The Milk Market (Baptiste Buczinski)

Our February Milk Market Outlook is here! EU milk prices keep rising, while the US sees declines. NZ stays strong, and China’s drop is slowing. Get key insights on production, prices, and market trends to stay ahead in the evolving dairy industry.

Don´t forget to SEE and share today!

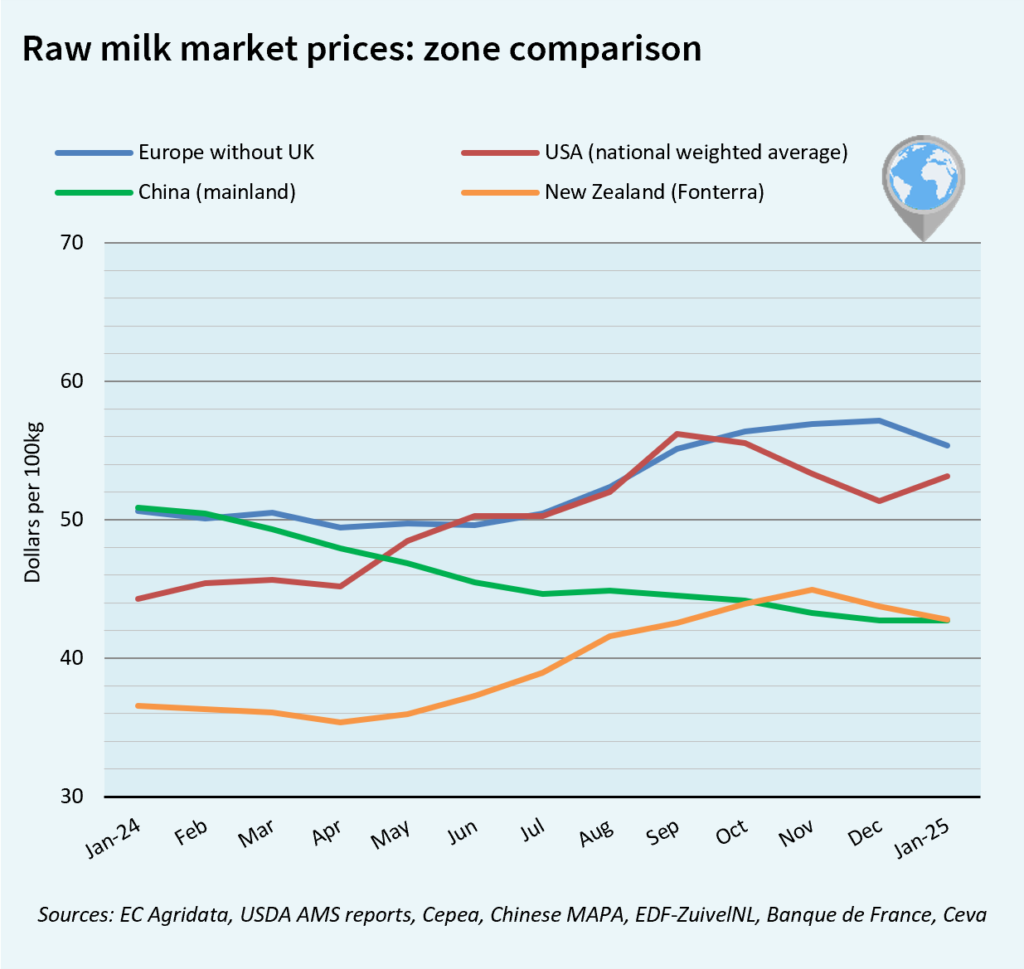

GLOBAL MILK MARKET PRICES

Since the beginning of the year, dairy ingredients prices show divergent trends depending on their origin: rising in Oceania, falling in the United States, and a more mixed situation in the EU. Raw milk prices remained strong, except in China.

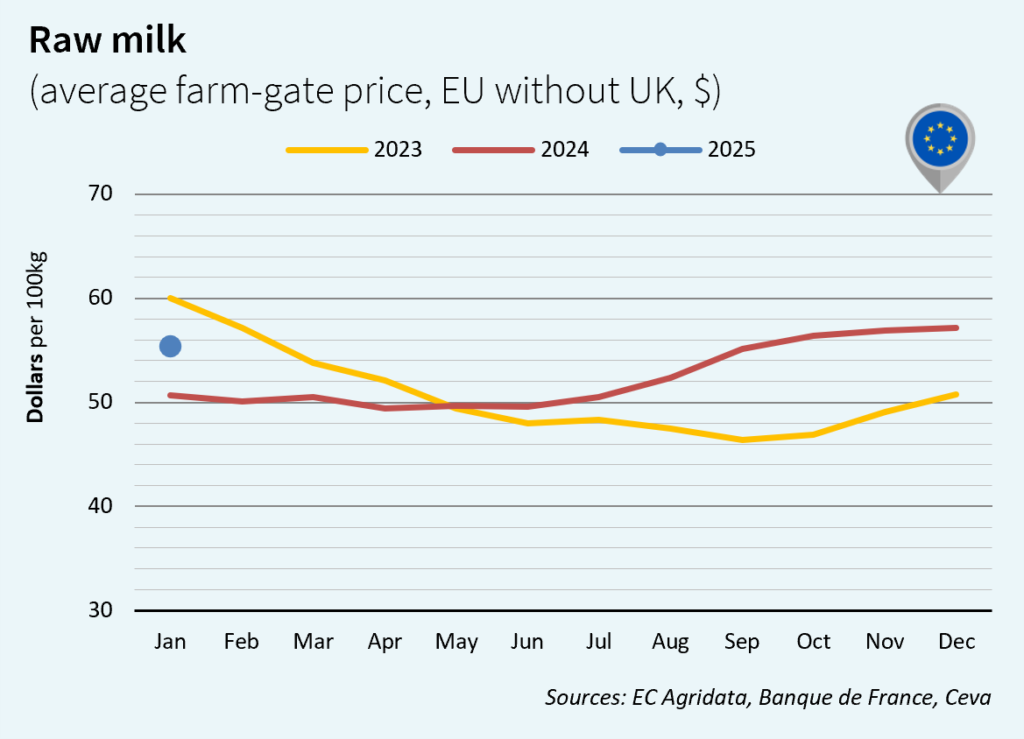

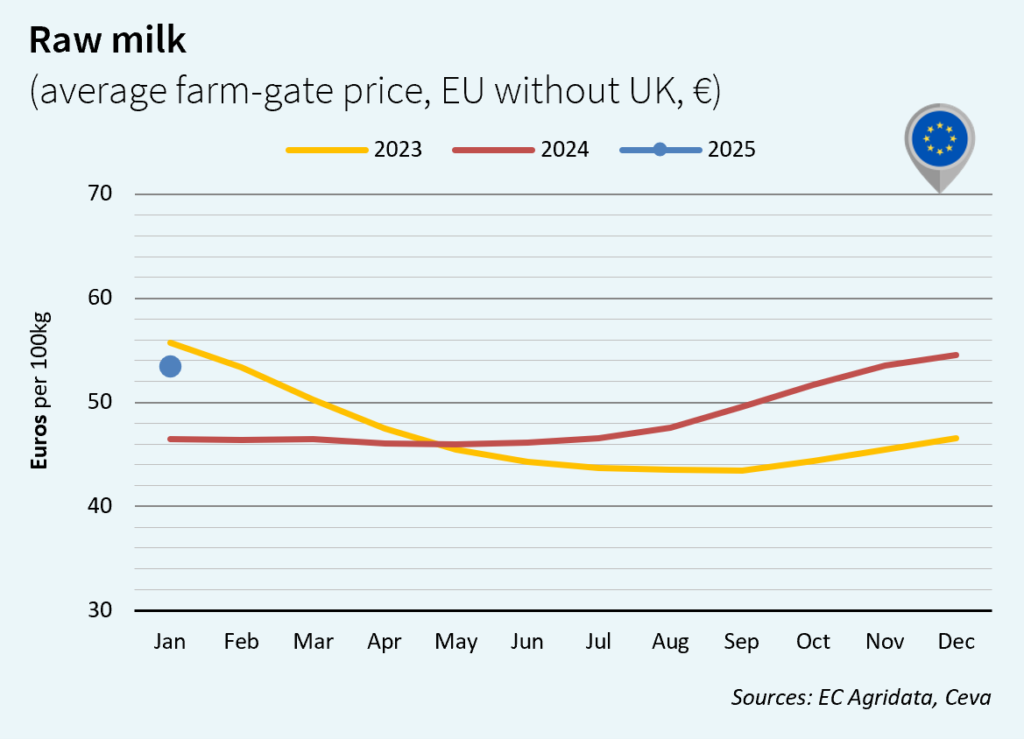

EUROPE´S MILK MARKET PRICES

Milk deliveries are affected in part of the EU by the bluetongue disease outbreak. In facts, the impact of bluetongue disease on dairy productivity remained strong. Dairy and powder markets remained flat. Cases of foot-and-mouth disease (FMD) have been discovered in a German farm (herd of water buffaloes), with some effects on trade. EU raw milk price was down but still strong, at US$55.38/100 kg (-3% /December 2024 but +20% /January 2024).

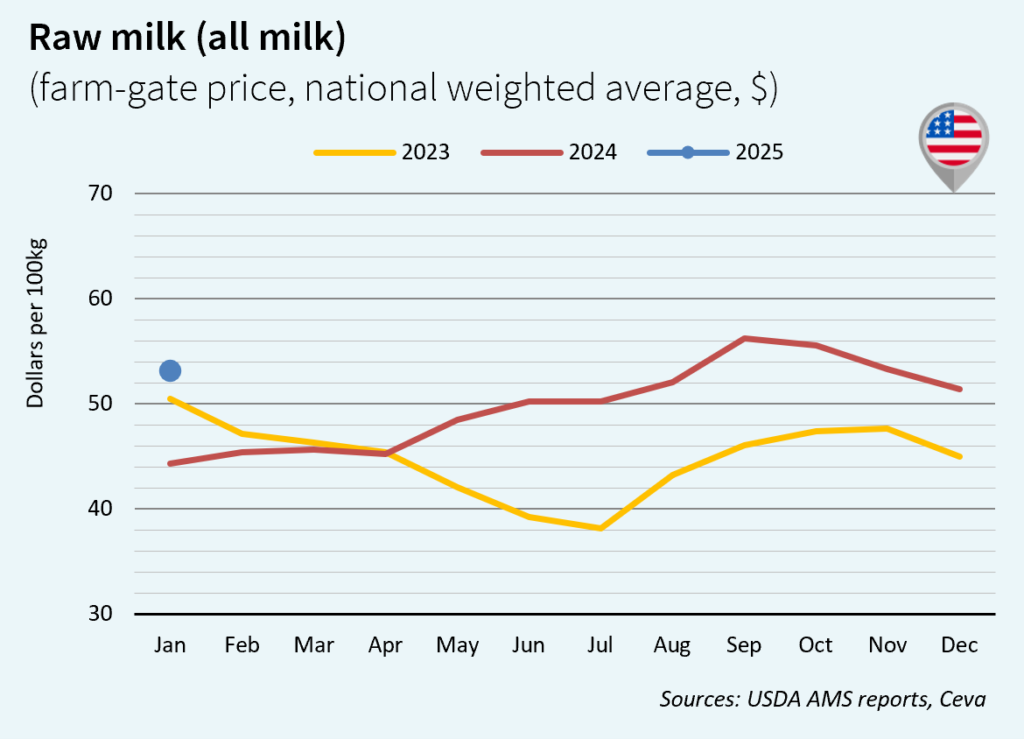

DAIRY MARKET TRENDS IN THE USA

Highly pathogenic avian influenza (HPAI) has significantly impacted dairy production in California, the top milk-producing state in the United States. In early 2025, the year-over-year decline in milk production in California was less pronounced but still significant (-6% /January 2024). Nationwide, milk production remained stable year-over-year (+0.1% /2024 at 8.66 million tons). The butter and powder markets are unstable and weighing on prices as President Trump intensifies trade retaliations. But US raw milk price was on the rise in January, at US$53.13/100 kg (+3% /December 2024 and +20% /January 2024).

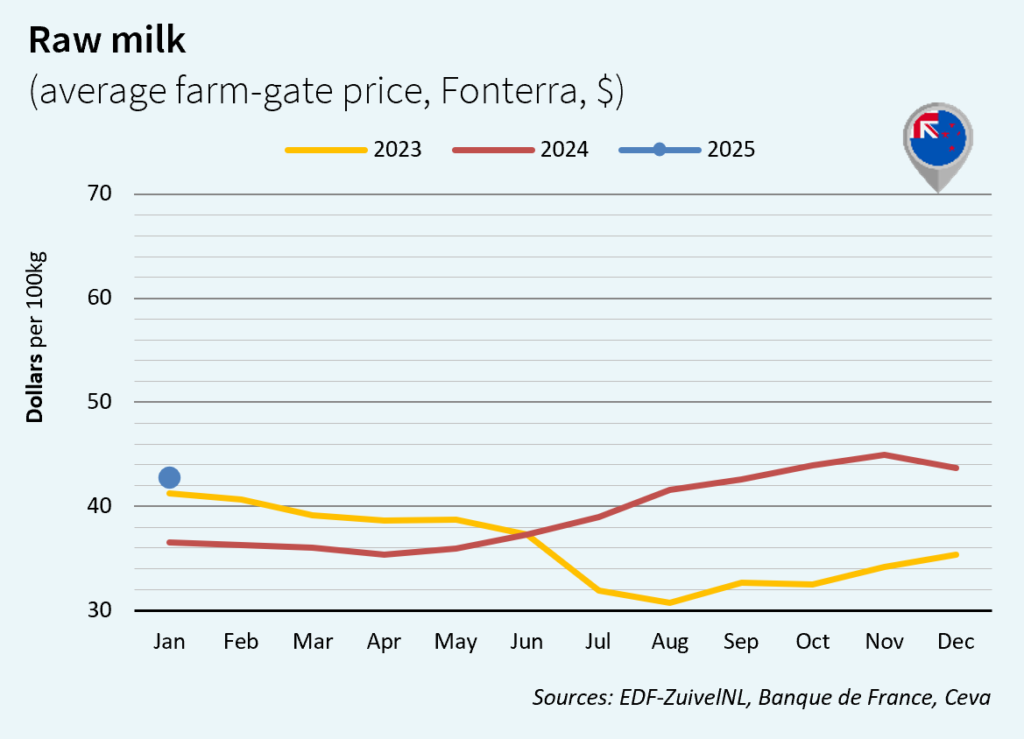

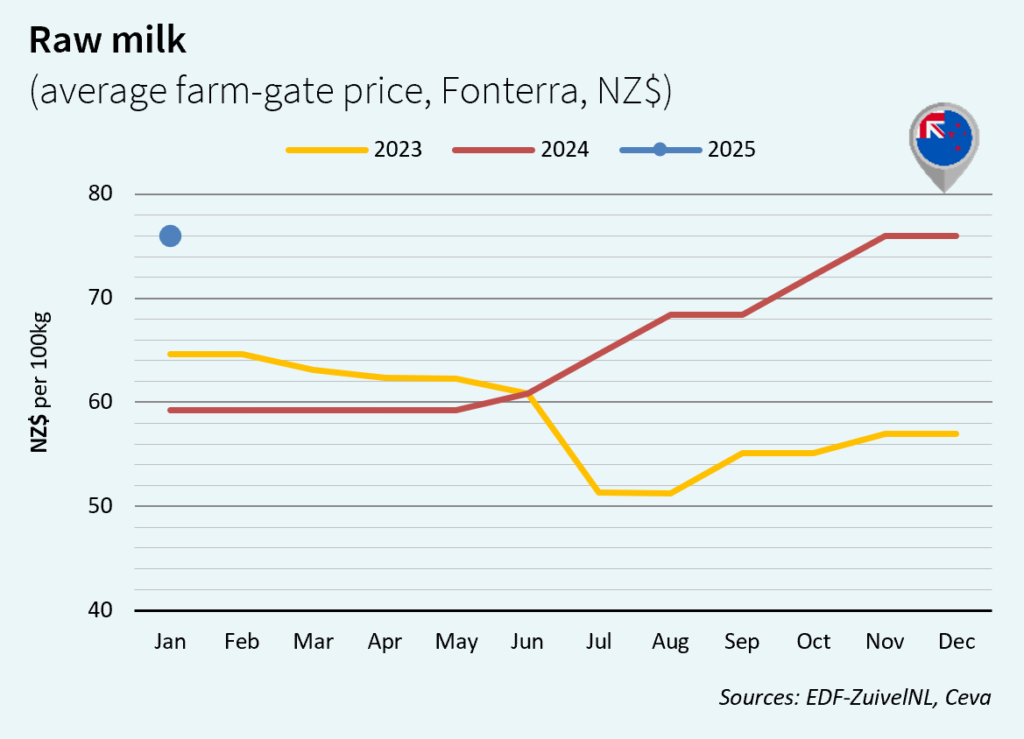

MILK TRENDS IN NEW ZEALAND

In New Zealand, since the start of the 2024-2025 dairy season last June, milk collection has remained relatively strong. January 2025 was no exception: 2.39 million tons of milk were produced in the country (+2.6% /2024). Demand for dairy products has been supporting prices for several months. NZ raw milk prices were still strong in January, but declining due to a weaker New Zealand dollar, at US$42.78/100 kg (-2% /December 2024 but +17% /January 2024). A drought episode is settling in the north of the country.

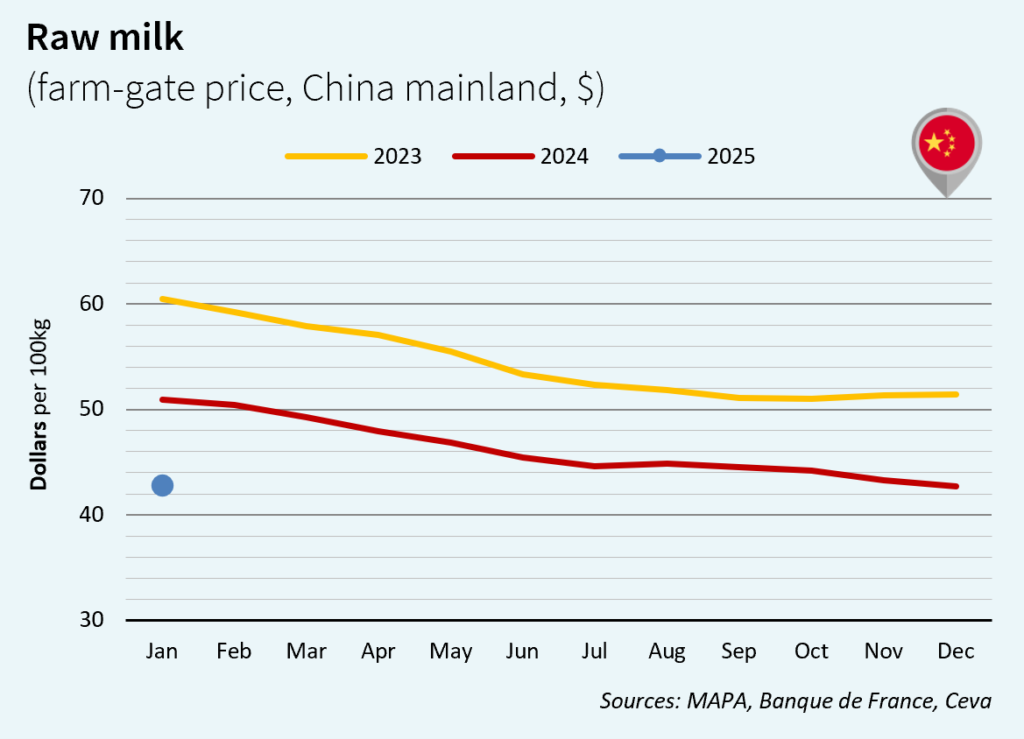

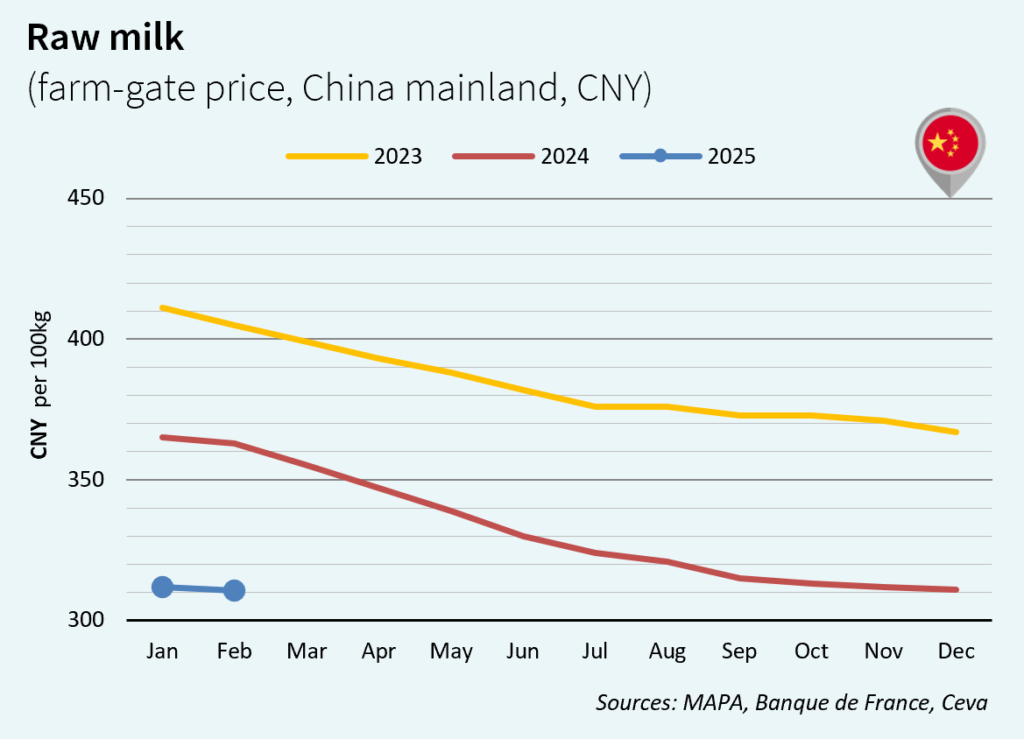

CHINA’s MILK MARKET

The dairy market situation in China remains complicated. 2024 saw domestic milk production progressively decline year-on-year, with Rabobank estimating a 5% reduction in production for the second half of 2024 as low farmgate prices and high production costs led to industry exits. Driven by lower production levels, But Rabobank expects China’s net imports of dairy products to rise by 2% in 2025, reversing a three-year decline. Meanwhile, in January, Chinese raw milk prices remained flat in US dollars at US$42.75/100 kg (= /December 2024 but -16% /January 2024).

Source: