The Milk Market (Baptiste Buczinski)

Our January Milk Market Outlook is here! EU milk prices keep rising, while the US sees declines. NZ stays strong, and China’s drop is slowing. Get key insights on production, prices, and market trends to stay ahead in the evolving dairy industry.

Don´t forget to SEE and share today!

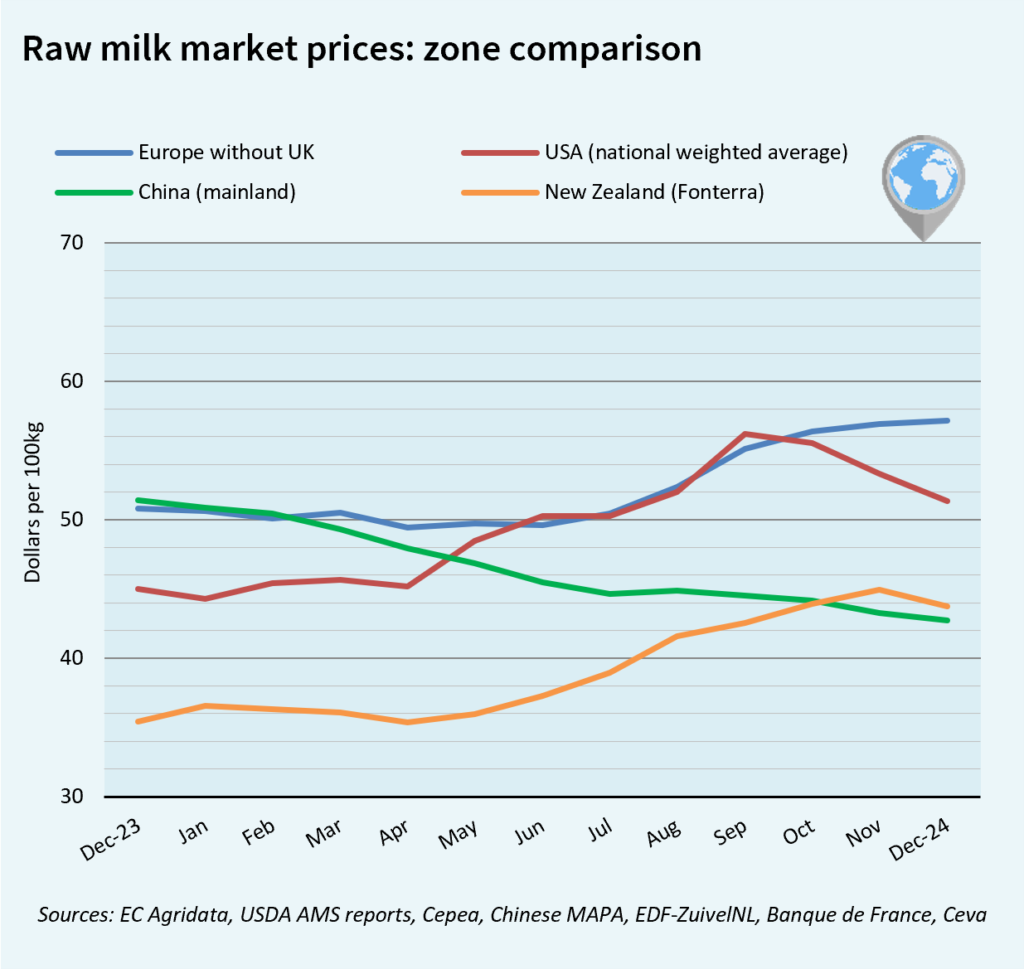

GLOBAL MILK MARKET PRICES

In December, raw milk prices were still rising in Europe. Prices were down in other areas in US$, mainly due to the strengthening of the US$ against other currencies. Chinese price decline appears to be slowing.

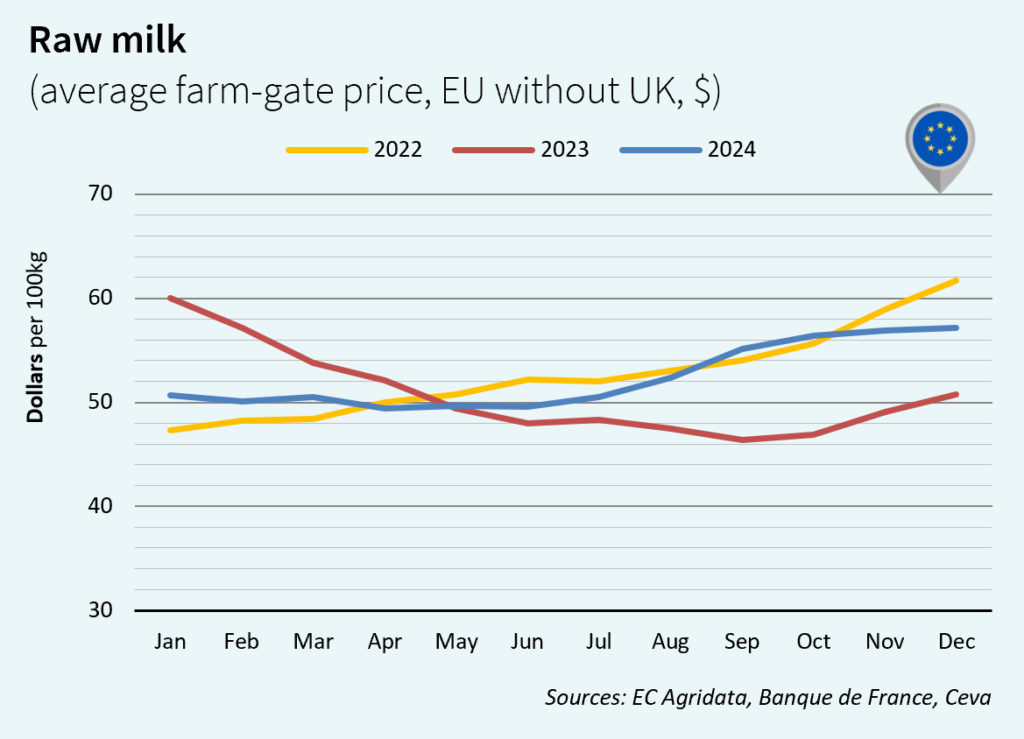

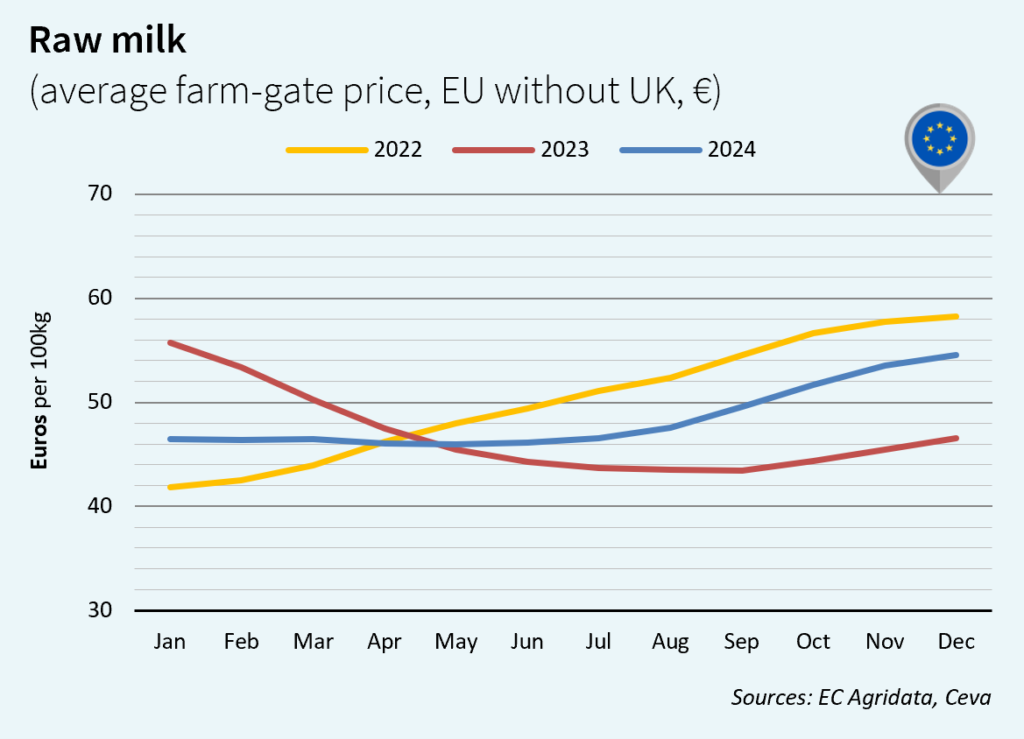

EUROPE´S MILK MARKET PRICES

EU raw milk price was still on the rise in December in euro (+1.9% compared to dec. 2024) and in US$ (+0.4%). From one year to the next, the increase reaches +17% in euro and +12% in US$. These good prices have boosted the collection. EU milk deliveries increased in November 2024 by +1.7% (+180,000 tonnes) compared to November 2023. Prices for butter, cheddar and whey powder remain positive. Producers can still hope for price increases.

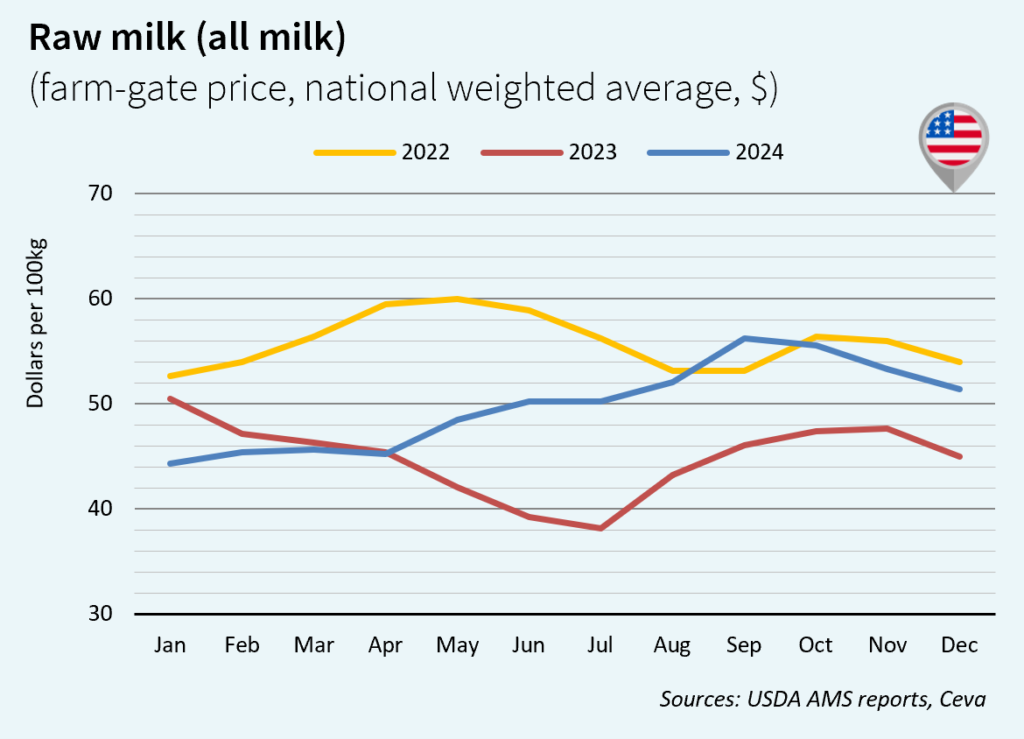

DAIRY MARKET TRENDS IN THE USA

US raw milk price continued to decline in December (-3.7% compared to November 2024) but remained well above its 2023 level (+14%). In December 2024, US milk production was down 0.5% from the year before. California production was down 6.8%, due to the avian flu, whereas production in the rest of the U.S. increased by 1.0%. The USDA predicts a 0.8% growth in total milk production in 2025 compared to 2024. Strong demand in the U.S. and less dairy in storage might help keep prices up.

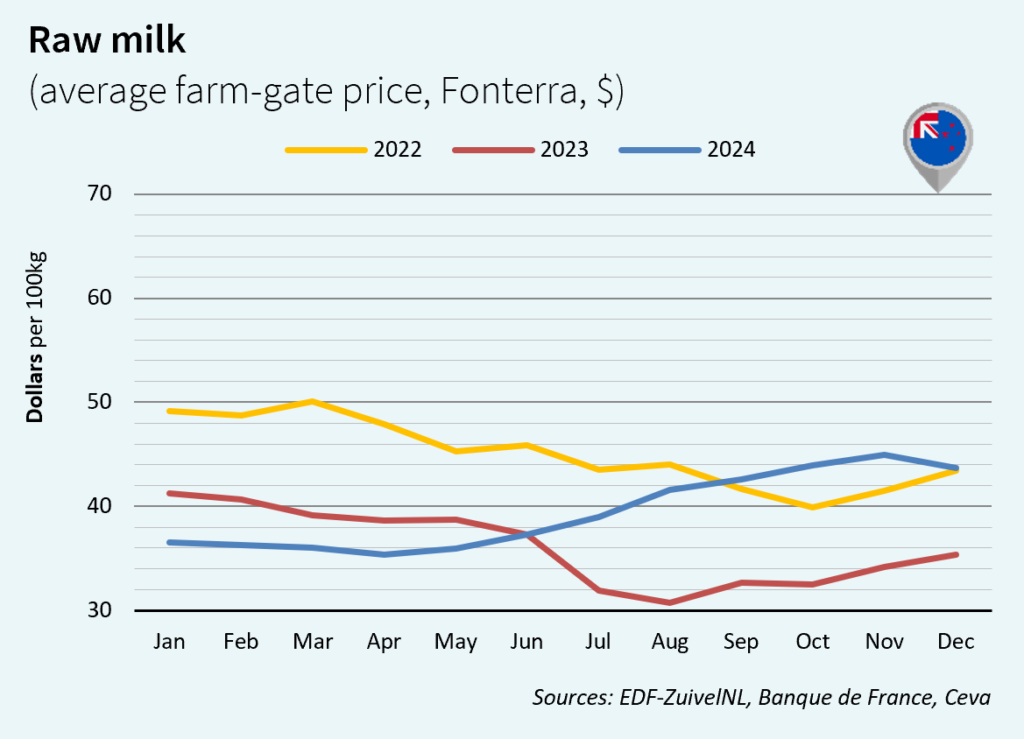

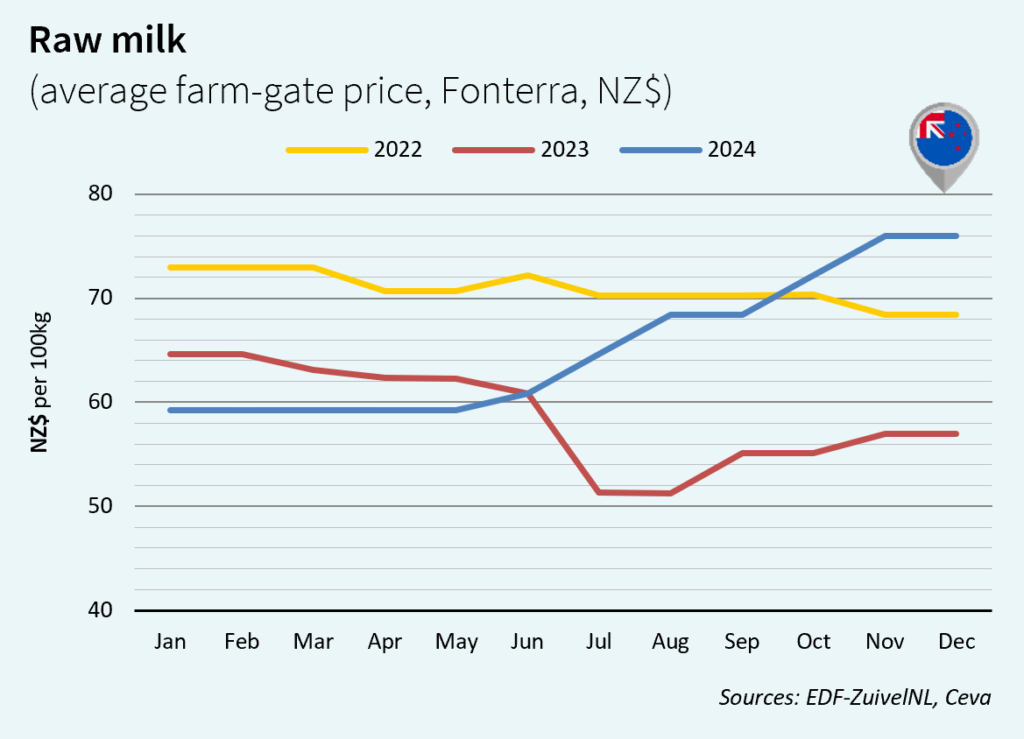

MILK TRENDS IN NEW ZEALAND

In December, NZ raw milk price was still high in NZ$, but slightly down in US$ compared to the previous month. At 76 NZ$/100 kg, it was significantly higher than last year (+33% /December 2023), even in US$ (+23%). These good prices boosted production in 2024. December production was up 1.4 percent on a tonnage basis compared to a year earlier. Fonterra has announced higher forecast farmgate milk price in 2025 as demand for cheese and WMP remains strong in key markets (Japan, South-East Asia, Algeria, Indonesia…).

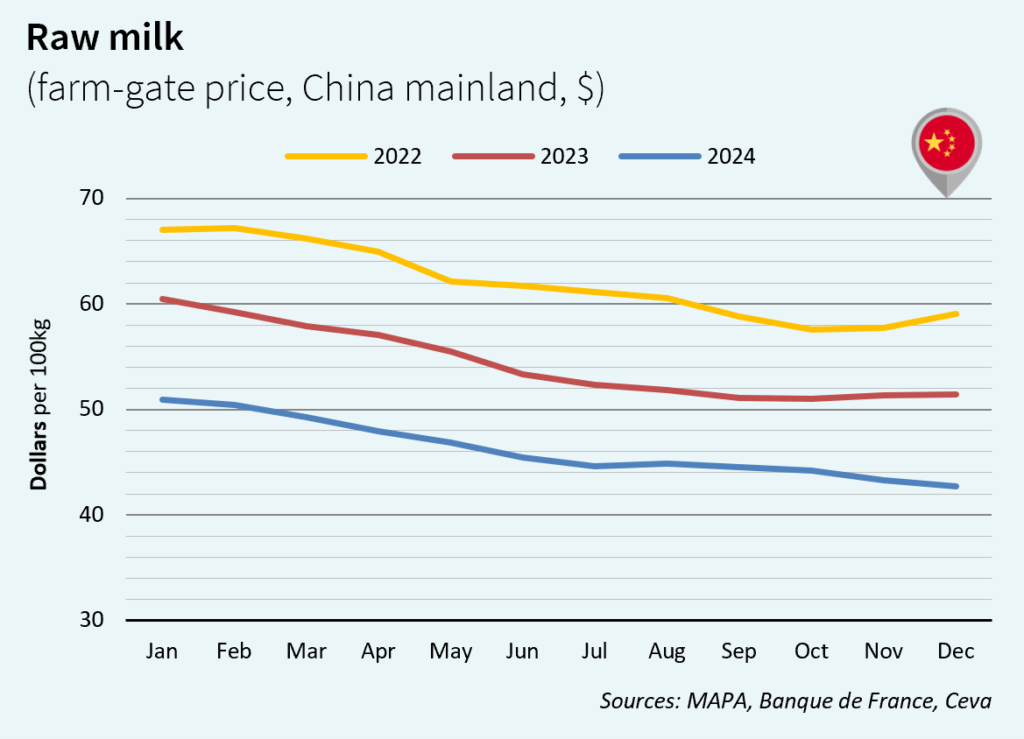

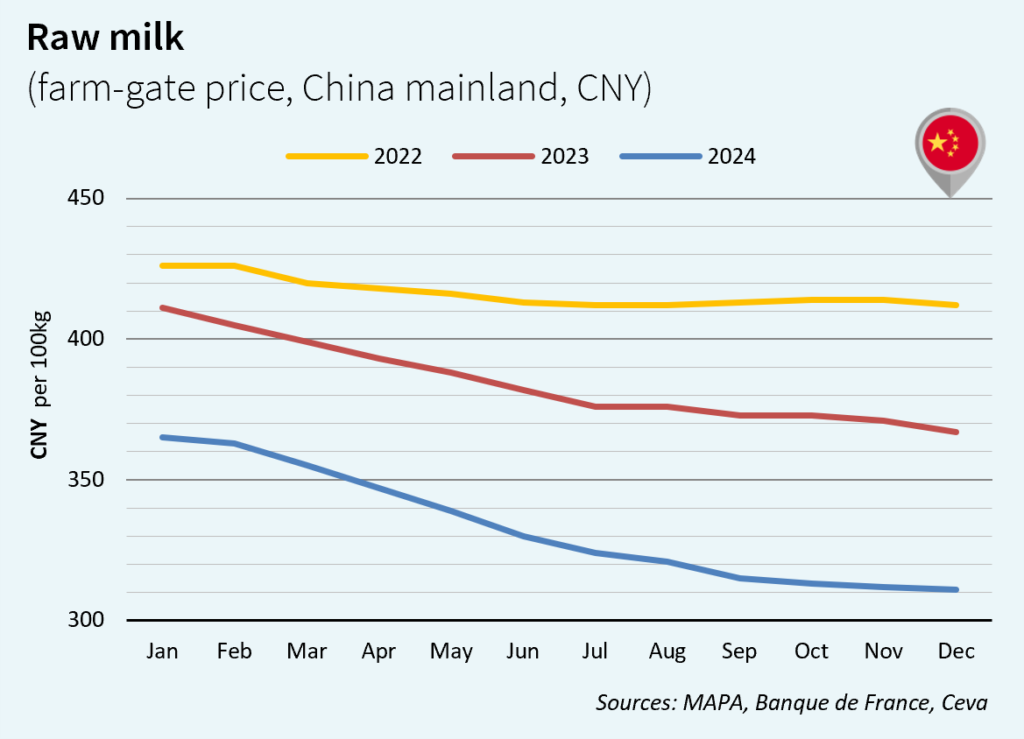

CHINA’s MILK MARKET

China’s milk price decline showed signs of slowing in December. Raw milk price only fell by 0.3% /November in national currency. However, it was still weak in USD, at 42.71 US$/100 kg (-17% /December 2023). The National Bureau of Statistics of China announced a drop in annual milk production in 2024 by 2.8% compared to 2023. This readjustment follows a sharp increase of 36% between 2018 and 2023. Faced with slowing demand from 2023, supply had to adjust. It is expected that supply and demand imbalances will ease during the year 2025.

Source: