The Milk Market (Baptiste Buczinski)

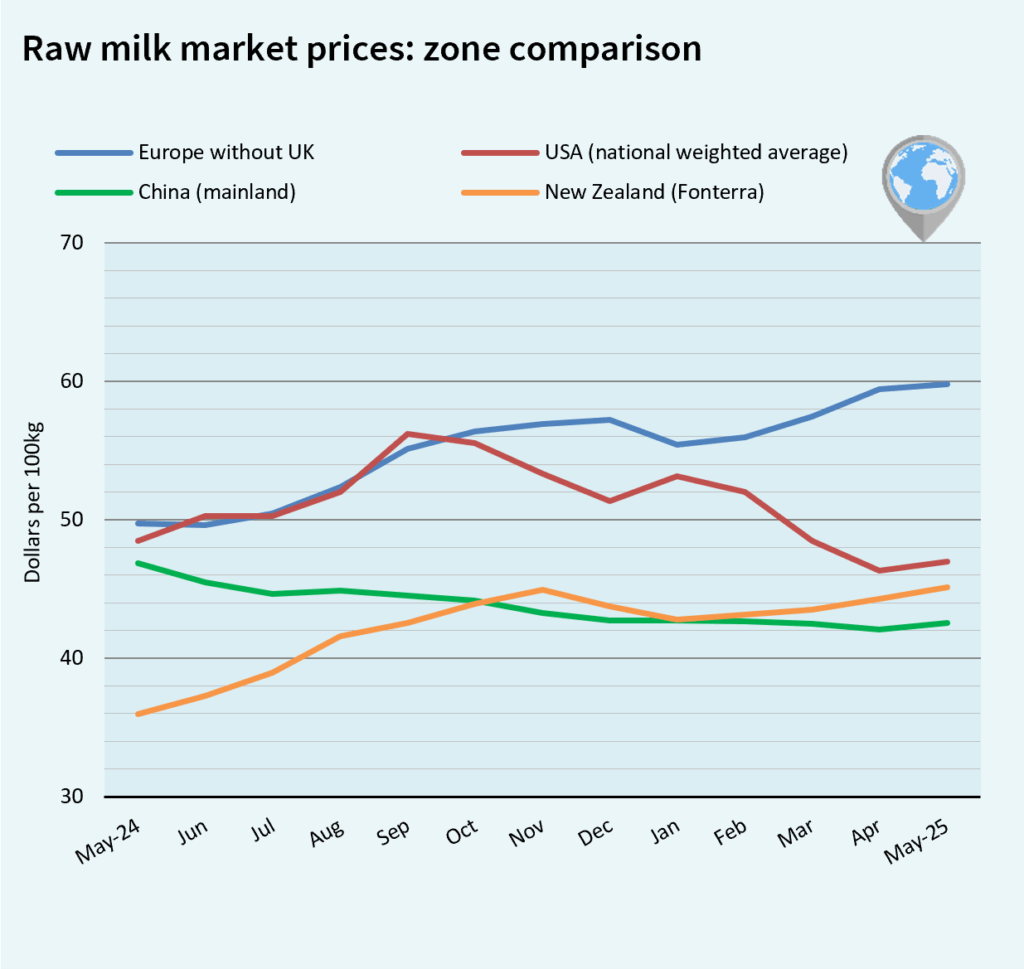

GLOBAL MILK MARKET PRICES

Driven in May 2025 by increased production in the United States, Argentina, New Zealand, and Belarus, the combined milk supply from the world’s main exporters was up year-on-year for the tenth consecutive month. Butter prices remain relatively firm in both Oceania and Europe and are recovering in the United States. Powder prices are converging, with a rebound in the U.S. and declines in Europe and Oceania.

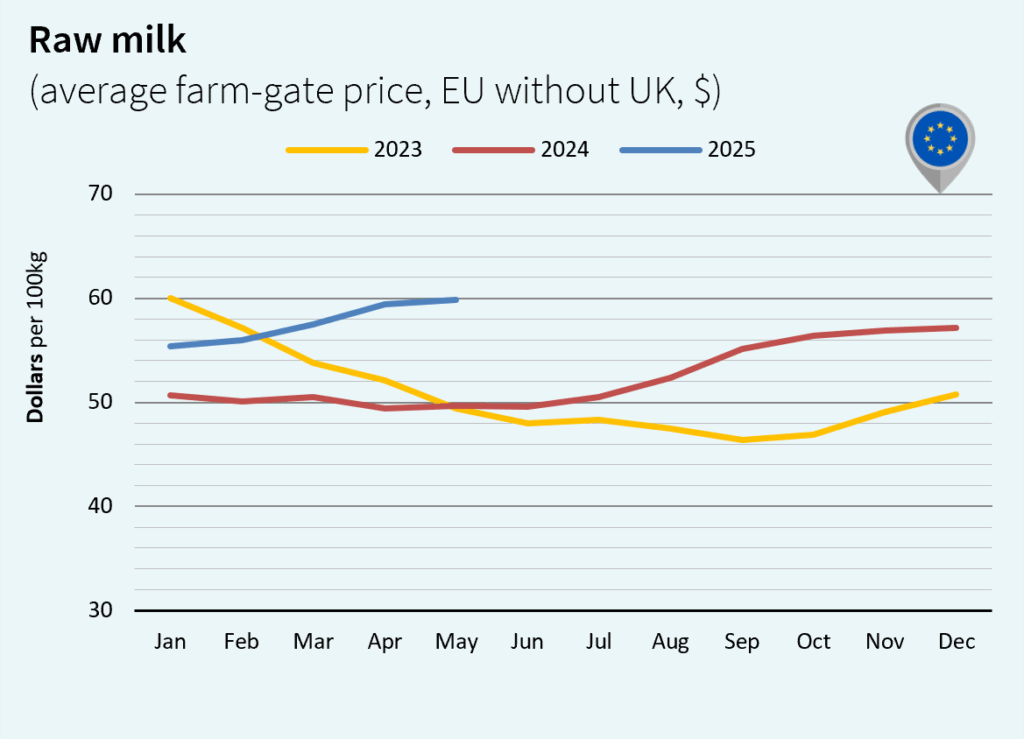

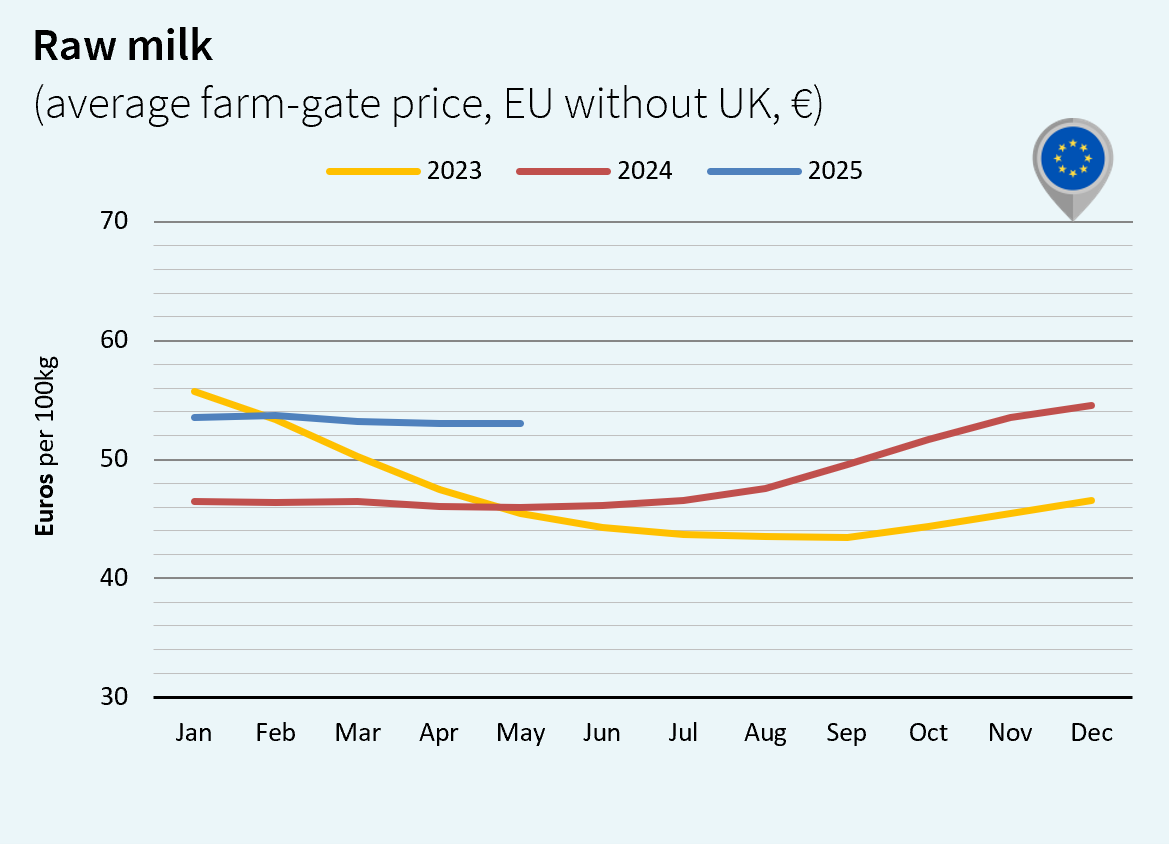

MILK MARKET IN EUROPE

For several months, milk collection in the EU-27 has been fluctuating between slight increases and decreases. In May 2025, it was stable year-on-year at 13.4 Mt (unchanged from 2024). Cumulatively, over five months, it remained slightly down at 61.8 Mt (-0.3% compared to 2024). Looking ahead, significant uncertainties persist due to the development of epizootics and the effects of excessive heat. Meanwhile, EU raw milk prices remained flat in euro, but stronger in US dollars. Milk prices reached US$59.81/100 kg (+1% vs April 2025 and +20% vs May 2024).

