The Milk Market (Baptiste Buczinski)

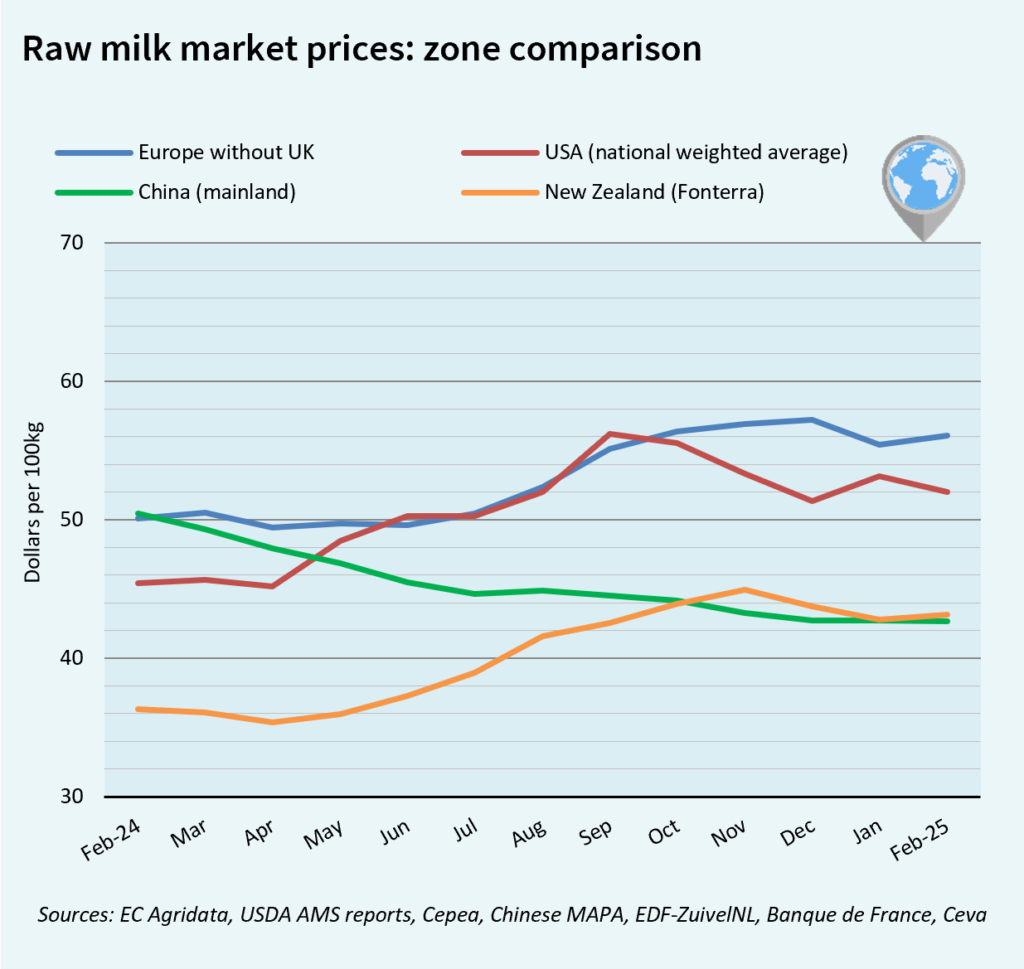

Our April Milk Market Outlook is out! Global dairy markets remain mixed: prices hold firm in Europe and Oceania, while the US and China continue to soften. Discover how production trends, animal disease outbreaks, and shifting demand are shaping the latest dynamics in milk deliveries and raw milk prices worldwide.

Don’t forget to SEE and share today!

GLOBAL MILK MARKET PRICES

Price dynamics for dairy ingredients have remained divergent since the beginning of 2025. While prices are relatively firm in Oceania and Europe, they are on a downward trend in the United States. Raw milk prices are falling there as well as in China, which remains in crisis.

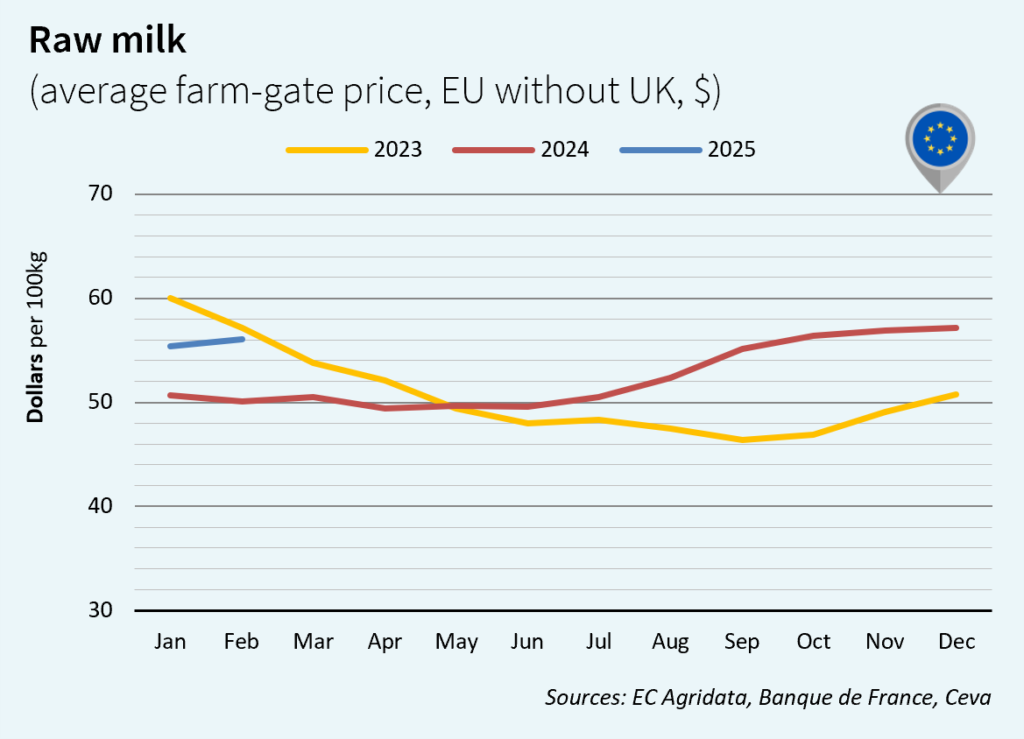

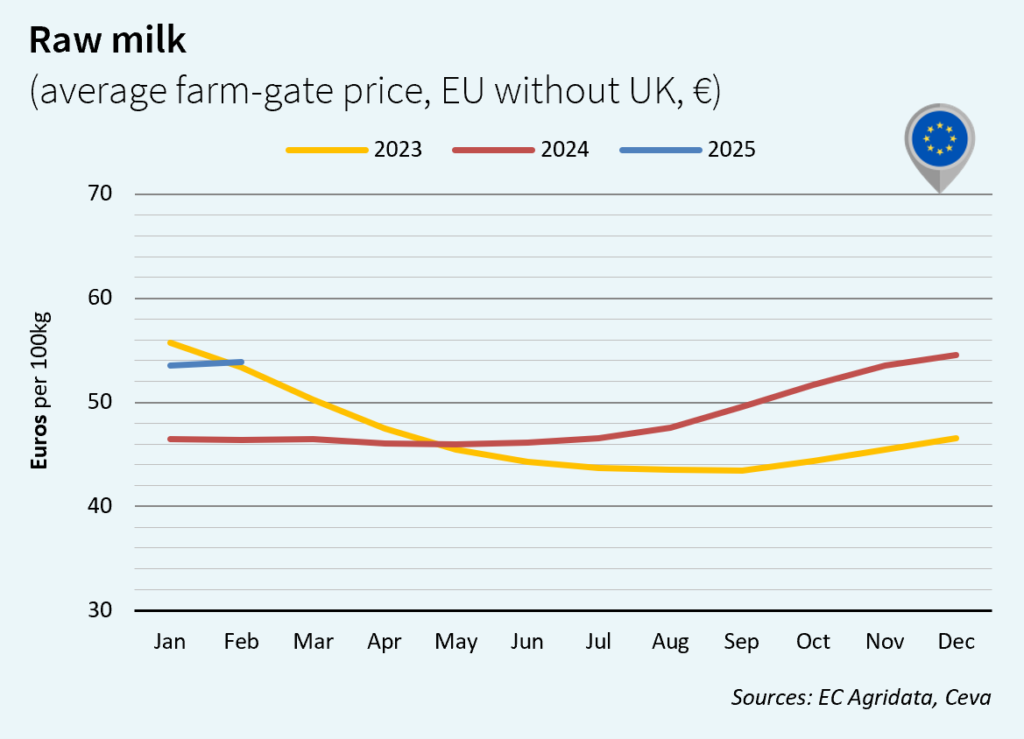

EUROPE´S MILK MARKET PRICES

Milk deliveries in February were still affected by the bluetongue outbreak, which continued to have a strong impact on milk productivity. EU milk deliveries fell to 11.01 million tons (-1,3% or -145 000 tons compared to 2024). Deliveries were down especially in France, Germany, Ireland, Italy or Spain. Despite a downward adjustment, EU butter prices remained firm. EU raw milk price remained also strong, at US$56.06/100 kg (+1% vs. January 2025 and +12% vs. February 2024).

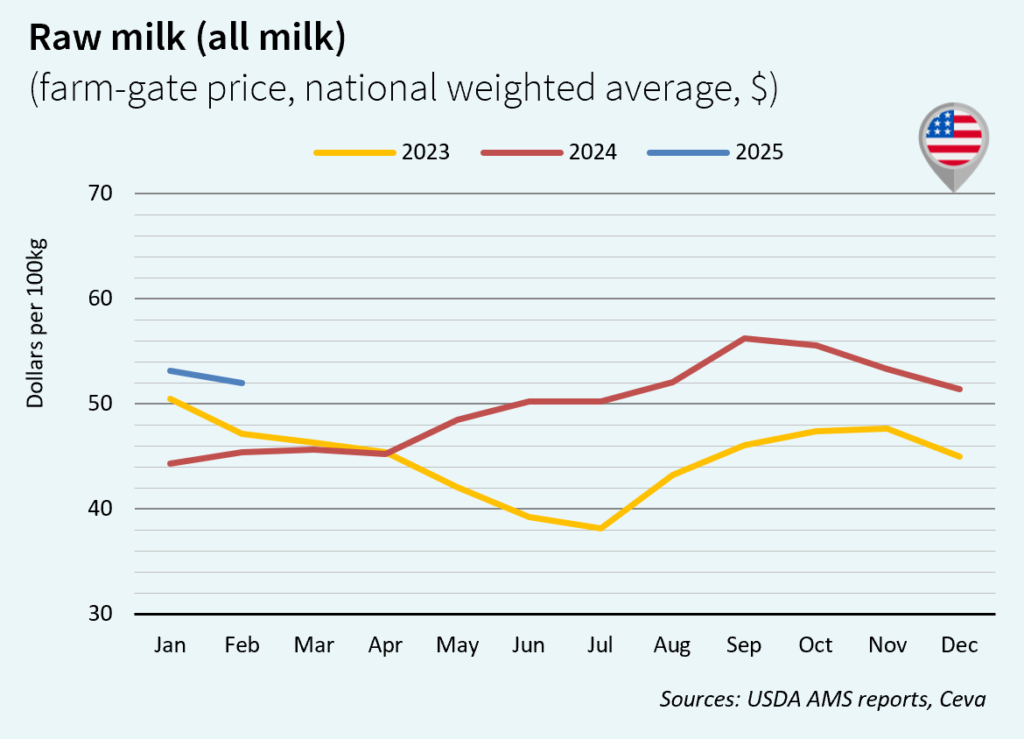

DAIRY MARKET TRENDS IN THE USA

In the United States, ingredient prices are under pressure as butter and cream supplies exceed demand. In February, milk deliveries were down (-2.5% compared to 2024 at 8.04 million tons), as was the raw milk price, which fell to US$52.03/100 kg (-2% vs. January 2025 but +15% compared to February 2024). The HPAI outbreak continued to affect dairy farms, particularly in California, Idaho, and Nevada.

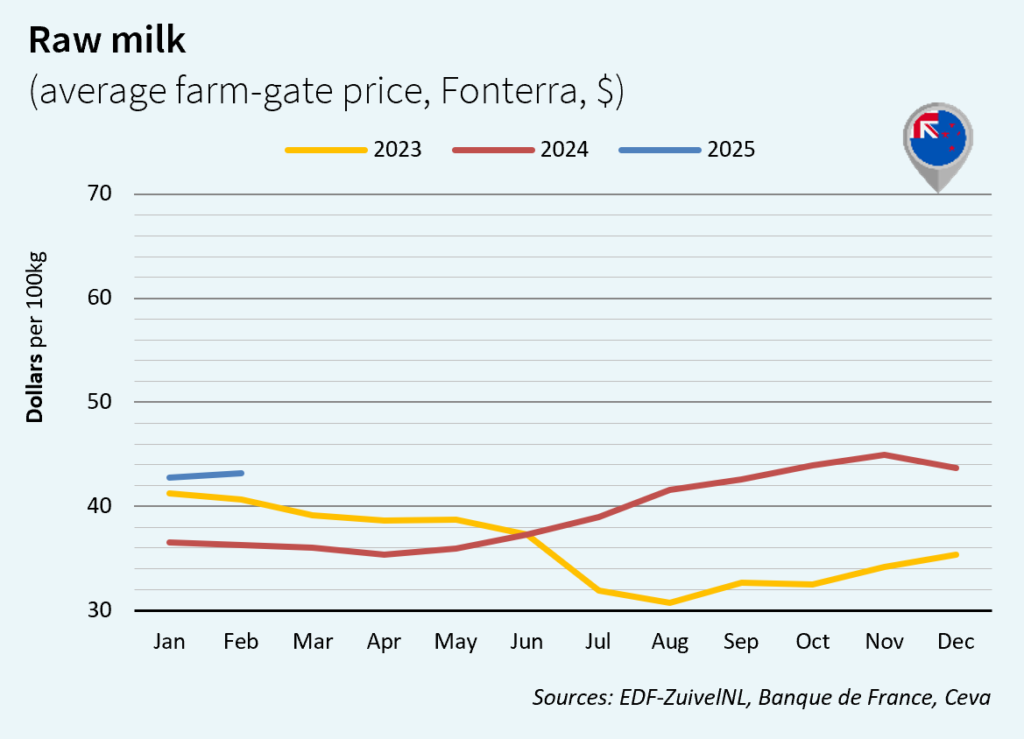

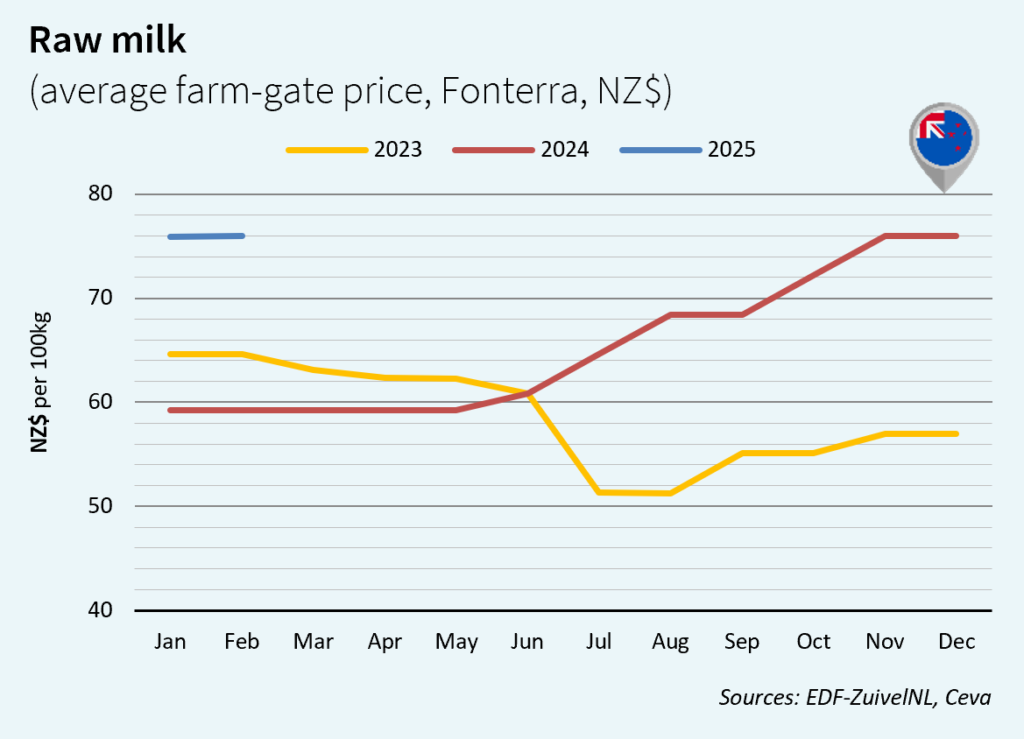

MILK TRENDS IN NEW ZEALAND

In New Zealand, since the start of the 2024-2025 dairy season last June, milk deliveries remained strong as did export demand for New Zealand dairy products. In February 2025, the trend remained unchanged despite an increasing drought episode in the north of the country. New Zealand produced 1.87 million tons of milk (+1% or + 17 000 tons compared to 2024). Demand for dairy products continued to support dairy ingredients prices. NZ raw milk prices remained strong in Ferbruary, at US$43.16/100 kg (+1% vs. January 2025 and +19% vs. February 2024).

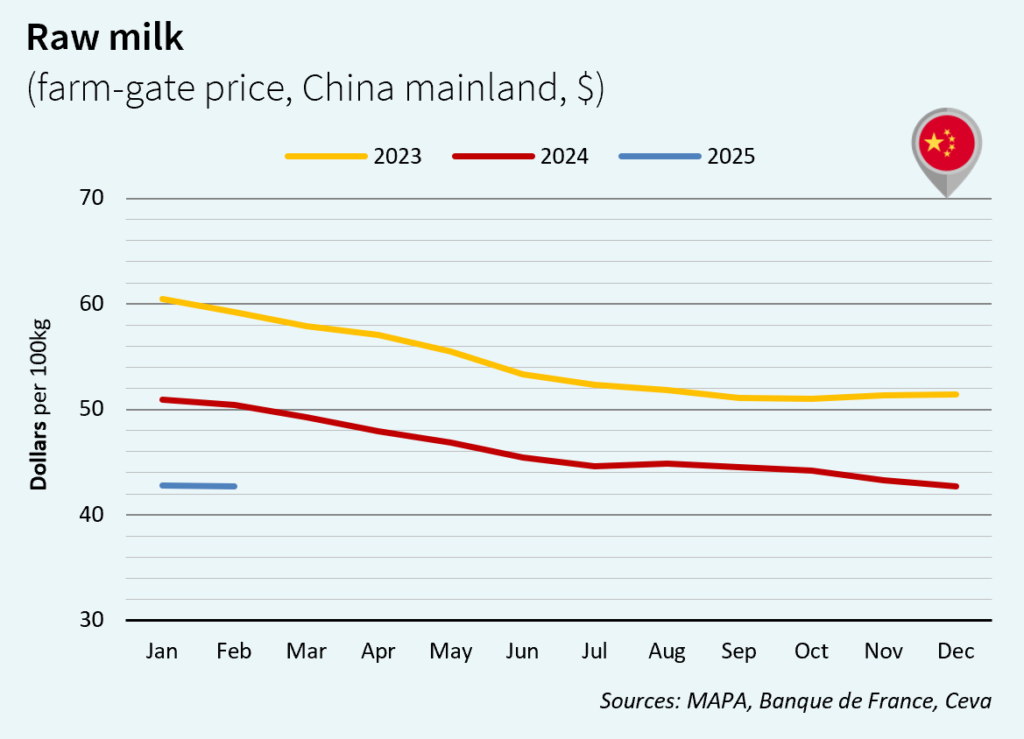

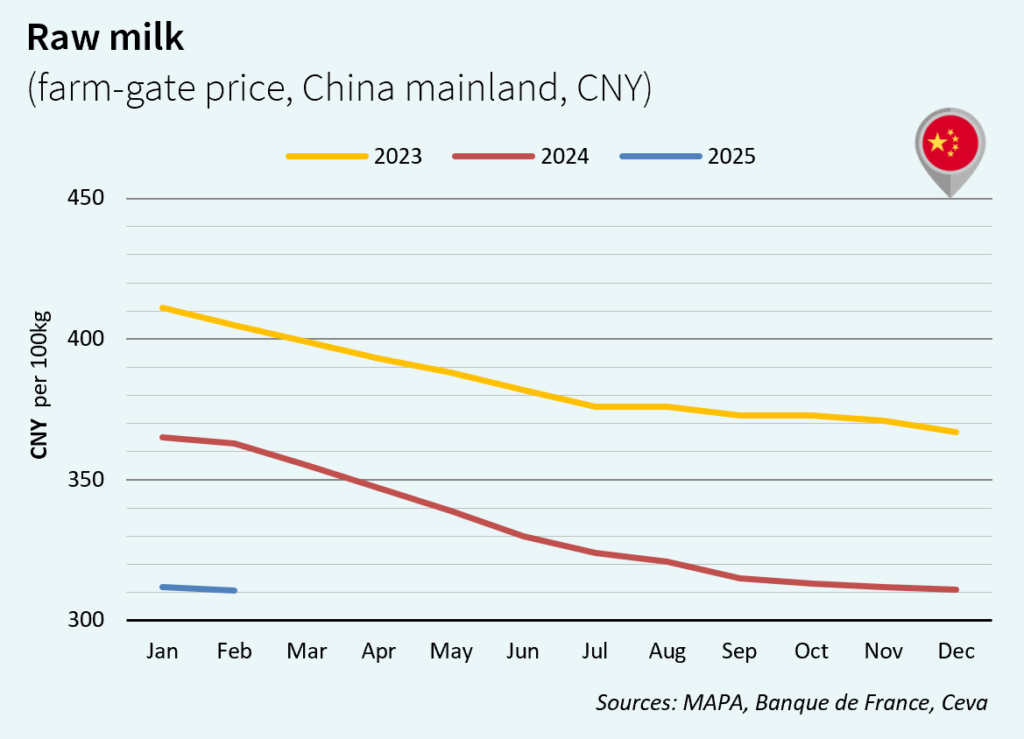

CHINA’s MILK MARKET

As in 2024, the Chinese market situation has remained complicated since the beginning of 2025 even though losses in China’s dairy cattle farming have gradually decreased. While the effects of the trade war initiated with the United States are still unknown, both production and demand remain sluggish in China. In February 2025, chinese raw milk prices remained one more time flat in US dollars at US$42.68/100 kg (equivalent to the prices of January 2025 but -15% compared to February 2024).

Source: