The Milk Market (Baptiste Buczinski)

GLOBAL RESULTS: MILK PRICE MARKET

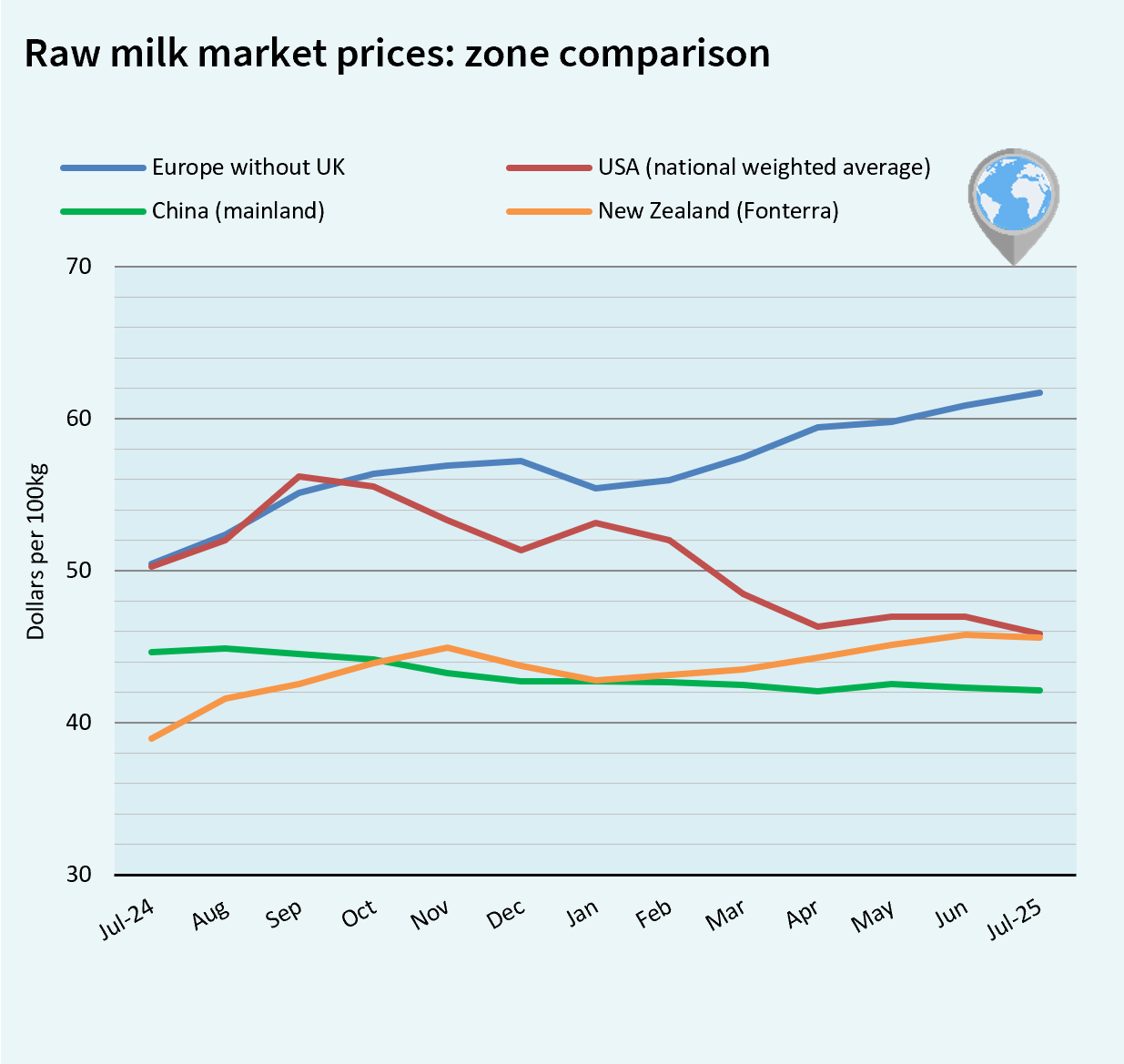

Milk production continues to grow in the main production regions, except in Australia. The increase is mainly driven by Argentina and the United States. Butter prices are generally trending downward. This trend is more pronounced in the United States and Oceania than in Europe. Milk prices are under pressure.

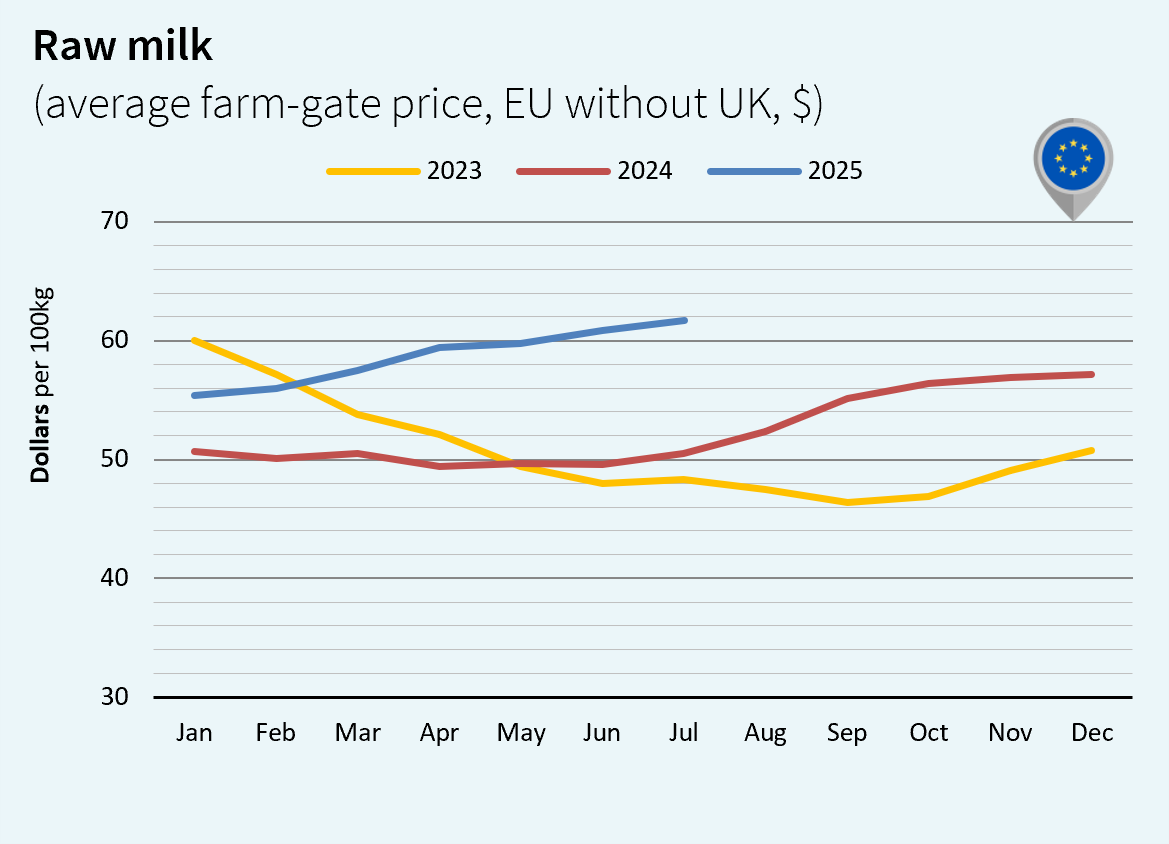

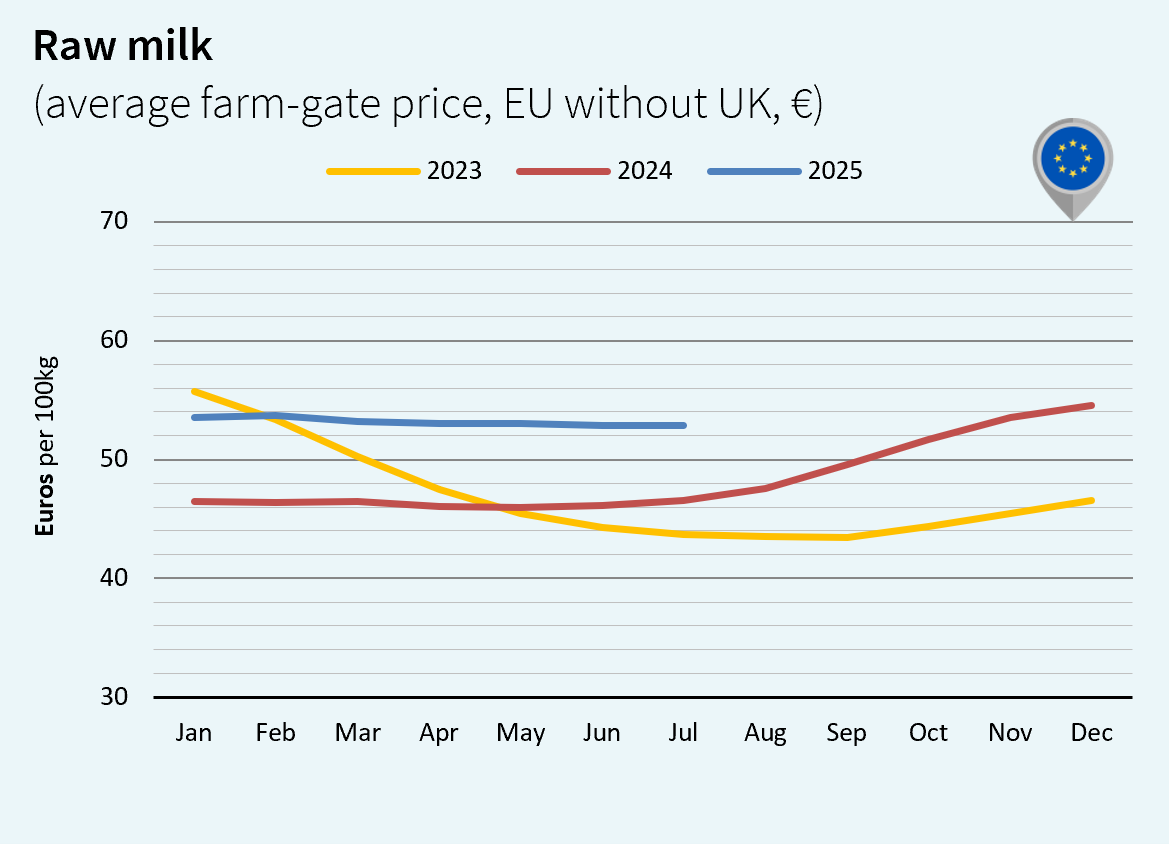

MILK PRICES IN EUROPE

In July 2025, European milk collection showed solid growth (+1.3% compared with July 2024). Collection increased in the main European producing countries, except in Germany where production has been declining for a year. In euros, the average milk price fell slightly, driven by decreases in Poland and Ireland. However, with the appreciation of the euro against the dollar, the European milk price rose in U.S dollar terms, at US$61.69/100 kg (+1% vs. June 2025 and +22% vs. July 2024).

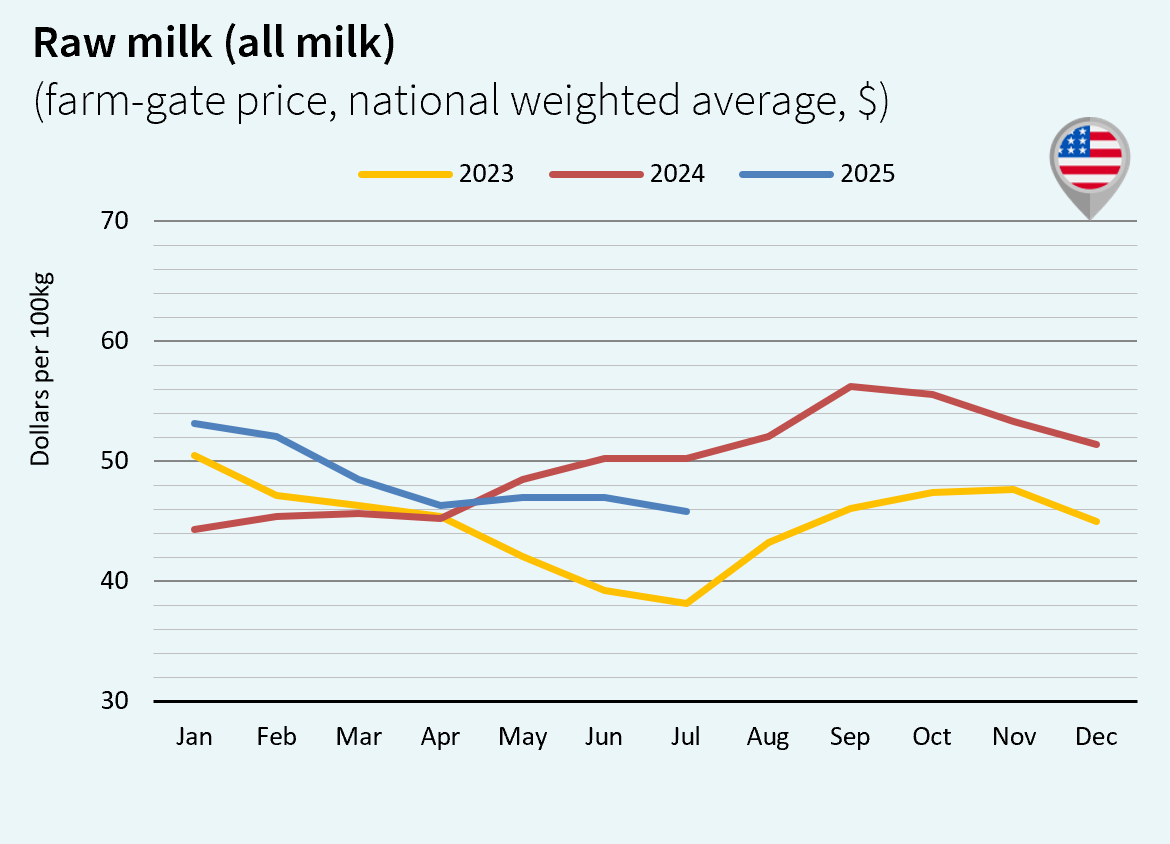

USA MILK MARKET TRENDS

In the USA, since the beginning of the calendar year, milk production has continued to grow year-on-year. In July 2025, it recorded an increase for the seventh consecutive month, reaching 8.88 million tons (+3.4% compared with 2024). Dairy product availability (especially butter) is high, and exports are price competitive. While the milk price paid to producers declined in the first half of 2025, feed costs also fell. The margin level remains attractive. In July, the US raw milk price was down, at US$45.86/100 kg (-2% vs. June 2025 and -9% vs. July 2024).

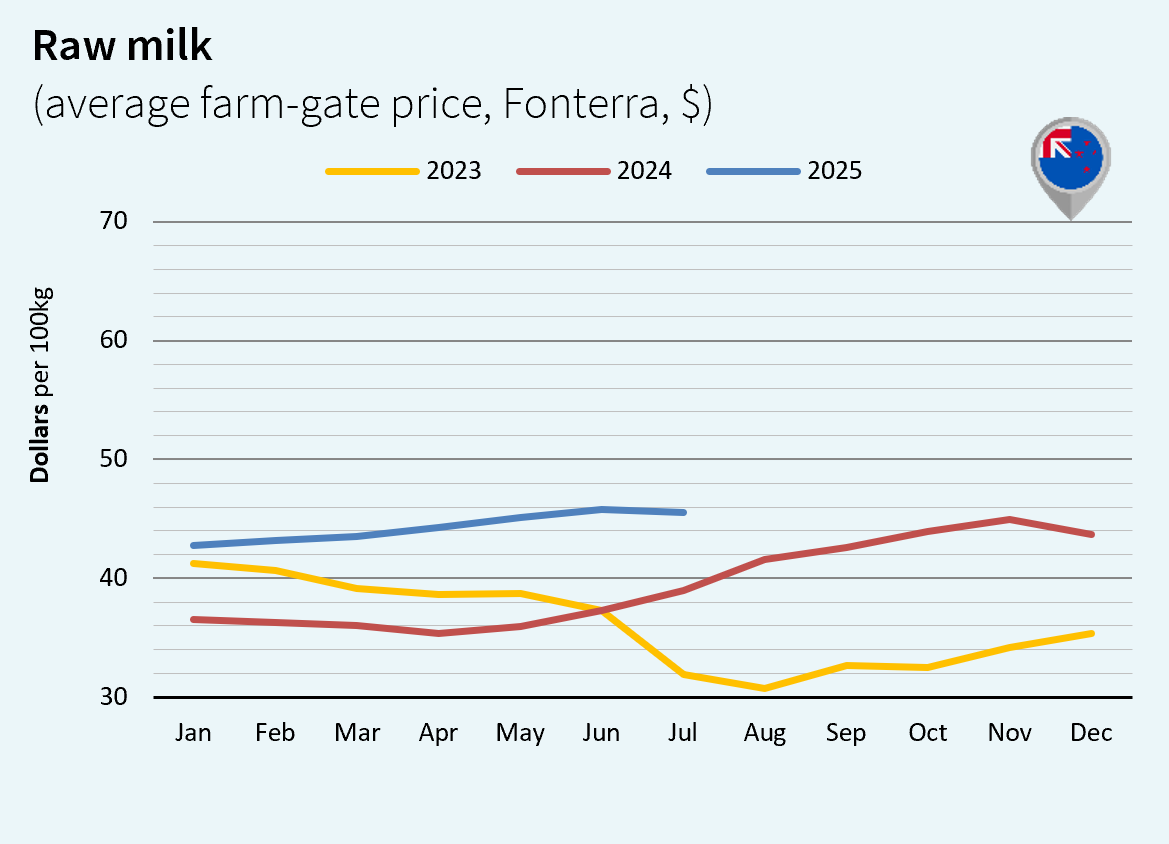

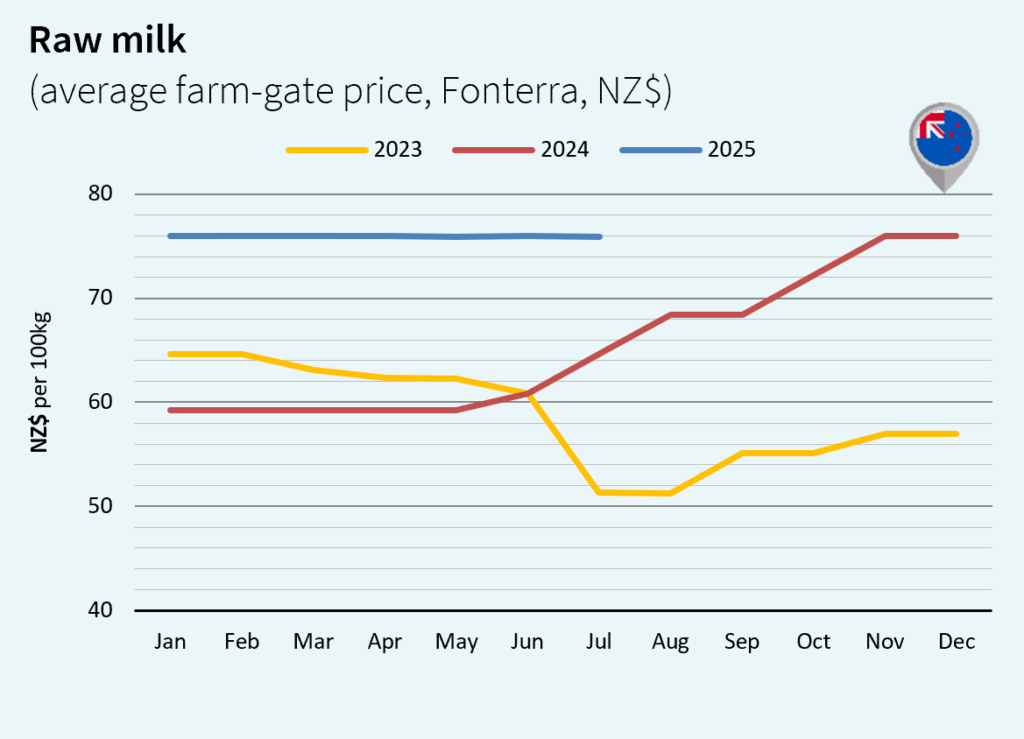

MILK MARKET PRICES IN NEW ZEALAND

In New Zealand, after a particularly dynamic June (+14.5% vs. 2024 at 261,000 t), production growth in July was more moderate (+0.6% at 312,000 t). The levels reached in 2025 set absolute records for the months of June and July. Prices in New Zealand are particularly attractive for producers. After a record price in the 2024/25 season, the price announced at the start of the 2025/26 season remained strong. In July, the NZ raw milk price remained strong in NZ$ and in US$, at US$45.57/100 kg (-0.5% vs. June 2025 but +17% vs. July 2024).

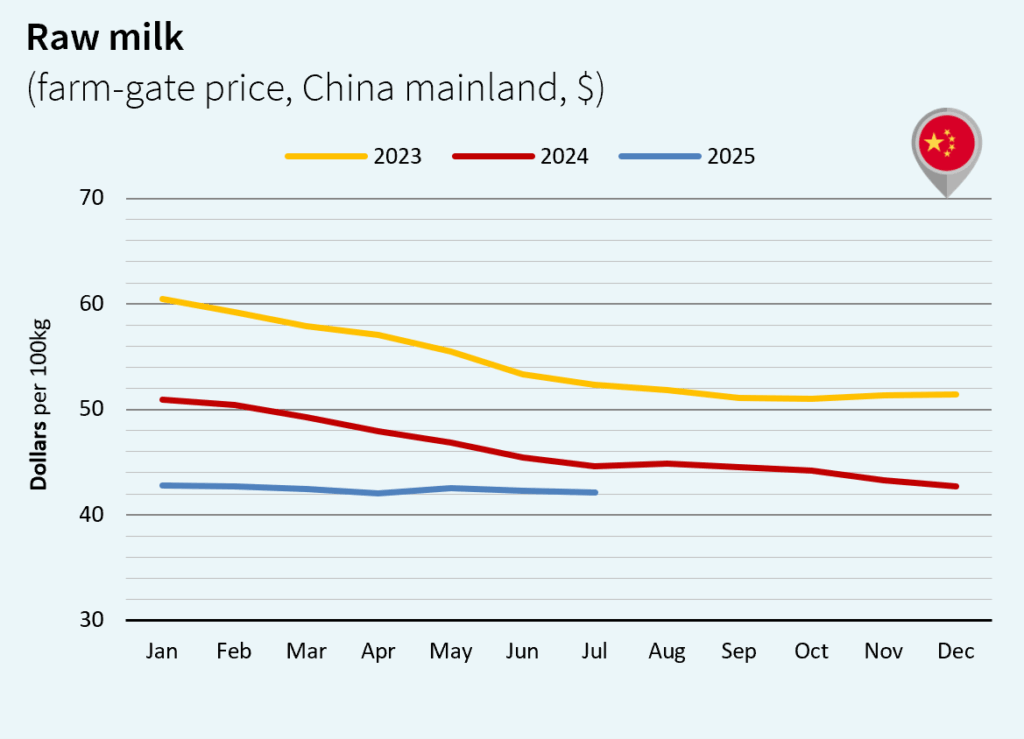

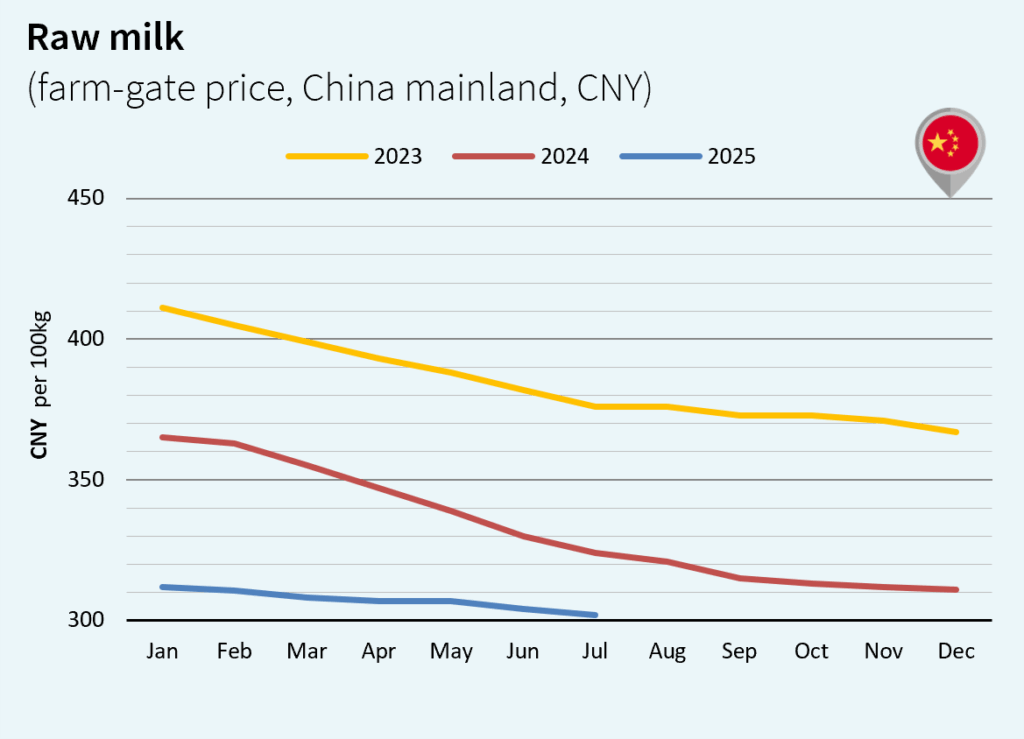

MILK MARKET PRICE IN CHINA

Both milk production and dairy market remained relatively subdued in China, despite some signs of recovery at the beginning of 2025. Recently, China added 6 months to anti-subsidy probe into EU dairy imports, until February 2026. Flows originating from the EU could be disrupted. Meanwhile, Chinese raw milk price was almost flat in July, at US$42.10/100 kg (-0.5% vs. June 2025 and -6% vs. July 2024).

Source: