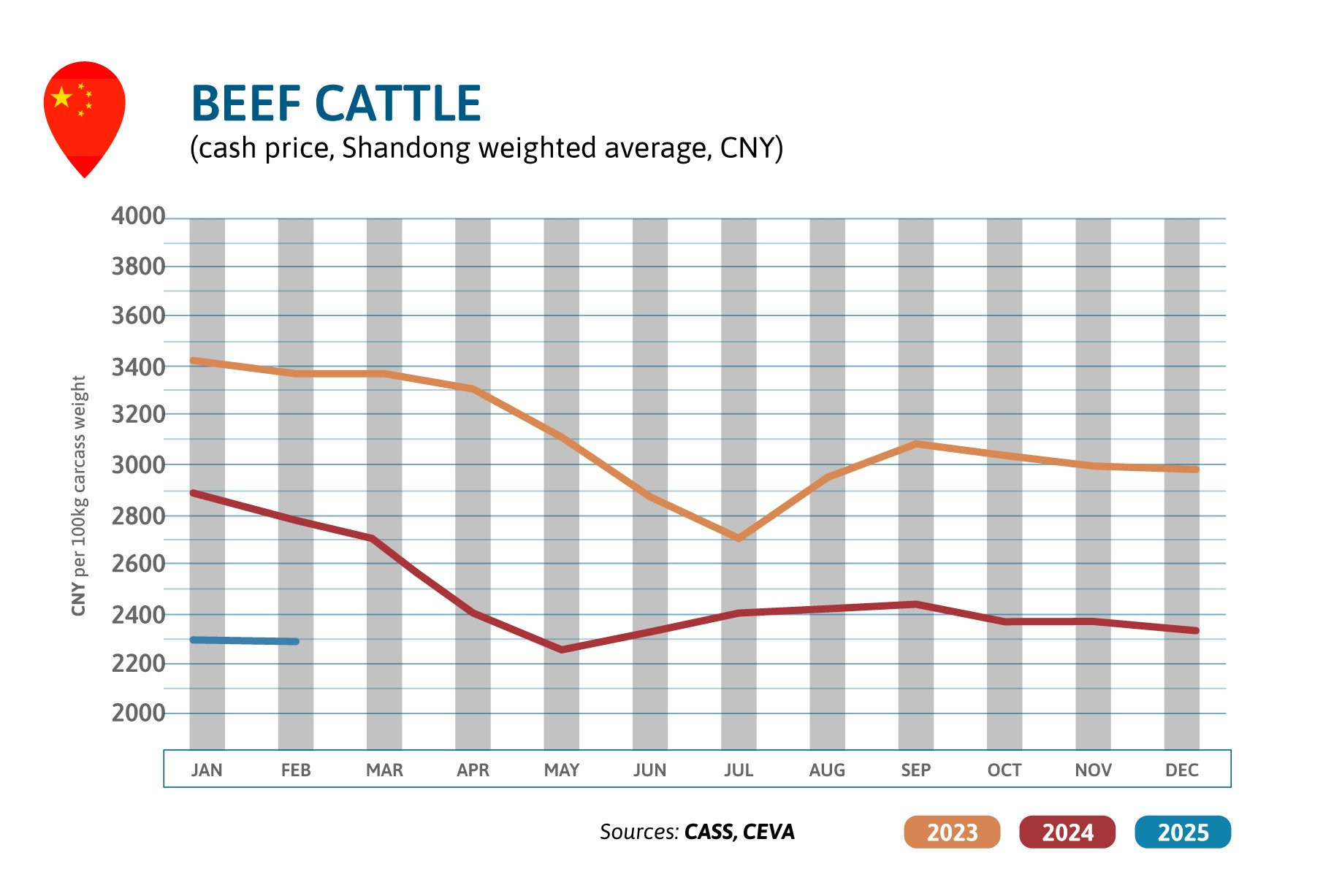

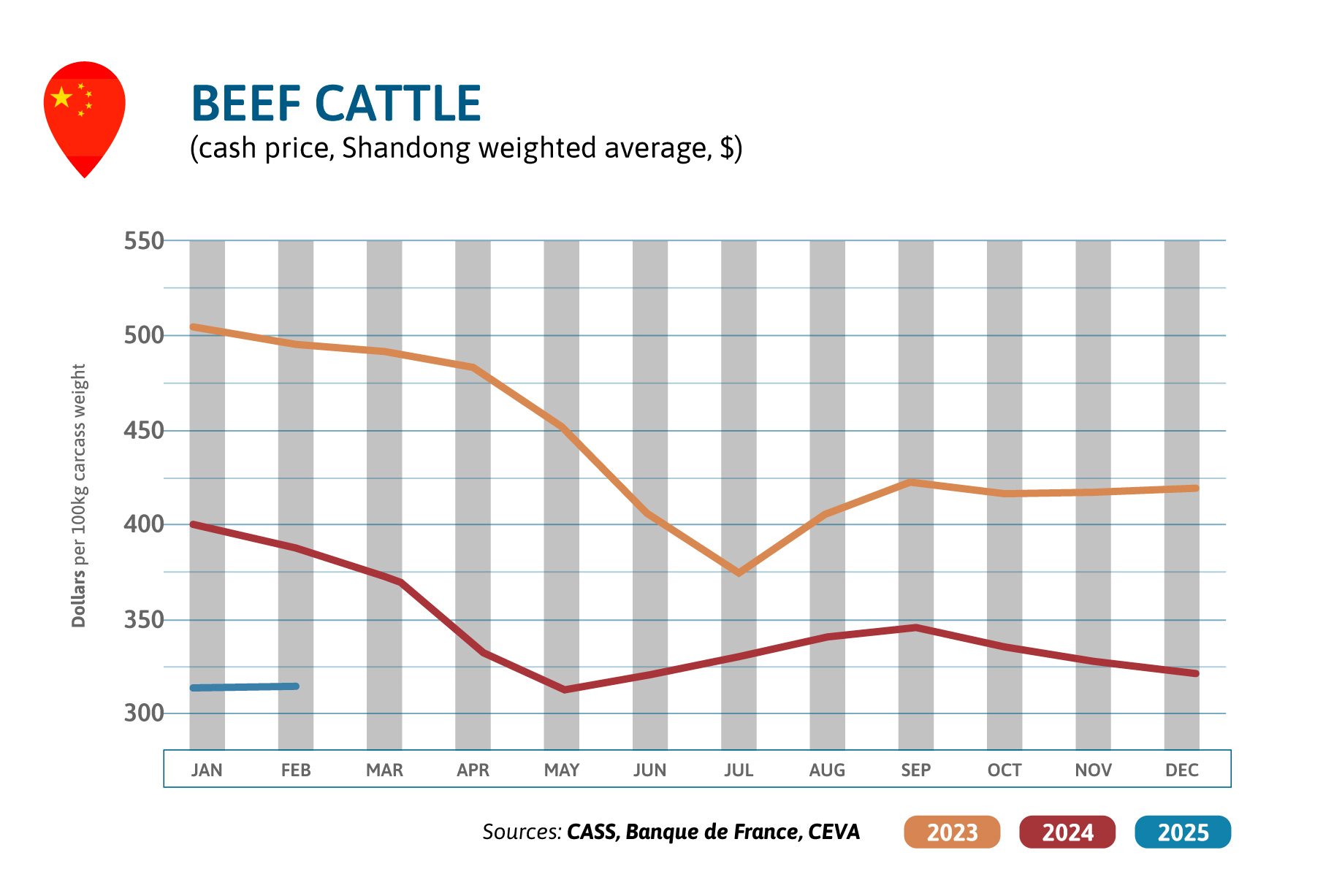

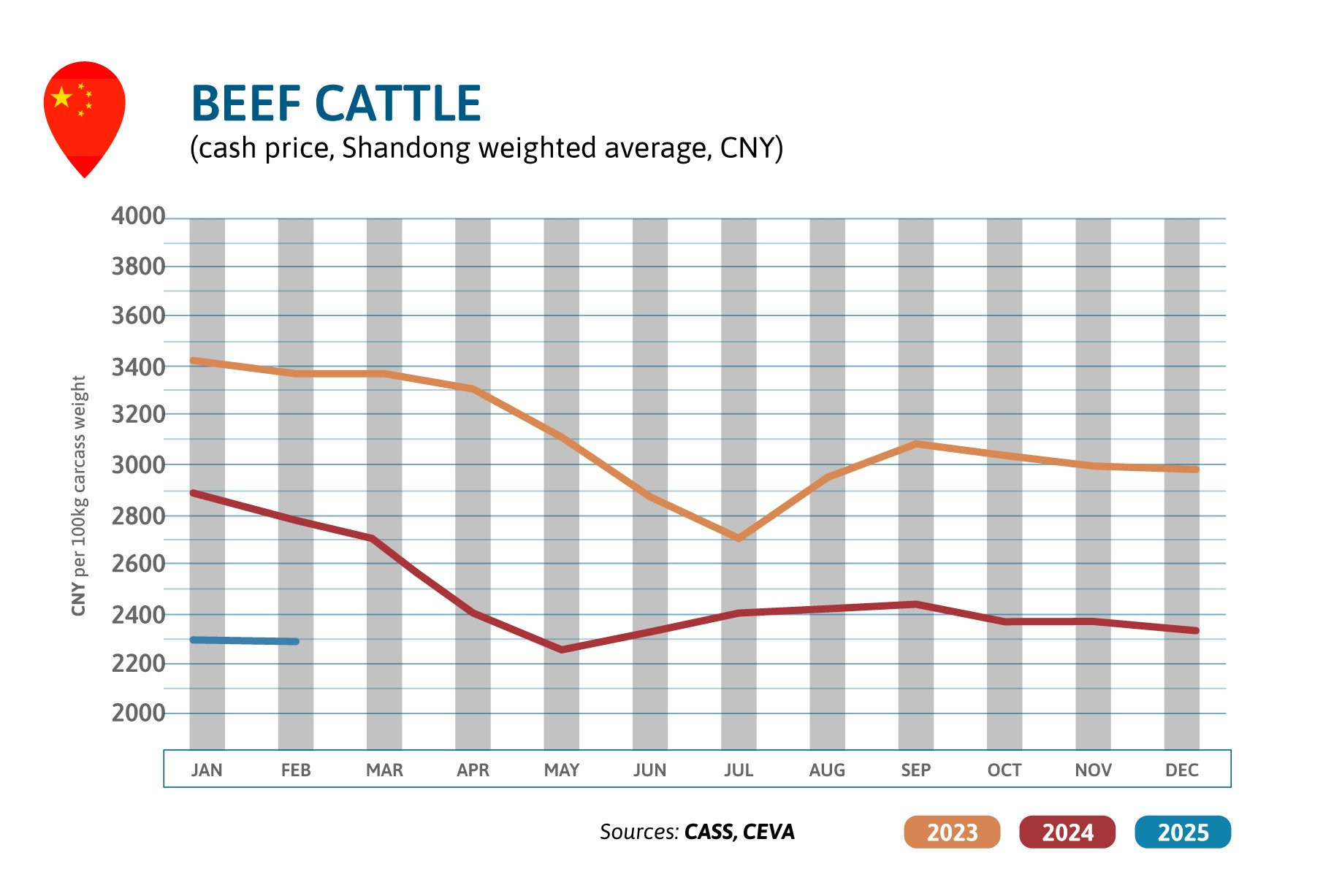

BEEF PRICES IN CHINA

In February, Chinese cattle prices stayed flat in US$, compared to previous month, but remain historically low (-36% /2023). Chinese economy continues to slow down in 2025, leading to more beef imports from cheaper countries (South America). USDA estimates Chinese domestic consumption stable in 2025, with a bit less national production, due to the important cow slaughterings in the past 2 years. Therefore, imports may slightly increase. In December, China launched a safeguard investigation on imported beef. Five main plants exporting beef to China will be visited during spring by the Chinese authorities.

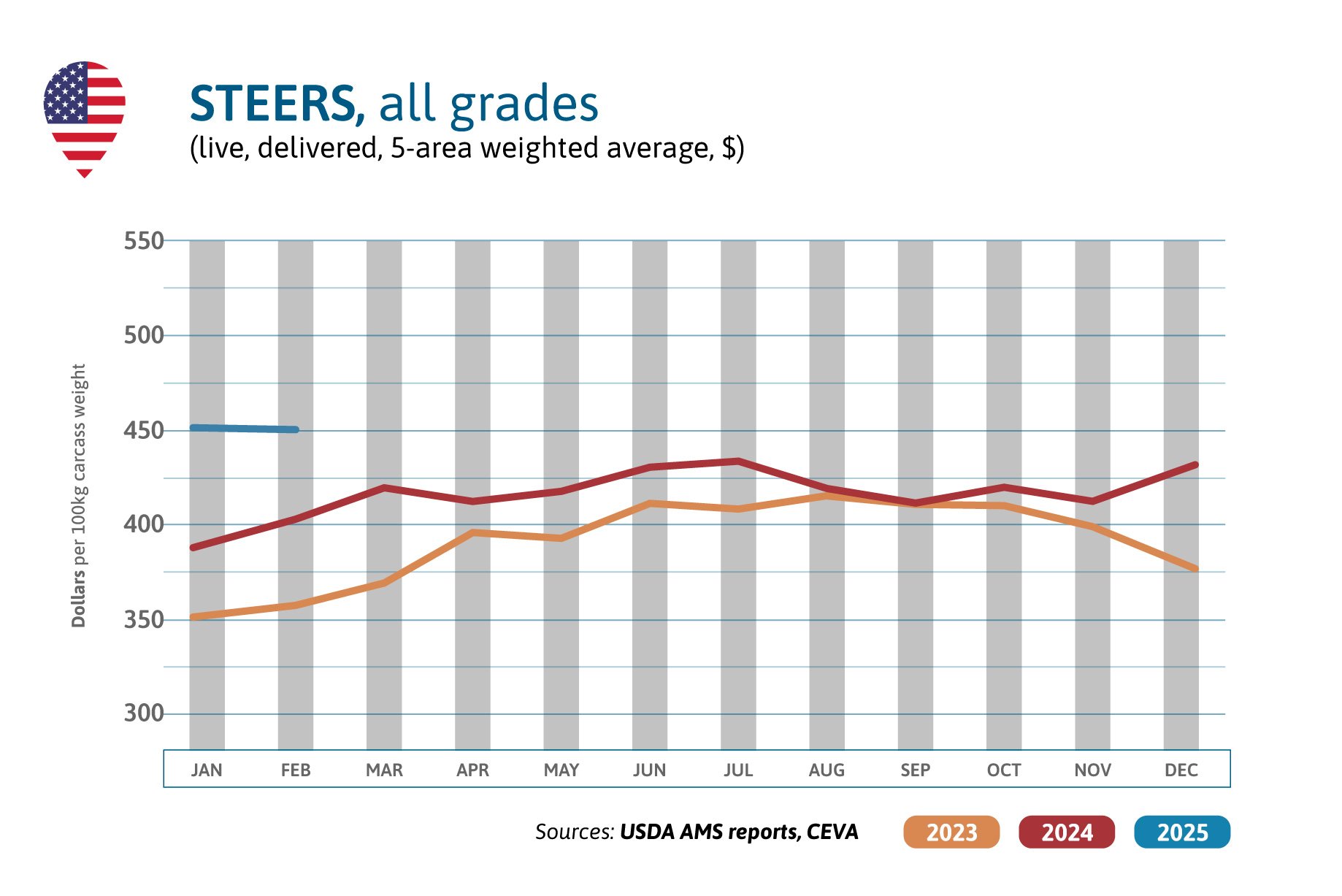

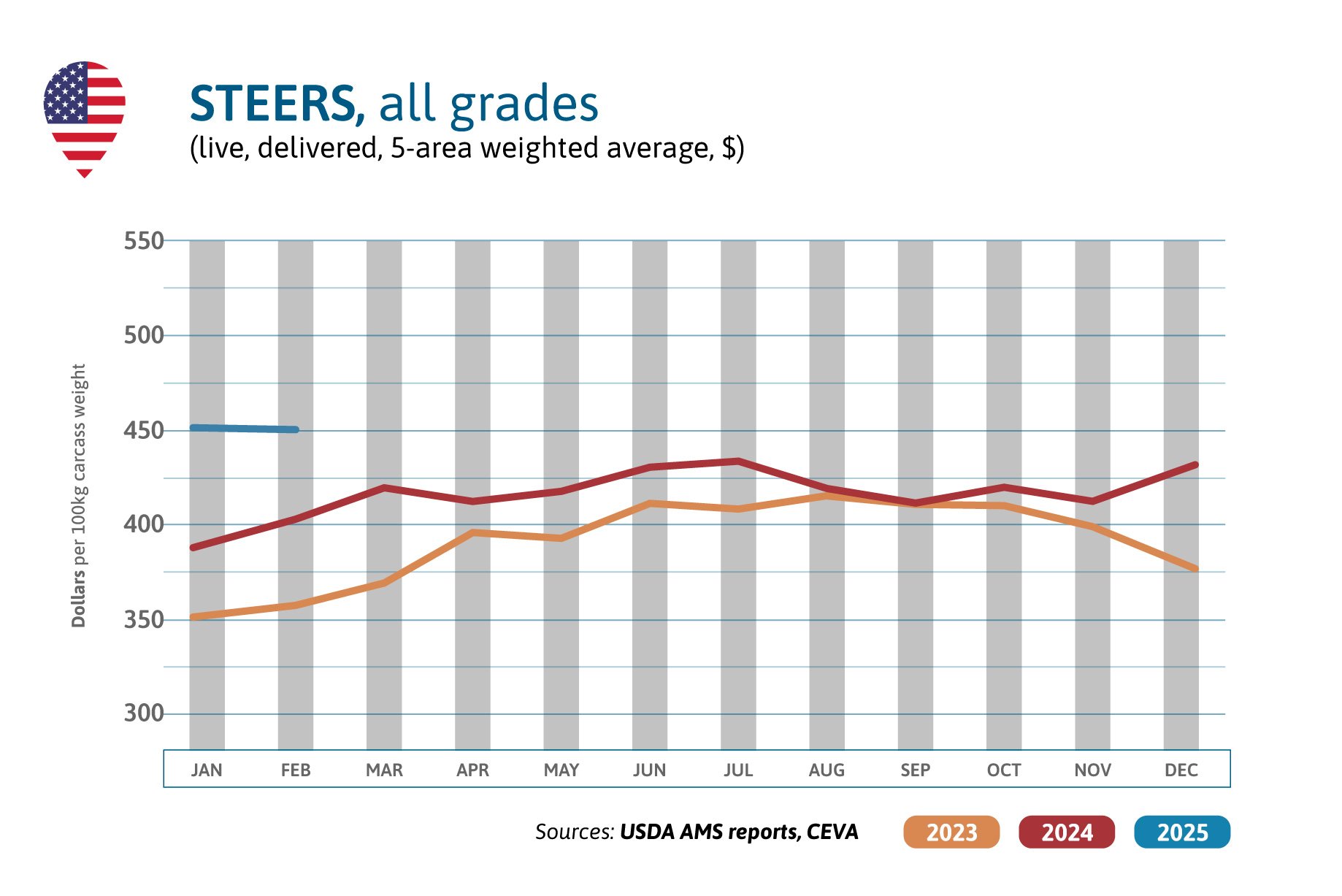

USA’S CATTLE MARKET

In February, steer market prices were flat compared to previous month but still well above last year’s level: +15%. Steer prices might be eroded the 2nd quarter of 2025, as demand appears a bit softer than expected. Meat production in the US may very slightly decrease in 2025 (-1%, USDA) with smaller numbers of cattle slaughtered but heavier carcass weights: +40 pounds per carcass in Jan-Feb 2025, compared to the same period 2024. Meatpackers seek to enter heavier cattle in process, to split operational costs per head on more carcass weight.

Source:

Make sure to check out our News and Events section for access to all the monthly beef and milk market outlooks.