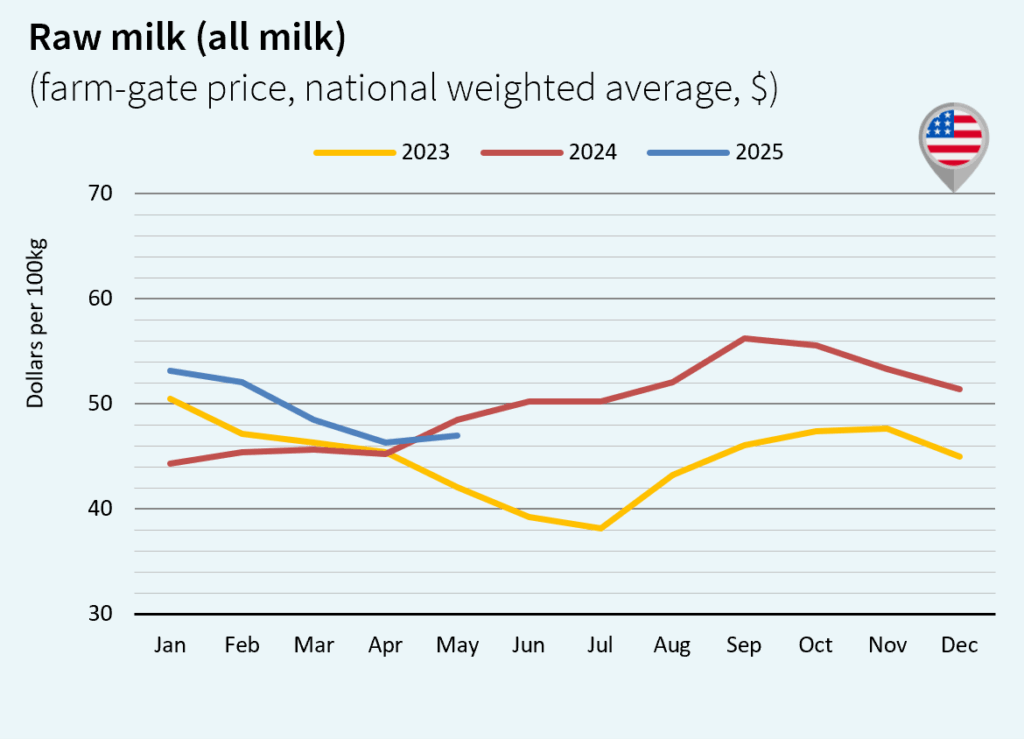

USA DAIRY TRENDS

In the United States, milk production has been rising year-on-year since January 2025. In May 2025, it increased by 1.6% to 9.04 million t, marking the fifth consecutive month of growth. While still limited, U.S. dairy ingredient prices are recovering. Exports of butter and butter-oil, available at competitive prices, reached 40,000 t (2.7 times higher than in 2024). As a result, the US raw milk price rose in May, at US$46.96/100 kg (+1.5% vs April 2025 but -3% vs May 2024).

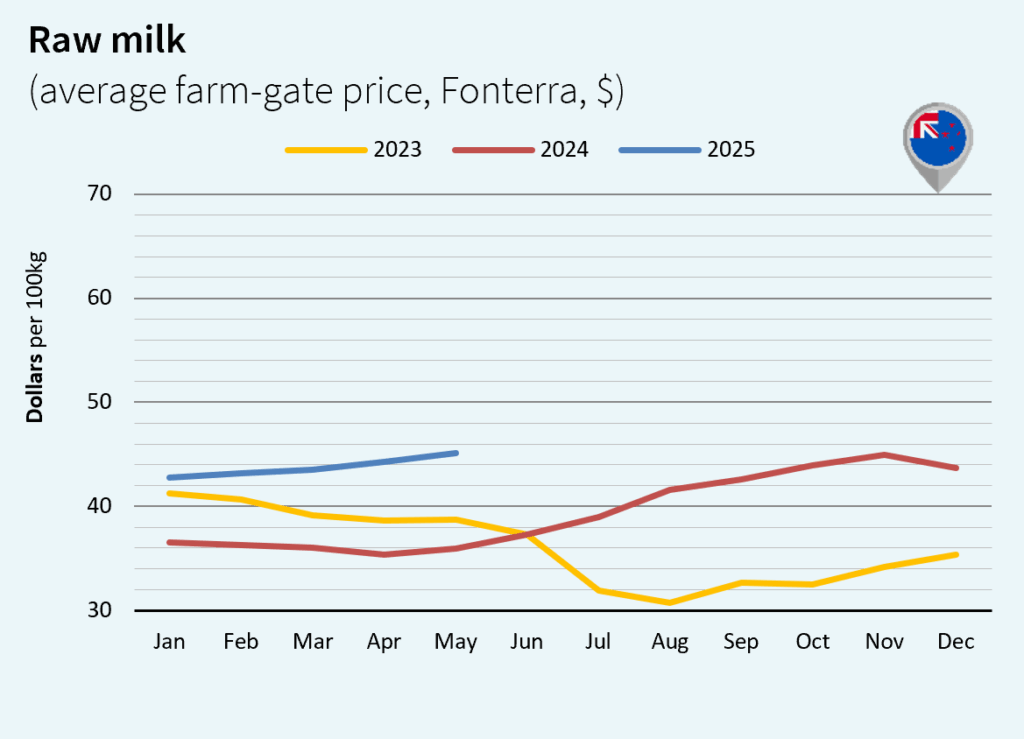

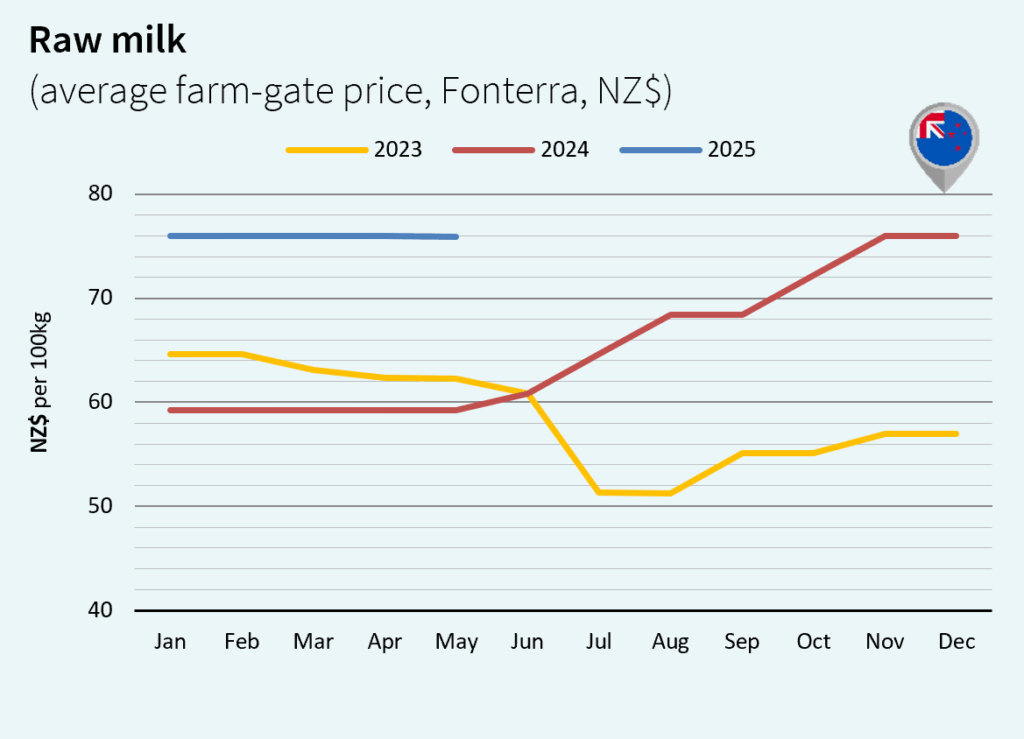

MILK MARKET PRICES IN NEW ZEALAND

In New Zealand, the end of the 2024/2025 dairy season in May 2025 saw a sharp year-on-year rebound in production (+8.3% vs 2024 to 993,000 t), setting a record for May milk production and surpassing collectors’ expectations. The 2024/2025 season was particularly favorable for New Zealand operators, especially for the cooperative Fonterra. At the end of the season, the NZ raw milk price remained firm in NZ$ and even stronger in US$, at US$45.11/100 kg (+2% vs April 2025 and +25% vs May 2024).

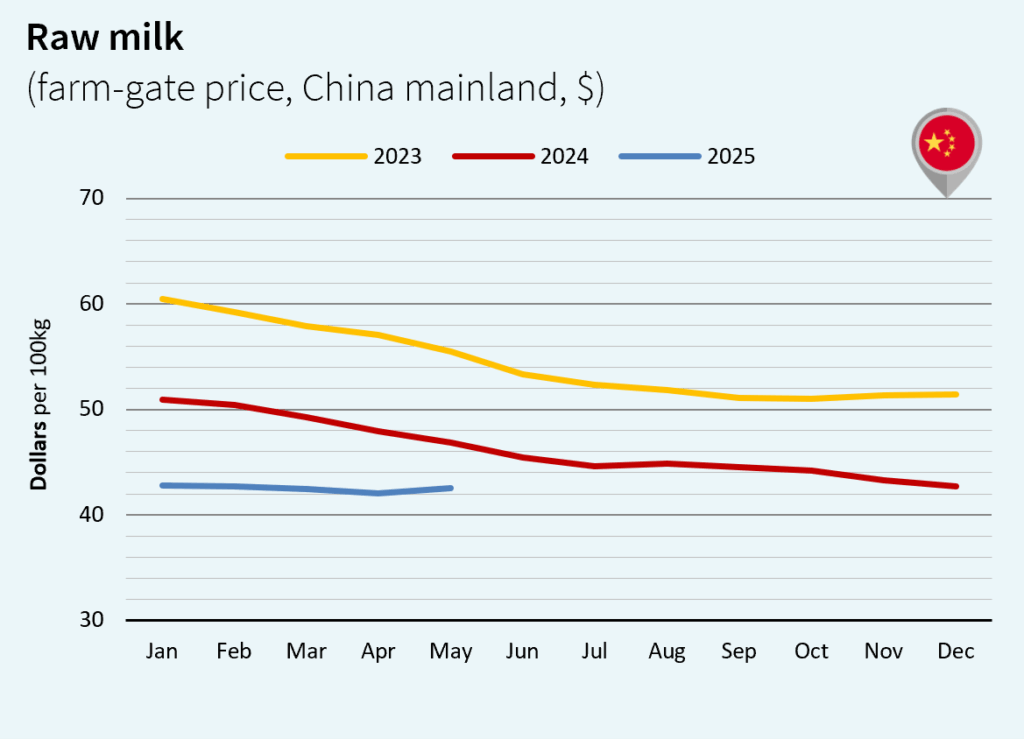

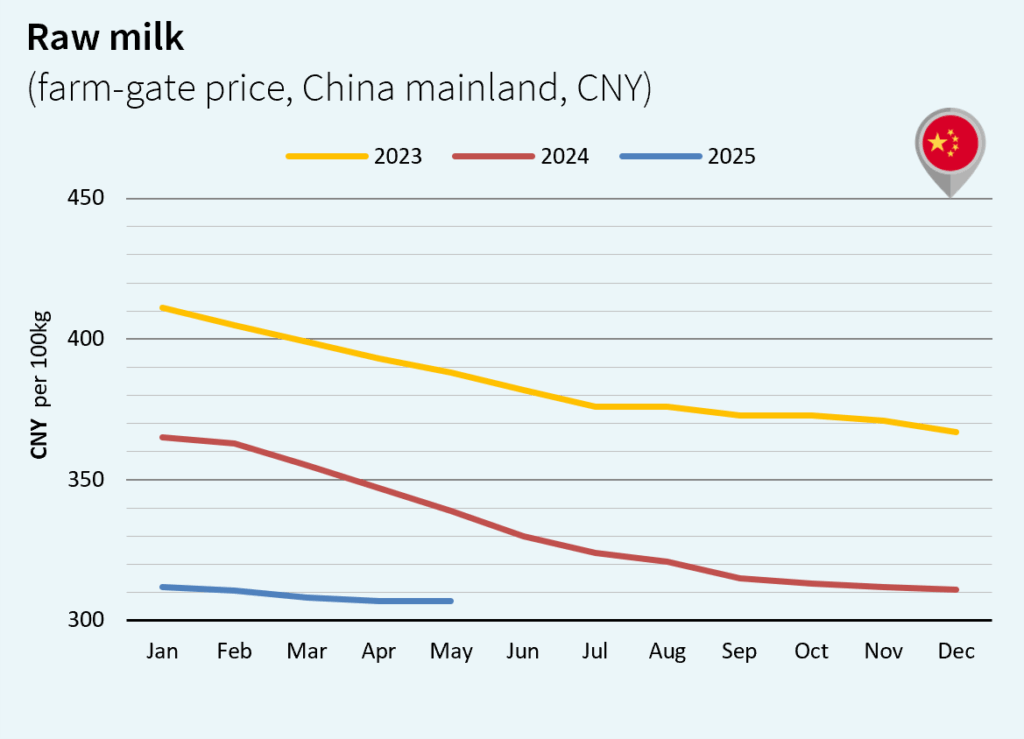

CHINA MILK PRICES

According to Rabobank, milk production in China is expected to decline by 2.6% year-on-year in 2025. A reduction in the number of cows and a weak farmgate price since the beginning of the year discouraged production increases. Import volumes are expected to rise due to reduced domestic supply and recovering demand. Meanwhile, Chinese raw milk price remained flat in Yuan but stronger in US$, at US$42.56/100 kg (+1% vs April 2025 but -9% vs May 2024).

Source: