The Milk Market (Baptiste Buczinski)

GLOBAL RESULTS: MILK PRICE MARKET

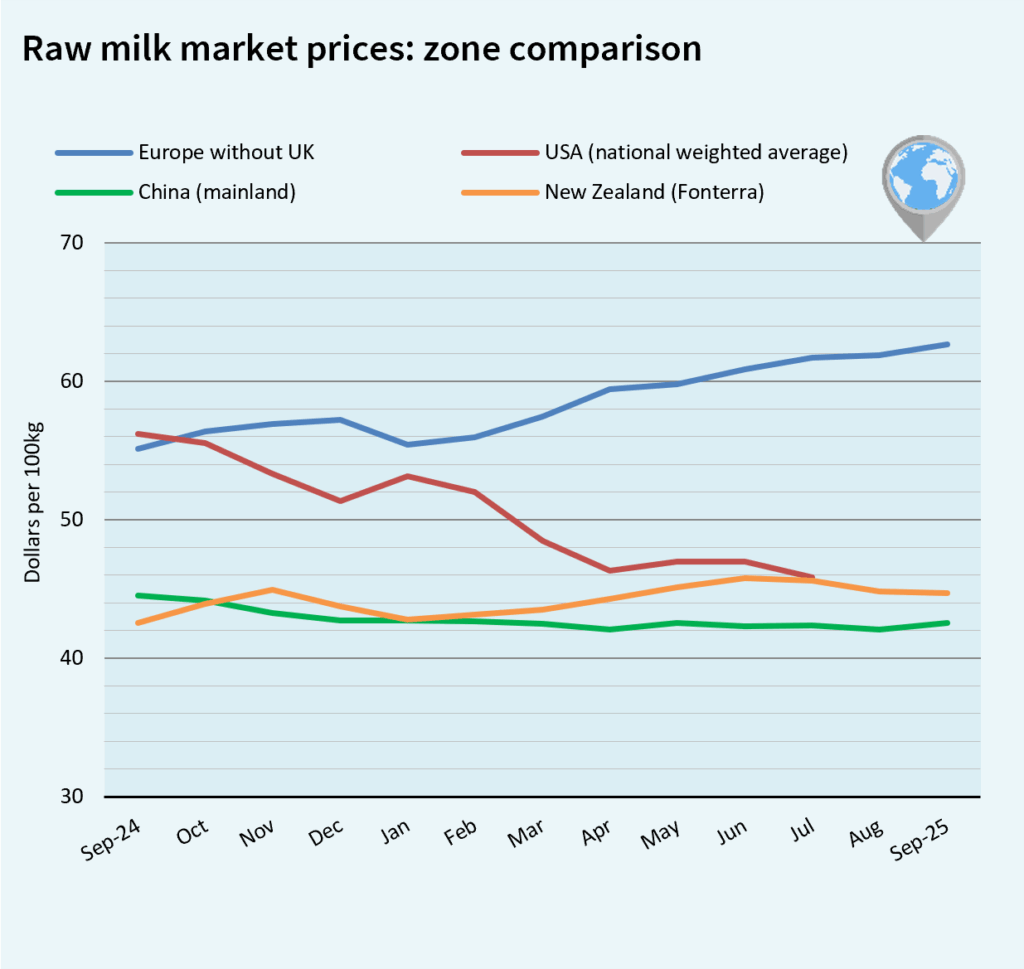

Global milk supply has continued to rise for more than a year, driven by sustained production growth across the main exporting regions. This steady increase in available milk is putting significant downward pressure on international dairy prices. Butter prices remain under strong strain in Oceania and Europe, with even sharper declines reported in the United States. Skim milk powder (SMP) follows the same negative trend, reflecting the broader weakness across global dairy markets.

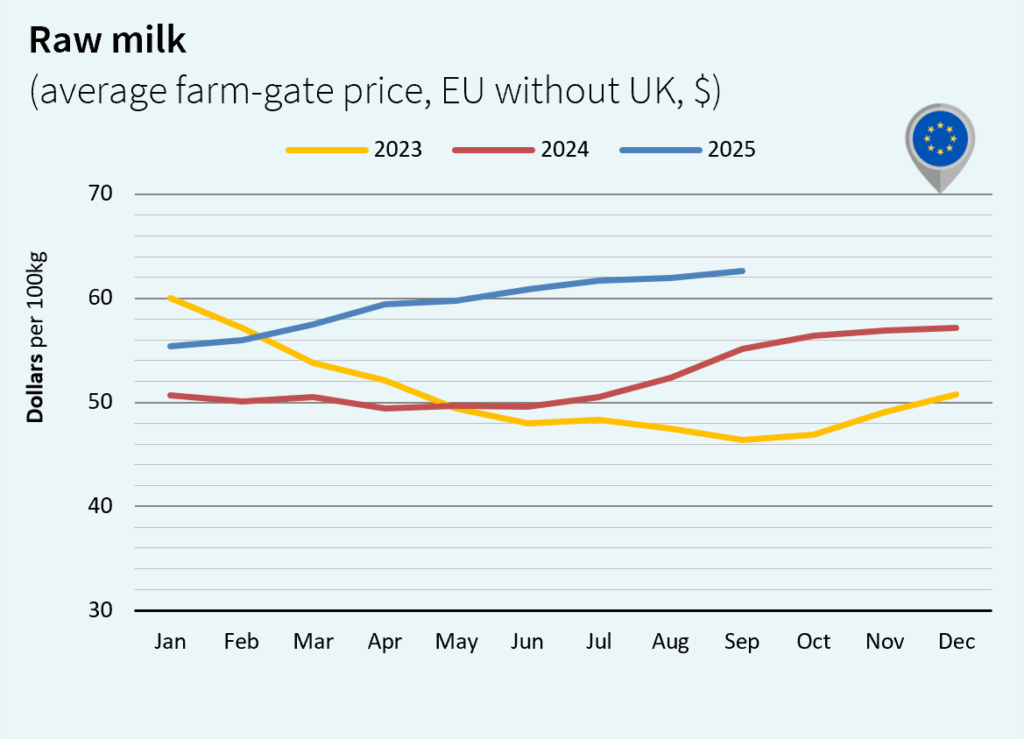

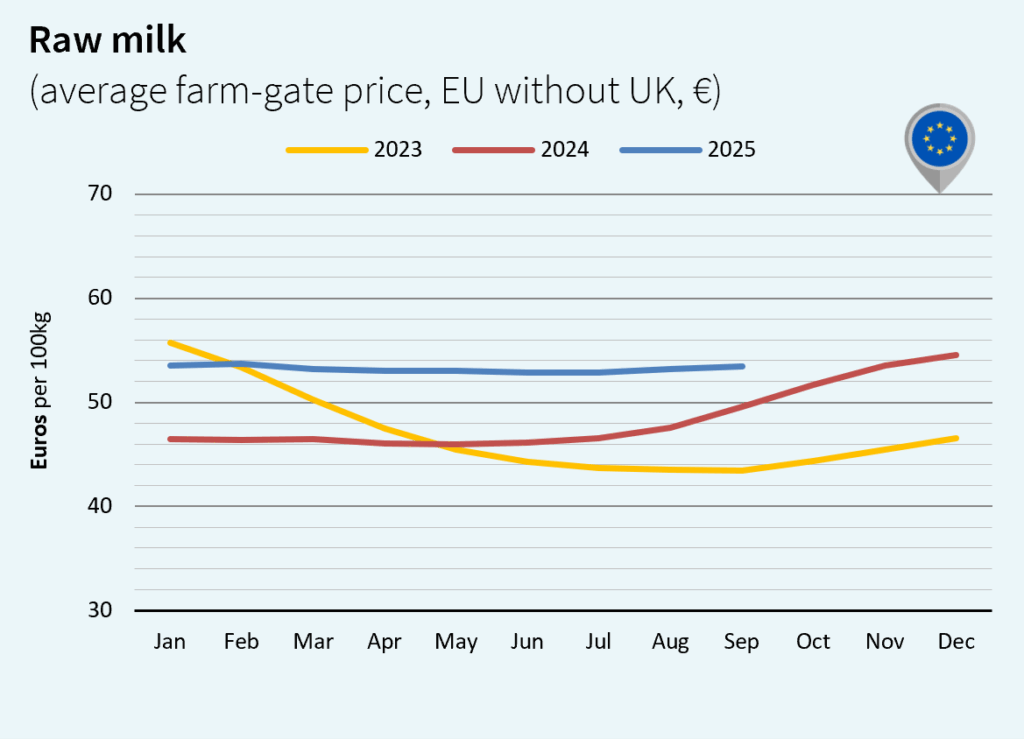

MILK PRICES IN EUROPE

The Europe milk market has seen milk collection trend upward since the beginning of summer. In September 2025, it recorded the strongest year-on-year increase, reaching 11.8 Mt (+3.9% vs 2024). Production has increased among all major producers, as milk prices have been supportive across much of the EU so far. The decline in dairy commodity prices has not yet had an impact on the raw milk price, although decreases have been observed in some Member States. It reached US$62.66/100 kg (+1.2% vs. August 2025 and +13.7% vs. September 2024).

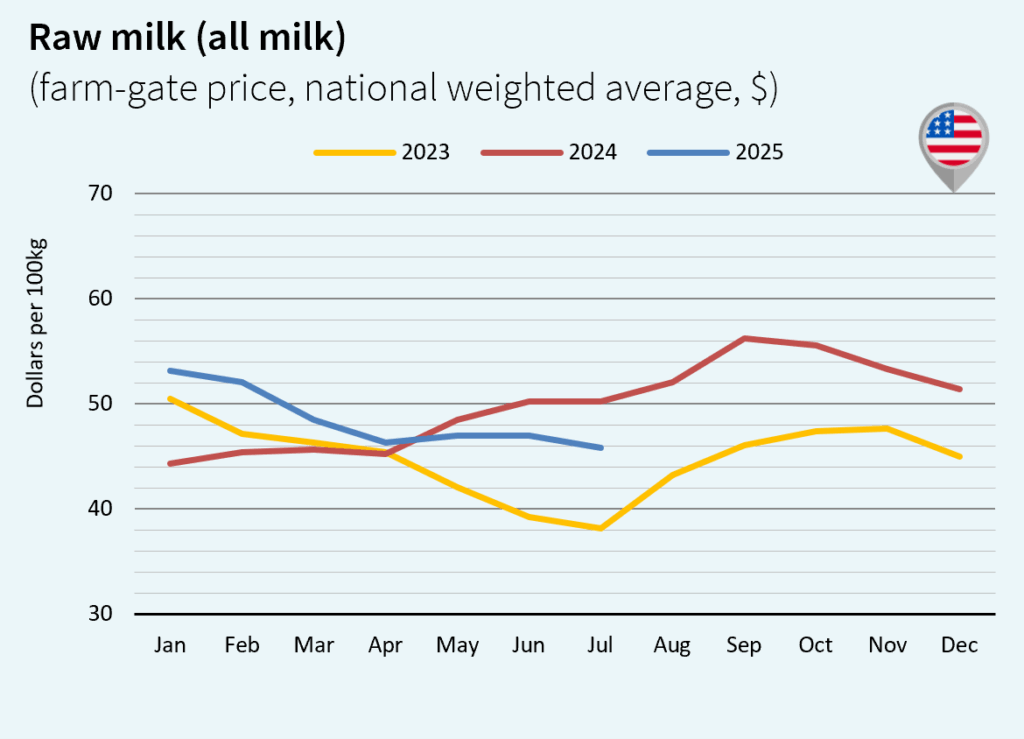

USA MILK MARKET TRENDS

In the US milk market, the release of some data is still blocked due to the government shutdown. Meanwhile, US milk production saw a significant new increase in September 2025 (+4.0% vs. September 2024). This increase in milk availability is leading to higher production and a drop in dairy commodity prices. This is putting pressure on the prices paid to producers. According to our estimates for September, the US raw milk price was down, at US$43.21/100 kg (-3.4% vs. August 2025 and -23.1% vs. September 2024).

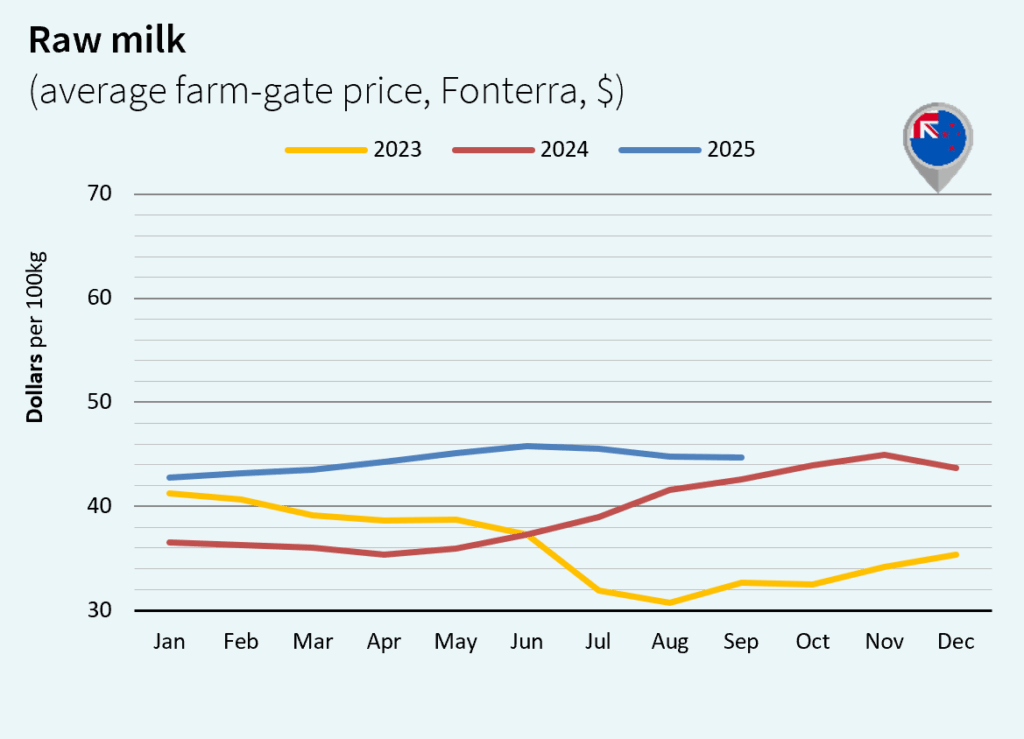

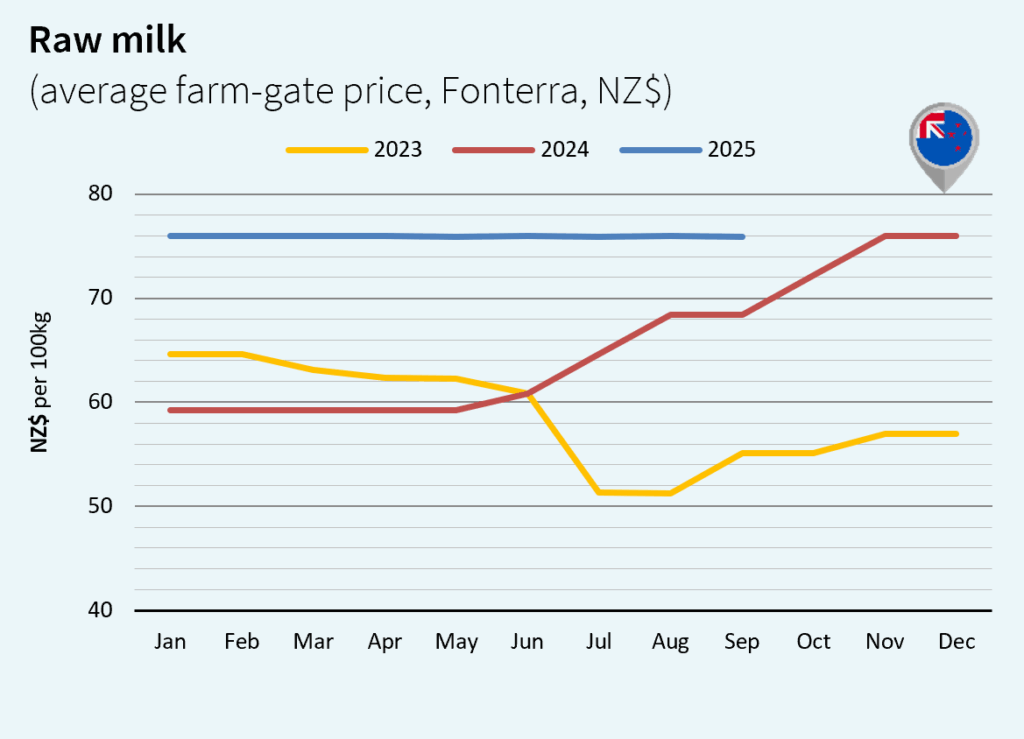

MILK MARKET PRICES IN NEW ZEALAND

In New Zealand, milk production increased year-on-year in September 2025 both in volume (+2.5% vs 2024, reaching 2.67 Mt) and in milk solids (+3.6% to 226,000 t). These are absolute records for the month of September. New Zealand dairy commodity prices are holding up better than others, supported by demand. In September, the NZ raw milk price remained flat in NZ$ but was still slightly down in US$, at US$44.71/100 kg (-0.3% vs. August 2025 but +5.0% vs. September 2024).

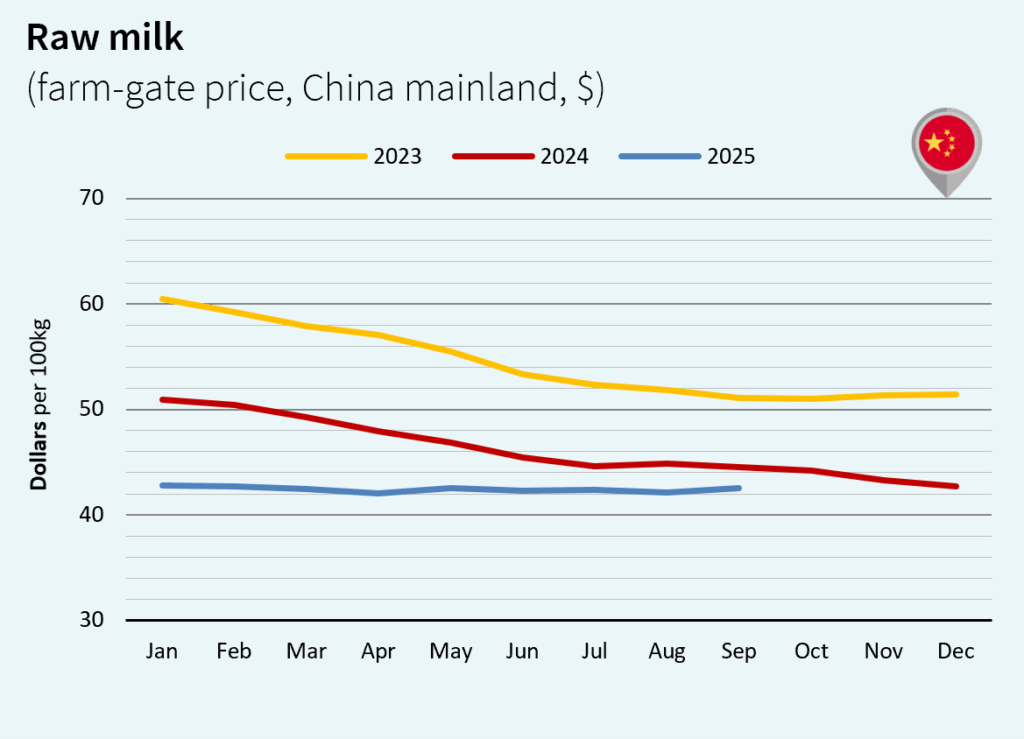

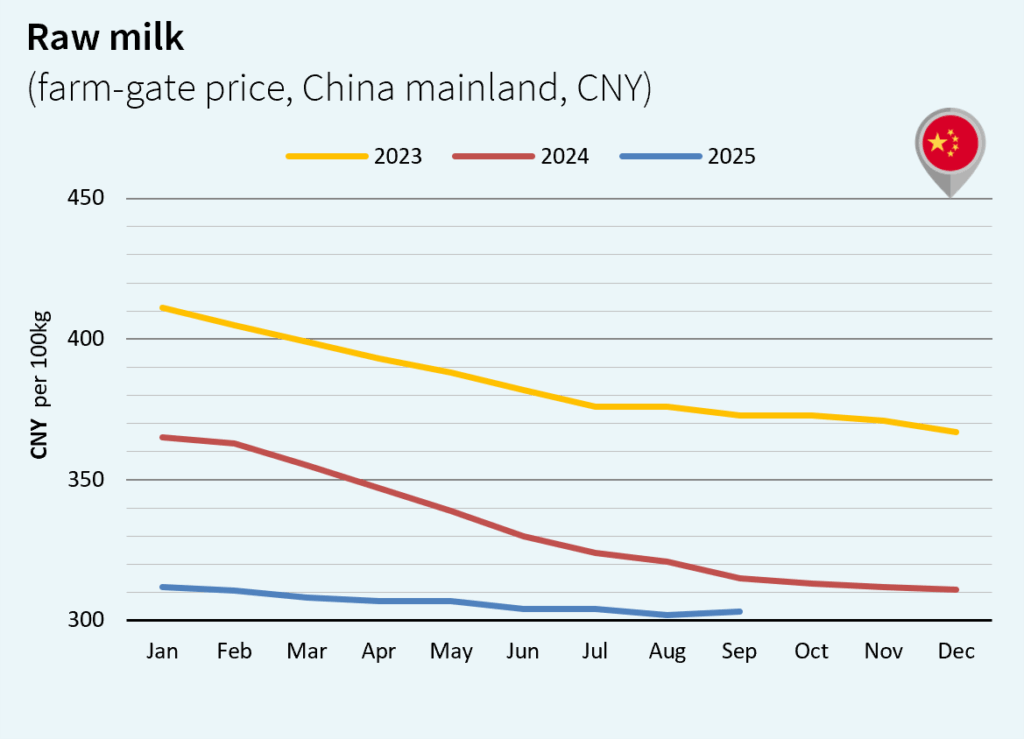

MILK MARKET PRICE IN CHINA

The Chinese dairy sector is slowly recovering from the overproduction crisis it experienced several months ago. Demand is slowly picking up as the economic crisis eases, despite significant ongoing trade tensions. After several months of decline, milk prices have recovered very slightly. In September, Chinese raw milk price was up, at US$42.53/100 kg (+1.0% vs. August 2025 but -4.4% vs. September 2024).

Source: