Beef Market Outlook (Baptiste Buczinski)

Welcome to the Beef Market Outlook – October 2025, your monthly overview of the global beef industry. This edition explores the latest beef production trends and price movements across Europe, Brazil, China, and the United States. Through data-driven analysis, we highlight the key factors shaping supply, demand, and profitability in the international beef market.

GLOBAL BEEF MARKET

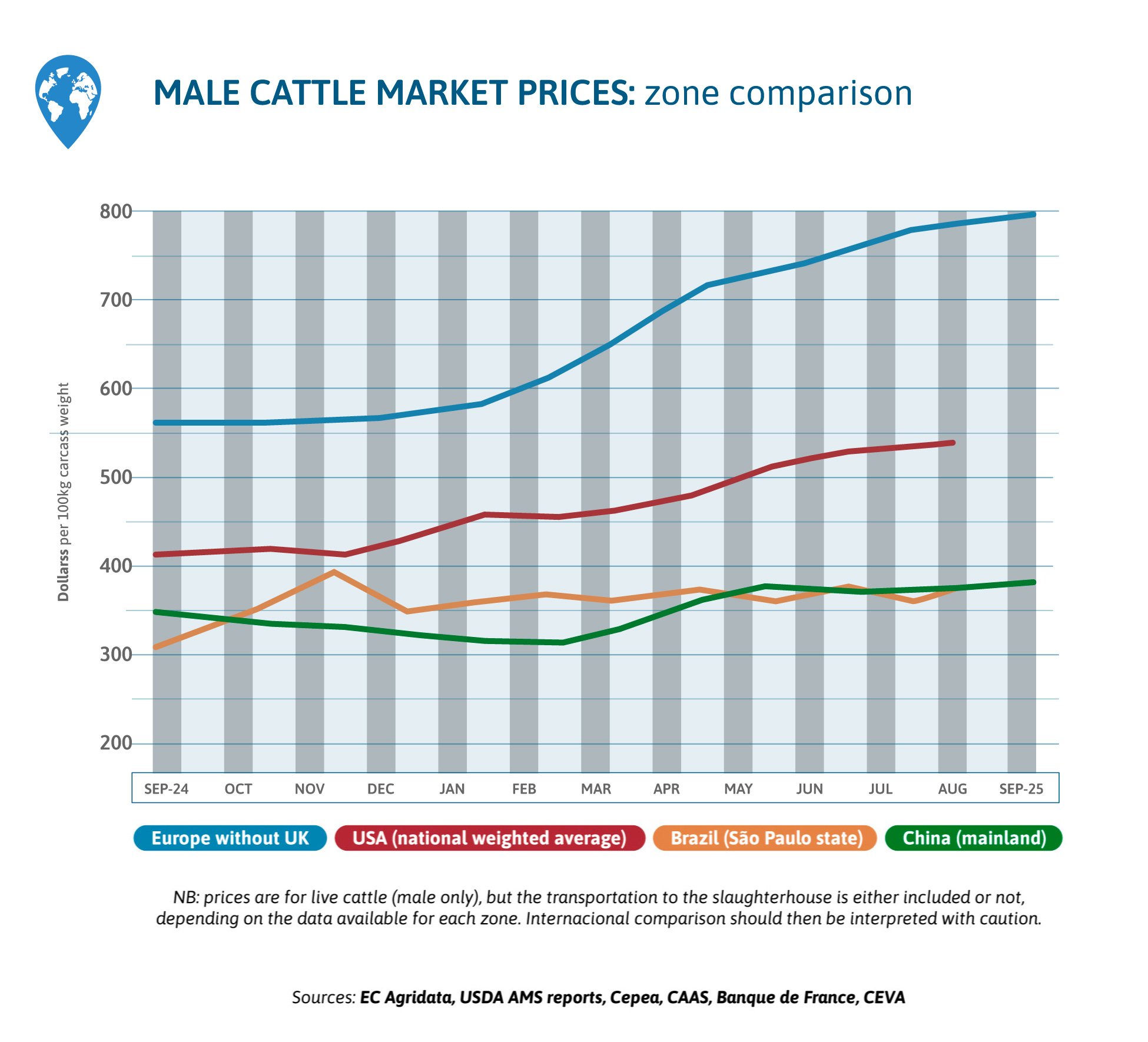

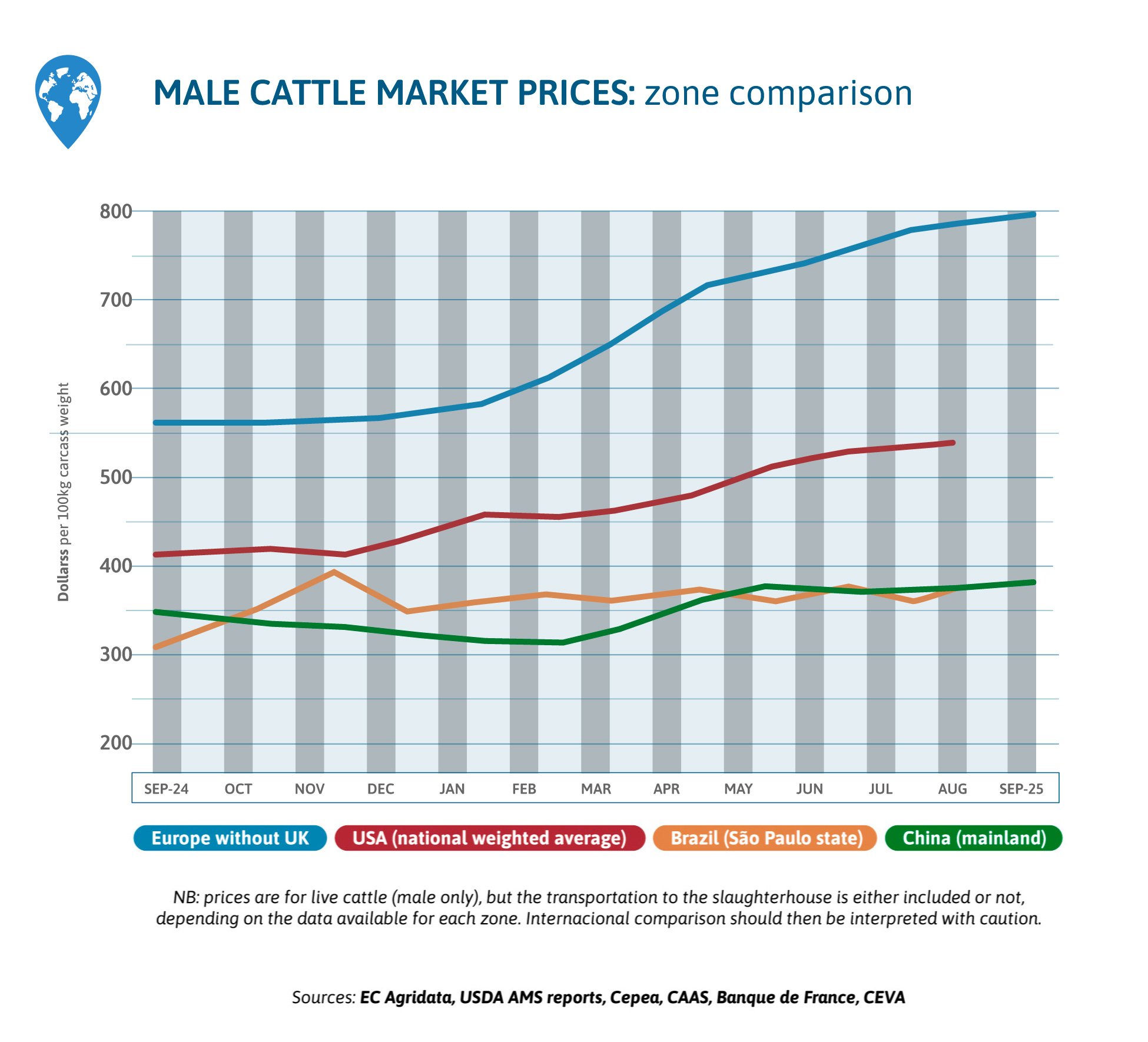

In September, Brazilian prices are slowly increasing, while Chinese prices follow Brazil, at a low level for the Middle Kingdom. In Europe, prices are still increasing, as herds and production decline.

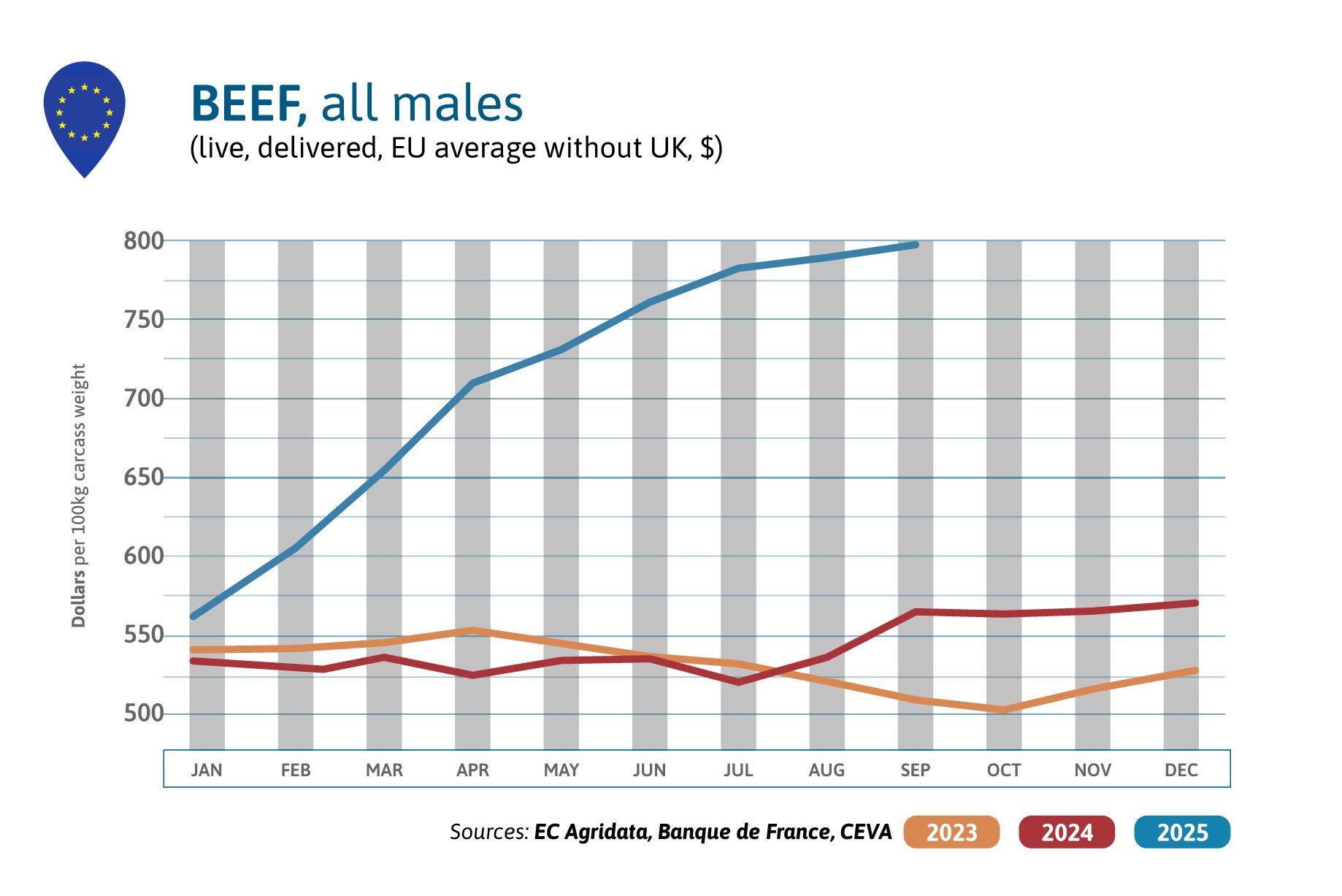

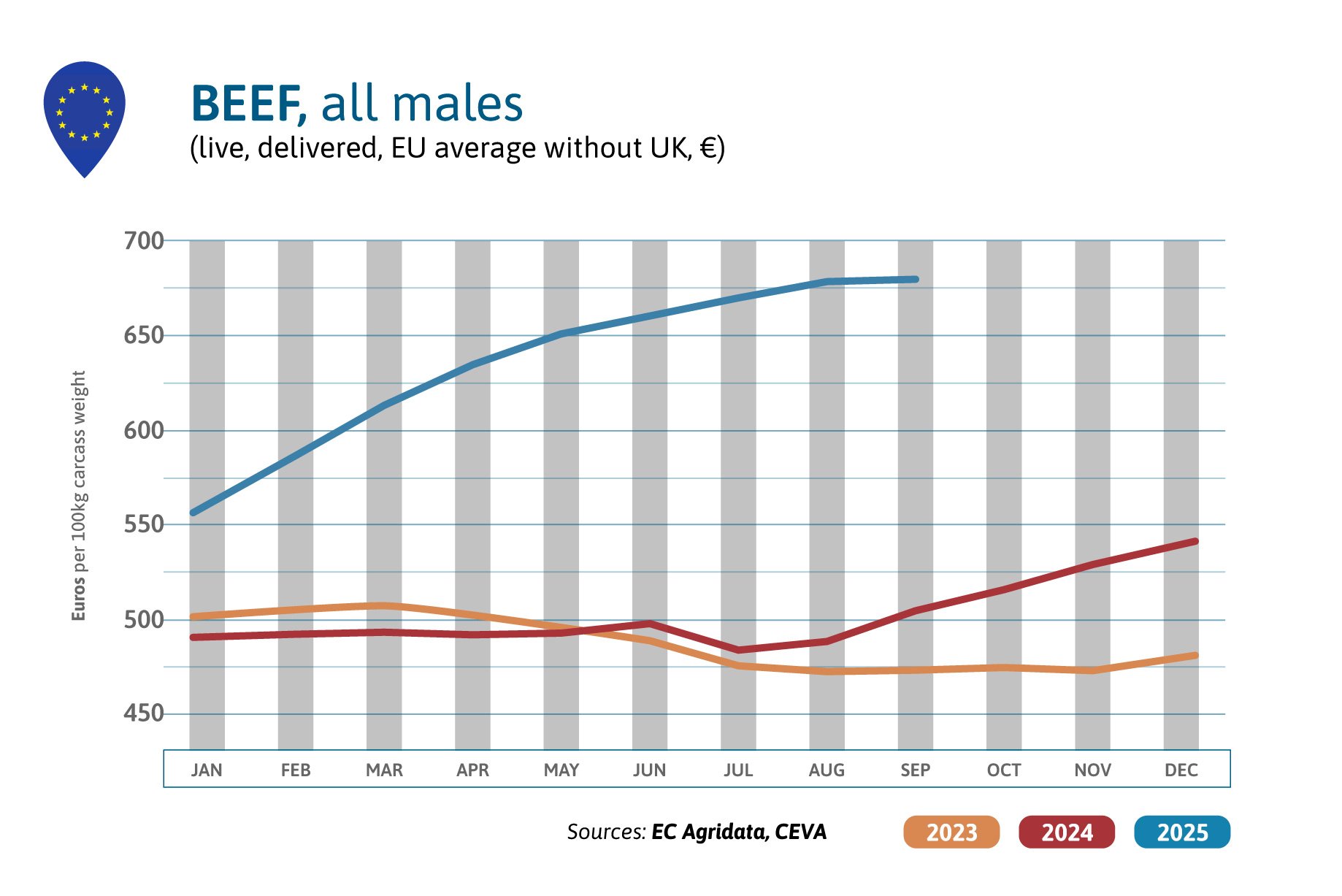

Europe Beef Market: Rising Prices Amid Permanent Cattle Shortage

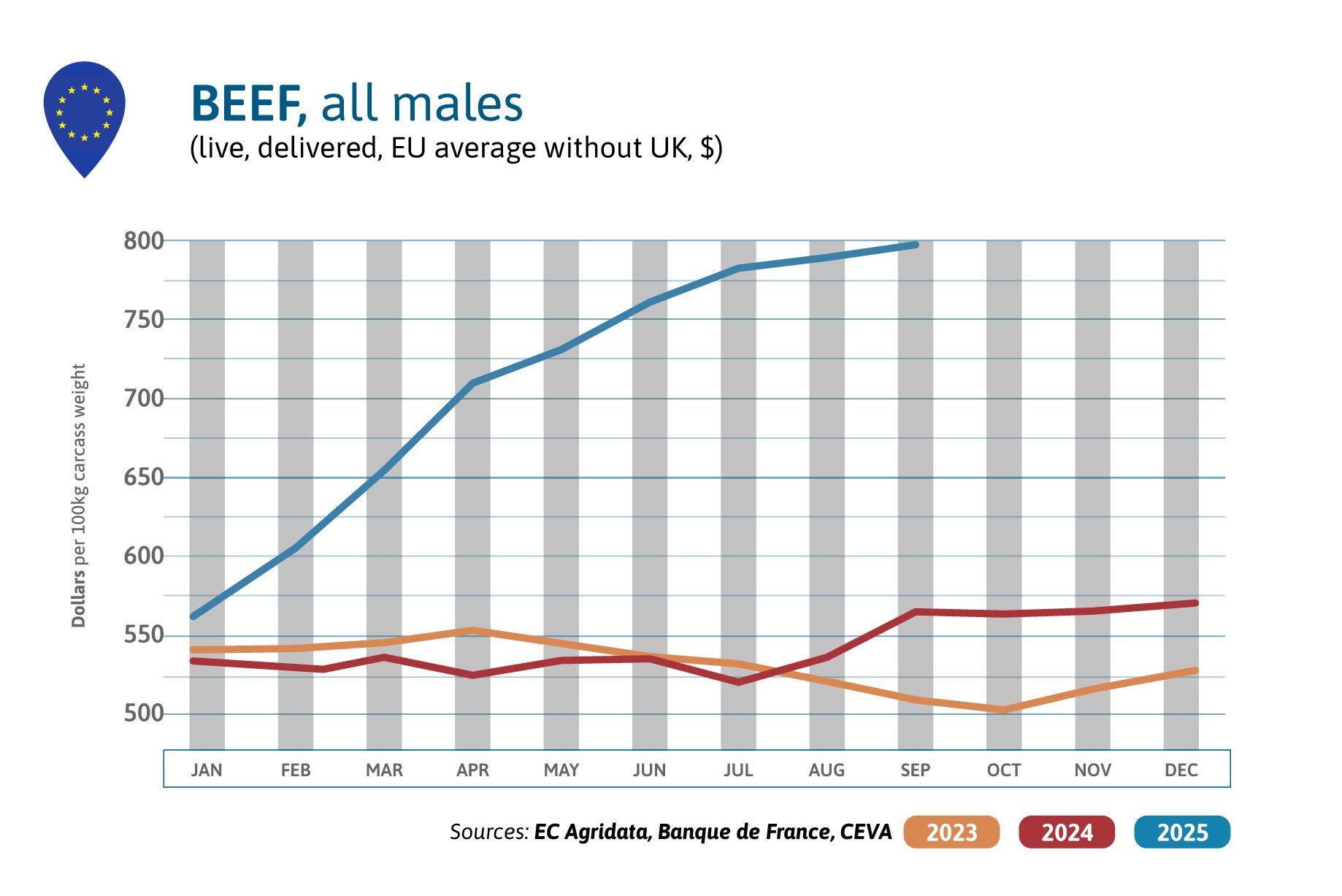

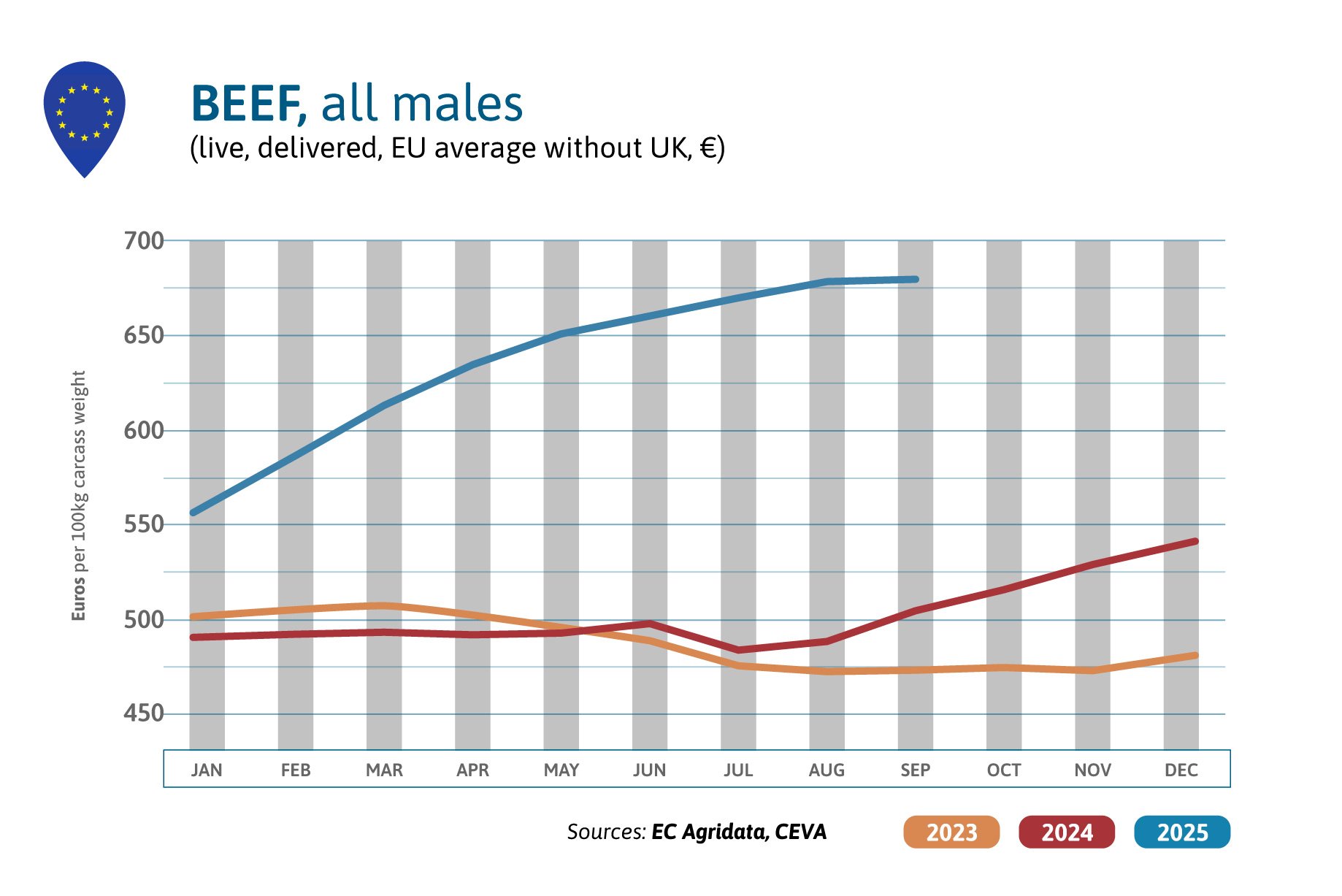

In September 2025, male cattle prices are ever again increasing (+1% compared to previous month in $US) and 42% above the already very high level of 2024. Cattle shortage is permanent in the EU. Because of this, EU’s beef imports have soared by 14% in the first 8 months of 2025, of which 60% of Mercosur beef meat, increasing by 23% compared to 2024.

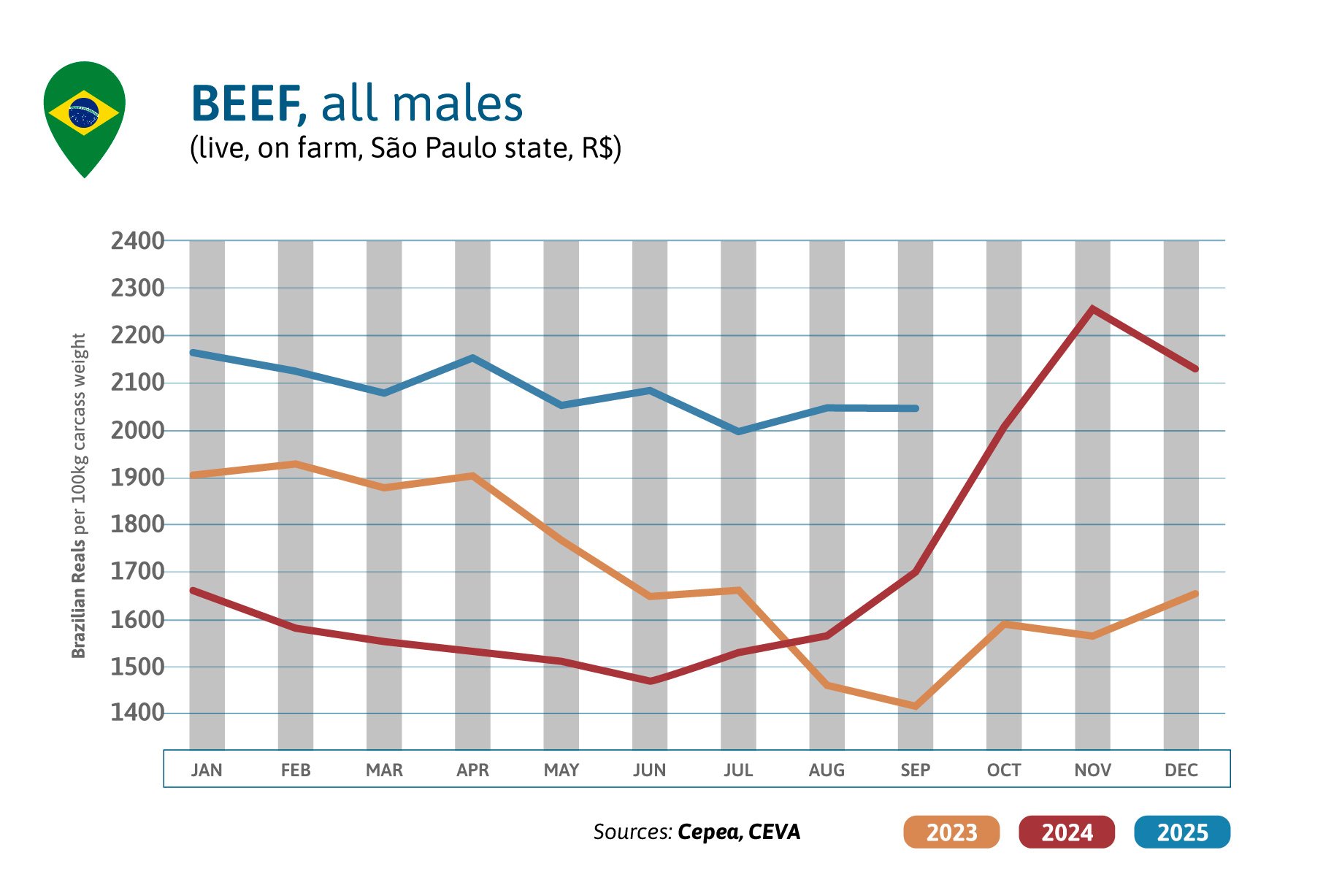

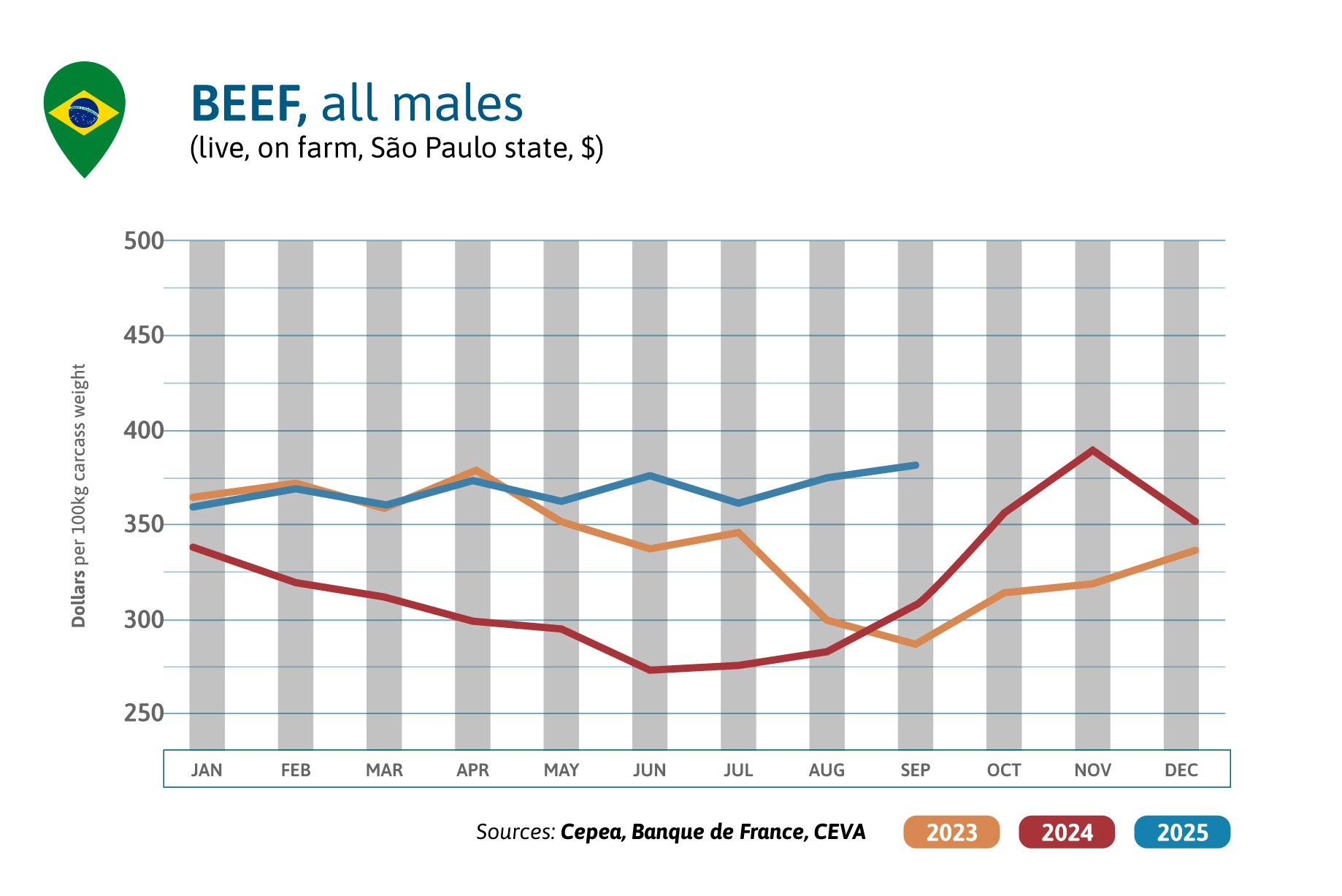

Brazil Beef Exports 2025: Record Exports Despite US Tariffs and Currency Pressure

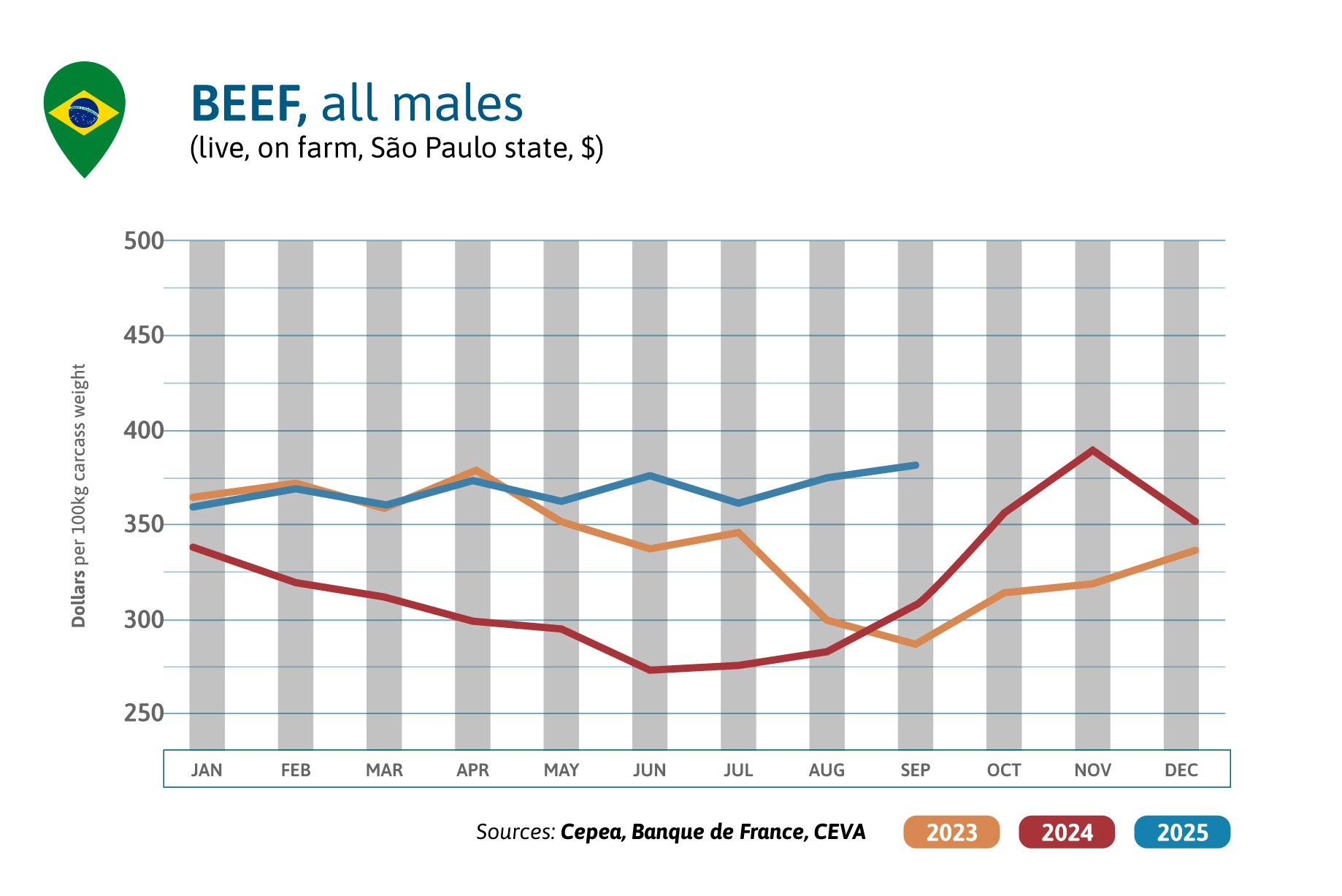

Brazilian beef prices are slowly increasing in US$ since the beginning of 2025 (+2% last month, +6% since January) but slightly decreasing in Réais (-5% since January). Prices remain much higher than last year (+24%). Brazil’s beef exports are 23% above record level of 2024 in the first 9 months of 2025 (and +23% in September). The US have put a 50% tariff rate on Brazilian beef since end of July, curbing down Brazilian exports to the US (-56% in August-Sept. compared to 2024). Brazil’s first export goal remains China/Hong Kong (1,5 million tons in 9 months) followed by the USA (281,000 tons) South America (189,000 tons) and Europe (100,000 tons, +50% compared to 2024).

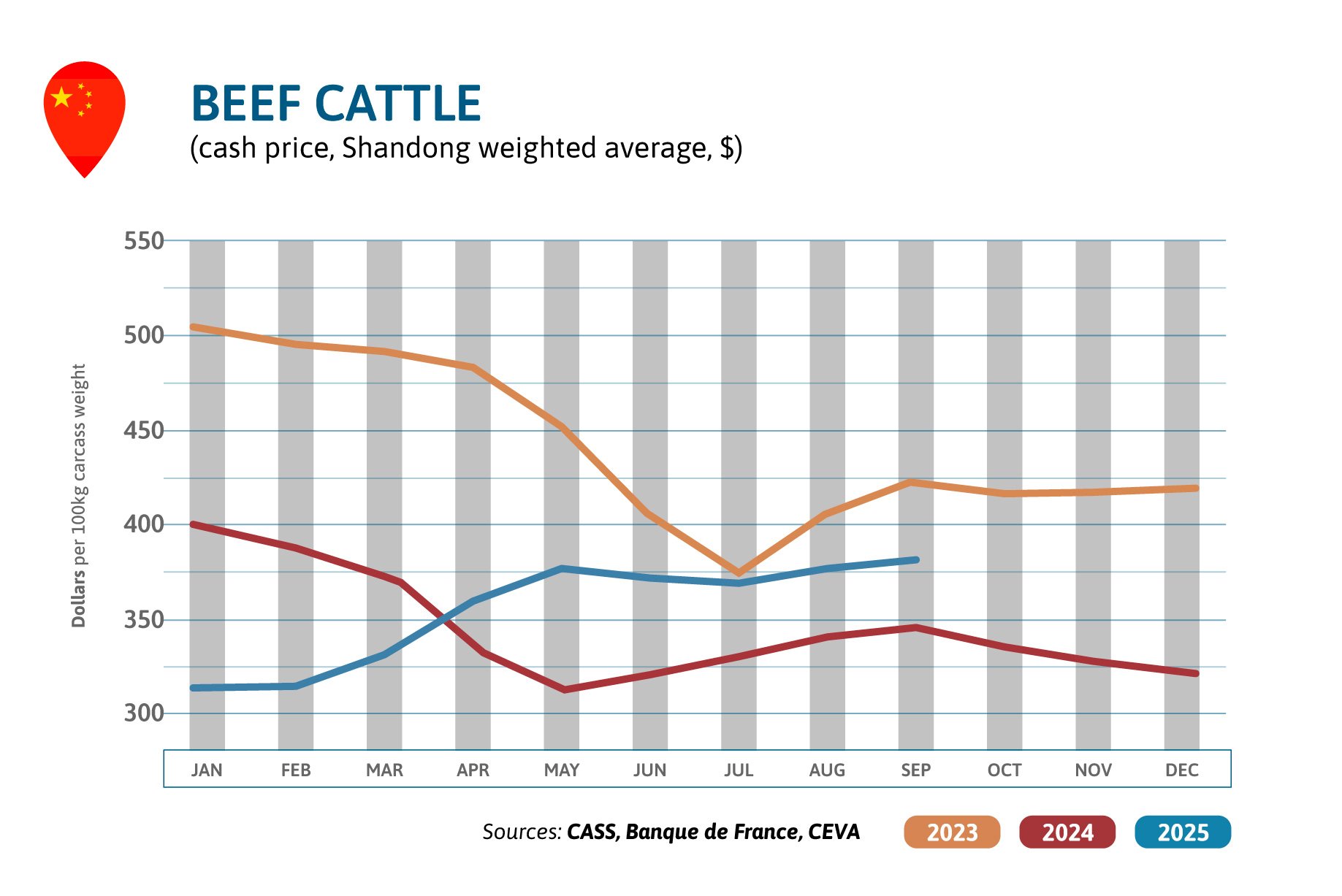

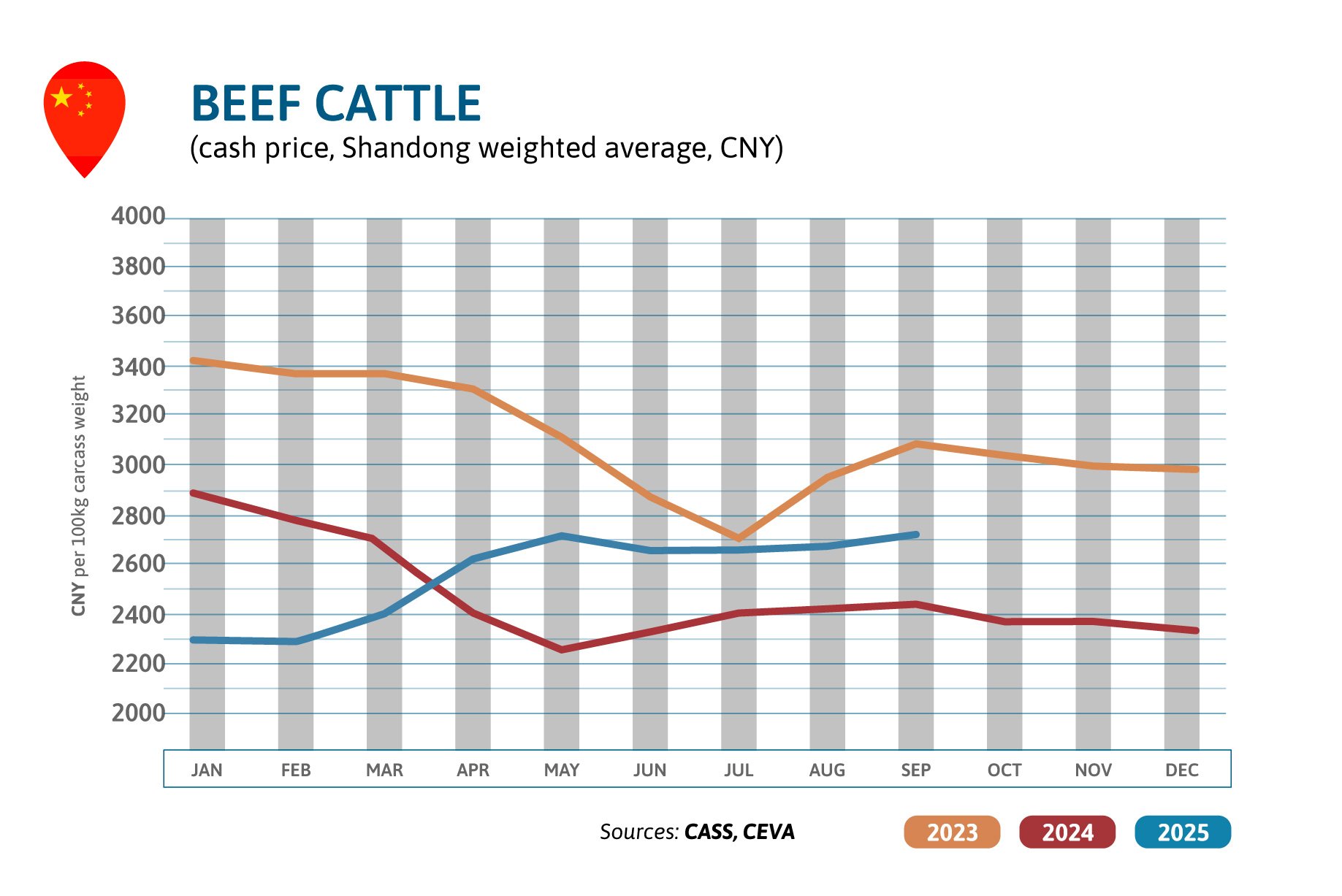

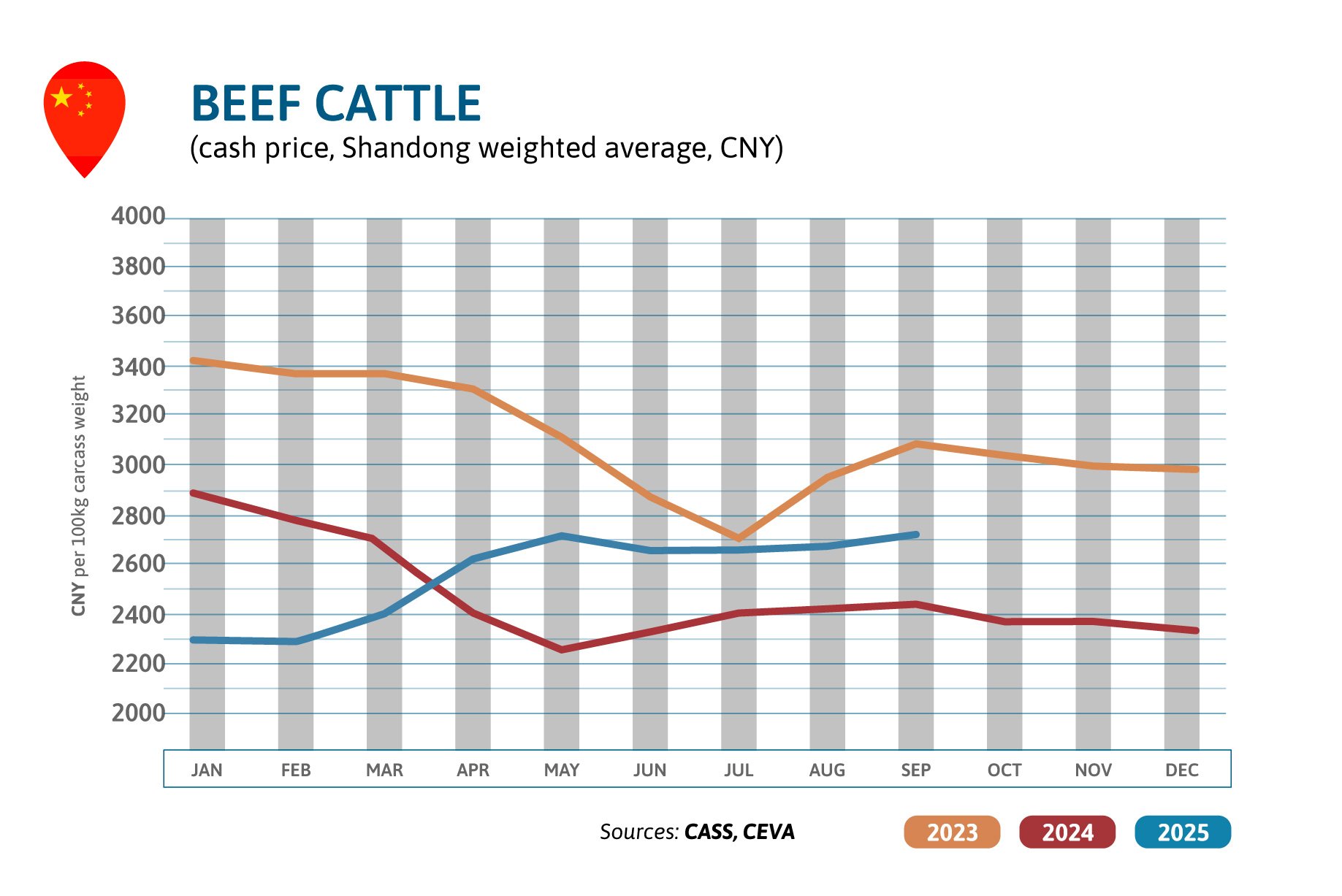

China Beef Market: Gradual Price Recovery as Imports Surge

In September, beef prices slightly increased in China (+2% in a month, like in previous month) and were 11% above the historic low level of 2024, still not recovering pre-crisis prices (-22% / 2022). While China’s beef imports were slowed during the first 5 months of 2025, they have accelerated after. In June, July and August, beef imports jumped by 23% year-over-year (y-o-y). Imports from Brazil are still increasing (254,000 tons in September, +35%) as well as from the rest of Mercosur and Australia. China should deliver its report on potentially excessive beef exports to its country at the end of November but has already put 10% more tariff on US beef.

United States Beef Prices: High Prices Amid Tight Supply and Trade Shifts

September US beef prices are not available since “shutdown”. Retail beef prices are very high. In August, ground beef was at 13.9 US$ per kg and the consumer price index for beef was up 13.9% y-o-y, overall inflation staying at 2.9%. As slaughtering decreases, beef meat imports increase (+13% in July y-o-y, and +30% as of January-July imports). For the same reason, beef exports recline (-19% in July y-o-y, and -9% for the January-July imports).

Source:

Make sure to check out our News and Events section for access to all the monthly beef and milk market outlooks.