The Milk Market (Baptiste Buczinski)

Our latest Milk Market Outlook is here! In April 2025, global milk collection followed an overall upward trend, with the EU and US seeing year-on-year growth, while New Zealand recorded its first dip in months. Prices held strong in Europe and Oceania, but remained under pressure in the US and China. Explore how seasonal patterns, weather impacts, and international trade tensions are influencing milk production and pricing across key markets.

Don’t forget to SEE and share today!

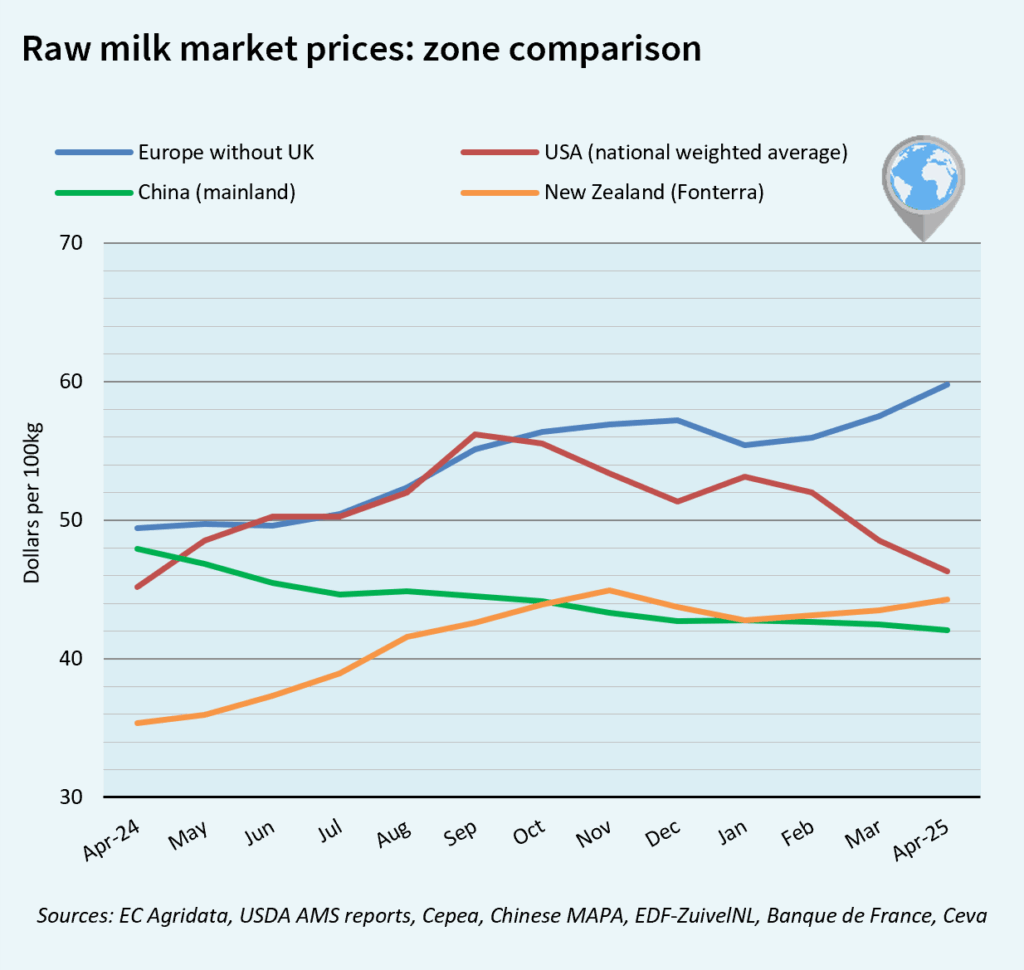

GLOBAL MILK MARKET PRICES

Milk collection trends among the main exporters remained divergent in April 2025, but were overall on an upward trajectory. Year-on-year, collection increased in both the EU and the United States. However, in New Zealand, milk collection stalled for the first time in many months. Milk prices were still under pressure in the US.

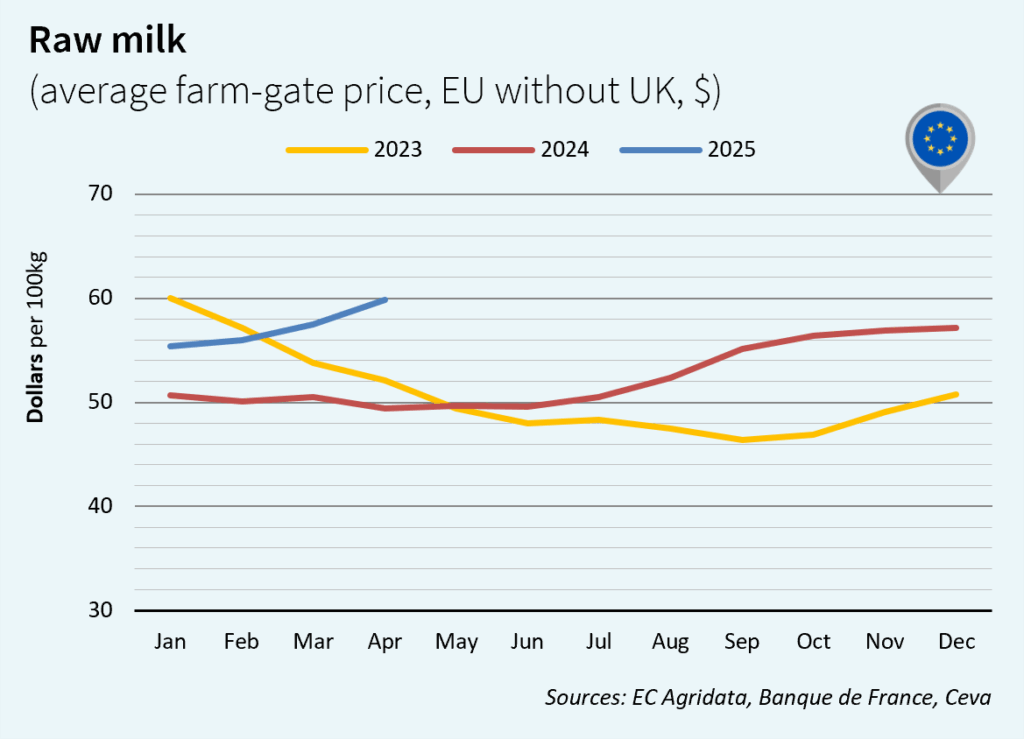

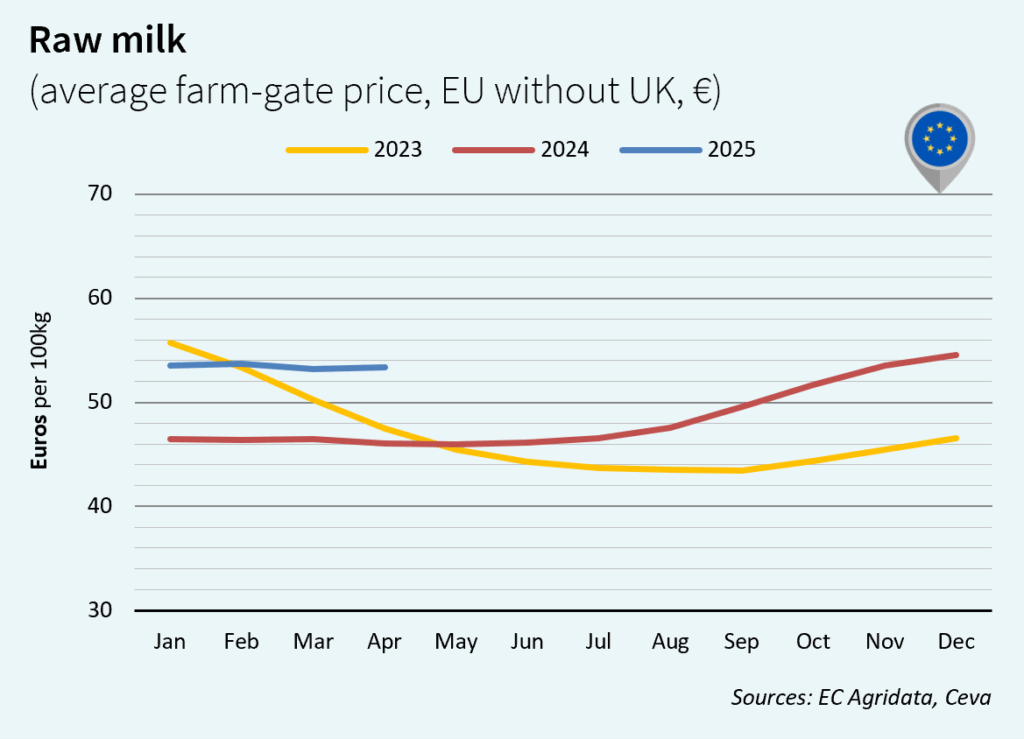

EUROPE´S MILK MARKET PRICES

After the decline in the first quarter of 2025, EU milk production rebounded in April, supported notably by the increase in Irish production. French and Polish collections were also up. EU Production has reached 12,9 Mtons (+0,7% vs 2024). Over the four-month period, it remained lower at 48.4 Mt (-0.4% vs 2024). Despite higher availability, milk prices remained strong, especially in euros. Prices were flat in US dollars, down following Trump’s international policy. Milk prices reached US$57.53/100 kg (+4% vs March 2025 and +21% vs April 2024).

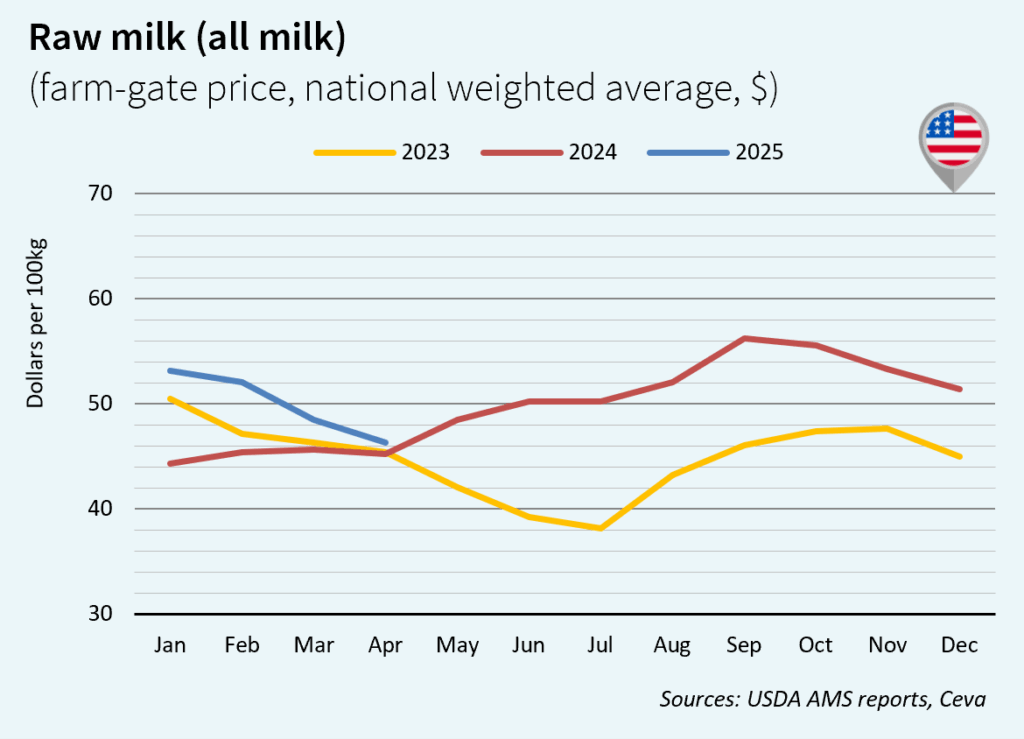

DAIRY MARKET TRENDS IN THE USA

In the United States, Milk production has rebounded since the beginning of 2025. It was again up year-on-year in April, reaching 8.8 Mtons (+1.5% vs 2024). In the wake of increased production and stocks in 2024, butter prices in the US have depreciated. In April 2025, the raw milk price was still down, at US$46.30/100 kg (-5% vs March 2025 but +2% vs April 2024). The competitiveness of US butter, amplified by a favourable euro/dollar exchange rate, supports exports. Recent signals were this pointing to a rise in butter prices.

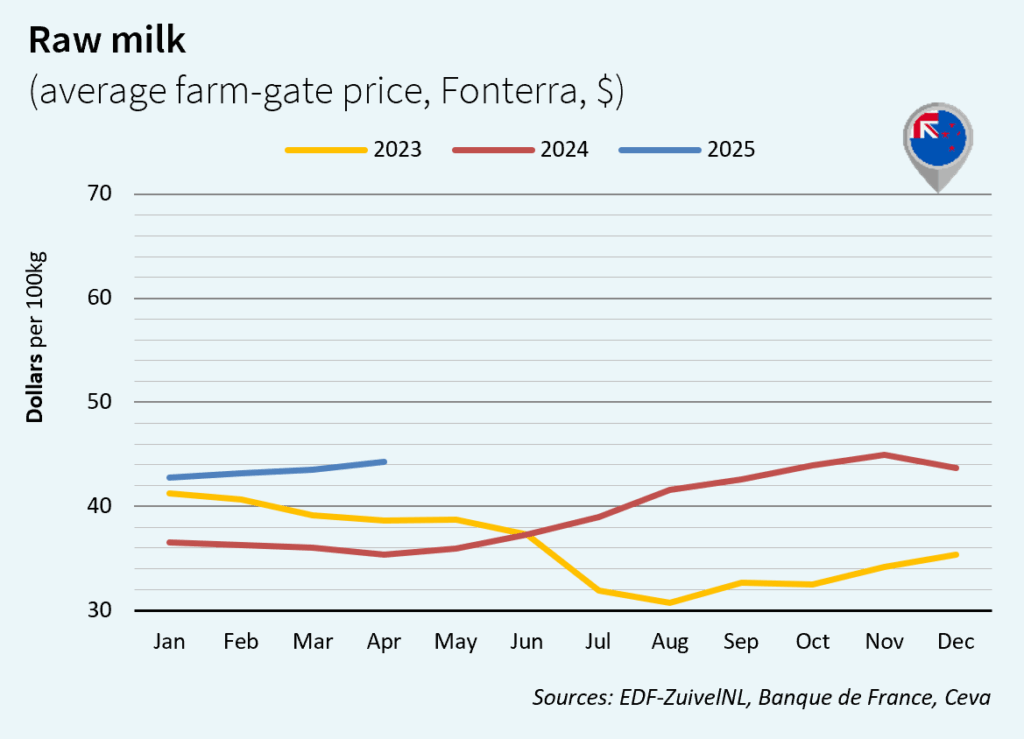

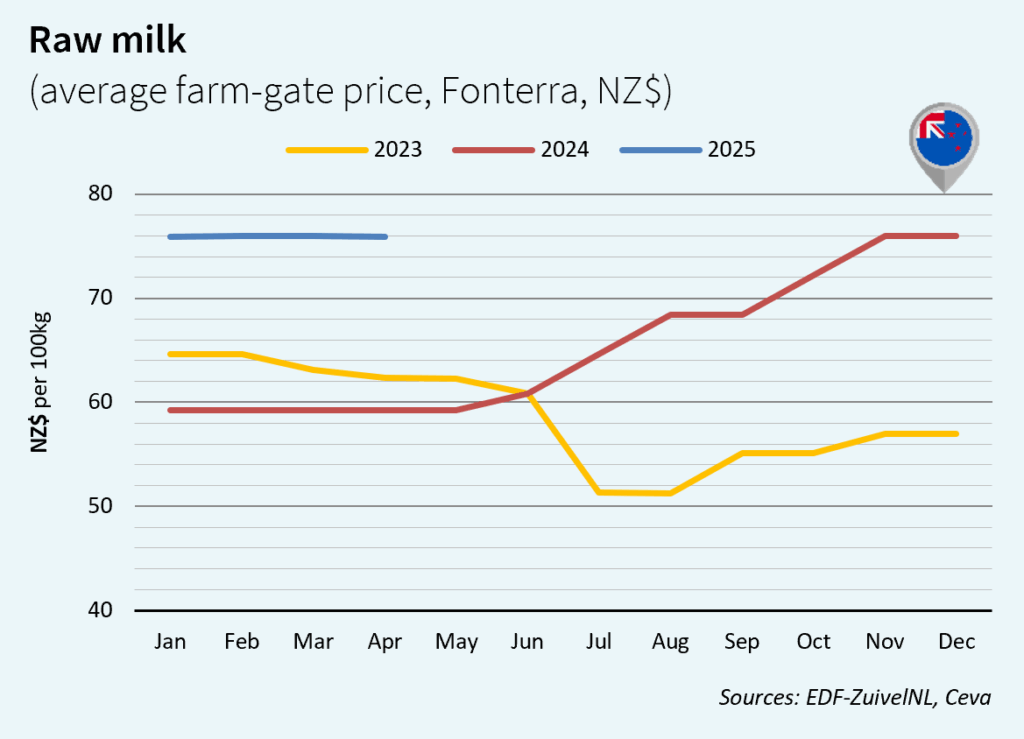

MILK TRENDS IN NEW ZEALAND

In April 2025, milk production in New Zealand was down, at 1,46 Mtons (-0,5% /2024). This marks the first decline since July 2024, as the end of the dairy season 2024/2025 approaches. The impact of the drought in the North Island is beginning to be felt. New Zealand exports were on the rise, particularly for cheese and butter. The NZ raw milk prices remained strong at a high level for the country, at US$44.26/100 kg (+2% vs March 2025 and +25% vs April 2024).

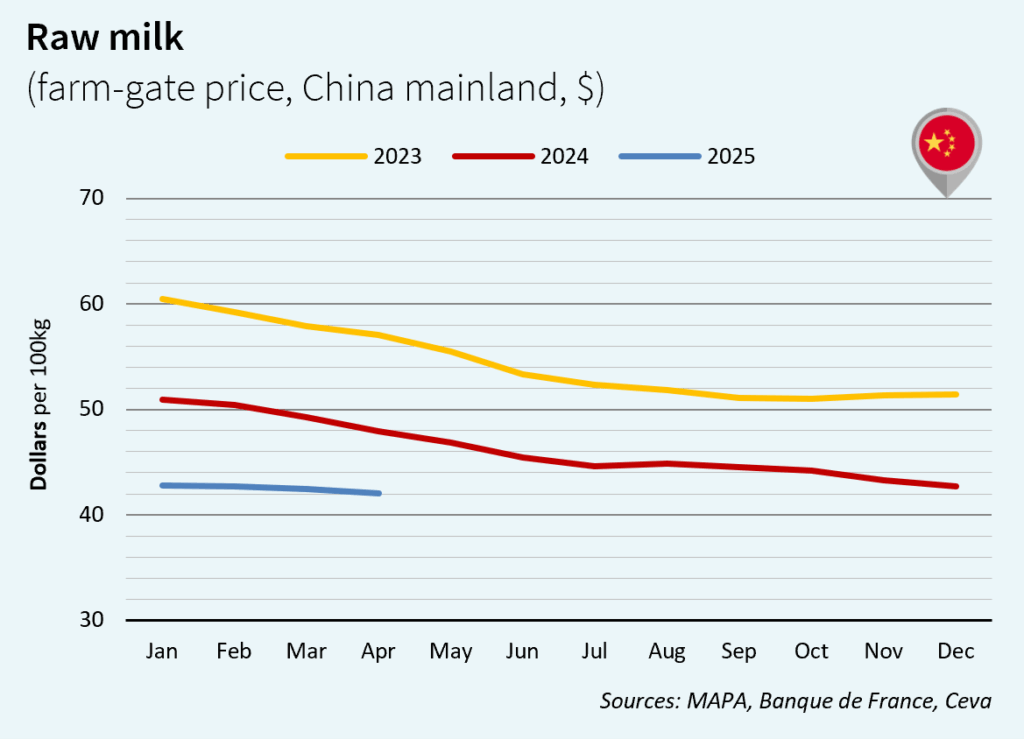

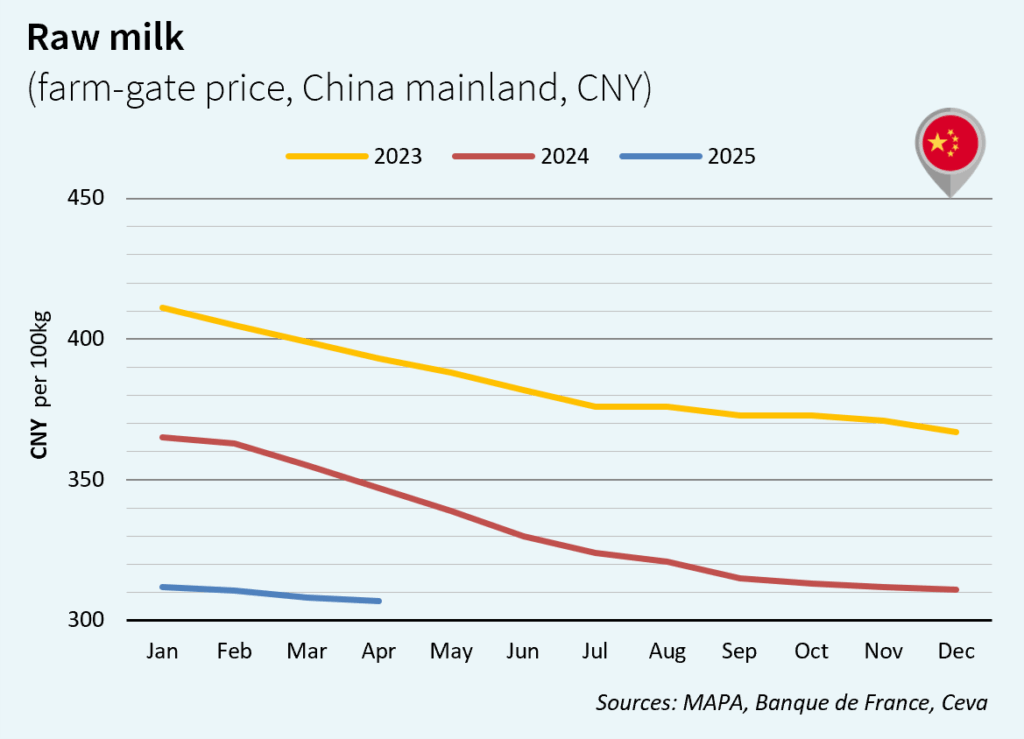

CHINA’s MILK MARKET

Little change on the dairy product markets in China in April. The dairy market remained depressed due to economic crisis and overproduction. The foreign trade situation remains unstable as trade disputes are ongoing with the United States and the EU. In 2025, cheese and cream imports from the EU could be limited. In the meantime, in April 2025, Chinese raw milk price remained flat in Yuan but DOWN in US dollar, at US$42.06/100 kg (-1% vs March 2025 and -12% vs April 2024).

Source: