Beef Market Outlook (Baptiste Buczinski)

Welcome to this month’s Beef Market Outlook. In this edition, we bring you the latest updates on beef cattle markets from Europe, Brazil, China, and the USA. Our analysis is built on thorough data, offering you a clear view of the trends that matter most.

SEE and share this valuable content.

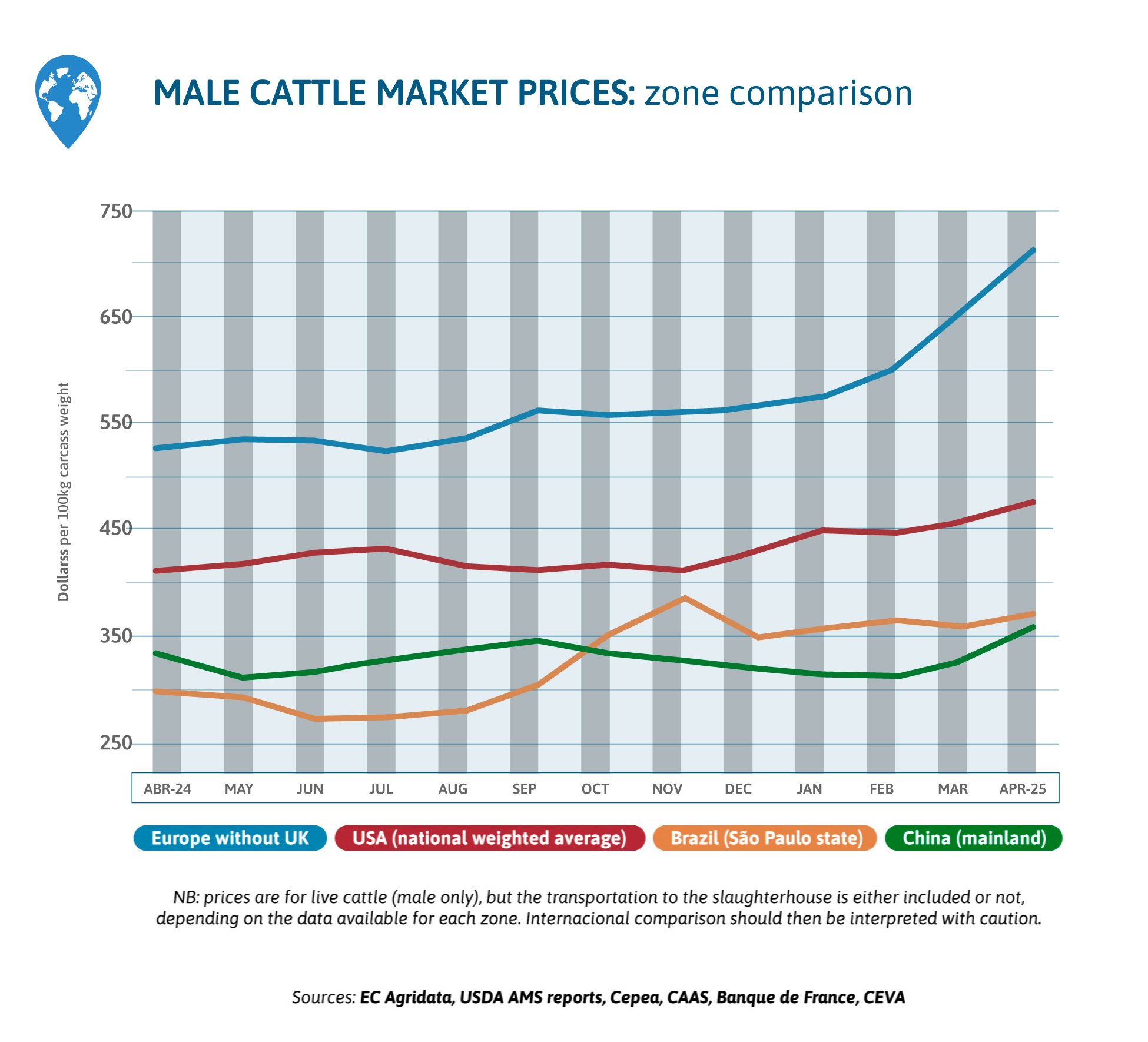

GLOBAL BEEF MARKET TREND

In April, cattle prices increased by 9% in China, finally crossing the very low price curve of 2024. Brazilian prices are improving. US prices are high and slowly increasing as cattle is scarce, while in Europe male prices soared again, from lack of cattle.

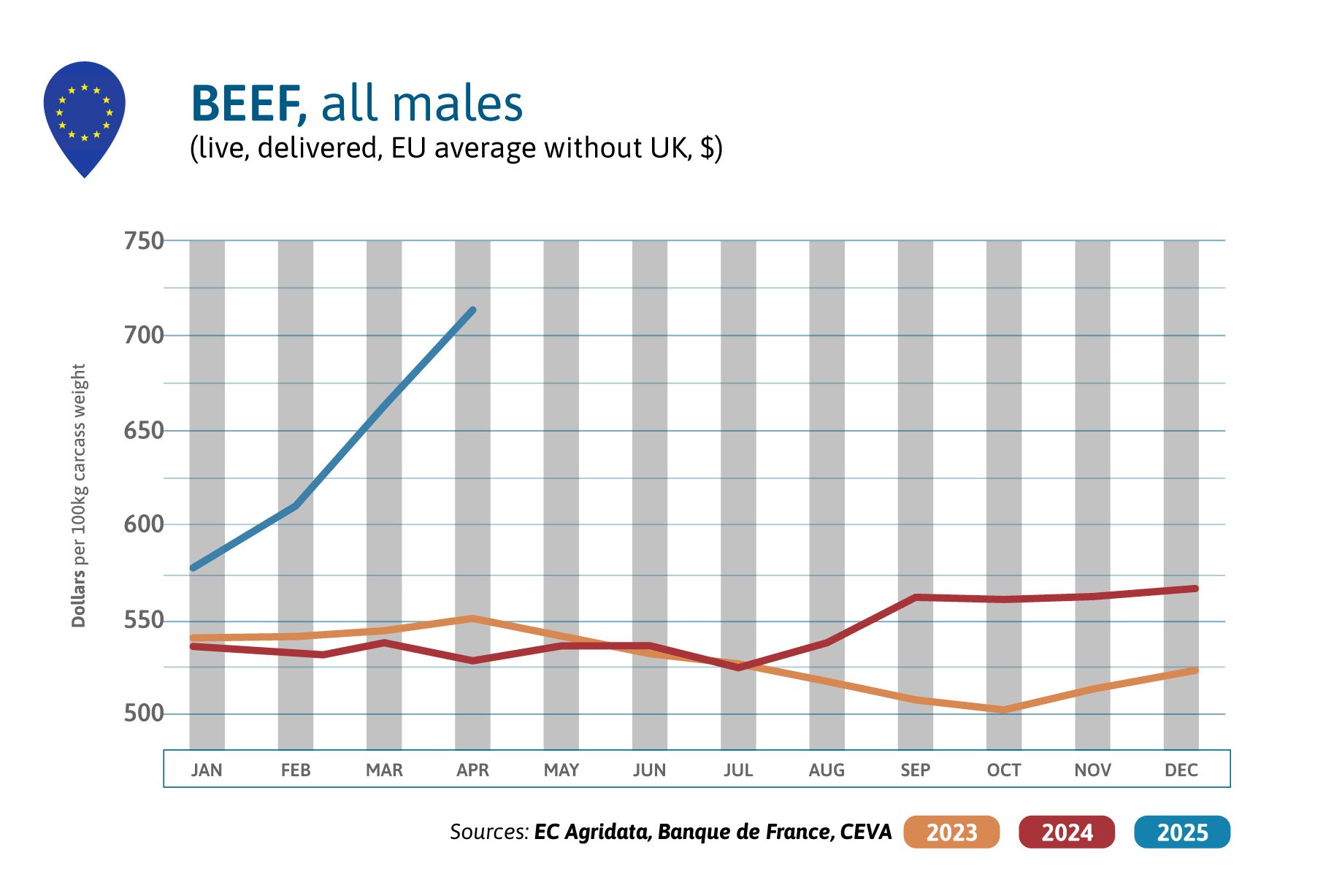

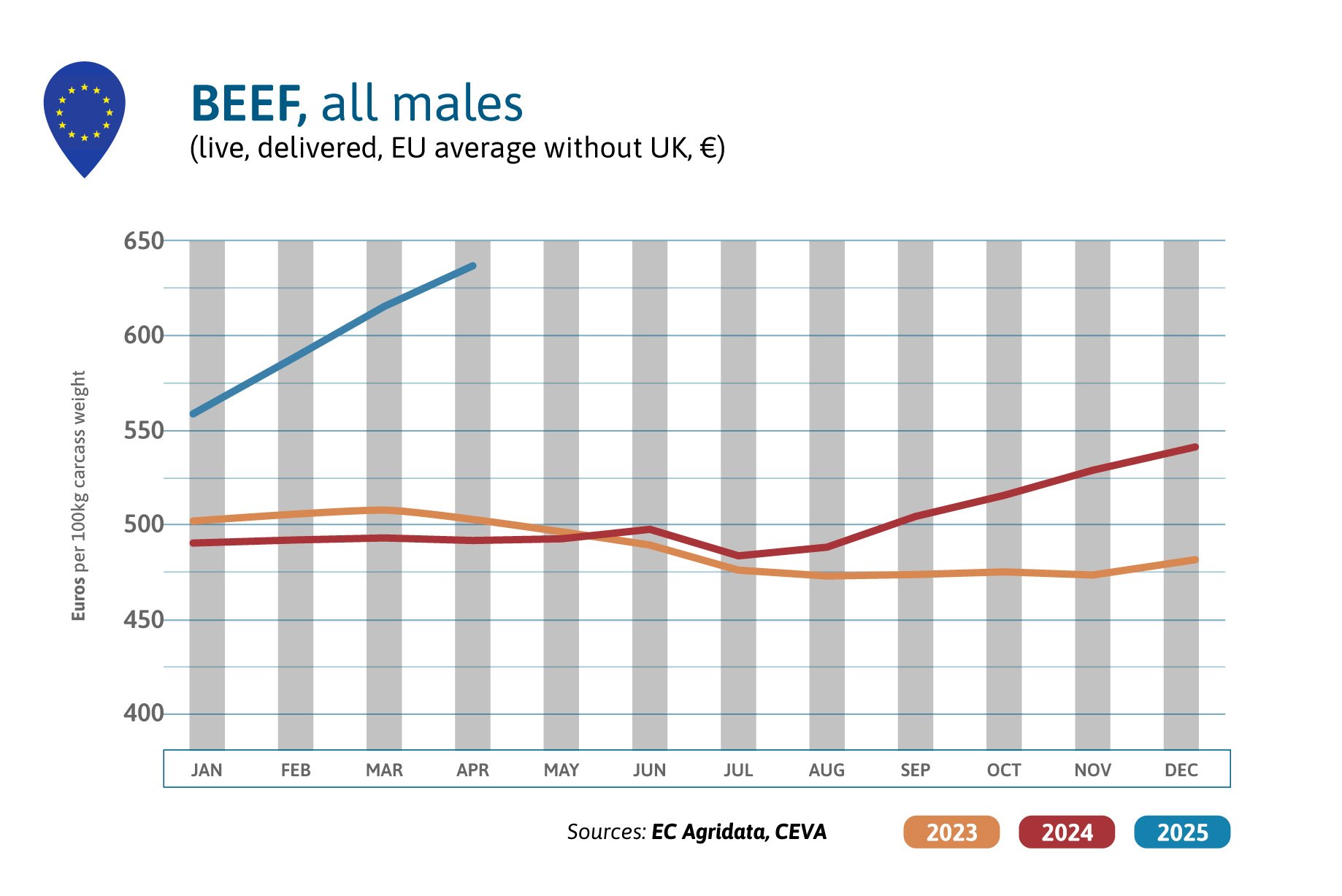

EUROPE

European prices for male beef soared by 7% compared to the previous month in US$ and are 35% above the 2024 high level! Male prices are still increasing, as Europe lacks cattle for slaughter, the number of males between 1 and 2 years of age having historically decreased by 3.4% y.o.y. in December 2024.

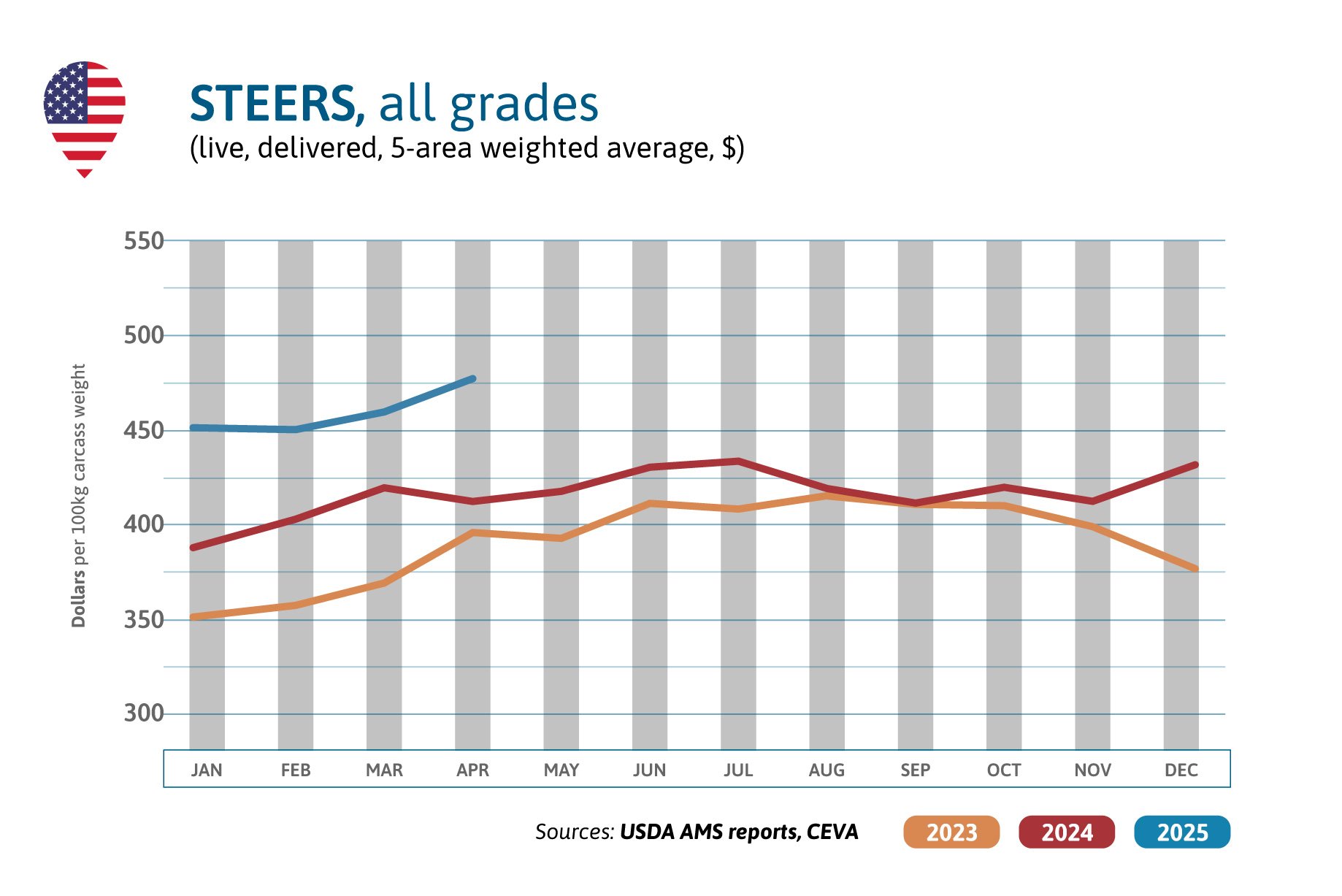

USA

In April, steer prices increased by 4% in a month and were 15% above last year’s high level. After the low slaughtering rhythm of February, cattle slaughter increased by only 1% in March, compared to last year. Cattle is kept on feed longer, as farmers expect higher prices from meatpackers in the months. On May 11, the U.S. authorities have activated a new ban on Mexican live cattle, as the New World Screwworm spreads towards the north of Mexico, now only 700 miles from the border.

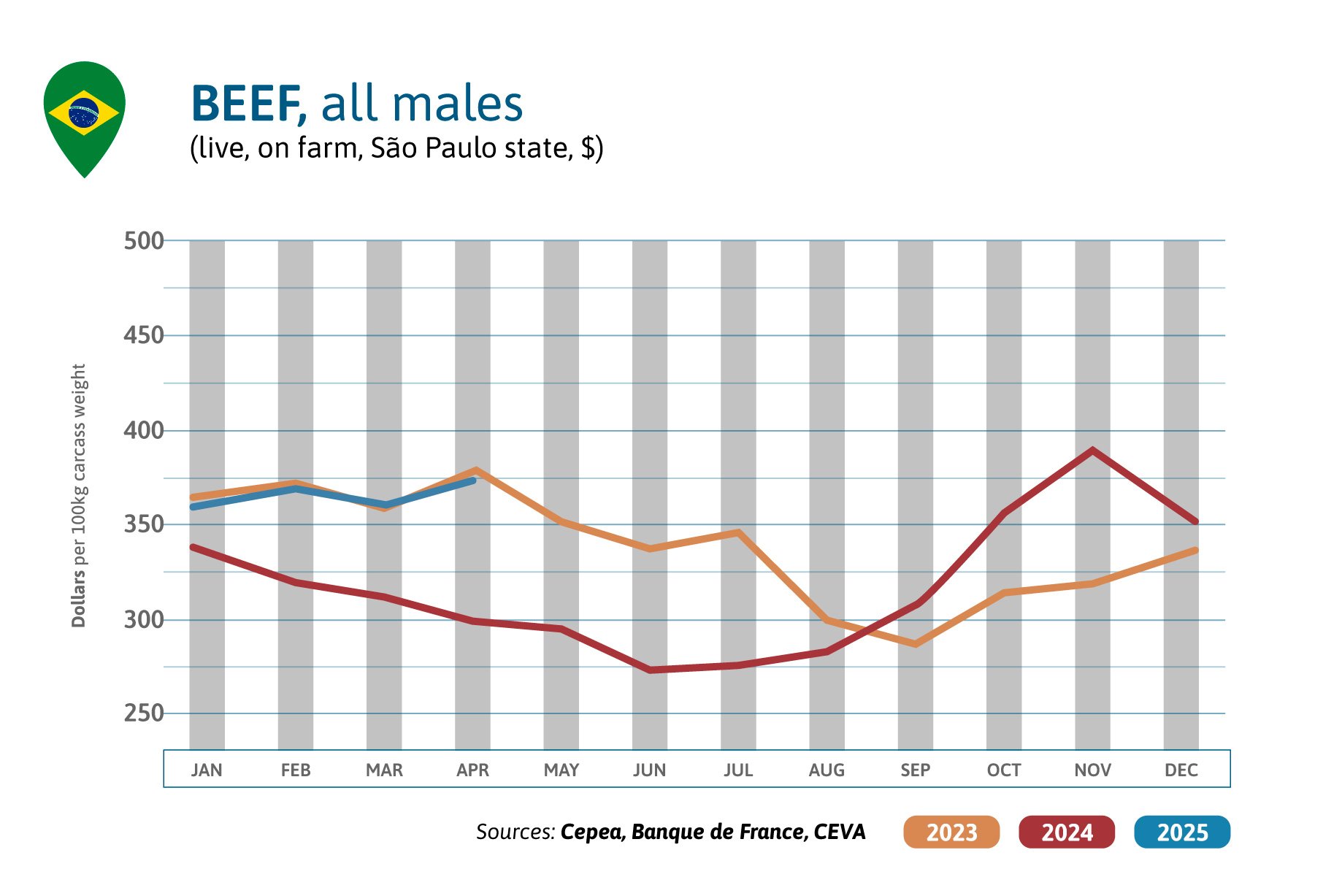

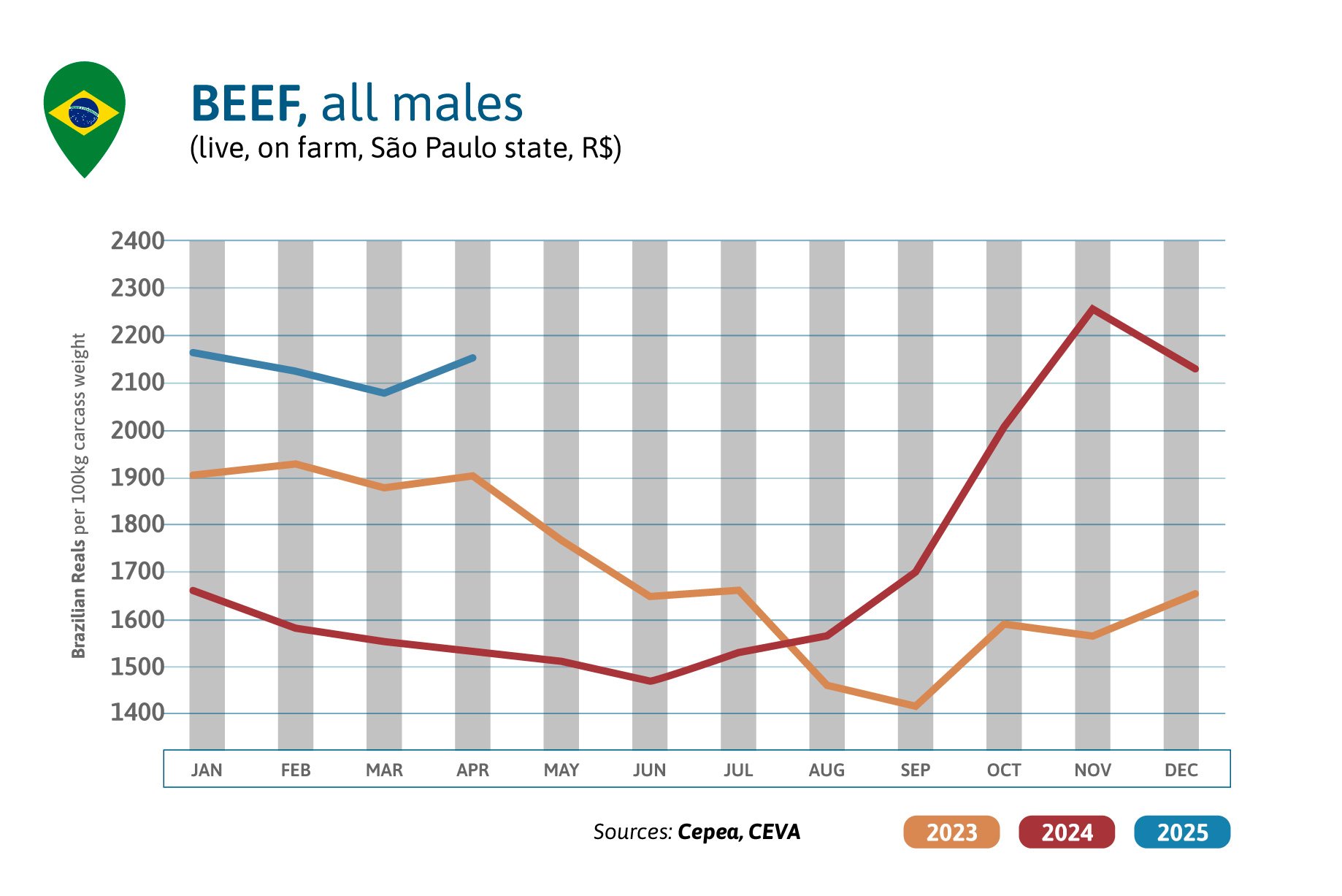

BRAZIL

Brazilian beef prices were 4% up in April compared to the previous month and were well above 2024: +25% in US$ and +41% in Reals, the local currency having lost 19% of its value in 2024. World demand is strong for beef and cattle slaughter increased by 4% during the first quarter (Q1) of 2025, after a giant leap of 14% during the year 2024. In April, Brazilian exports still increased by 16% y.o.y. In total 1.18 million tons cwe have been shipped since January (+13%): 386 000 tons cwe to China (+3%), 135 000 tons to the USA (x 2.6 compared to 2024).

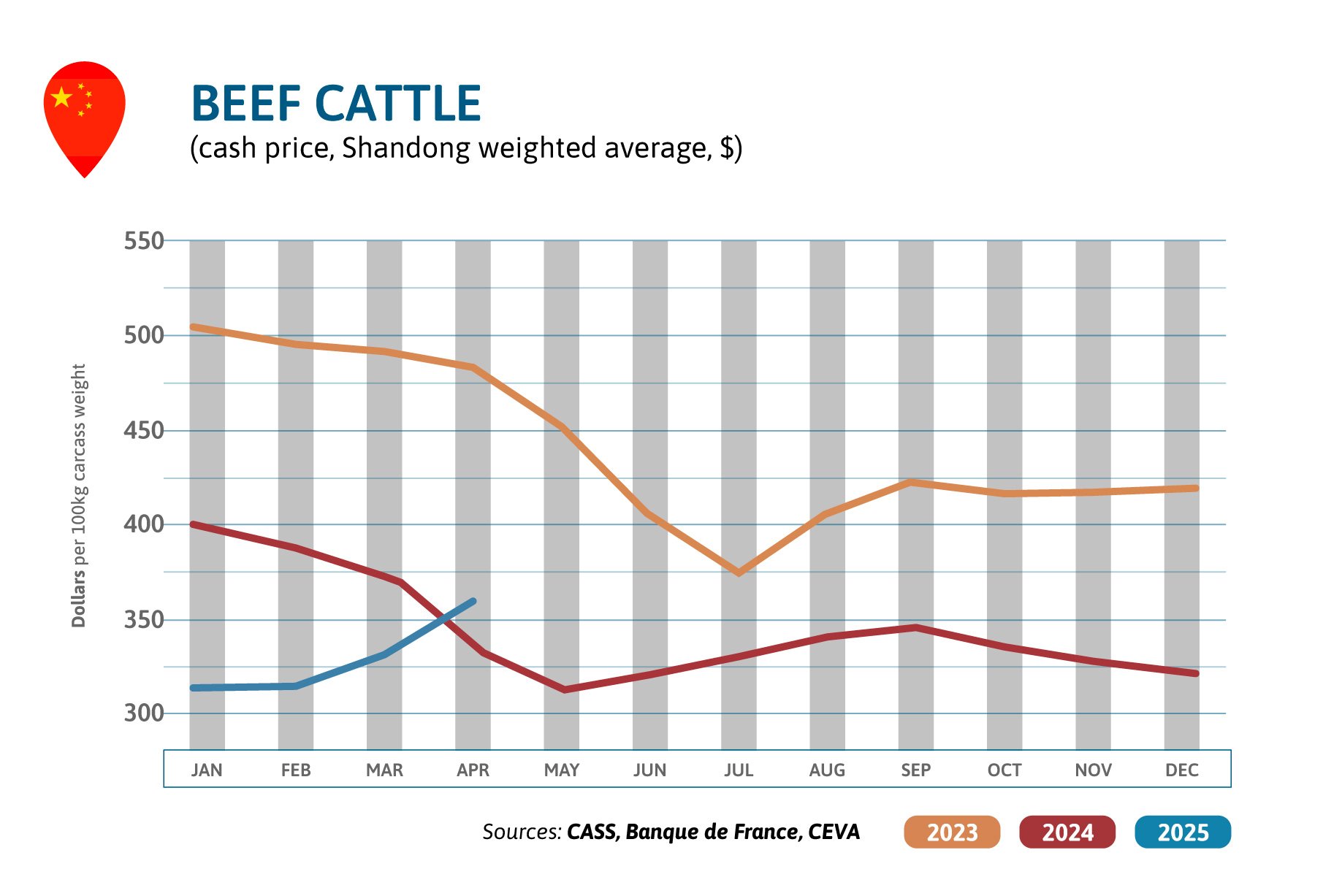

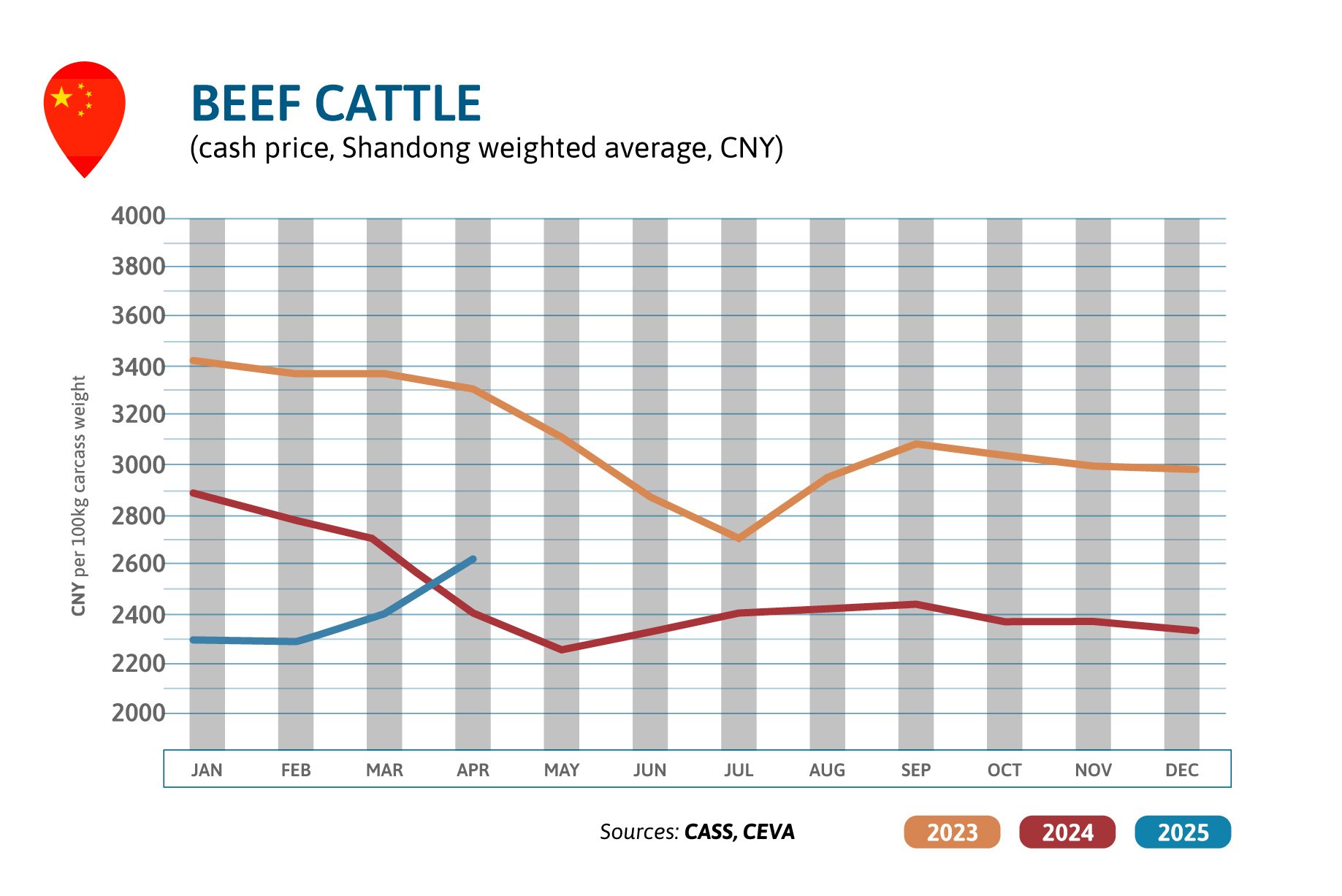

CHINA

In April, Chinese cattle prices increased by 9% in a month and are now 8% above the April 2024 level (but still 25% lower than to 2 years ago). This improvement in cattle prices is linked to the decrease in beef imports. In Q1- 2025, China and Hong Kong together imported 740 000 tons cwe of beef meat, 10% down from 2024 figures. The Chinese Ministry of Agriculture indicated that last year, the average profit per head of cattle fell from 2,500 RMB in previous years, to only 350 RMB, causing as much as 20% of local farmers (the smallest) to exit the activity (source : local experts).

Source: