The Milk Market (Baptiste Buczinski)

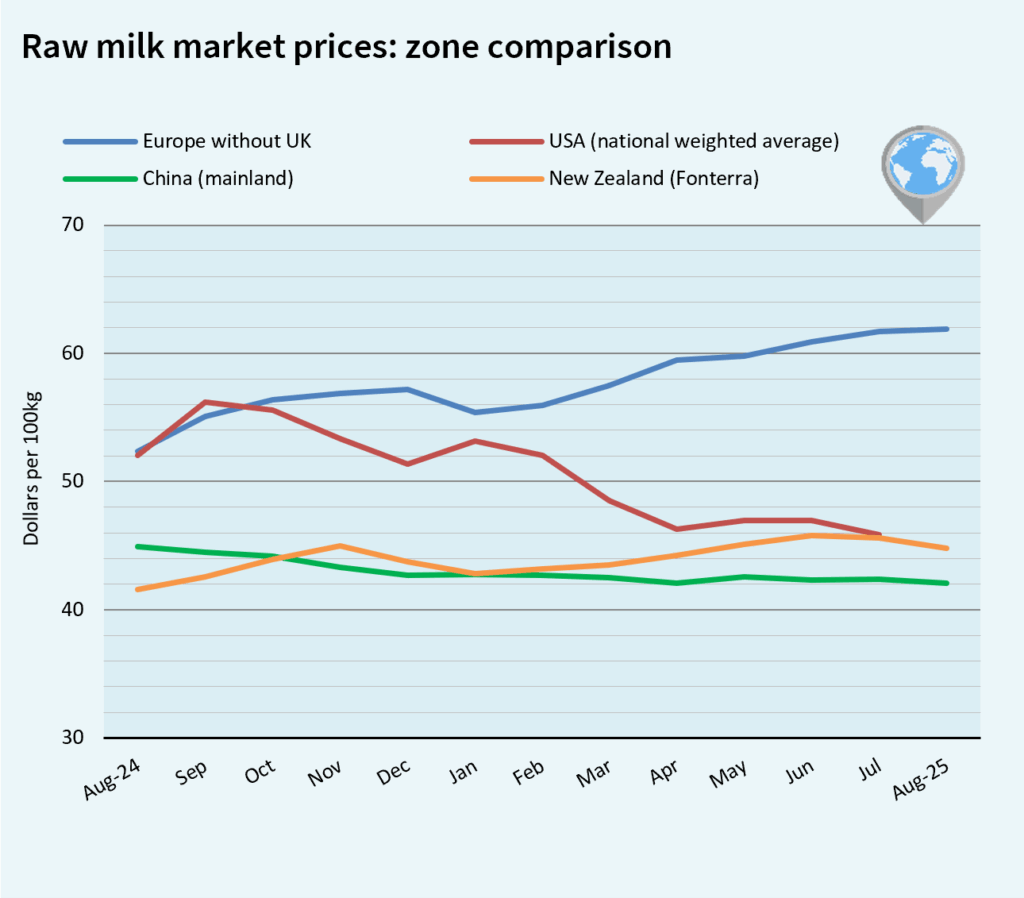

GLOBAL MILK MARKET PRICES

Global milk production continues to rebound. The supply of dairy ingredients (butter, powders) now exceeds demand. World prices for butter and powders are trending downward. While milk prices remain stable in Europe and New Zealand, they have fallen sharply in the United States.

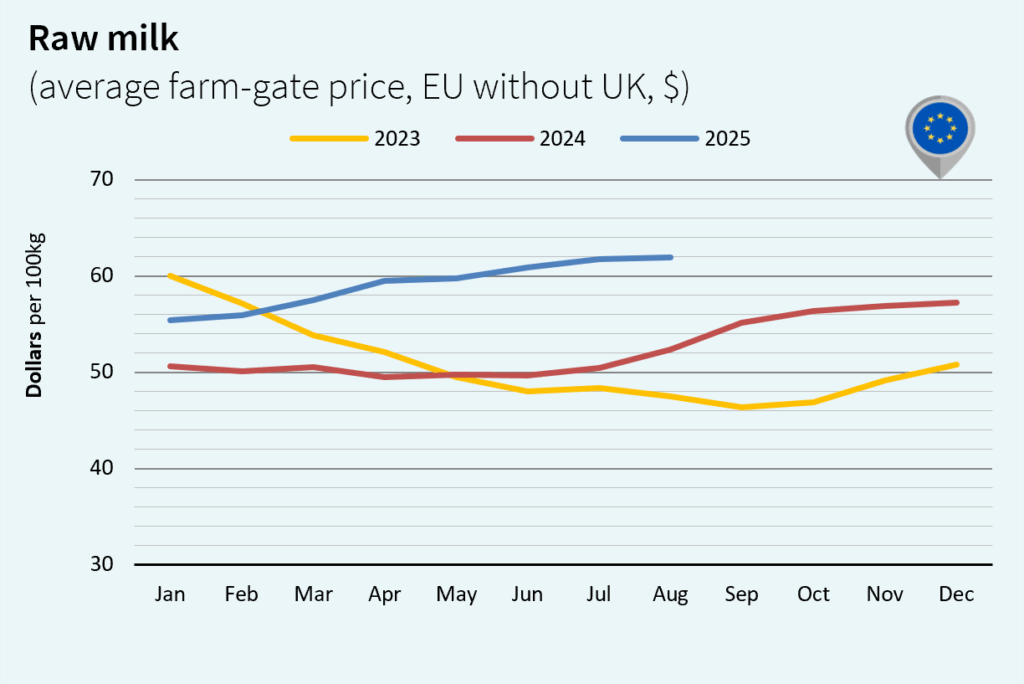

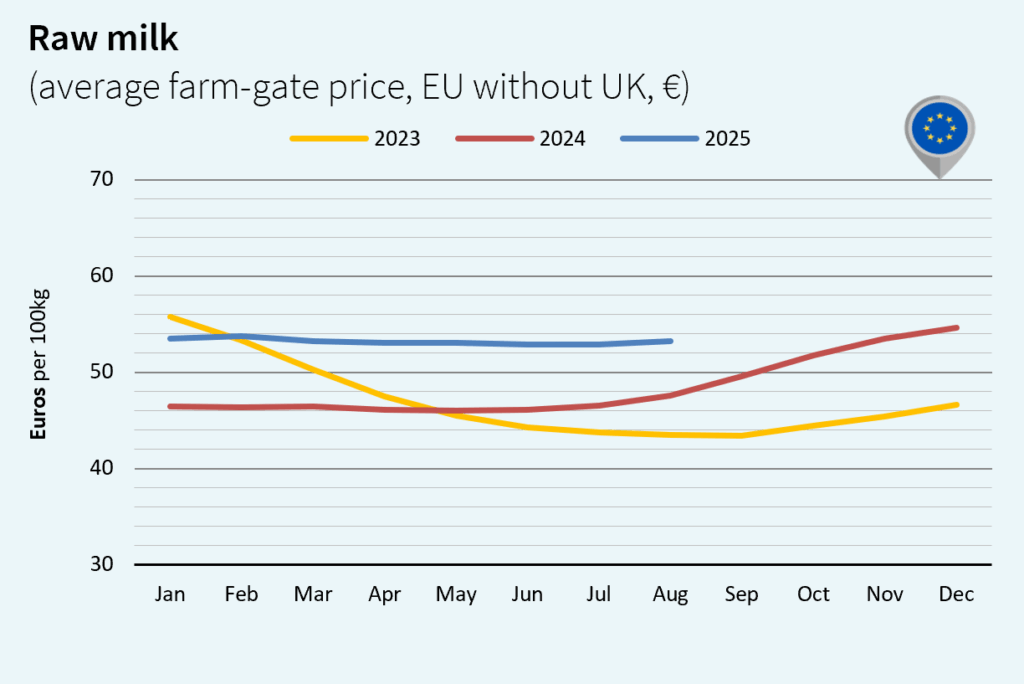

EUROPE´S MILK MARKET PRICES

In August 2025, European milk collection saw another significant increase, reaching 12.3 Mt (+2.4% vs. 2024). Over the first eight months, cumulative collection was slightly higher at 99.3 Mt (+0.3% vs. 2024). Collections were up year-on-year among all major European producers. While butter prices have finally begun to decline, following a trend already seen elsewhere, the price of raw milk has held up well in both euros and dollars. It reached US$61.91/100 kg (+0.3% vs. July 2025 and +18.3% vs. August 2024).

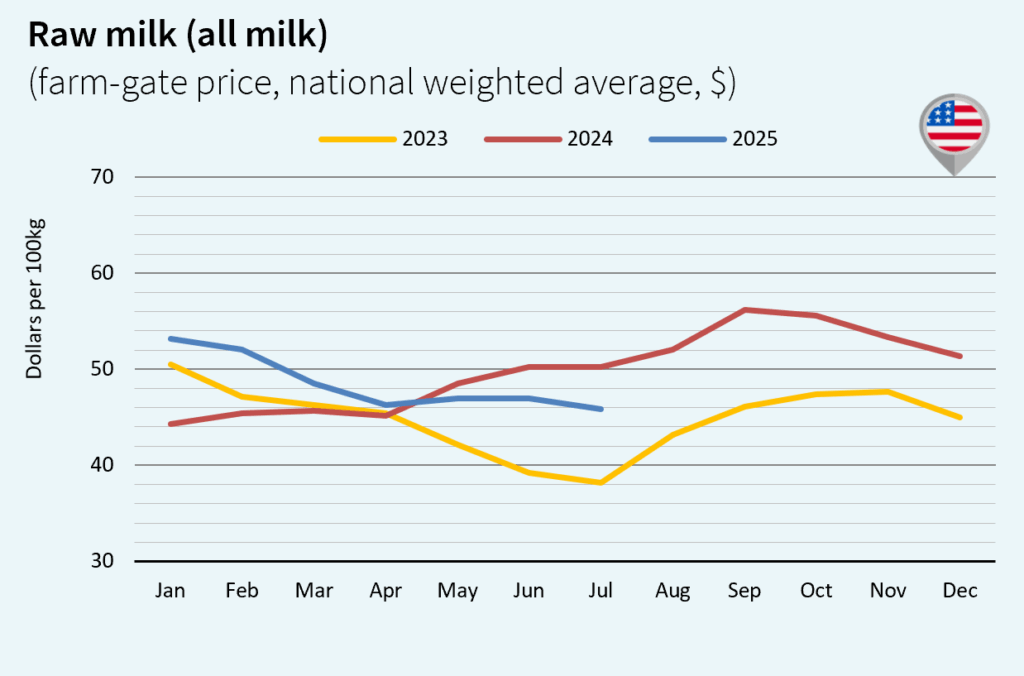

DAIRY MARKET TRENDS IN THE USA

In the USA, the release of data has been blocked due to the lack of agreement on the budget, which has led to government shutdown. In the meantime, milk production saw a significant year-on-year increase in August 2025 (+3.2% vs. 2024). Despite the recent decline in raw milk prices, profit margins continue to encourage production. Although raw milk price data were not published for August, prices are expected to have fallen due to the drop in butter and powder prices.

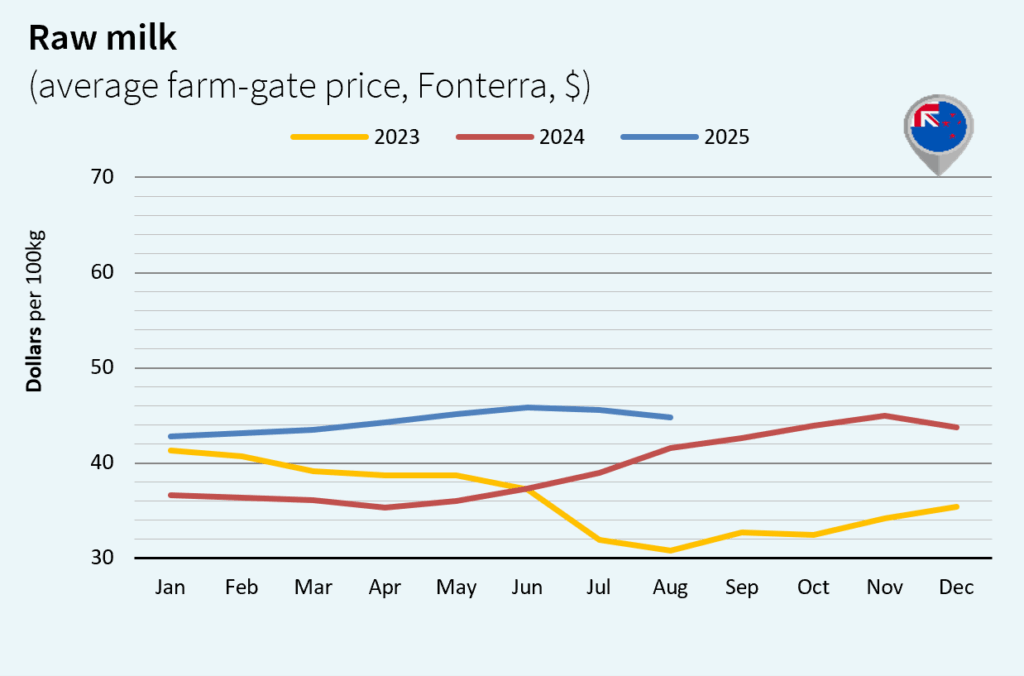

MILK TRENDS IN NEW ZEALAND

In New Zealand, after a record 2024/25 season, particularly in terms of prices, the new season began with an increase in milk production. Production was up year-on-year in August 2025 (+1.8% vs. 2024). The same was true for Milk Solids (+2.7% vs. 2024). Despite the decline in global dairy commodity prices, demand for raw milk remained strong and supported prices. In August, the NZ raw milk price remained totally flat in NZ$ but was down US$, at US$44.82/100 kg (-1.6% vs. July 2025 and +7.8% vs. August 2024).

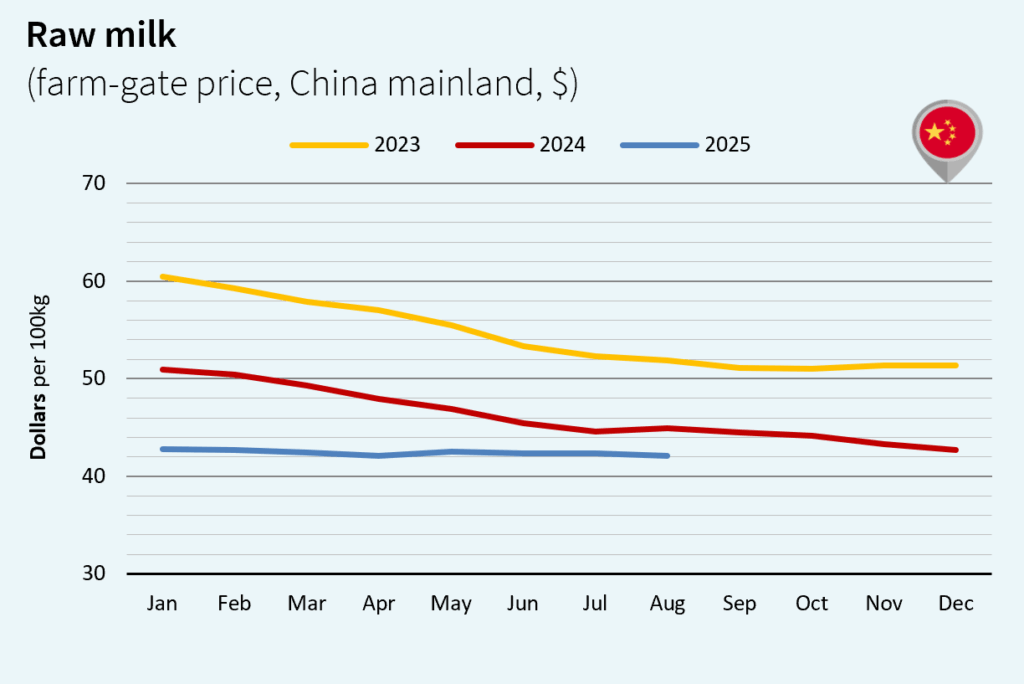

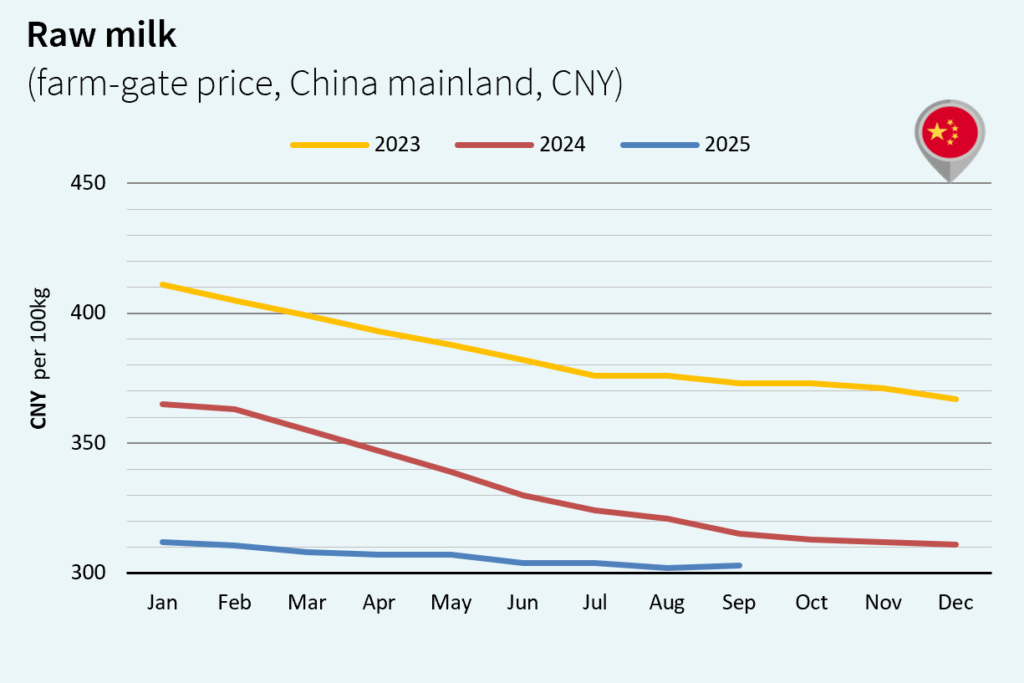

CHINA’S MILK MARKET

China’s dairy market rebalance is underway. Despite stronger growth in the second quarter and probably in the third, it has not reached the expected level. This is mainly due to weak consumption, deflationary pressures, and ongoing trade tensions. Milk prices remain under pressure. In August, Chinese raw milk price was down, at US$42.10/100 kg (-0.7% vs. July 2025 and -6.2% vs. August 2024).

Source: