Beef Market Outlook (Baptiste Buczinski)

Welcome to the updated Beef Market Outlook 2025, your source for the latest analysis of the global beef market. In this edition, we review the most recent developments in beef cattle production and prices across Europe, Brazil, China, and the United States. Backed by comprehensive data and market insights, this report highlights the key trends, challenges, and drivers shaping the international beef sector.

GLOBAL BEEF MARKET

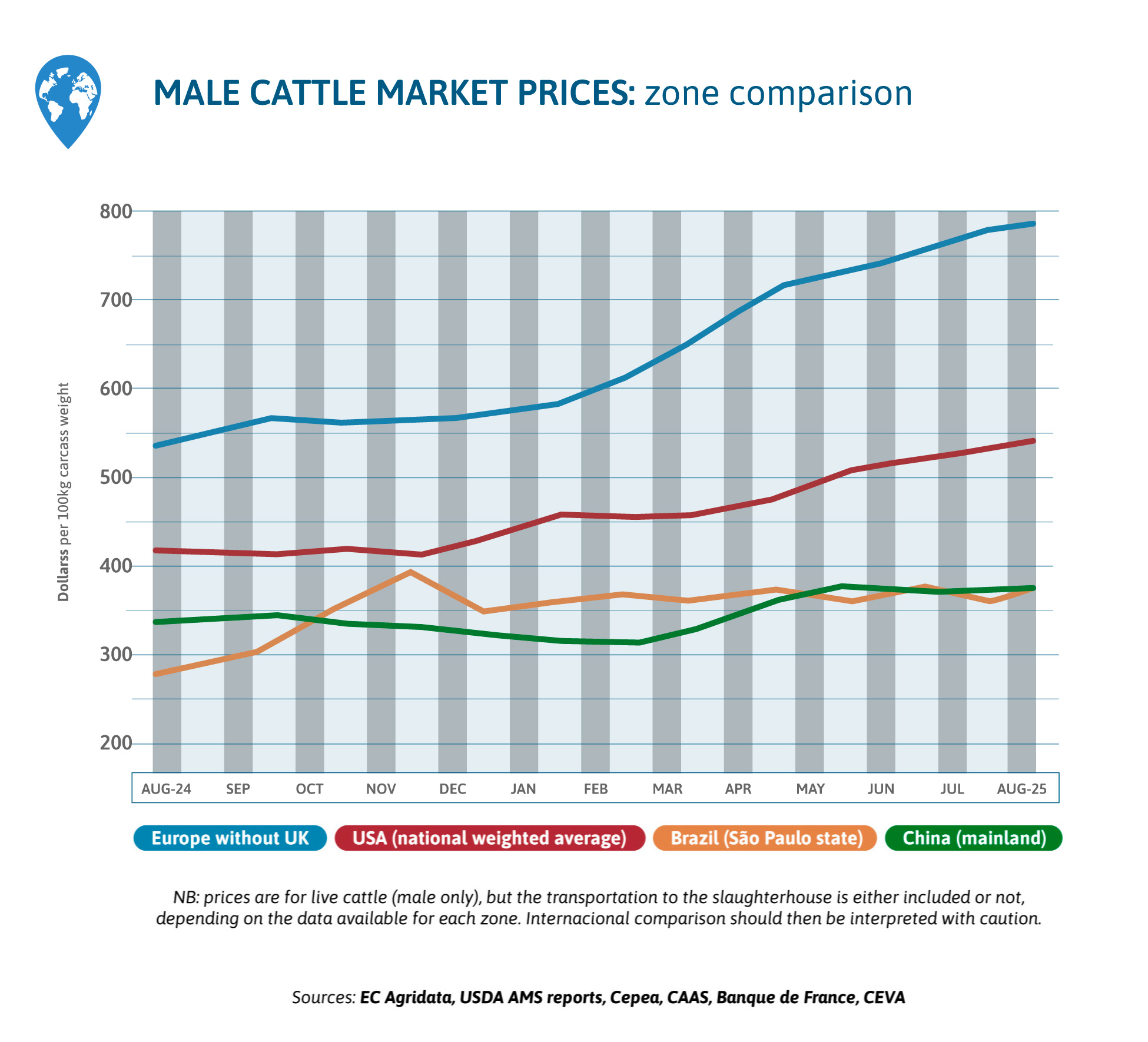

In August, Brazilian prices were globally stable at high level for the country, while Chinese prices were equivalent to that, which means still quite low. US prices are increasing as cattle is kept longer on feed with the ban on Mexican bovines. In Europe, prices are much higher and still increasing, from global lack of volumes.

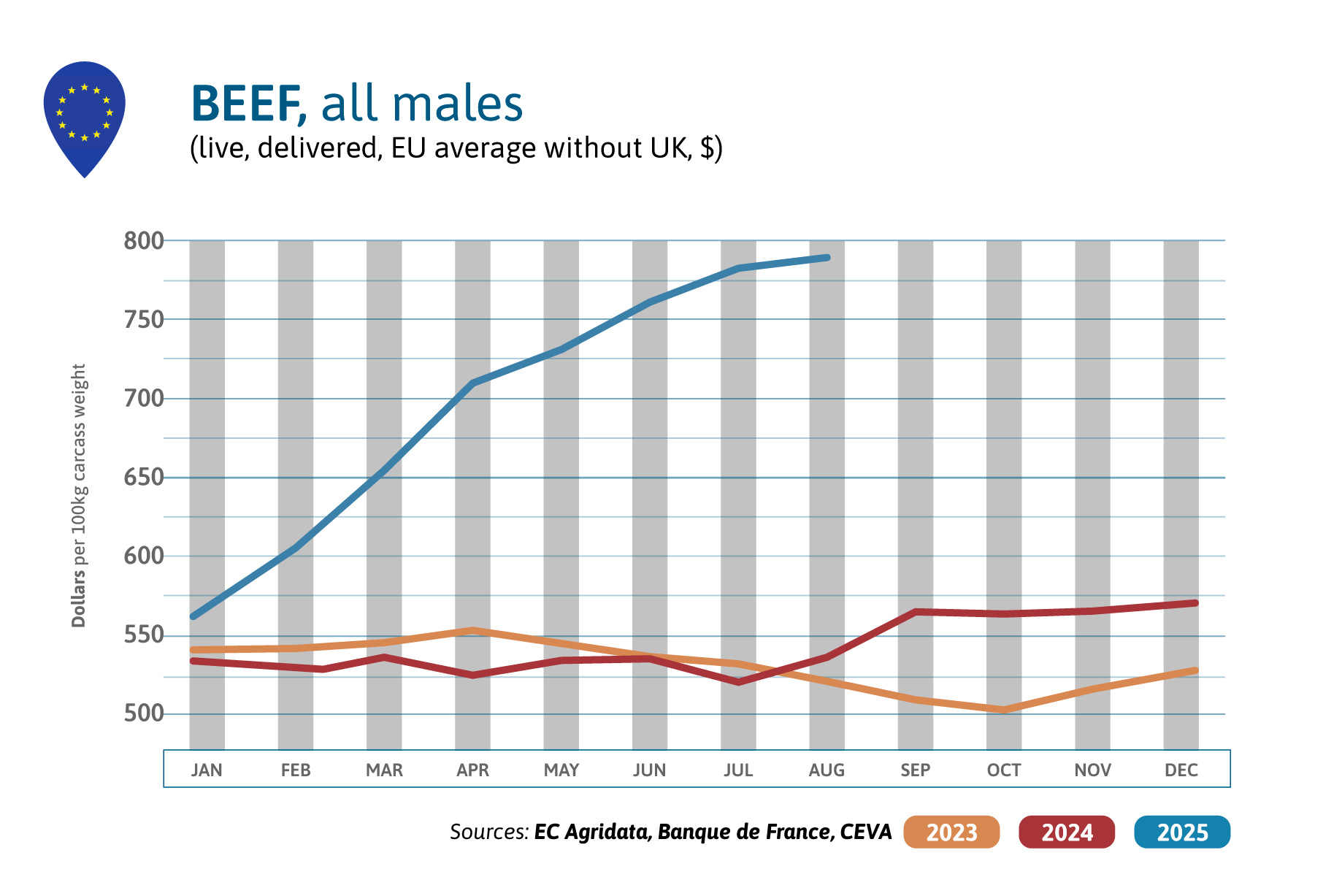

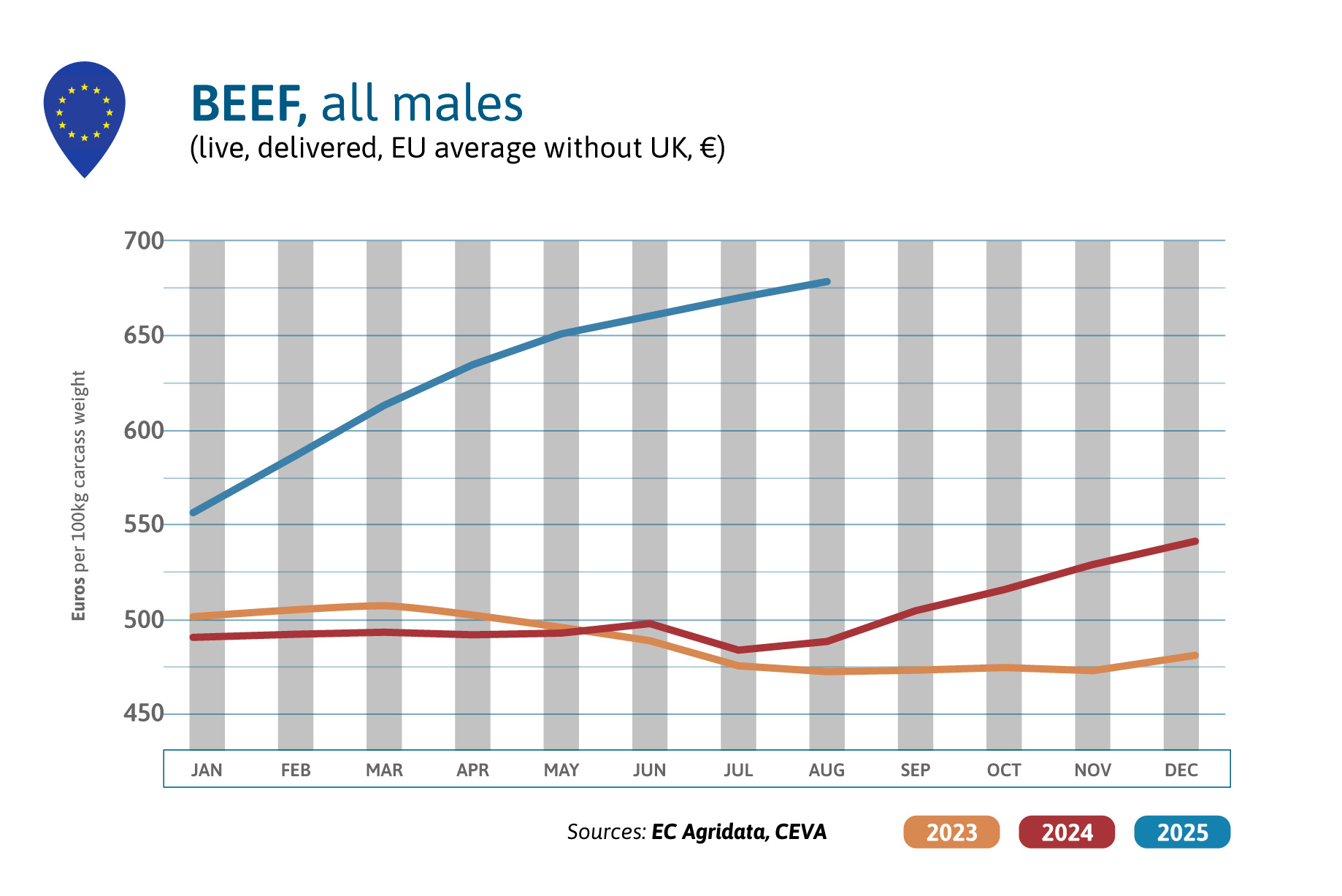

Europe Beef Market: Rising Prices Amid Persistent Cattle Shortage

Brazil Beef Exports 2025: Stable Prices, Strong Global Demand

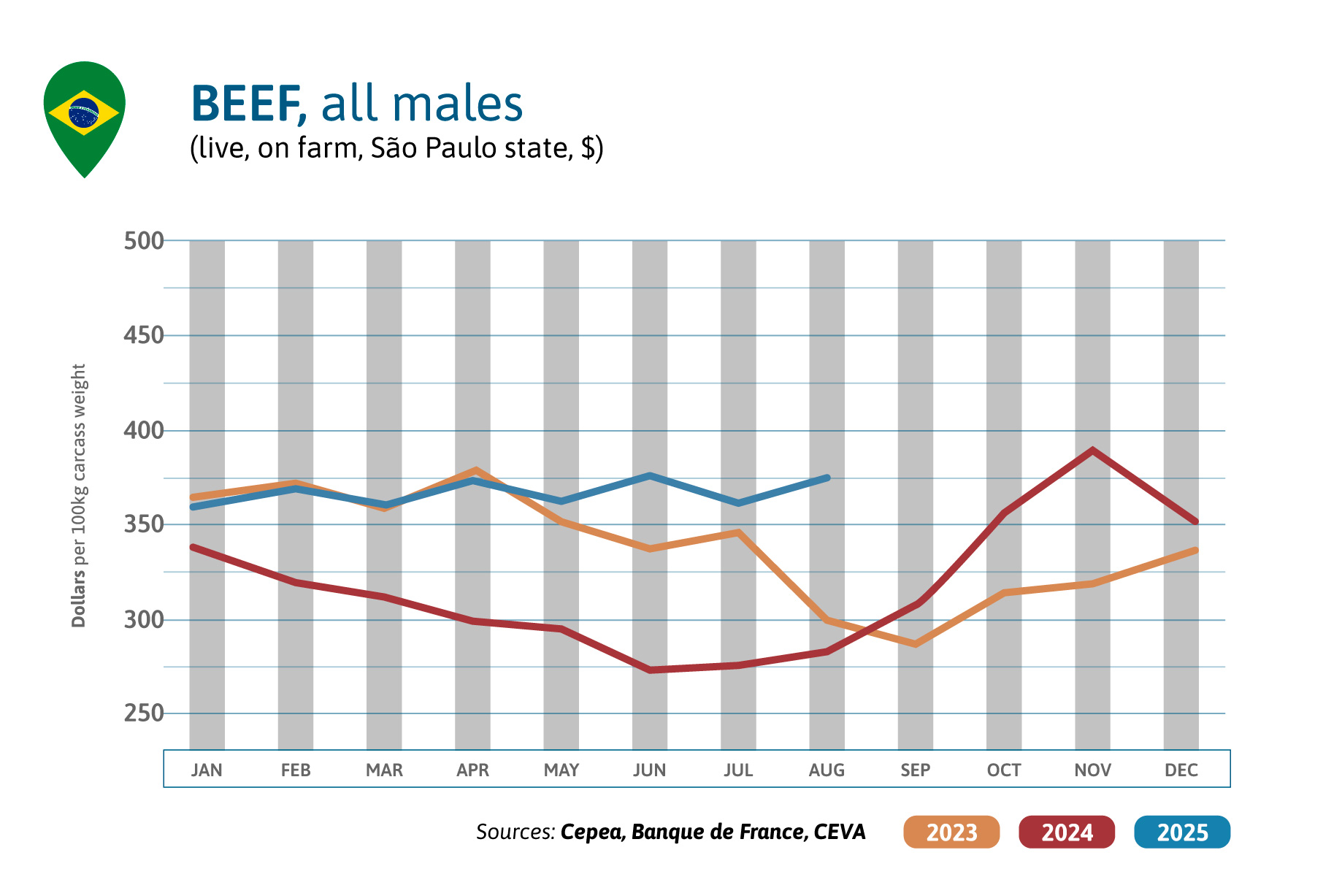

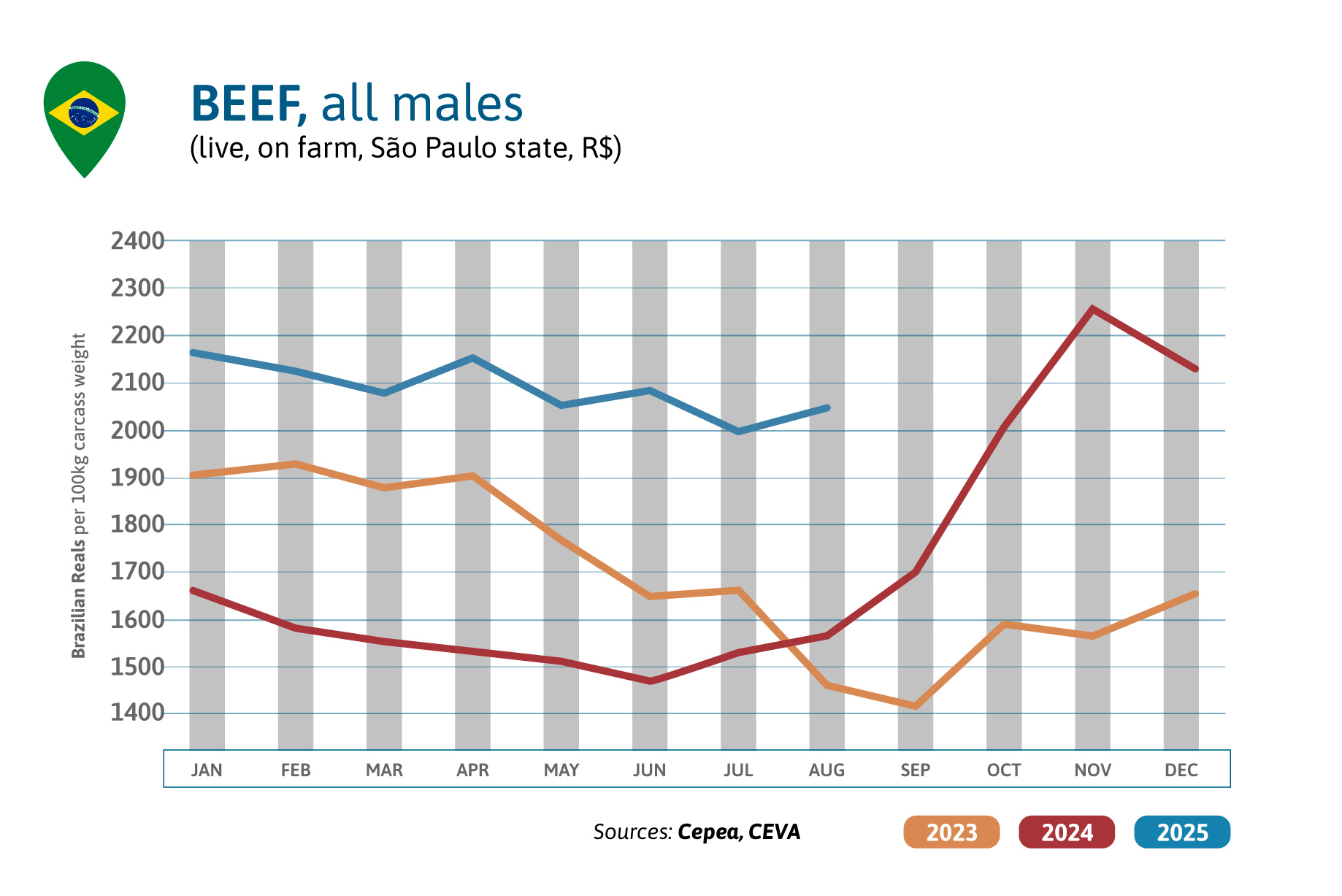

Brazilian beef prices are oscillating this year but remain globally stable in US$ and slightly decreasing in Réais (-5% since the beginning of 2025). But prices are much higher than last year: + 33%. The World needs beef and Brazilian beef exports have increased by 15% above record level of 2024 in the first 8 months of 2025. The US have put a 50% tariff rate on Brazilian beef since end of July. Brazil is the US’s 1st beef furbisher (25% of the volumes). But Brazilian exports’ goal is firstly China/Hong Kong (1,26 million tons in 8 months) followed by North America (380,000 tons) South American (164,000 tons) and Europe (81,000 tons, +44% compared to 2024).

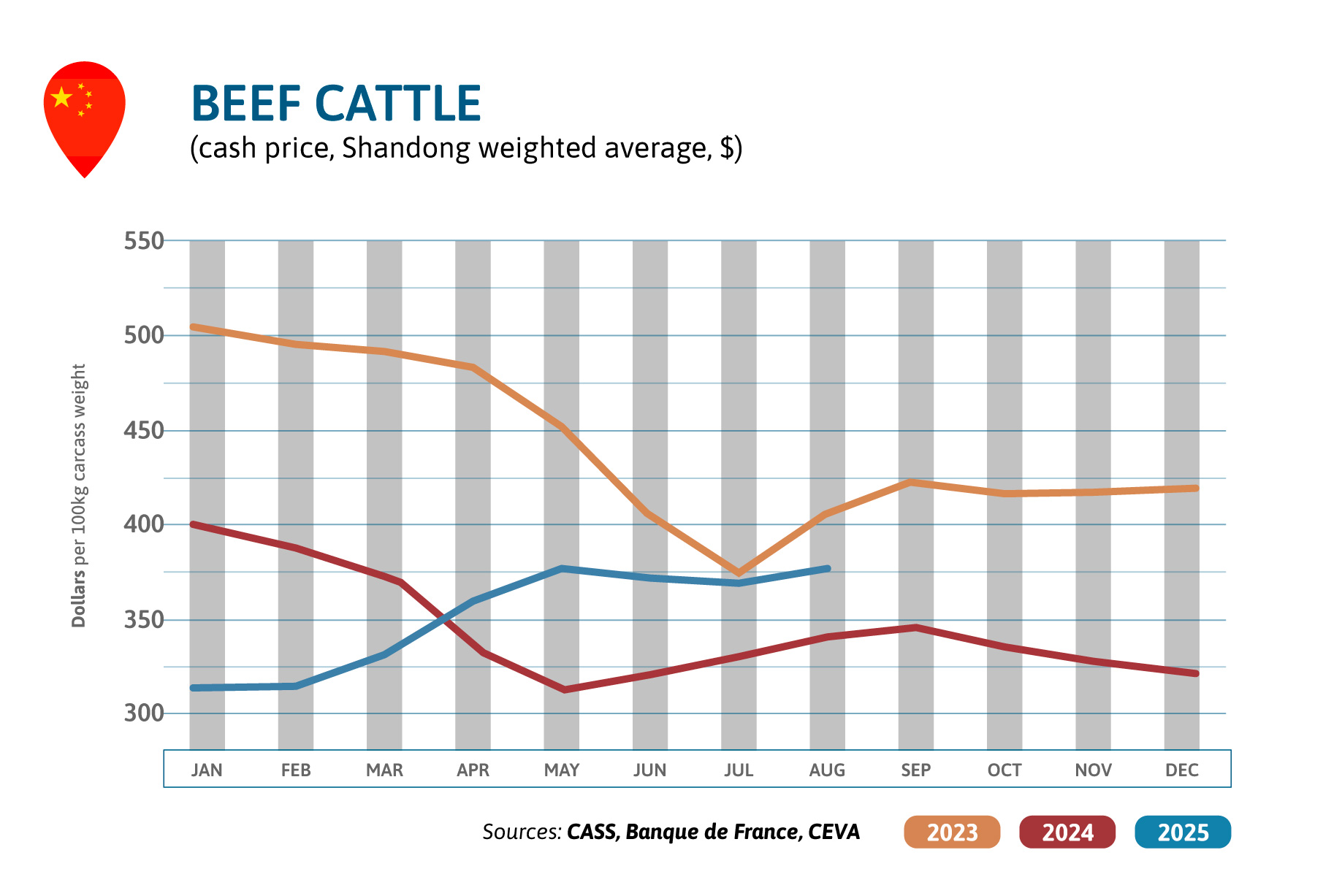

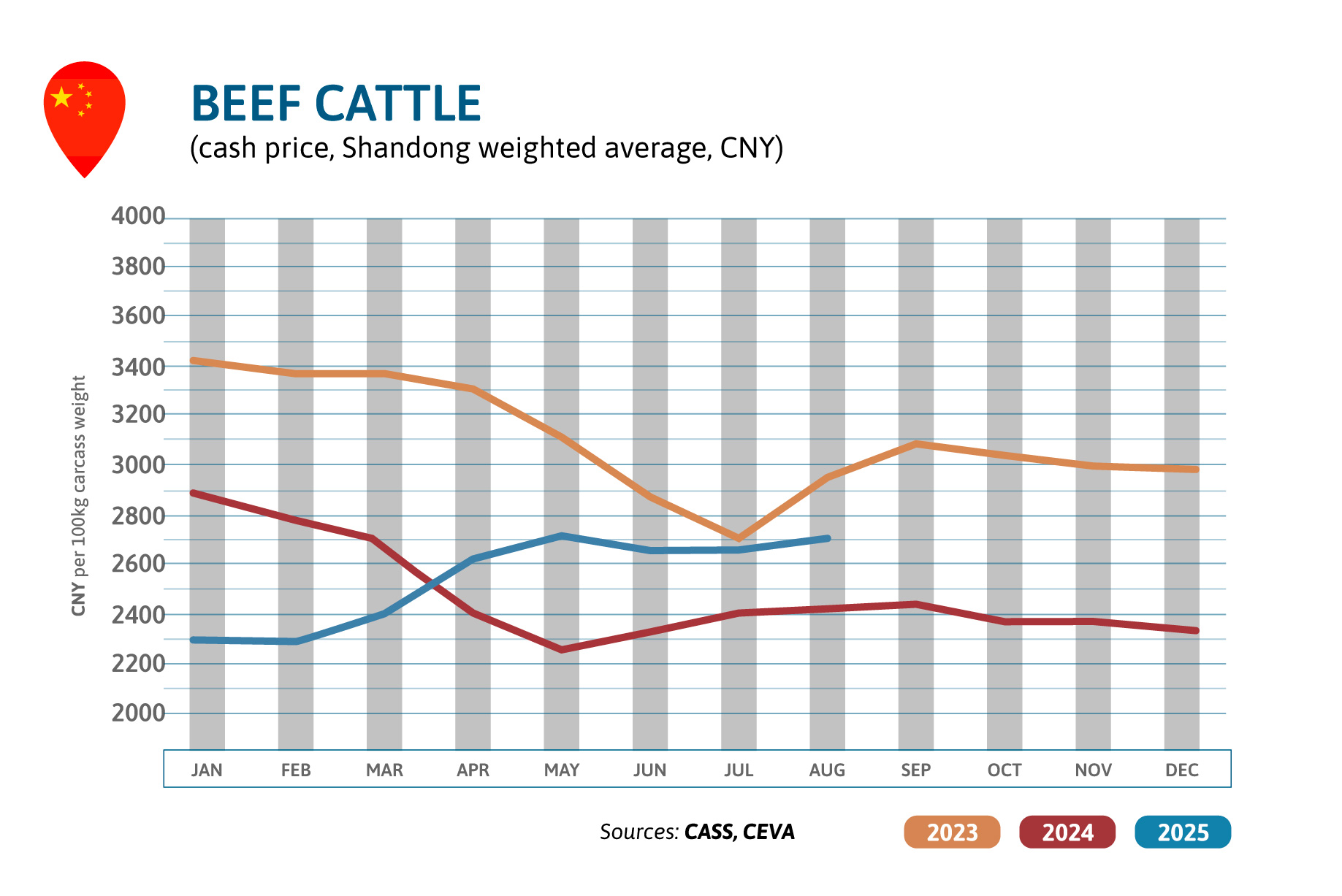

China Beef Market: Prices Recover Slowly, Imports Accelerate

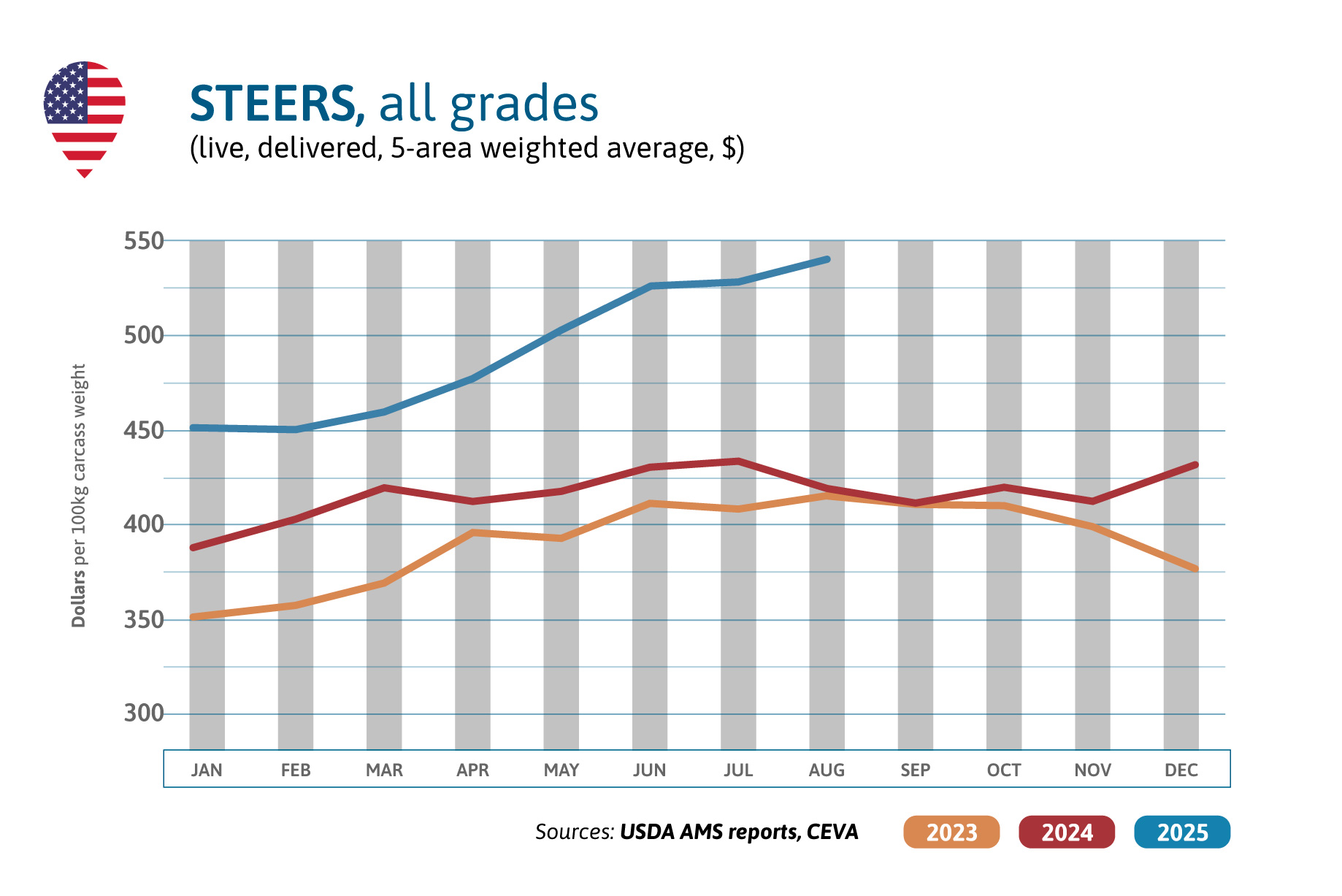

United States Beef Prices: Supply Constraints and Trade Shifts

Source: